$Sea Ltd(SE)$ jumped more than 15% at one point after announcing its Q1 earnings, and was steady during the day, eventually closing +8.2%, also reflecting investor optimism about its earnings report, which beat expectations.The company's stock hit a new year-to-date high and recovered 40% from its 2021 high.

The whole Q1 is characterized by "profit>growth", and the profit margin is a big surprise, with the profit margins of games and e-commerce exceeding expectations.But on the other hand, the continuity of seasonal sudden increase, slowdown in revenue growth of e-commerce business and the risk of financial business is still worthy of vigilance.

In the short term, the IP linkage dividend already exists, but in the long term, we need to verify the steady state profitability of e-commerce and the ability of financial risk control.

Performance and Market Feedback

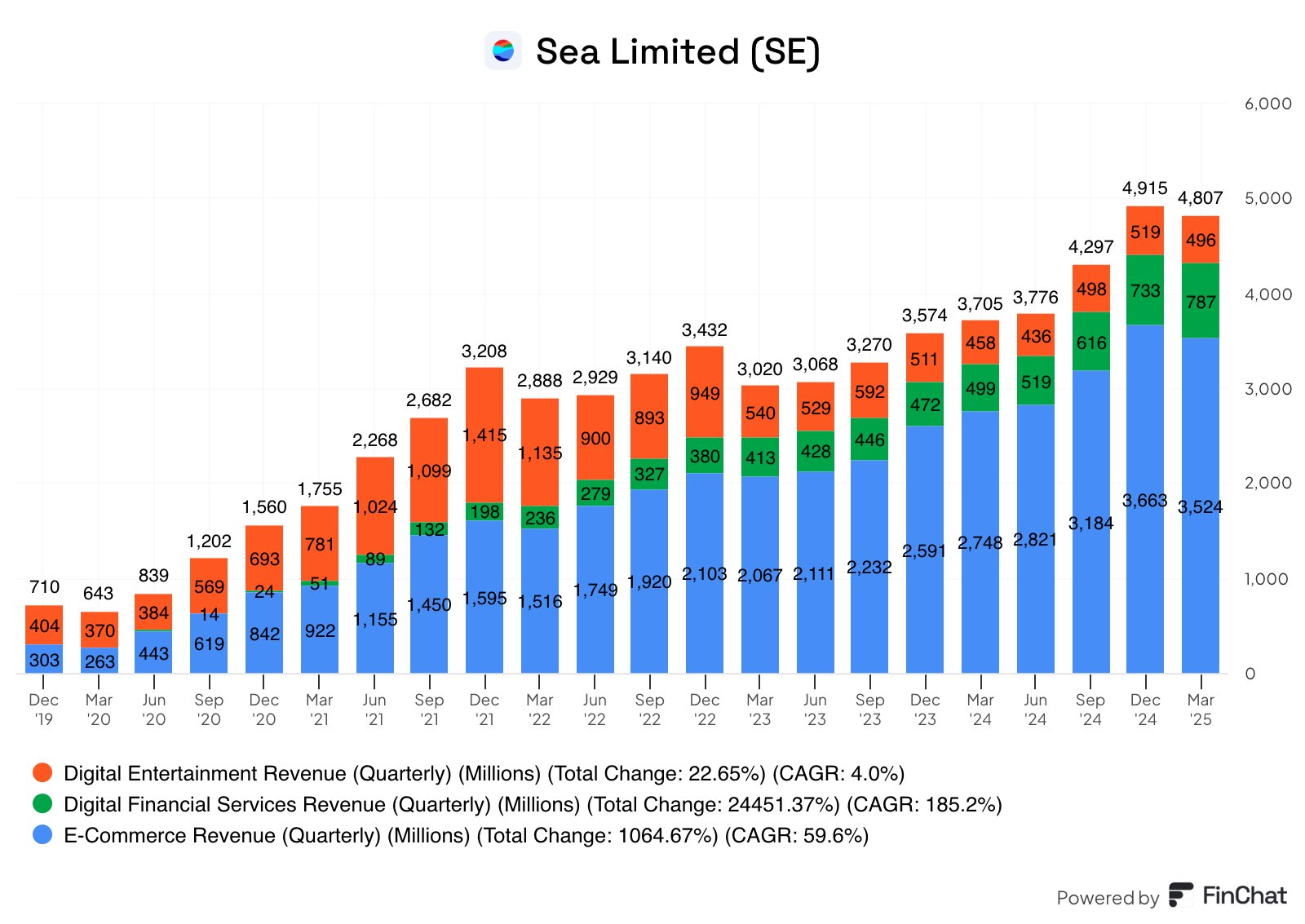

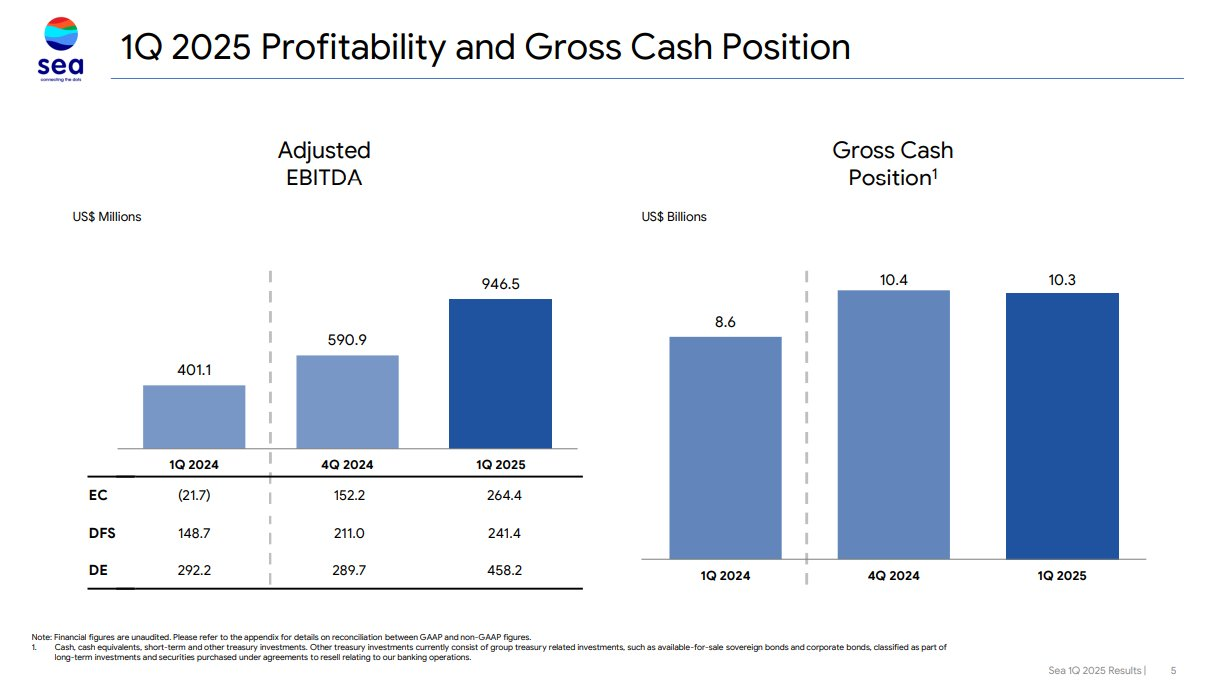

Q1 overall revenue of $4.84B (+29.6% YoY) was slightly lower than the expected $4.89B. However, on the net profit front, it reached $411M, a turnaround compared to a loss of $23M in the same period last year, with a diluted EPS of $0.65, which exceeded the market's expectation of $0.63.

In terms of business segments, e-commerce (Shopee) reported GMV$28.6B (+21.5%), revenue of $3.52B (+28.3% yoy), and operating margin of 5.5% (well ahead of expectations of 2.4%).Digital Finance (Monee) revenue $787M (+57.65.8B (+76% yoy), but bad debt accruals +174% yoy.Gaming (Garena) water $775M (+51.4% yoy), daily users returned to pre-event peak, paid user ratio rose to 9.8%.

Investment highlights

Garena's game business growth rate exceeded expectations, and IP linkage drove the short-term explosion of users and water flow.

Flow and user growth: Garena's game business flow soared 51% year-on-year (compared to the market's expectation of only 11%), mainly due to the linkage between "Free Fire" and "Naruto" IP, which drove the daily active users close to the pre-pre-epidemic peak.Active users increased by 15 million YoY, paid users reached 65 million (exceeding estimate of 53 million), paid ratio increased from 8.2% to 9.8%, and water per capita increased by 15% to $12 YoY.

Profit performance was better, with adjusted EBITDA up 56.8% YoY and margins improving from 57.1% to 59.1%.

