$Tencent Holdings (00700) $The financial report was released. Judging from the superficial figures, the company's first-quarter revenue was 180.022 billion yuan (RMB, the same below), an increase of 13%, and the adjusted net profit was 61.329 billion, an increase of 22% year-on-year. Both data exceeded market expectations.

In the past year, the market has paid great attention to Tencent's gross profit margin and capital expenditure. Tencent's efficient cost control ability has led to continuous improvement in the overall gross profit margin. However, with the high base effect and investment in AI, the gross profit margin will also begin to come under pressure in the second half of 2024. In the latest first quarter of 2025, the company's gross profit margin reached a new high of 55.8%, mainly due to the growth contribution of high-margin revenue sources (games and advertising, etc.), as well as the improved cost-effectiveness of payment services and cloud services. This figure directly reflects the company's ability to control costs, and the latest quarterly financial report shows that this ability is still very reliable.

JPMorgan Chase released a research report stating that Tencent's first-quarter financial report was solid, and its revenue from ARVR games and online advertising accelerated to more than 20%, showing that the group has unique advantages that enable it to achieve sustainable profit growth. In addition, despite the impact of the increase in capital expenditure in the second half of the year on earnings, the growth rate of the Group's earnings per share in the first quarter is still higher than the growth of turnover, and it is expected that its share price will react positively in the short term.

For investors who want to go long on Tencent after the financial report, they can consider using selling put options to go long on Tencent.

Options Strategy: Using Put Options to Go Long Tencent

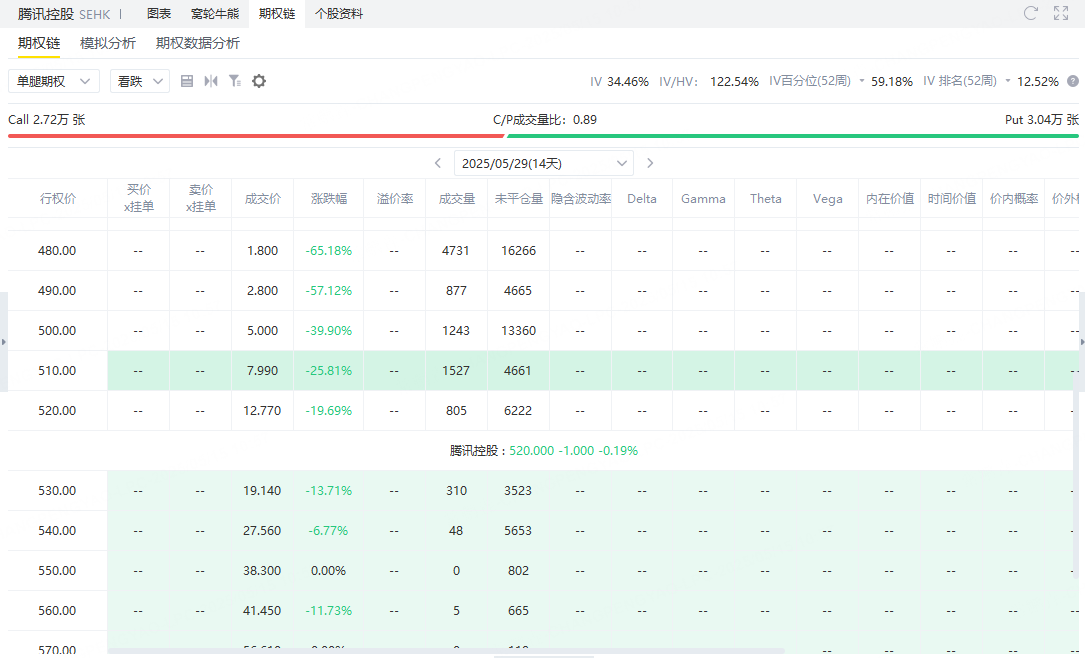

The current Tencent price is 420Hong Kong dollars, we can sellExpires May 29, 2025, exercise price 520, premium 1435Put Option (Put Option) to go long Tencent.

This strategy can not only make profits when Tencent rises, but even if Tencent trades sideways or falls slightly, it can still rely on premium to earn earnings.

Sell onePut option (Put) with an exercise price of HK $520 expiring on May 29, 2025

Premium chargeable:HK $1435

Contract unit:100 shares

This means that you charge premium of HK $1,435, and at the same time promise that before May 29, 2025,If Tencent's stock price falls below HK $520, the other party has the right to ask you to buy Tencent at a price of 520。

1.Maximum benefit:

If the stock price is ≥ HK $520 at expiration, the option will not be exercised.

You retain all premium rights:

Maximum gain = HK $1435

2.Break-even Price (Break-even Price):

When you actually buy Tencent, the price is:

520 − 1435/100 = HK $505.65

That is, if Tencent falls toHK $505.65, you are flat.

3.Maximum loss:

If Tencent's stock price falls to 0:

Loss = (520 − 0) × 100 − 1435 = 52000 − 1435 = HK $50,565

It belongs to the naked selling strategy of "limited income, unlimited loss".

In the face of the unstable global situation, using the options market, we can efficiently do long Tencent while controlling risks by selling put options. This is not only a smart way of trading, but also a sound investment choice that conforms to market trends.

Comments