$Twilio(TWLO)$ , a leader in SaaS, jumped 9% at one point right after its stock performance earnings report, and then rose for 10 consecutive trading days.

The company's excellent Q1 results, along with strong FY25 guidance, led to a surge in investor confidence.Even some investment banks believe the updated 2025 guidance is still too conservative.

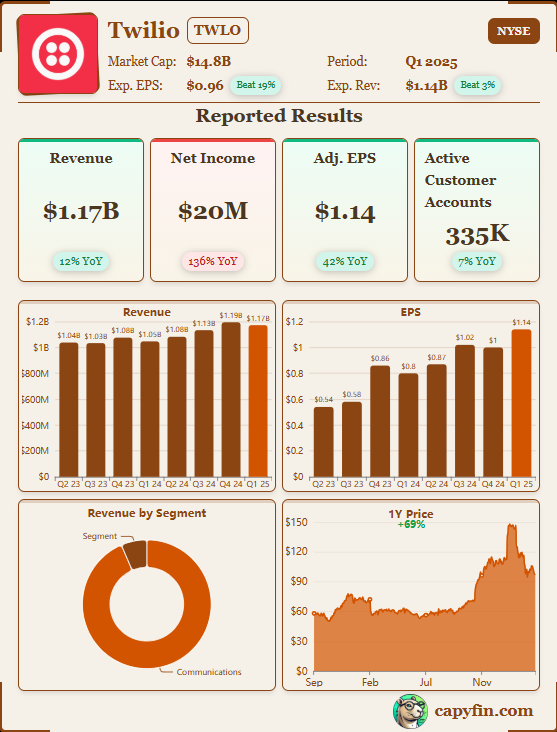

Performance and Market Feedback

Overall Q1 revenue of $1.17B, +12% yoy, topped estimates of $1.14B, achieving double-digit revenue growth for the third consecutive quarter.Communications revenue was $1.097B, +13% yoy.

On the earnings front, Non-GAAP operating income was $213M. net income was $20.02M, a sharp improvement from the net loss in Q1 2024. eps was $1.14, well ahead of expectations of $0.94

Investment Highlights

Strong recovery on the revenue side with increased attractiveness of principle AI-enabled products.While Q1 was a double-digit increase from a relatively low base in the same period last year, the increase in Net Dollar Retention (NDR) to 107% from 102% in Q1'24 is also a good indicator of the popularity of many of Twilio's offerings (e.g., ConversationRelay) with customers and the expanding partnerships with voice-enabled AI startups.Artificial Intelligence startups are expanding.AI-powered voice interactions are sparking new interest and customer adoption rates, and cross-channel adoption is improving ROI.

Key growth drivers were ISVs, self-service, cross-selling and international expansion.Growth was realized across all of the company's top five verticals, including financial services, technology, professional services, retail and e-commerce.Twilio also announced a partnership with ElevenLabs to augment AI capabilities with more than 1,000 voices in more than 40 languages.

Strongly upgraded full-year earnings guidance.Expect full year organic revenue growth of 7.5-8.5%, up from prior guidance of 7-8%; Non-GAAP operating profit of $850-875M, up from prior guidance of $825-850M; free cash flow of $850-875M, up from prior guidance of $825-850M

Cash flow strengthened, with cash, cash equivalents and short-term marketable securities at $2.45B at the end of Q1, up from $2.38B at the end of the previous quarter. $126.3M worth of stock was repurchased in Q1.Meanwhile, $1.87B remains from the current $2B stock buyback.

Comments