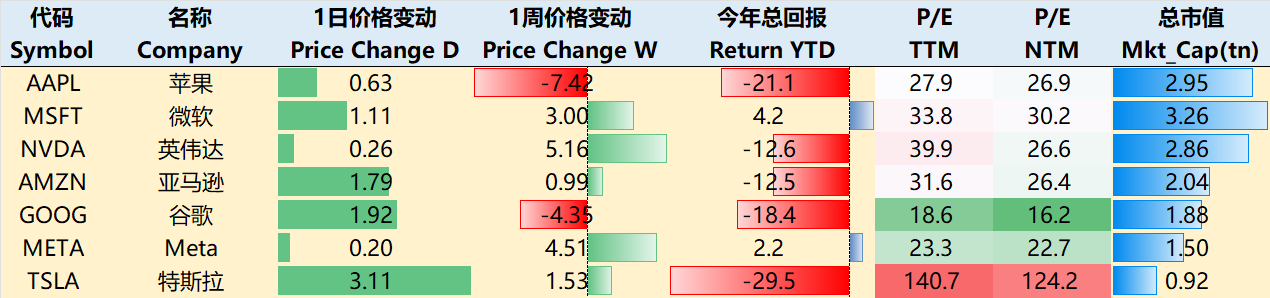

Big-Tech’s Performance

Weekly macro storyline: Gold Pauses, Crypto Takes the Baton; Powell Clashes with Trump

The May 7 FOMC meeting unsurprisingly paused rate hikes for the third consecutive time. The statement highlighted increased economic uncertainty, explicitly mentioning for the first time the "dual risks of rising unemployment and accelerating inflation." During the press conference, Powell dismissed political pressure, warning that high tariffs could lead to simultaneous increases in inflation and unemployment, hinting that rate cuts might be delayed until the second half of the year. Trump, predictably displeased, called him "Mr. Too Late," further escalating tensions between the White House and the Fed. Earlier, "New Bond King" Gundlach warned that inflation could exceed 4% by year-end, potentially forcing the Fed to cut rates or even implement yield curve control (YCC).

Gold retreated this week, with the dollar index rebounding above 100. Meanwhile, cryptocurrencies surged, with BTC breaking through the $10,000 mark again, further undermining the dollar’s safe-haven status.

Trump’s first "big deal" materialized—a preliminary U.S.-U.K. tariff agreement, reducing car tariffs to 10% (for the first 100,000 units) and eliminating steel and aluminum tariffs, though the U.S. retained a 10% baseline tariff while warning of higher rates for other countries. The EU plans to retaliate with tariffs on €95 billion worth of U.S. goods and has filed a WTO complaint targeting products like cars and aircraft. Escalating trade conflicts are adding pressure to global supply chains, with the U.S. trade deficit widening 9.6% month-over-month in March.

This week saw a flurry of earnings reports, with consumer-facing companies mostly citing headwinds, while the advertising sector remained divided. AI and cloud services continued to thrive.

Big Tech staged a broad rebound this week, except for Apple, which reported the first-ever decline in Safari search volume and announced plans to integrate AI search—shifting expectations for both Google and itself.

As of May 8 closing, most Big Tech stocks rebounded over the past week: $Apple(AAPL)$ -7.42%, $Microsoft(MSFT)$ +3.00%, $NVIDIA(NVDA)$ +5.16%, $NVIDIA(NVDA)$ +0.99%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -4.35%, $Meta Platforms, Inc.(META)$ +4.51%, $Tesla Motors(TSLA)$ +1.53%。

Big-Tech’s Key Strategy

Why Did Apple Stab Google Now?

On Wednesday, Apple’s Senior VP of Services, Eddy Cue, revealed that Safari search volume declined for the first time in April, attributing it to AI adoption. He also announced plans to add AI search to the browser.

While rumors of AI replacing traditional search are rampant, confirmation from an insider like Apple carries a "turning point" significance. The news spooked Google, sending its stock down 7% that day.