However, attention needs to be paid to sustainability, as management also said on the call that it was unable to give full-year guidance for Garena.This kind of short-term growth relies on IP linkage most of the user retention rate, which is also very common in Tencent's game cycle, but historical experience shows that as long as there is no major operational matters, the probability of old users activated after the flow of water stabilized, and from the point of view of the current quarter's deferred revenue is also not a big problem.

E-commerce growth slowed, but profit release exceeded expectations

GMV growth slowed to 21.5% YoY, down 2% to 21.5% (vs. market expectation of 23%) due to lower order volume growth to 19% and weak customer unit price growth (+2% yoy).Meanwhile revenue was +28% yoy, smaller than last quarter's +41%, mainly due to a 0.3 pct YoY drop in 3P Mall realization rate (impact of shipping fee waiver policy) Margin jumped to 5.5%, much higher than the market's 2.4% estimate, mainly due to 3P Mall's gross margin improvement (10% up to 16.5%).

The market has actually lowered its GMV growth expectations, so it is not very sensitive to this, but the pace of profit release exceeded expectations.

In addition, the Brazilian business has been a bright spot in Q1 and has been able to maintain a leading price advantage.At the same time, management believes that Brazil has a lot of growth potential in the coming quarters, and margins (EBITDA) are in the middle of the pack, slightly higher than some of the Southeast Asian country markets.

Digital finance business expansion comes with risks

Q1's loan balance +76% yoy, but bad debt accruals +174% yoy and new market expansion dragged margins (operating margin 29% vs. 30.7% expected).Longer term, credit penetration improvement remains the core narrative, but asset quality needs to be monitored.

Q1 West also saw strong growth in gross loans.

Earnings guidance and valuation debate

Management is confident, saying "strong start supports full-year target", but did not provide specific figures.Current market cap of $90B implies linear growth assumptions for 2025-2026 (e-commerce margins continue to improve, financial business doubles in size), but watch out for a drop in gaming traffic, increased competition from e-commerce, or a spike in financial bad debt.

Comments