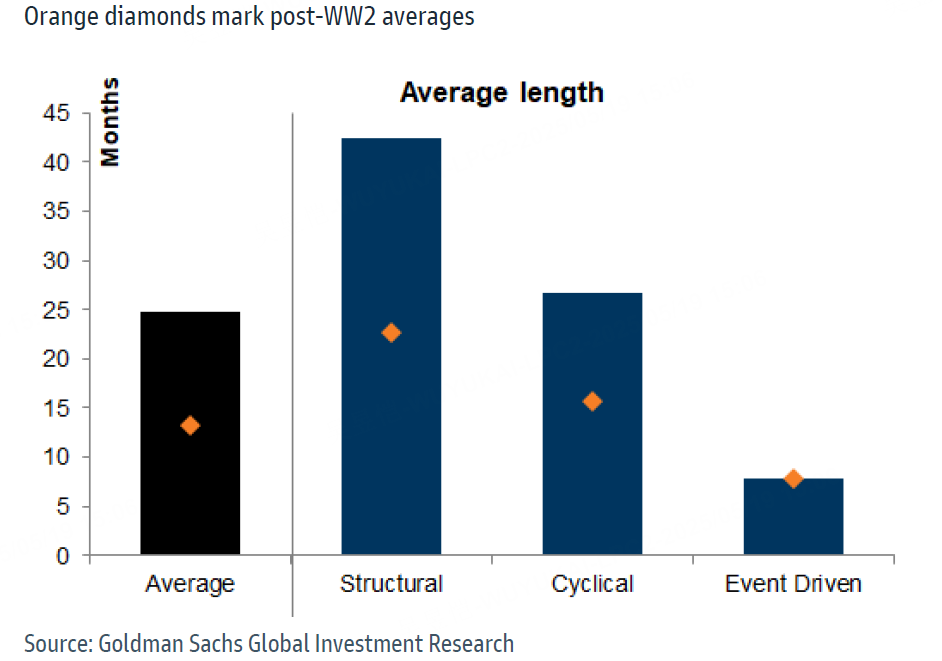

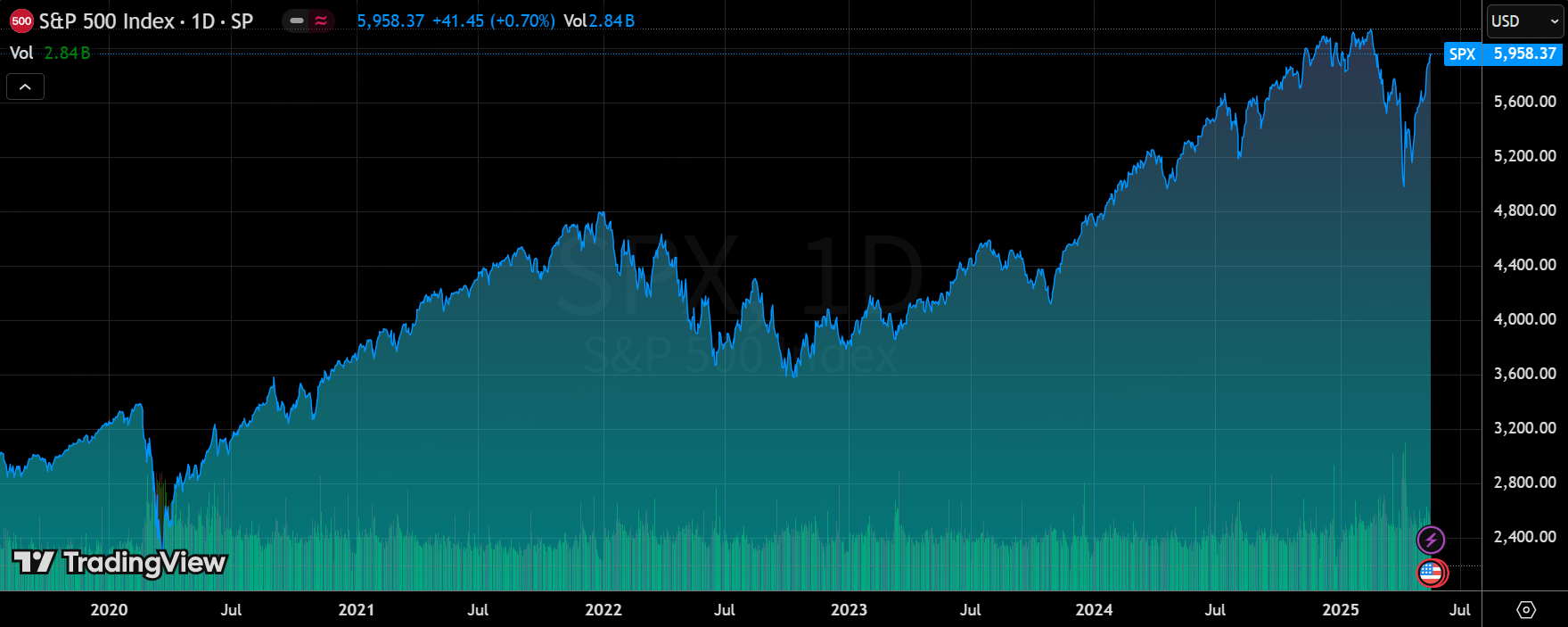

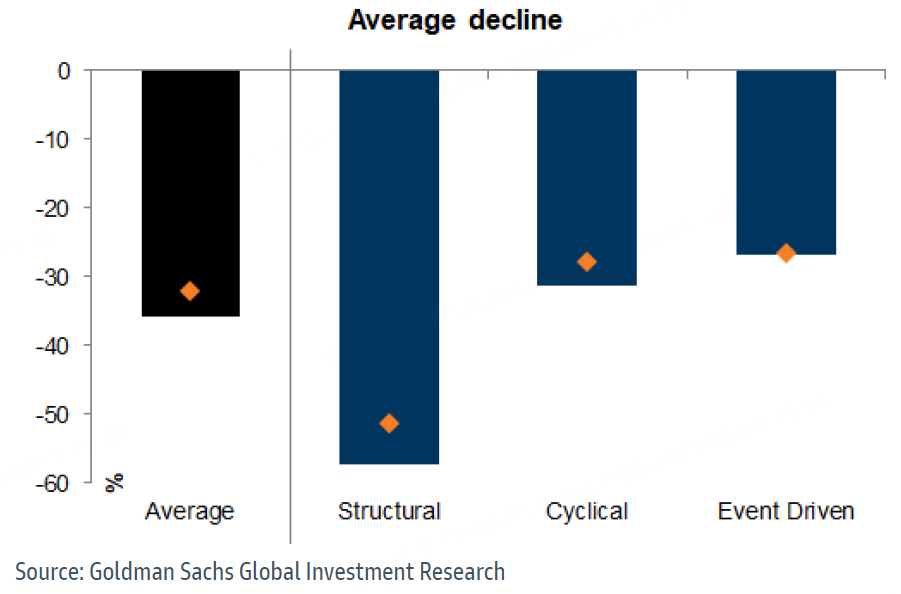

Against the backdrop of the market shock triggered by the "Independent Day" policy, the US stock market quickly fell into a technical bear market. The $S&P 500(.SPX)$ index lost nearly 20% and $NASDAQ(.IXIC)$ retreated more than 23%.According to Goldman Sachs' categorization framework, bear markets can be divided into three categories: structural bear markets, cyclical bear markets and event-driven bear markets, whose differences are mainly reflected in the triggering mechanism, duration, and the depth of the impact on the economy and the financial system.

Structural bear markets usually originate from the bursting of asset price bubbles and over-leveraging of the private sector, often accompanied by rising risks in the banking system and economic recession.Examples include the Great Depression of 1929 and the global financial crisis of 2008;

Cyclical bear markets are more closely tied to fluctuations in the economic cycle, with investors reducing their positions ahead of time in anticipation of a downturn in corporate earnings, often on the eve of an economic slowdown or recession;

Event-driven bear markets are triggered by sudden external factors, such as policy changes or geopolitical conflicts, which cause sharp short-term adjustments but markets tend to recover more quickly.

Judging from current fundamental analysis, this market downturn does not constitute a structural bear market.

The central divergence in the current market is whether the current correction is a classic event-driven pullback (triggered by tariff policy) or a precursor to the economy entering a downward cycle, i.e. a cyclical bear market.The key difference between the two is whether the tariff policy will lead to a broad-based recession.

Market sentiment repair still faces multiple constraints

Despite the recent rebound in risk assets, structural pressures and policy uncertainties are still constraining the scope for a sustained recovery:

The lagged impact of tariffs: up to now, the actual effective rate of US tariffs is still as high as 13%, higher than the level before "Liberation Day", which may continue to raise corporate costs and push up inflation, thus squeezing profitability;

Monetary policy uncertainty intensified: the Federal Reserve interest rate cut is expected to be postponed from the original July to December, the market also began to digest the "intermittent meeting" rhythm of interest rate cuts, easing expectations of marginal decline may trigger valuation compression;

