$NetEase(NTES)$ reported excellent Q1 2025 results, with strong growth in old and new game businesses driving a significant increase in overall revenue and profit, and improved operational efficiency and solid cash flow laying a solid foundation for the company's future growth.Meanwhile, the innovative business retained its profitability in a low-profile manner, and the market underestimated its ability to withstand pressure.As a result the overall market reaction was positive and the share price also performed strongly after the earnings report. $NTES-S(09999)$

Results and Market Feedback

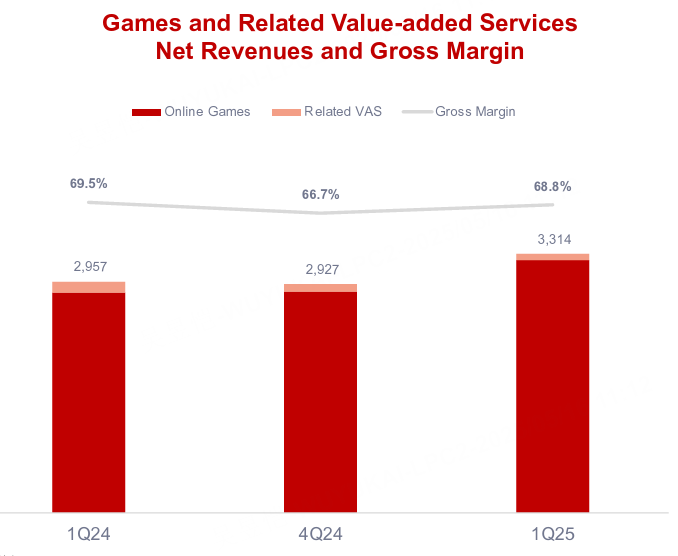

Q1 performance was strong, with overall revenue reaching RMB28.8 billion (approximately US$4.0 billion), a year-on-year increase of 7.4%, exceeding market expectations.Among them, revenue from games and related value-added services amounted to RMB24.0 billion (approximately US$3.3 billion), an increase of 12.1% year-on-year, accounting for approximately 83% of the total revenue, which became the main driving force of the earnings growth

Gross profit margin improved to 64.2%, demonstrating strong profitability. Net profit attributable to shareholders was RMB10.3 billion (approximately US$1.4 billion), a significant year-on-year increase of 64.2%, while non-GAAP net profit was RMB11.2 billion (approximately US$1.5 billion), a year-on-year increase of 35.8%, and non-GAAP net earnings per share was US$0.49, significantly higher than the market expectation of US$0.37.

Operational efficiency also improved, with operating expenses declining 14.4% year-over-year to RMB8.0 billion, mainly due to optimization of game marketing expenses and reasonable control of R&D investment.The company maintained strong cash flow, with a net cash balance of RMB137 billion (US$18.9 billion), a further increase from the end of last year, reflecting a solid financial position

NetEase shares rose sharply after the results were announced, gaining more than 14% after hours to close at $122.76, a new high in recent years, as the market is confident in the company's future growth.

Investment highlights

Game business is the "ballast" to withstand the pressure, and once again delivered a high score!

Q1 game revenue amounted to 24 billion yuan, an increase of 12.1% year-on-year, greatly exceeding the market expectation of 23.08 billion yuan; gross profit of 16.55 billion yuan, an increase of 10.8% year-on-year, gross profit margin increased to 68.9%.

This quarter netease did not break down the hand swim / end game structure, but from the product performance point of view, whether end game or hand swim are "something".

Explosive "Beyond the Boundary" on-line immediately reached the sixth Steam best-seller list;

Marvel Contest of Champions topping the Steam global charts after its second season;

Once Human surged to Top 1 on the iOS charts in over 160 countries after its launch;

The registered users of "Against the Current" exceeded 30 million;

The return of the Blizzard system has brought about the "new power of old IP", and "World of Warcraft", "Hearthstone Legend" and "Watchmen" have performed strongly in the Chinese market.

This quarter's strategy of "evergreening" old games worked well. Instead of relying on "frantic volume buying" to hit a hit, the company relied on "high-quality content + content marketing" to activate the stock of players and pull in new users.Thanks to this, selling expenses decreased by 33% year-on-year, hitting the lowest level in nearly four years.

This may be closely related to NetEase's internal anti-corruption last year.Promotion investment is more rational, but the sound of the game has not weakened, and even formed a positive feedback of the "smart money".

Of course, this is also due to this year's game "small year", there is not too prominent new explosive game, so the excellent IP of the old game once again to get a higher degree of activity and water flow.

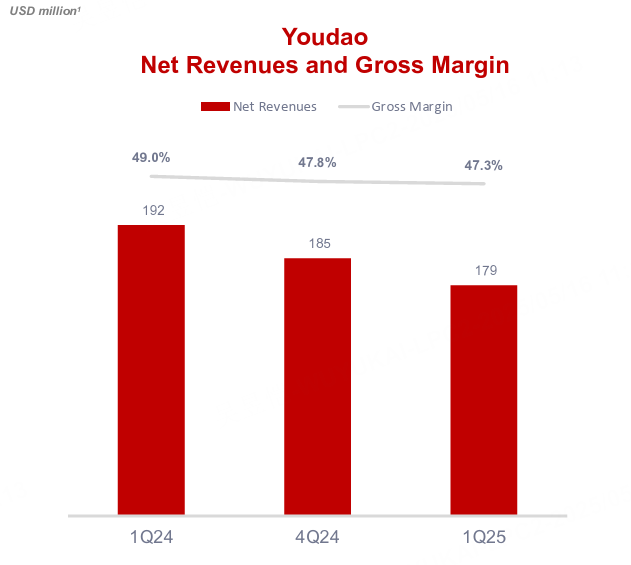

Youdao, cloud music and other innovative businesses: difficult but stable, revenue under pressure, but the quality of operations improved, reflecting the "profitability first" strategy.

Revenue of 1.3 billion yuan, down 6.7% year-on-year, but earnings exceeded expectations: Q1 operating profit of 104 million yuan, up 247.7% year-on-year.** Continued efforts in the application of AI technology, "Ziyi" big model to drive the upgrading of learning services, AI subscription business sales increased by more than 40% year-on-year

Cloud music revenue declined 8.4% year-on-year to 1.9 billion yuan, but gross profit margin rebounded to 36%.The business has shown resilience after reducing copyright burden and optimizing its operating structure.

Revenue from innovation and other businesses declined by 17.6% to $1.62 billion.

Profit release under cost control.Gross profit was RMB 18.48 billion, up 8.6% year-on-year; gross profit margin was 64.1%, up 0.7 percentage points year-on-year.Selling expenses decreased by 1.5 billion yuan year-on-year, and overall operating leverage was further released.

Non-GAAP earnings per ADS was US$2.44, greatly exceeding expectations.Net cash balance continued to climb to RMB137 billion with healthy and stable cash flow.The company declared a quarterly cash dividend of $0.135

NetEase revealed in its earnings call that it will focus on globalized masterpieces such as Infinity, MARVEL Mystic Mayhem and Destiny: Rising, while continuing to promote its long-term operation strategy of "classic IP+content update".

Has the market misjudged NetEase?

In the AI concept hype, content creative industry into the "fast consumption anxiety", NetEase relies on the "old game is not old, explosive solid, new products steadily", against the trend of steady progress.Because it "does not look so sexy", the market on the contrary, long-term conservative expectations.

But the fact proves, netease in the game cycle bottom still have strong pressure resistance and profitability - especially in blizzard return, long product renewal, globalization speed and so on multiple factors superimposed, netease is steadily out of a "guarded out of the strange" growth curve.

Comments