Overall, $Cisco(CSCO)$ Q3 2025 earnings report shows the company has achieved significant growth based on its traditional networking business, leveraging AI infrastructure and strategic innovation, and both earnings and guidance exceeded market expectations, with the stock reacting positively.Management's solid execution and effective response to macro risks have laid a solid foundation for the company's continued growth in the future.

Results and Market Feedback

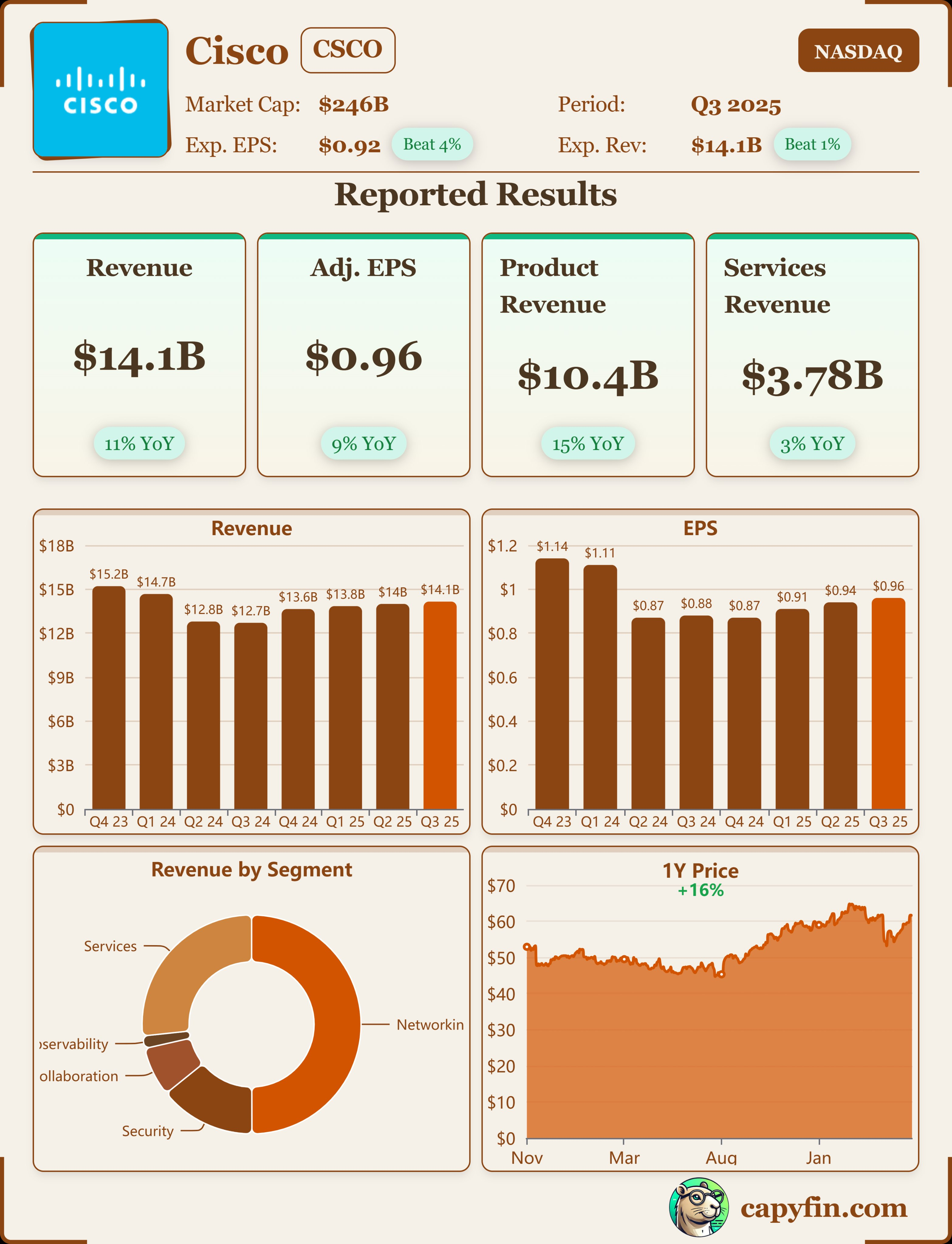

Cisco Systems (NASDAQ: CSCO) reported strong results for the third quarter of fiscal year 2025, exceeding market expectations overall.The company reported total revenues of $14.1 billion, up 11% year-over-year (+11% yoy), beating the market's general estimate of approximately $14 billion.Non-GAAP earnings per share (EPS) came in at $0.96, beating analyst estimates of $0.92 by 4.3% and up 9% yoy. GAAP EPS came in at $0.62, up 35% yoy

In terms of net income, GAAP net income reached $2.5 billion, up 32% year-over-year, while non-GAAP net income was $3.8 billion, up 8% year-over-year.6 Product orders were up 20% year-over-year, and up 9% excluding the impact of the Splunk acquisition, demonstrating strong demand in the company's core business.Of particular note, Artificial Intelligence (AI) infrastructure orders for large-scale networking customers exceeded $600 million, reaching the $1 billion target one quarter ahead of schedule

Following the earnings release, Cisco shares rose approximately 2.3% to 2.8% in after-hours trading, reflecting positive investor reaction to its results and future outlook.235 The company declared a quarterly cash dividend of $0.41, demonstrating solid cash flow and shareholder returns

Investment Highlights

Results exceeded expectations with both revenue and profit growth

Revenue of $14.1 billion grew 11% year-over-year, with non-GAAP EPS of $0.96 exceeding market expectations, and margins remained strong, with gross margins of 68.6% and operating margins of 34.5%

Product revenue grew 15% and service revenue grew 3%, demonstrating good performance in both the company's hardware and software services businesses

