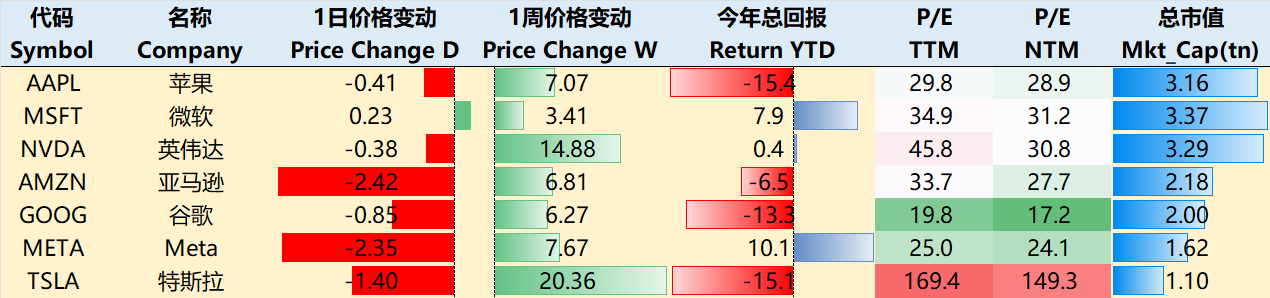

Big-Tech’s Performance

Weekly macro storyline: Trump’s adrenaline, Powell’s indifference

The week started off optimistically, as the "win-win" outcome of the Geneva talks between China and the U.S. exceeded expectations, boosting risk assets on both sides. However, Fed Chair Jerome Powell took a tough stance, stating that the Federal Reserve is re-evaluating its policy framework—modifying references to "average inflation targeting" and "underemployment"—shifting to stricter inflation control (targeting close to 2%) and remaining vigilant about an overheating labor market. This implies the Fed will insist on waiting for post-tariff-impact data before considering rate cuts, and the 2% inflation target is now interpreted as more immediate than long-term—essentially a direct challenge to Trump.

Chinese tech earnings stood out this week. Despite some flaws, leading names like $TENCENT(00700)$ and $Alibaba(BABA)$ both fell after reporting. In terms of performance, Tencent > Alibaba. The market seems more focused on the AI roadmap and capex: on one hand, there’s high anticipation for rapid cloud platform growth; on the other, strict scrutiny over profit margins. Possibly, the previous “cost-cutting and efficiency” expectations set by DeepSeek raised the bar too high, putting pressure on how Chinese tech firms monetize.

Is the Middle East poised to rise as the next AI infrastructure hub? Trump, accompanied by top tech minds, visited the Middle East to secure deals with countries like the UAE and Saudi Arabia. The UAE's G42 will build a 5GW data center park (1GW under construction), receiving 500,000 Nvidia top-tier chips annually (20% for domestic use, 80% for U.S. companies). Saudi Arabia signed a $600 billion agreement to deploy 1,000MW of AMD and Nvidia systems via HUMAIN. Leveraging capital and energy advantages, the Middle East is becoming a global AI infrastructure nexus, offering low-cost energy (e.g., solar) and fast approval processes. The region's data center capacity is expected to exceed 6GW by 2030.

Most major earnings are now out. Consumer bellwethers like $Wal-Mart(WMT)$ posted solid Q1 results but issued cautious guidance for Q2, hinting at upcoming price hikes to offset pressure.

Big Tech bounced overall this week. As of market close on May 15, the weekly performance of major tech stocks: $Apple(AAPL)$ +7.07%, $Microsoft(MSFT)$ +3.41%, $NVIDIA(NVDA)$ +14.88%, $Amazon.com(AMZN)$ +6.81%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +6.27%, $Meta Platforms, Inc.(META)$ +7.67%, $Tesla Motors(TSLA)$ +20.36%。

Big-Tech’s Key Strategy

Tesla’s Sprint Moment?

