$Walt Disney(DIS)$ Q2 FY2025 results were strong, with streaming and theme parks driving significant profitability and investment appeal.Management remains optimistic about the full-year business outlook and the stock price reacted positively.

Performance and market feedback

Core performance greatly exceeded expectations

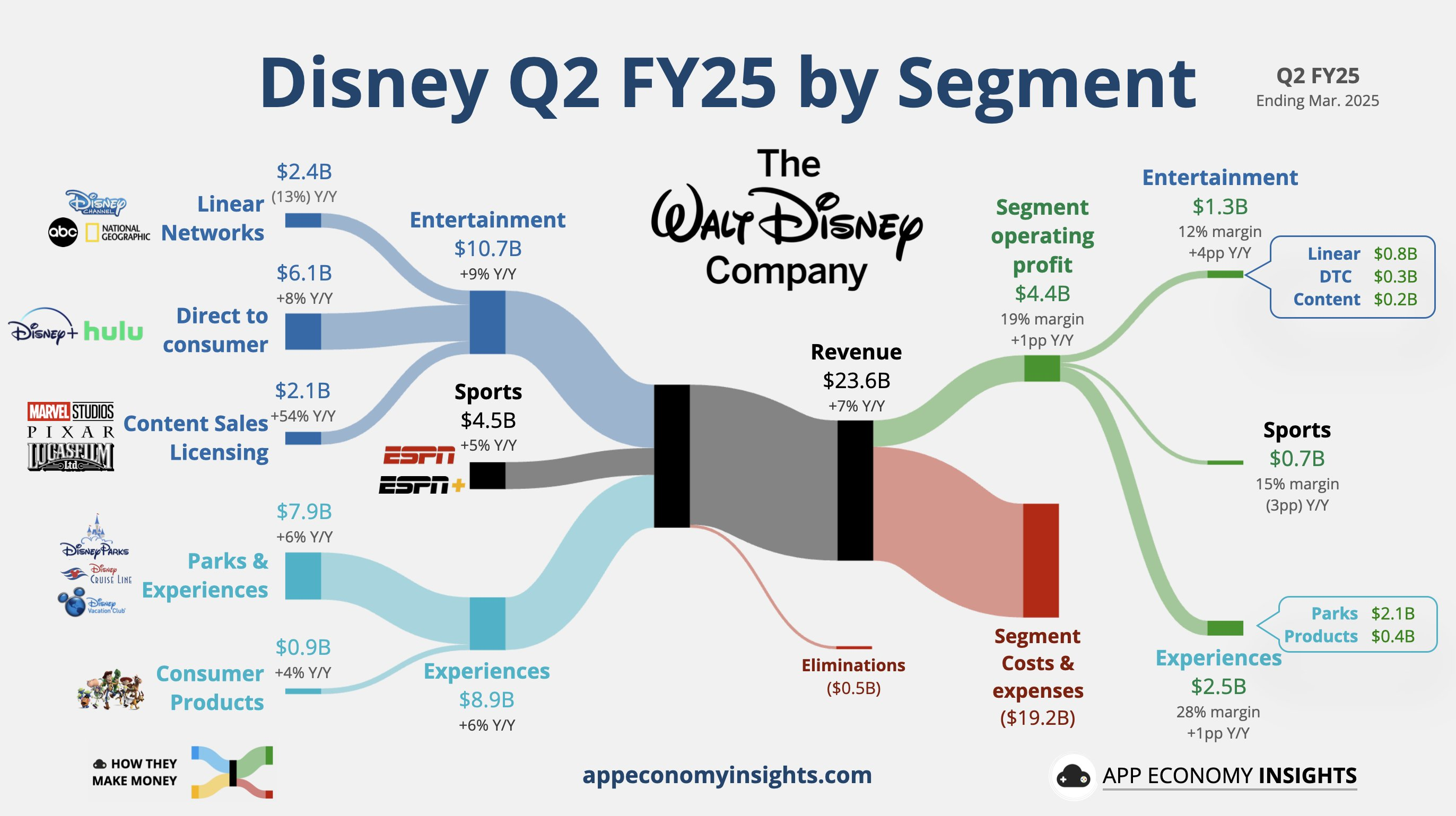

Revenue: Q2 FY2025 overall revenue reached $23.6B, +7% yoy, exceeding market expectation of $23.05B ~ $23.17B;

Profit: Operating profit increased by 15% to $4.4B, pre-tax profit increased significantly to $3.1B from $0.7B in the same period last year; Adjusted EPS was $1.45, up 20% from $1.21 in the same period last year, and higher than the market's expectation of $1.20.

