After the Hong Kong market closed on May 14, $TENCENT(00700)$ released its Q1 2025 financial report.

Following a previous quarter where Tencent significantly outperformed market expectations, with steady growth in both gaming and advertising, the company — like other Chinese tech giants — has re-entered an investment cycle. Thanks to excellent cash flow, it continues its aggressive share repurchase program while simultaneously increasing its AI investments.

Since this report came just two months after the previous one — during a period impacted by tariff concerns — the market has started to reprice high-quality, non-U.S. assets. As a result, investor expectations ahead of Tencent’s Q1 release were very optimistic. Even without share buybacks, Tencent’s stock had already regained losses from April and was approaching its year-to-date high prior to the report.

Key Highlights of Q1 Performance

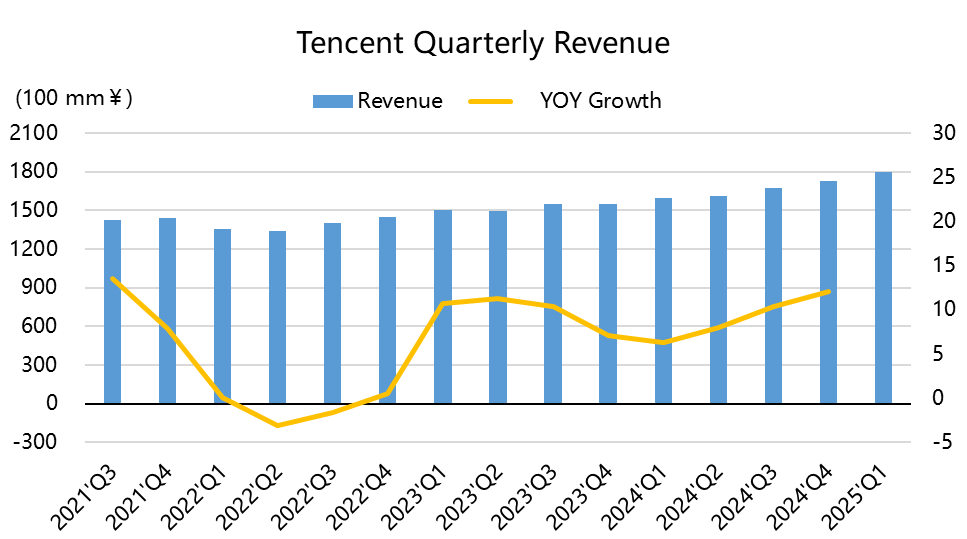

Revenue growth continued to rise after returning to double digits, with a surprise beat of over 2%.

Gaming and advertising segments outperformed, supported by ongoing updates of legacy titles and the success of new releases. AI upgrades also improved ad targeting precision and delivery efficiency. Fintech and enterprise cloud services showed steady growth, largely in line with expectations.

On the cost side, the increase in COGS was primarily driven by gaming content distribution and server bandwidth. But with revenue growing faster, gross margin reached 60%. Marketing expenses rose only 4%, while G&A expenses surged 36%, reaching 18.7% of revenue (up from 17% in Q4), mainly due to overseas restructuring and higher AI-related R&D. As a result, EBIT grew by 9.5%, trailing revenue growth and slightly missing expectations (RMB 57.6bn vs 59.2bn).

Profit from associates fell back to RMB 4.58bn from a spike of RMB 9.25bn in the previous quarter. Net margin was 26.5%, and adjusted net margin stood at 34%. Adjusted EBITDA came in at RMB 81.6bn.

Based on a closing price of HKD 521, Tencent’s current TTM PE has dropped to 19.5x, and the 2025 Forward PE is 23.4x, still low compared to the U.S. Magnificent 7.