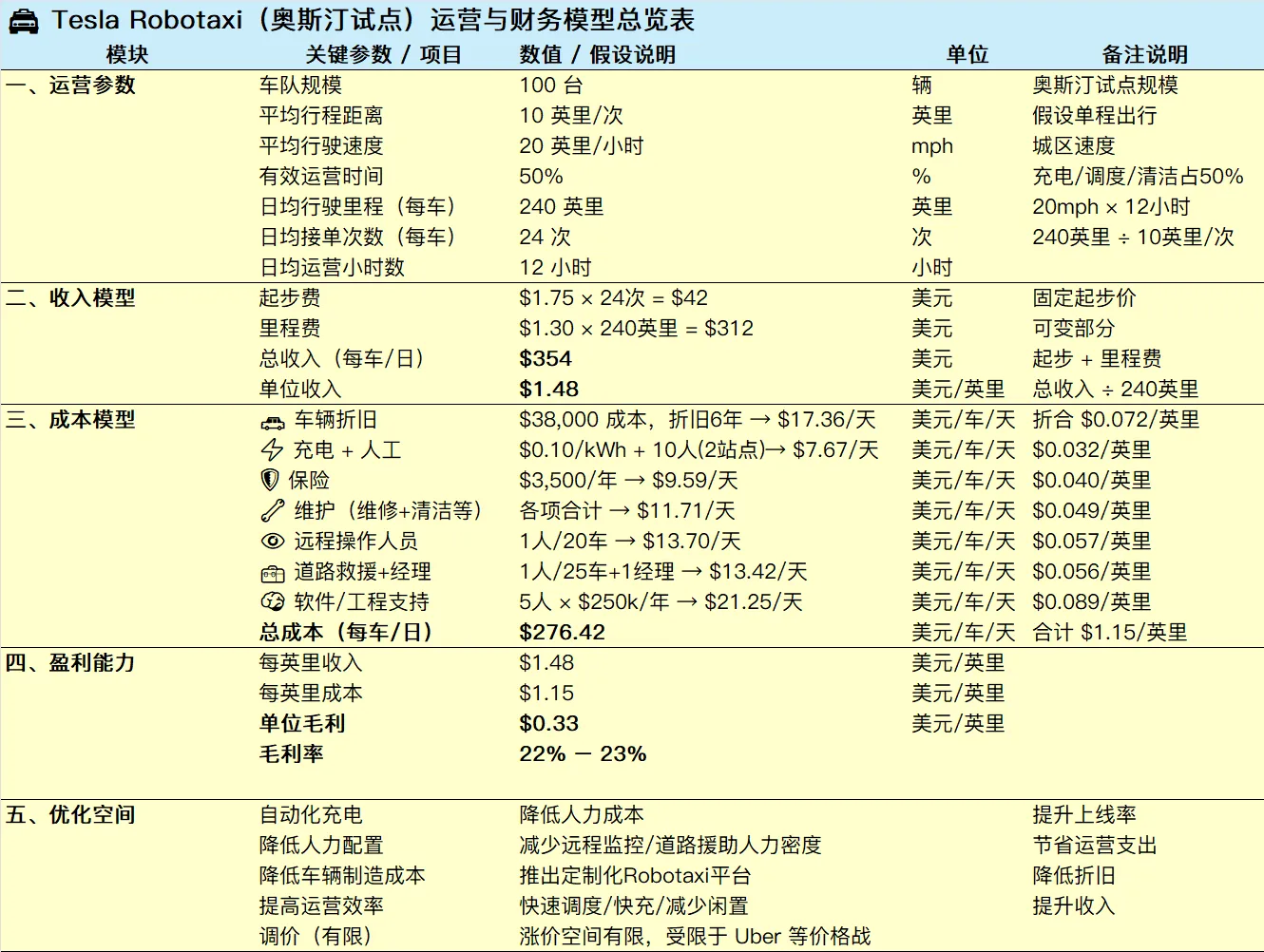

TSLA shares have rebounded from the April 7 low to around $350, nearing late-February levels. Tesla was the first to suffer during the recent downturn but held above $210, making its rebound more forceful. A major driver is anticipation for the June launch of Robotaxi. Tesla’s valuation doesn’t rest solely on its core auto business, but also includes:

The maturing energy storage segment

Robotaxi (a potential game-changer for margins)

The humanoid robot Optimus and other future tech—elements that introduce a speculative component.

Morgan Stanley, one of TSLA’s more aggressive analysts, has set a $410 target price. Their valuation breakdown (using 9% WACC) is:

Core Auto Business: $75/share (4.7 million units by 2030, 16.1% EBITDA margin)

Network Services: $160/share (65% penetration by 2040, $200 ARPU)

Shared Mobility: $90/share (7.5 million vehicles, $1.46/mile by 2040)

Energy Business: $67/share

Third-party Suppliers: $17/share

Regardless of whether this is justified, the key milestone for now is June in Austin—Tesla’s Robotaxi. The pilot will deploy 10–20 Model Ys to validate autonomous driving software, ride-hailing app, and fleet dispatch system.

According to some summarized projections by Grok:

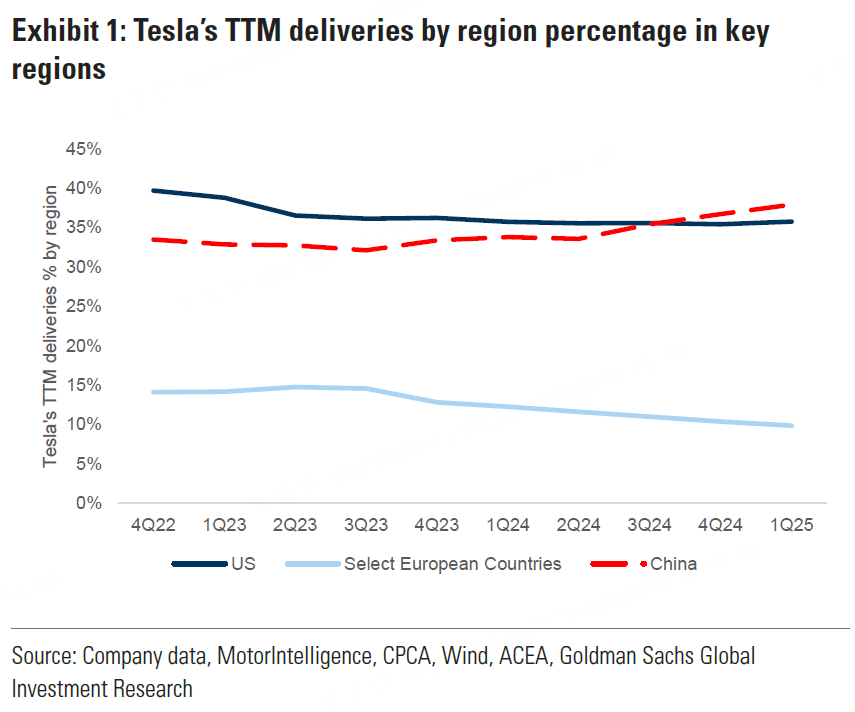

China Market: FSD Opportunities and Challenges

FSD (Full Self-Driving) is showing early traction in China, but localization remains insufficient. In early 2025, Tesla rolled out FSD updates for Chinese users, including steering and traffic light recognition. Pricing is around ¥64,000 (~$8,750), which is higher than most local rivals. Though its globally trained model ensures fast deployment, there are issues such as misreading road rules or veering off lanes. Domestic competitors—BYD, Li Auto, Huawei, XPeng—are already offering advanced NOA (Navigation on Autopilot) features in lower-priced models.

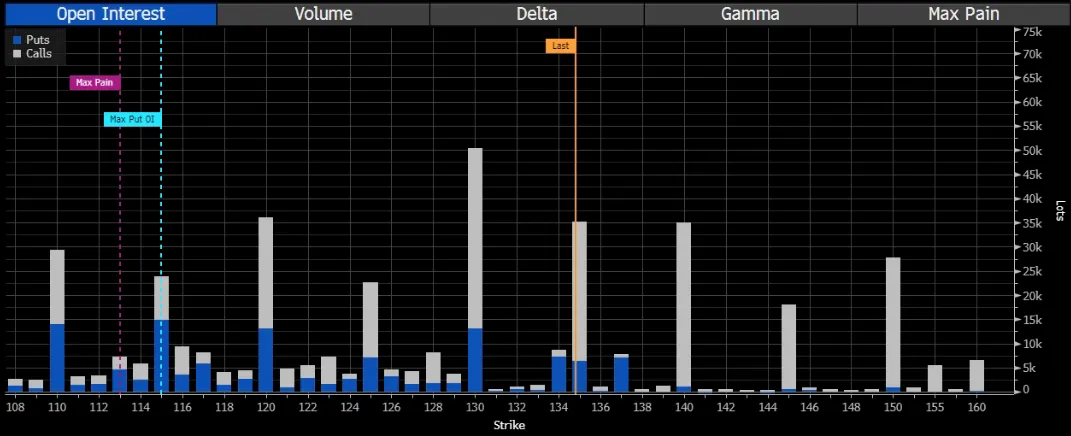

Big Tech Options Strategy

Chipmakers set to benefit?

This week’s Nvidia–Saudi deal came as an unexpected catalyst, causing a mild short squeeze. The stock is now fluctuating in the $130–150 range and will likely consolidate around $140 before earnings.

Chinese tech giants Tencent and Alibaba—key Nvidia clients—reported earnings this week. Both significantly reduced Capex, potentially tied to Nvidia's $5.5B inventory buildup. This could suggest that their purchases haven't fully transitioned into domestic substitutes.

Nvidia plans to open a research center in Shanghai. Although export restrictions have hit China sales, CEO Jensen Huang remains bullish on the market’s potential—estimating $50 billion in value over the next few years. The center will study local customer needs, align with U.S. export rules, contribute to global R&D, and attract Chinese AI talent. Huang aims for the U.S. to lead in global AI standards, fearing that total withdrawal would leave the field open to Huawei and other rivals.

Meanwhile, ByteDance, Alibaba, and Tencent are closely watching geopolitical risks, assessing whether Nvidia can deliver redesigned high-end chips. Nvidia is exploring solutions but legal uncertainty clouds its final strategy.

Big-tech Portfolio

The so-called “Magnificent Seven” (TANMAMG: Tesla, Apple, Nvidia, Microsoft, Amazon, Meta, Google) form an equal-weighted portfolio with quarterly rebalancing. Backtesting shows it has dramatically outperformed the S&P 500 since 2015:

TANMAMG return: +2375.36%

SPY return: +243.26%

Excess return: +2132.10%

However, year-to-date in 2024, Big Tech has seen some pullback:

TANMAMG return: -3.3%

SPY return: +1.05%

Over the past year:

TANMAMG Sharpe Ratio: 1.01

SPY Sharpe Ratio: 0.52

TANMAMG Information Ratio: 1.16

$S&P 500(.SPX)$ $NASDAQ(.IXIC)$ $Invesco QQQ(QQQ)$ $NASDAQ 100(NDX)$ $SPDR S&P 500 ETF Trust(SPY)$

Comments