Market analysts, including Ming-Chi Kuo, worry that Google’s dominance in search advertising could be severely undermined, potentially following Yahoo into obsolescence. Reasons include:

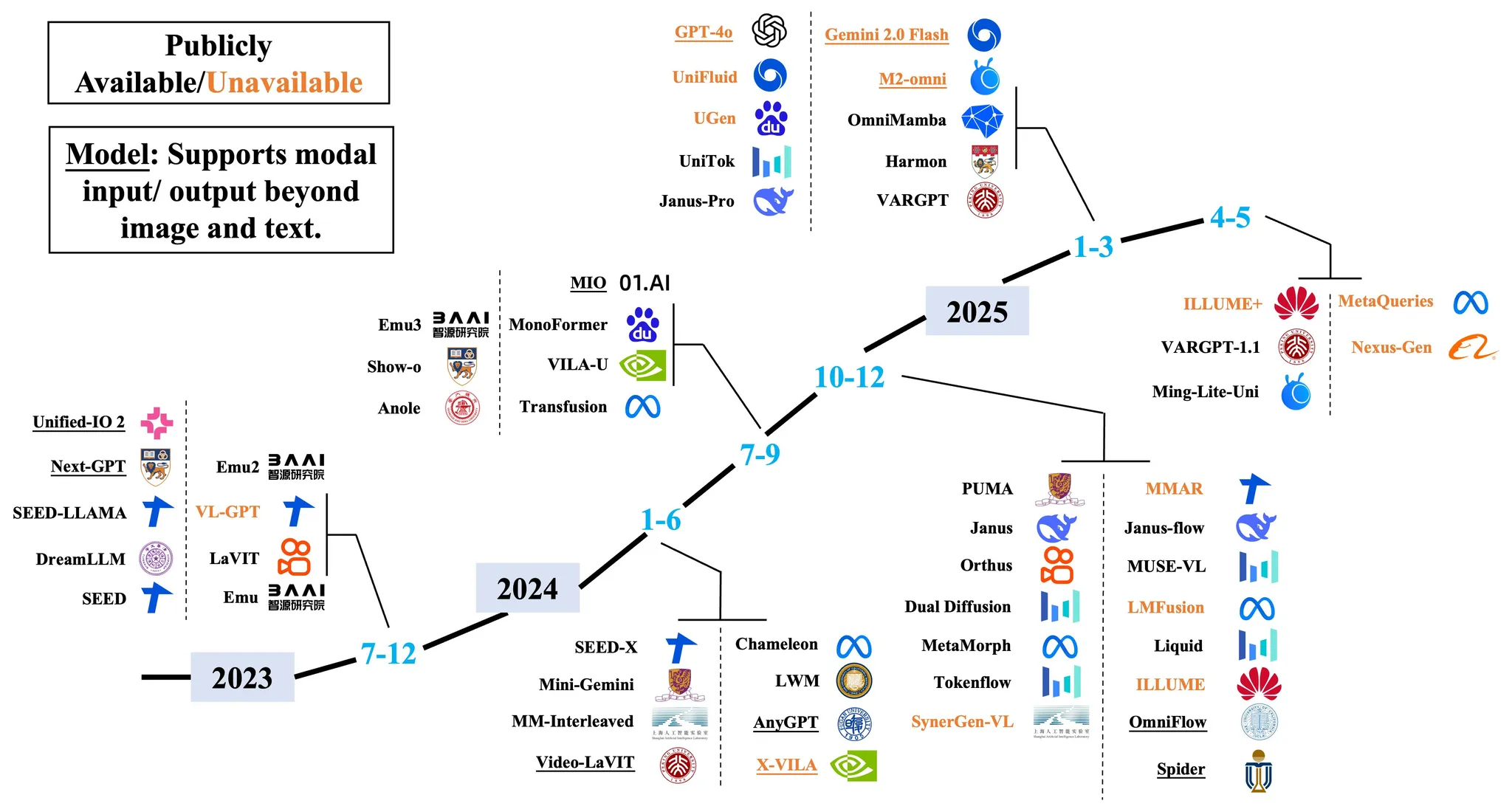

AI search squeezing traditional search. Though not yet reflected in Google’s earnings, GenAI providers are already capturing search market share, even if they haven’t monetized ads yet.

Search market share must drop significantly before ad revenue is impacted. For now, AI products like OpenAI’s haven’t fully evolved to disrupt ads.

Google’s search business is a "time-capture" game, akin to 2022 fears that TikTok would replace Meta’s social matrix.

The market has long priced in GenAI’s threat to search (Google is the lowest-valued Magnificent Seven stock). Third-party data shows Google’s search share has dropped from 90% pre-AI to under 70%.

Conversely, Google is among the most aggressive in AI transformation, embedding AI into search ads to boost monetization.

Commercial queries (e.g., e-commerce, local ads) show promise, with advertisers willing to spend similarly or more on AI search—if platforms solve ad integration.Google’s ecosystem relies on Chrome, but AI platforms currently depend on it. Unless OpenAI creates a browser to dethrone Chrome (as Chrome did to IE), fragmentation prevents any AI player from breaking free.