Investment Highlights

1. Gaming: Seasonal Peak + New Releases Drive Surprise Upside

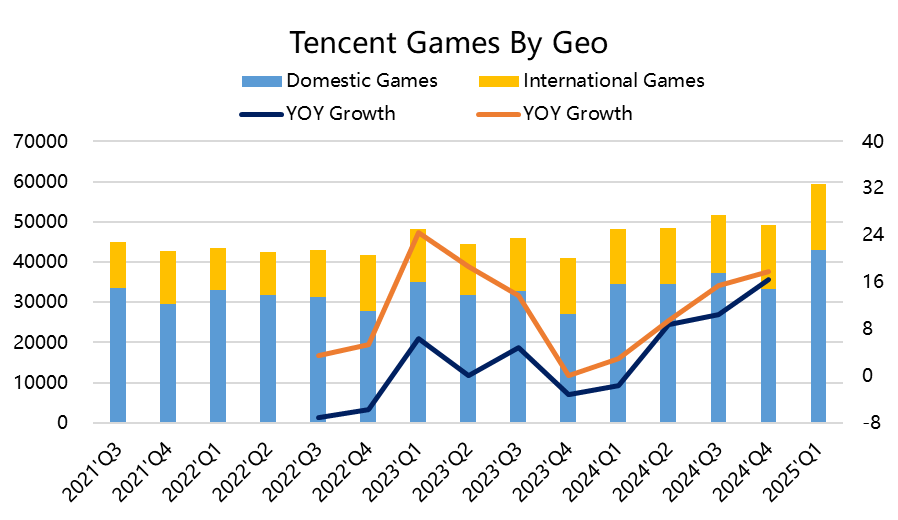

Gaming remains in a release cycle, supported by peak-season performance and the launch of new titles. Domestic and international game growth rebounded, with VAS growing 17% YoY, outpacing the overall 12% revenue growth.

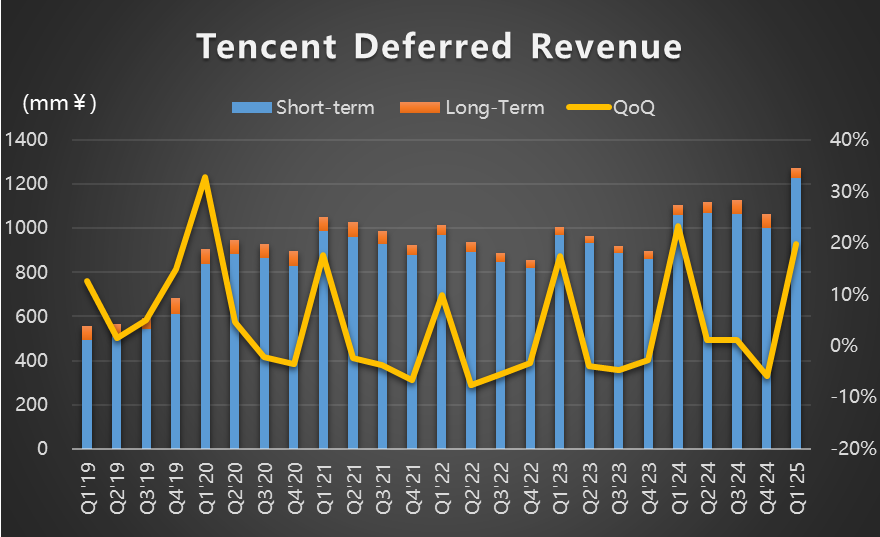

Domestic game revenue rose 24% YoY, and overseas 23% (vs. 15% in Q4). The earlier surge in deferred revenue suggests a sustained upward cycle in gaming cash flow.

Long-standing titles like Honor of Kings and Peacekeeper Elite hit record highs in in-game spending. Dungeon & Fighter: Origins and Delta Force made strong revenue contributions. The latter reached record user activity levels and continues to show strong engagement. Future growth will rely heavily on operational excellence.

Overseas growth continued at a double-digit pace, led by titles like Brawl Stars, Clash Royale, and PUBG Mobile.

Social networking revenue also benefited from mini-game platform fees. The upcoming pipeline in Q2 (e.g., Dream Star IP spinoff) could sustain momentum, though regulatory scrutiny may affect monetization.

