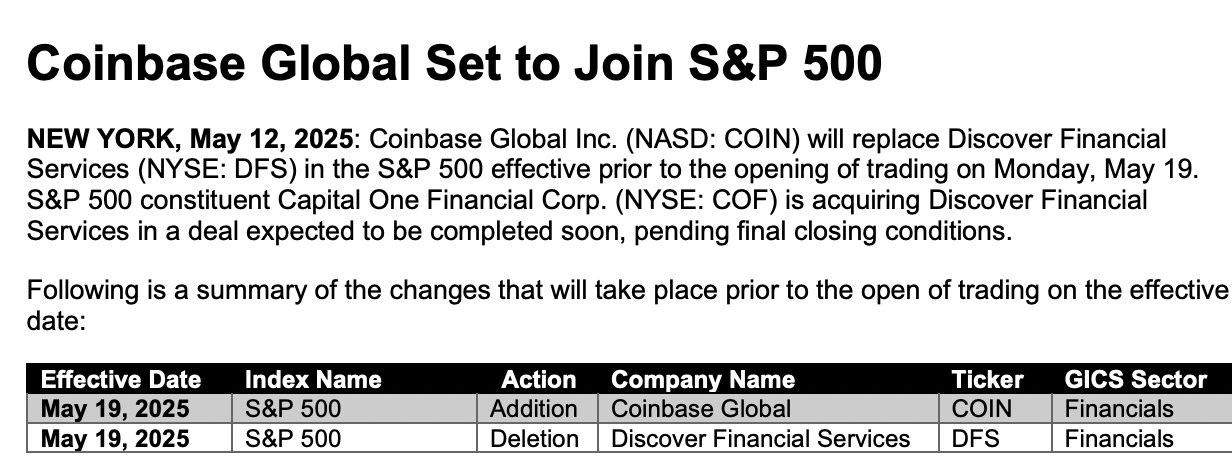

On May 19, $Coinbase Global, Inc.(COIN)$ will officially replace $Discover(DFS)$ as a component stock of the $S&P 500(.SPX)$ This event is not only a major milestone for Coinbase but also a symbolic moment signaling the mainstream acceptance of the cryptocurrency industry by traditional financial markets. Coinbase's stock surged 10% in after-hours trading, pushing its market capitalization past $53 billion, as market sentiment soared.

Why Coinbase? Compliance, Profitability, and Industry Representation

Coinbase’s inclusion was not accidental—it is the result of several key factors:

Compliance Strength: Amid tighter regulations, Coinbase has become one of the most compliant crypto exchanges, with stringent KYC/AML policies and a global licensing footprint.

Profitability Criteria Met: The S&P 500 requires constituent companies to be profitable in both the most recent quarter and over the last four quarters. Coinbase posted a net profit of $65.6 million in Q1 2025, meeting the standard.

Industry Representation: As the largest cryptocurrency platform in the U.S., Coinbase serves as a crucial bridge between traditional finance and the crypto market. Its inclusion signifies that crypto assets are officially entering the “mainstream asset” category.

Short-Term Market Reaction: Liquidity Premium and Passive Fund Inflows

Historical data shows that stocks typically experience a short-term price surge after being added to the S&P 500, due to:

Index Replication Demand: Index funds and institutional investors must buy the stock to replicate the index, creating immediate buying pressure.

Increased Liquidity: With reduced holding restrictions for institutions, trading volumes are expected to rise further.

Passive Capital Inflows: Index funds must buy in proportion to weight. Given the $6 trillion AUM tracking the S&P 500, COIN could see net inflows of around $6 billion.

Since the end of 2023, companies added to the S&P 500 saw an average gain of 7.38% between announcement and effective date, with $Palantir Technologies Inc.(PLTR)$ reaching a high of 25.12%. High-beta stocks with significant attention—such as $PLTR$, $Uber(UBER)$ $Dell Technologies Inc.(DELL)$ $SUPER MICRO COMPUTER INC(SMCI)$ $DoorDash, Inc.(DASH)$ —often saw larger price increases.

However, investors should be wary of profit-taking risks, as part of the expected gains may already be priced in.

Long-Term Impact: Sustained Performance and the “S&P Effect” on Crypto

Over the long term, companies added to the S&P 500 typically exhibit strong financial performance, with increases in both market cap and EPS. While share prices may rise before and after inclusion, there is often a subsequent pullback or consolidation, followed by sustained growth based on fundamentals.

Coinbase’s inclusion may trigger a chain reaction:

More Crypto Firms in Mainstream Indices: Companies like $Block, Inc. (formerly Square) and $Riot Platforms (RIOT)$, with relatively strong compliance, could be next in line.

Faster Institutionalization and Regulation: Traditional financial institutions may increase allocation to crypto assets, accelerating standardization in the industry.

Challenges Remain:

Profitability Volatility: Due to crypto market fluctuations, Coinbase’s net profit fell 94% YoY in Q1 2025, highlighting the sector's cyclical risks.

Intensifying Competition: Global players like Binance and Kraken still hold significant market share, pushing Coinbase to continually innovate to stay ahead.

Investment Takeaway: A Historic Moment, but Stay Rational

For investors, Coinbase’s inclusion in the S&P 500 is both an opportunity and a test:

In the short term, there may be trading opportunities due to passive capital inflows.

In the long term, attention should shift to regulatory risks, technological evolution, and the broader development of the crypto industry.

Comments