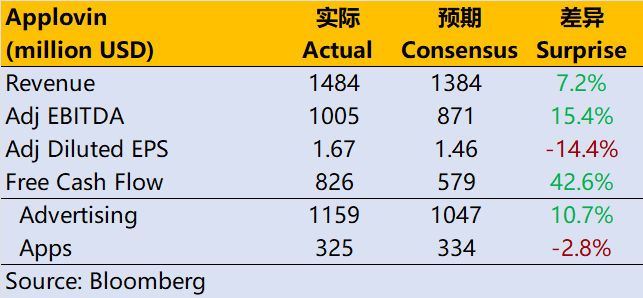

$AppLovin Corporation(APP)$ after-hours earnings report was a far cry from $Unity Software Inc.(U)$ pre-market.Despite five short-sale reports on its head, APP fought back with a margin beat and a 113% rise in free cash flow for the quarter, further bolstering the company's buyback.

Performance and Market Feedback

Exceeded advertising growth and earnings expectations

Q1 revenue was $1.5 billion, up a whopping 40% year-over-year.Adjusted EBITDA rose 83% to $1 billion, with a 68% margin.Of that, the advertising business contributed $1.16 billion, a 71% jump year-over-year, while its own app was divested in May.

On the profit side, adjusted EBITDA was $943 million, with a horrible 81% margin, up 600 basis points YoY.

Free cash flow was up 113% year-over-year to $826 million, implying an 82% conversion rate from adjusted EBITDA to free cash flow.

Guidance-wise, Q2's implied ad revenue growth rate of $119.5B-$112.5B (68%-71%) and adjusted EBITDA is also expected to be in the range of $970M-$990M, with margins going to a scary 88%.

Market Reaction

After-hours once fell 7%, but then immediately turned up 13-15%, also shows that investors are surprised by the earnings report.More importantly, after being sniped by a number of bearish reports, the "technical black box" was revealed, investors are quite cautious about it.

However, the actual impact on Q1 is not large, and the company's business is relatively simple, from the game advertising to e-commerce, but also found another upward path. Q1 performance and guidance for Q2, e-commerce advertising growth, as well as the traditional advertising by the industry is not expected to be prudent, but instead, out of the independent market.

Investment Highlight

Sale of gaming business, perfect transformation of advertising, e-commerce is progressing well.

The company sold its 1P gaming assets in May, to Tripledot Studios for $700m consideration (cash + equity), a downgrade from previous pricing (original valuation of $900m) but a complete transformation into an asset-light advertising platform.Meanwhile a key driver of growth in Q1 advertising was the optimization of machine learning models that enable mobile gaming companies to scale effectively.And expansion in e-commerce and online advertising continued to be driven by AI-driven advances in personalization technology and the development of self-service dashboards.

The outlook is strong, bucking the trend to preserve growth.

The company expects advertising revenue in Q2 to be between $1,195 million and $1,215 million and adjusted EBITDA between $970 million and $990 million, targeting an adjusted EBITDA margin of 81% at the company-wide level.While peer guidance suggests Q2 will be impacted by seasonality (META, unity), the company is not slowing down guidance and the focus on AI development and advertiser engagement ensures long-term growth.

The company reiterated its focus on enhancing machine learning models and refining e-commerce and online advertising tools to sustain growth and profitability.Advertiser churn in e-commerce and growth in spending per advertiser.The churn rate for advertisers spending $250,000 per year is less than 3% and underscores the fact that the online advertising model is continuing to improve.

Valuation and Shareholder Returns.

The company repurchased $1.2bn of shares in Q1 (30% of the full year program), which equates to a 3.8% shareholder return if the full year repurchase amount reaches $4bn, which is fully supported by the company's strong repurchase in terms of current free cash flow.

The current market capitalization corresponds to a 2026 EV/EBITDA of about 23x, which is higher than Meta's 15x, but still short of meme myth stocks like Palantir.Of course, the premise of high valuation is to engage in growth, if e-commerce advertising continues to exceed expectations, the current valuation is still supported, but if the growth rate falls back, the valuation will be under pressure.

Comments