Deferred revenue reached RMB 127.4bn, up 15.3% YoY and 19% QoQ, indicating visibility in near-term gaming revenue.

2. AI-Driven Ad Monetization Acceleration

Advertising revenue rose 20% YoY to RMB 31.85bn, fueled by strong demand across video accounts, mini-programs, and WeChat Search inventory.

After an acceleration in Q4, market expectations were high for advertising — and Tencent delivered. High-margin ad business further lifted gross margin.

AI-powered upgrades to Tencent’s ad platform boosted targeting accuracy and delivery efficiency, improving advertiser ROI. Enhanced WeChat ecosystem engagement and surging demand for AI-generated creatives (e.g., text-to-image, digital human livestreaming) helped strengthen the platform’s monetization loop.

The addition of Yuanbao AI assistant to WeChat contacts boosted user activity. Competitors like Douyin, Kuaishou, and Xiaohongshu are also enhancing internal search features with algorithms tuned to user behavior.

While Q2 could see a seasonal decline, full-year outlook remains strong, buoyed by AI-powered precision advertising.

Overall ad gross margin rose from 53% in Q4 to 56%.

3. Fintech & Enterprise Services: Stable Growth, Improving Margins

Revenue rose 5% YoY, with gross margin improving 4ppt to 50%.

Payments, the largest segment, saw stabilization due to stronger offline activity but has not yet entered a full rebound. Growth was mainly driven by wealth management services.

Cloud services benefited from stronger demand and Tencent’s technological improvements, attracting more enterprise clients.

4. Cost Structure: Gross Margin Hits Record High, But AI Spending Pressures Profitability

Revenue cost growth of 4% lagged the 12% revenue growth, thanks to game content efficiencies and better server utilization. This drove gross margin up to an above-expectation 60%.

However, future AI investments may result in higher depreciation and amortization, likely keeping margins in the 55–60% range.

Operating profit slightly missed expectations, not due to marketing costs, but because G&A jumped 36%. The company cited a one-off RMB 4bn expense related to overseas restructuring — likely involving Sumo Group — as well as AI-related investments. Excluding this, G&A grew 19.6%, still above revenue growth, suggesting future pressure on margins.

5. Non-Operating Income Supports Earnings Beat

Associates contributed RMB 4.6bn in Q1, higher than the RMB 2.8bn a year ago but down from RMB 9.4bn in Q4. However, investment income doubled from RMB 650m to RMB 1.4bn, offsetting lower interest income.

Major profit contributors among Tencent’s associates include:

Domestic: Kuaishou (01024), Pinduoduo (PDD), Tongcheng Travel (0780), China Unicom (0762), KE Holdings (BEKE)

Overseas: Supercell, Spotify (SPOT), Sea Ltd (SE)

These firms saw profit growth in 2024, delivering stronger associate earnings to Tencent.

6. Capex and Strategic Focus: AI, Cloud, Commerce

Q1 capital expenditure rose 91% YoY to RMB 23bn, in line with full-year 2025 guidance of over RMB 100bn.

R&D spending hit RMB 18.91bn, up 21% YoY.

The increase in CapEx is a strategic move to maintain competitive advantage, though not overly aggressive at this stage.

Tencent also announced the creation of a WeChat E-Commerce Product Department, aiming to turn WeChat from a traffic platform into a transaction platform.

Initiatives include integrating mini-programs, video accounts, and payments into a seamless ecosystem;

Reducing reliance on third-party platforms like JD and Pinduoduo;

Exploring live commerce, direct-to-consumer brands, and C2M models — similar to Douyin’s e-commerce strategy.

Valuation

Tencent’s Non-IFRS net profit reached RMB 69.3bn, up 18% YoY.

Adjusted EBITDA was RMB 63.9bn, up 17% YoY, faster than revenue growth.

With the stock price recently rebounding to HKD 521:

TTM PE has fallen from 27.7x to 19x;

Forward PE (2025 EPS) is at 17.4x, still low compared to U.S. tech peers.

Comments