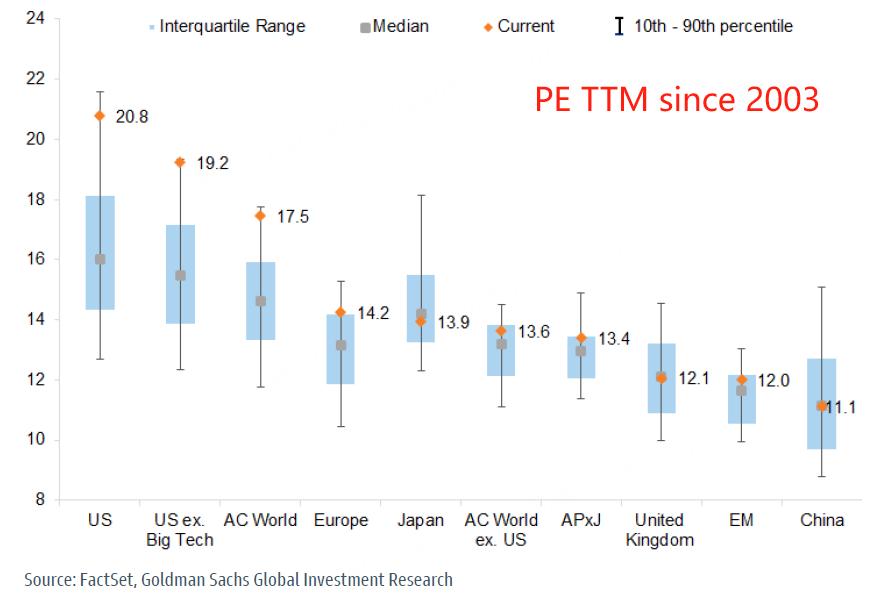

Valuation level is facing the pressure of correction: the S&P 500 index current price-earnings ratio is close to the historical high; and the non-U.S. market is relatively cheap, but compared to its own historical valuation pivot, is still in the middle-high range, the overall margin of safety is insufficient;

Macro data uncertainty verification: although some cyclical plate valuation has reflected industrial output and other "hard data" rebound, but with the PMI and other "soft data" there is still a significant deviation, if the subsequent economic indicators continue to weaken, may trigger a new round of valuation correction.

Historical data show that the event-driven bear market rebound quickly, but the follow-up tends to show a shock trend.The current S&P 500 retracement speed in the past 75 years ranked third, the short-term policy benefits have been partially overdrawn, further upward space or relatively limited.

Investment Allocation Recommendation: Diversified Layout and Alpha Strategy in Parallel

1. Diversified allocation by geography and industry dimension

Geographical diversification has obvious advantages: year-to-date, U.S. stocks have risen relatively moderately, while U.S.-dollar-denominated European markets have performed spectacularly, with an overall increase of 18%, of which the German and Italian indices have risen by more than 27%, and the Hong Kong stock market has also risen by 14%.In the weakening trend of the U.S. dollar, non-U.S. market assets to enhance the attractiveness;

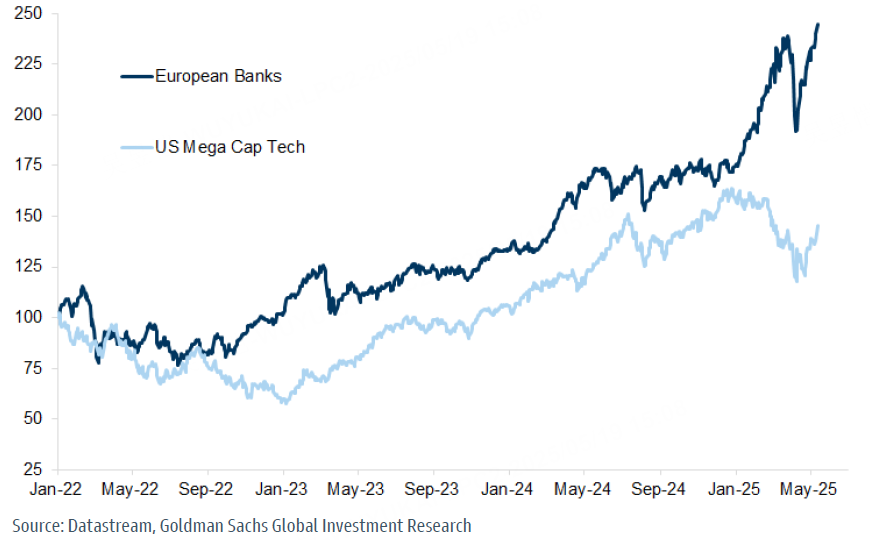

Sectoral allocations need to focus on balance: it is recommended to reduce the concentration of allocations to large U.S. technology stocks, and pay due attention to the restoration opportunities in the value sector.In the case of European banks, for example, the cumulative return since 2022 has reached 100%, significantly better than the U.S. technology sector (75%) over the same period, and the current valuation is still at a low level.In addition, technology stocks need to be differentiated internally - despite the pressure of short-term adjustments, leading technology companies 2025 Q1 earnings are expected to grow as much as 30% year-on-year (compared to the S&P average of 9%), the long-term growth logic is still solid, and AI-related investments are still sustainable.

2. Alpha-oriented stock selection strategy

Quality growth stocks: Focus on companies with sustained earnings growth, especially those with leading edge in technological changes such as AI and automation, whose earnings resilience is expected to continue to be unleashed in a moderate growth environment;

Value return strategy: focus on companies with stable dividend and share buyback mechanisms, especially in the financial and industrial sectors, which can capture medium-term returns through dividend reinvestment and valuation recovery;

Pricing power as core competitiveness: in the context of continued pressure on the cost side, companies with strong pricing power are better able to stabilize profit margins and should be prioritized as allocation targets.

$SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$

Comments