$Palantir Technologies Inc.(PLTR)$ is the best-performing component of the S&P 500 so far this year, with shares up 64% YTD, completely ignoring the 2025 trend of a general decline in tech stocks.Meanwhile Painful Death has validated short-term growth momentum (U.S. political and corporate demand), but the market has a very low tolerance for internationalization stagnation and DOGE risk at high valuations, and investors have seen a lot of profit-taking.

The market is currently focused on the following three main points:

Whether US defense contracts (resume) accelerating in the second half of the year;

Whether international commercial revenues can be repaired (if corporate IT budgets adjust after tariffs fall);

Gross margin changes from AI investments.

Performance and market feedback

Core Data

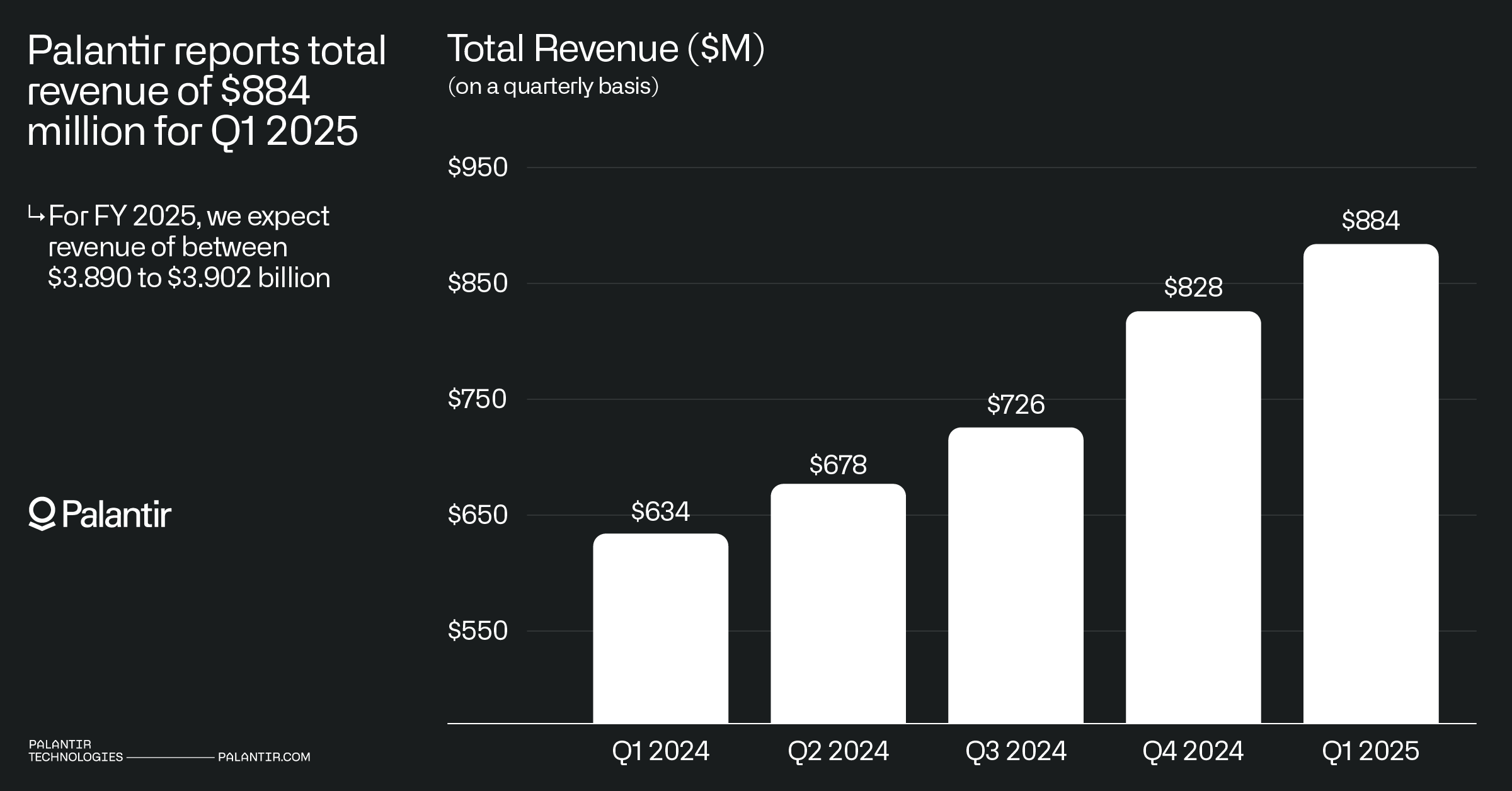

Overall revenue of $884M (+39% YoY), including

Government revenue +45% yoy (U.S. +45%, international +46%)