Artificial Intelligence Business Drives Growth

AI infrastructure orders exceeded US$600 million, a significant increase from US$3.5 million in the previous quarter, achieving the US$1 billion target ahead of schedule, highlighting Cisco's competitiveness in the AI field and strong market demand

AI-related products and the enterprise AI market have become new growth engines for the company, and strategic partnerships and technological innovations continue to advance, enhancing future growth potential.

Balanced regional business performance

Americas revenue of $8.38 billion, up 14% year-over-year, with a gross margin of 67.7%.

Europe, Middle East and Africa (EMEA) region revenue of $3.74 billion, up 8% year-on-year, gross margin of 71.2%

Asia Pacific, Japan and China (APJC) revenue of $2.03 billion, up 9% year-over-year, with gross margins of 67.2

Upbeat financial guidance

The company is guiding for fiscal 2025 fourth quarter revenue of $14.5 billion to $14.7 billion and non-GAAP EPS guidance of $0.96 to $0.98, both above analysts' expectations (revenue of approximately $14.51 billion and EPS of $0.95).

Full year revenue is expected to be $5.65 billion to $5.67 billion and non-GAAP EPS is expected to be $3.77 to $3.79, both upwardly revised from previous estimates

Executive Moves and Macro Risks

CFO Scott Herren is retiring at the end of July and will be replaced by Mark Patterson, Corporate Strategy Officer, a smooth management transition that will help to maintain continuity of the company's strategy

The company's guidance takes into account the impact of U.S. tariffs on China, Canada and Mexico, which is expected to put pressure on margins, but overall confidence remains high

Analyst Concerns and Company Response

Analysts focused on how the company is sustaining growth in a complex macroeconomic environment and trade policy, with CEO Robbins emphasizing the company's continued drive for AI and core business growth through its secure network portfolio and global partnerships.

Investors are concerned about the sustainability and scale of the AI business, and Cisco demonstrated strong momentum and technology leadership in AI orders to boost market confidence

Comments