Operating metrics:

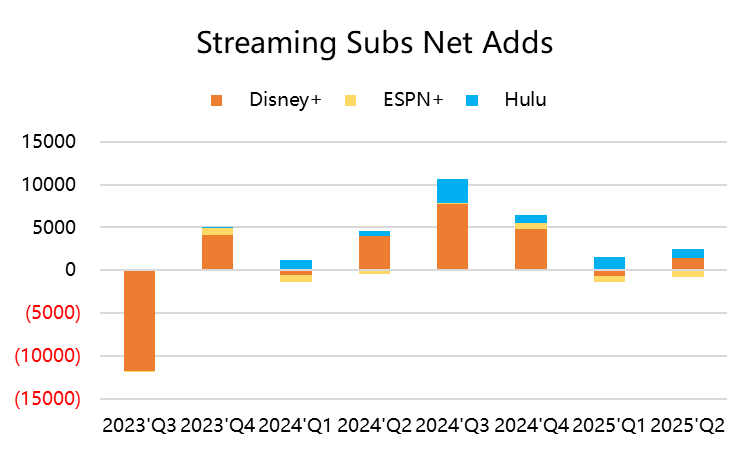

Disney+ subscriptions increased by a net 1.4 million, reversing the loss of 700,000 subscribers in the prior quarter, bringing total subscriptions to 126 million

Hulu subscriptions up 1.1M to 54.7M, Live TV subscribers down slightly

DTC profit of $336 million, up significantly from $47 million in the same period last year and profitable for the fourth consecutive quarter.

Theme Parks & Experiences revenue growth of 6%-7%, operating income growth of 9%-13%, particularly strong performance in the U.S. domestic parks, operating income growth of 13% year-on-year

Earnings guidance: FY2025 revenue growth was raised by 6%-8%, adjusted EPS guidance was raised from $5.44 to $5.75, with year-over-year growth of approximately 16%, significantly exceeding market expectations; double-digit growth is also expected in FY2026 and FY2027.Going forward, we will focus on movie content releases, the launch of ESPN's new DTC product, and a number of expansion projects in the experiential business; the theme park business remains optimistic in the face of economic uncertainty and increased competition

Investor Feedback

Shares jumped about 10.76%, reflecting positive investor reaction to earnings beat and upward revision of earnings guidance

Investment Highlights

Streaming business greatly exceeded expectations, and the effect of crackdown on shared accounts is remarkable.

The DTC business has been profitable for 4 consecutive quarters, with Q2 profit reaching $336 million (compared to only $47 million in the same period last year).At the same time there is the effect of subscription price hikes and crackdown on shared accounts, but at the same time user stickiness remains strong and subscriber growth exceeded expectations.

Among them, Disney + 1.4 million new subscribers (expected to lose 1.25 million), reversing the trend of last quarter's loss of 700,000, Hulu users continue to increase, ARPU enhancement, streaming media full-year profit or up to 1 billion U.S. dollars (the original target of 875 million U.S. dollars), but at the same time need to be vigilant about the intensification of competition and the pressure on the cost of content

Theme parks are recovering strongly, increasing investment in parks against the trend.

Q2 operating income of $2.49bn (+9% YoY) was the core driver of earnings.U.S. domestic park revenues grew 13%, benefiting from a rebound in attendance, hot holiday packages and strong bookings for new cruises (e.g. Disney Treasure).Meanwhile, investment in domestic U.S. theme parks achieved an all-time high in ROIC.While international tourist arrivals remained below pre-Epidemic levels, domestic tourist arrivals made up for it.

The international parks business is under less pressure, with Shanghai and Hong Kong Disneyland declining on weak revenues and Paris remaining in decline.The outlook for 2025 expects full-year operating revenue growth of 6%-8%, with seasonal demand (e.g., Halloween, Christmas seasons) in the second half of the year likely to push results further.

The company is bucking the expansion trend: it has announced a partnership with Miraal Group to create Disneyland Abu Dhabi (the seventh theme park resort) in the UAE.Disney is responsible for designing and providing operational expertise, while the Miral Group is responsible for funding and construction, with the aim of serving a significant international visitor base from regions such as the Middle East, Africa and Asia.

Plans to invest over $30 billion in theme parks in Florida and California to enhance product offerings, create jobs and support the U.S. economy.

Earnings guidance raised, valuation potential further realized

The company raised its full-year earnings estimates, with updated adjusted EPS expectations for 2025 now at $5.75, up from $5.30 previously.

Reflecting management's confidence in the expansion of content distribution, ESPN's DTC offerings and experiential businesses, the streaming business continues to grow and aims to accelerate profitability through technology, ad tech improvements, and content investments.ESPN's direct-to-consumer offerings are set to roll out in the next few months, with more details on pricing and functionality to be announced soon.

At an upwardly revised adjusted EPS of $5.75 for fiscal 2025, the dynamic PE for the next 12 months is only about 14x, which is at a historically neutral to low valuation

Comments