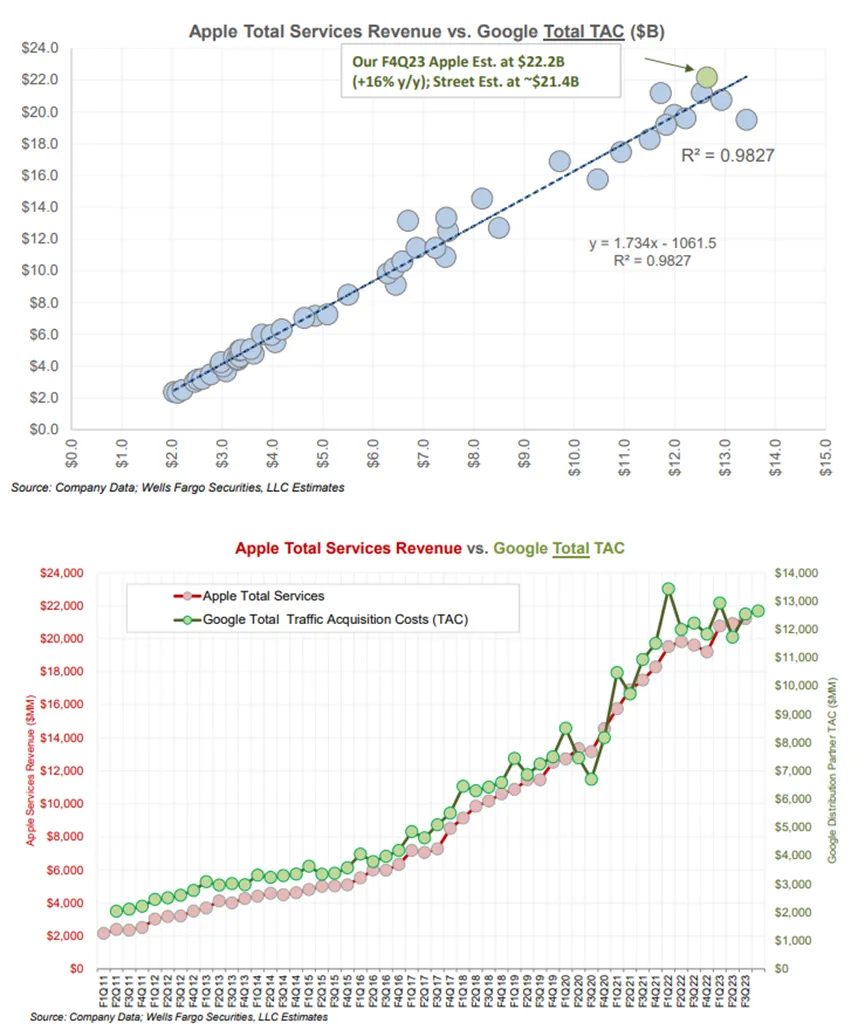

Crucially, Google pays Apple a "tax" as Safari’s default search provider—Traffic Acquisition Costs (TAC) eat ~20% of Google’s ad gross profit. So why would Apple "cut off its nose to spite its face"?

Apple’s "earnings anxiety." Hardware growth is slowing due to macro headwinds, forcing Services to carry the load—but even that faces risks (e.g., third-party app stores, lower App Store fees). Eddy Cue, as Services VP, is under pressure.

Antitrust concerns. Google’s revenue-sharing deal with Apple is already under DOJ scrutiny. Embracing AI search could diversify monetization and mitigate antitrust risks—or prove Google’s partnership is the "efficient choice."

Eddy Cue’s messaging. Beyond needling Google, he even joked that "AI might make iPhones obsolete in 10 years." Steve Jobs would’ve cringed, but the takeaway is clear: Apple is preparing for the worst.

Big Tech Options Strategy

Focus On This Week: Good News for Chips?

Trump plans to roll back AI chip restrictions, proposing "a simpler rule." Major tech firms, including Nvidia, had opposed the curbs.

GB300 is set for pilot production in Q2 (July-August), with mass production in Q3 if yields meet expectations. A downgraded H20 AI chip for China is also slated for release within two months.