Commercial revenue +33% yoy (U.S. strong, international -5% yoy)

Adjusted operating profit of $214 million, operating margin of 19.9% (vs. 12.8% y/y, beating expectations), adjusted operating margin of 44

Number of customers: net increase of 51 (US commercial customers accounted for 50, international only +1)

Contract metrics: TCV 1.5B (+661.9B (+170M YoY), Billings 905M (+45% yoy))

Market Reaction.

Shares are down ~9% post-earnings (after-hours), with the first decline in international commercial revenues causing investor concern, especially pressure on international business from Trump's tariff policy, and the current overvaluation causing more investors to take profits (25-year EV/Sales 75x).

Investor sentiment is diverging, with short-term growth not much of a concern at this point (high Billings growth, strong US demand), but internationalization disruption and DOGE (defense budget cuts) concerns have not been fully eliminated.

Investment Highlights

1. Core business: government and commercial "two sides of the ice"

US Govt. business resilience exceeded expectations: +45% yoy in revenue and continued delivery of defense contracts (e.g., TiTAN intelligence vehicles), offsetting DOGE concerns.Palantir (AI/data analytics cited as a high ROI area) has not been impacted by previous statements by the US Secretary of Defense to "cut low ROI spending".The key risk is a slowdown in US government contract awards, and we need to see the actual impact and how the budgets fall in the second half of the year.

International government outbreak (European defense demand, revenue +46% yoy) but commercial growth rate slips.Germany and UK forced to choose Palantir due to lagging technology of local AI defense companies (e.g., BAE Systems) and long-term data security concerns.

International commercial commercial business differentiation

US commercial: high TCV growth, AIP penetration driving growth (automotive, financials, pharma).

International commercial: revenue -5% yoy (first decline), mainly due to weak European economy + tariff expectations + data security concerns (no clear response on the call).

2. Operating indicators: strong short-term growth, medium-term concerns

Short-term indicators are bright:

Billings +45% yoy, net revenue retention of 124% (up YoY), indicating customer stickiness.

RPO medium and long-term contract share rebounded, supporting future revenue visibility.

Internationalization bottleneck:

Only 1 net addition of international customers, revenue share declined to 29% (US domestic share rose to 71%).

Core conflict: global leadership in product competitiveness (AIP+Foundry), but geopolitical and macro-environment suppresses expansion.

3. Performance guidance: full year target raised, margins under pressure

2025 guidance:

Revenue midpoint raised to $3.896 billion, +36% yoy (original guidance of +34%), Q2 guidance of +39% yoy (unchanged from Q1).

Adjusted operating margins were maintained at 44% (44.2% in Q1), AI investment recognition or suppressed profit improvement.

4. Market focus and earnings verification

DOGE impact: not reflected in Q1, but slowdown in contract awards needs to be guarded (call said "recovery in H2").

Valuation controversy:

Pro side: product moat (AI military/commercial applications), high increase in US commercial TCV.

Counter side: internationalization blocked, TAM (Total Accessible Market) blurred (international commercial downturn or pulling down long term expectations).

5. Conference call highlights

Progress on AI: AIP standardization reduces deployment costs, but customization still dominates (gross margins under pressure)

Markets remain concerned about how to deal with budget constraints.Management downplayed the short-term impact of tariffs, saying "customer demand takes precedence over geo-friction".

On the government side of the order book, the company said it expects to do very, very well in the stress-testing system.

In addition, the market is concerned about budget cuts in the U.S. Department of Defense.The company stated that penetration testing and disruptive factors are driving the demand for the solution as efficiency and elite management become critical.The company expresses positive sentiments about its ability to capitalize on the growing demand.

Comments