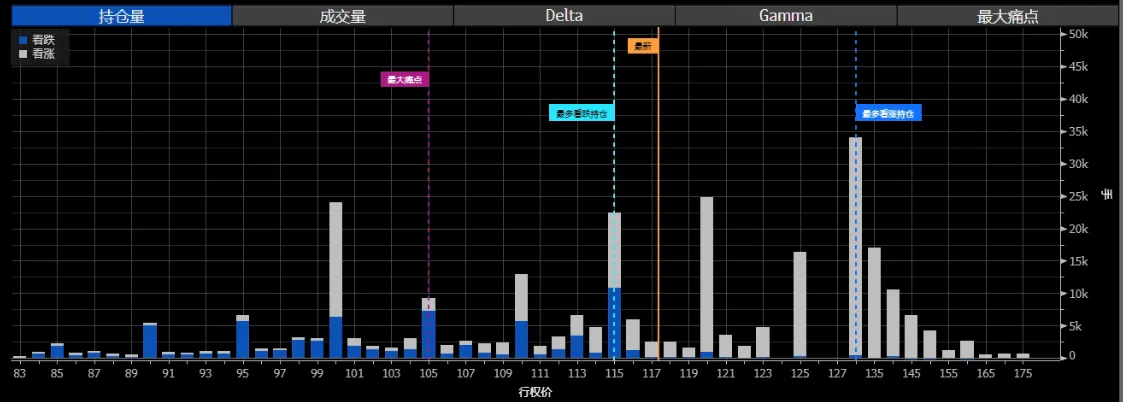

For May 30 (earnings week) expirations, open interest is heavily concentrated in 120–130 calls, with max pain currently at $130.

Big-tech Portfolio

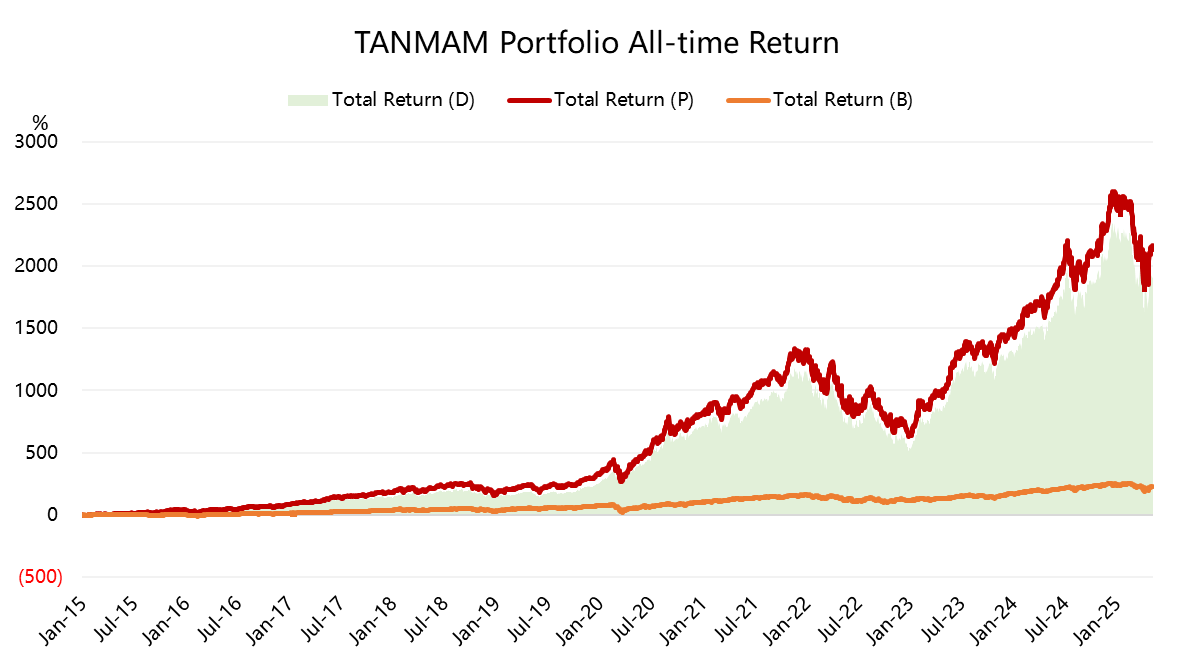

The "Magnificent Seven" form an equal-weighted, quarterly-rebalanced portfolio. Backtesting since 2015 shows staggering outperformance

Total return: 2160.93% vs. SPY’s 228.50% (1932.44% alpha).

YTD, the port is down 11.67% vs. SPY’s -3.3%.

Over the past year, the portfolio’s Sharpe ratio rose to 0.73 (SPY: 0.4), with an info ratio of 0.82.

$S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ $NASDAQ(.IXIC)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$

Comments