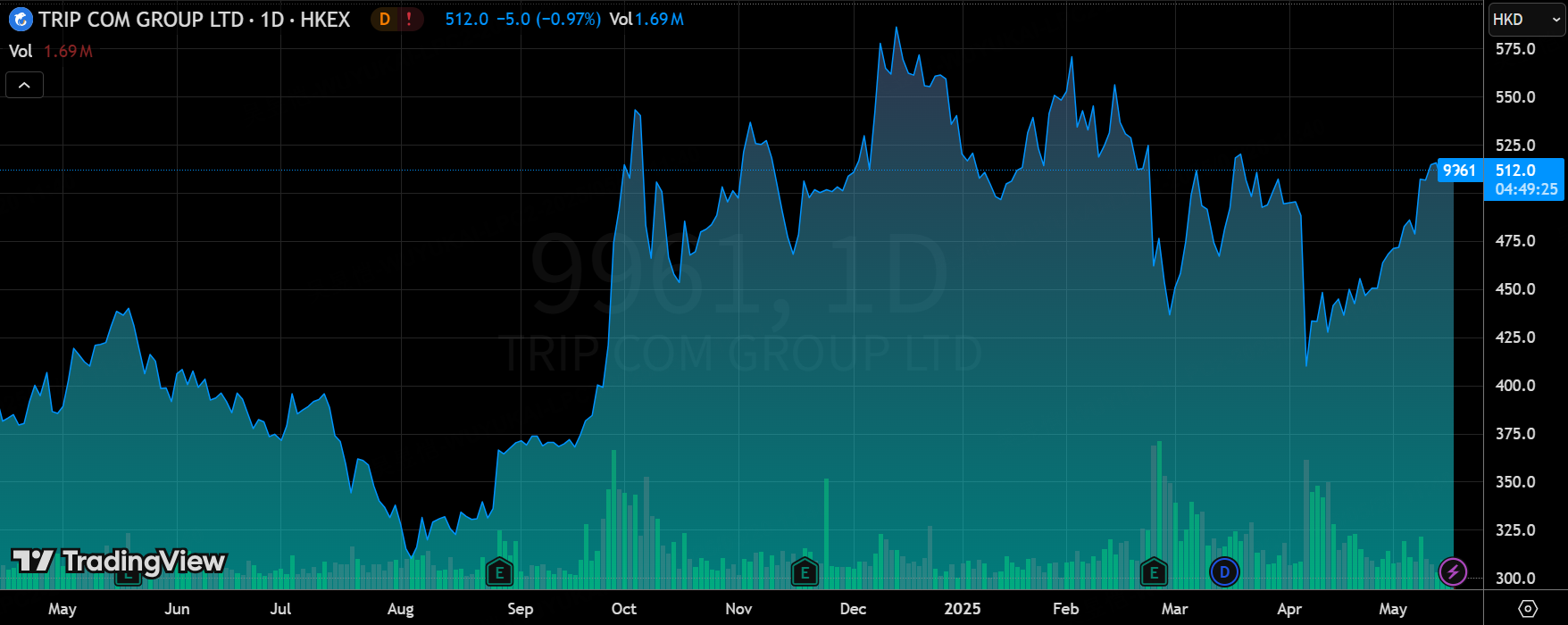

Q1 earnings report of $Trip.com Group Limited(TCOM)$ is characterized as "solid but mediocre": revenue is in line with expectation, profit slightly exceeded but growth rate is sluggish, and overseas business is slowing down at the margin.Current valuation has partially reflected overseas growth expectations, and we need to be wary of domestic consumption weakness and policy risks.Neutral rating, wait for clearer signals of profitability inflection point of sea business. $Trip.com Group Limited(TCOM)$ $TRIP.COM-S(09961)$

Performance and Market Feedback

Quick overview of core data:

Revenue: net income of $13.83 billion, +16% yoy, in line with market expectations.

Profit: adjusted operating profit of $4.04 billion, +7% yoy, slightly ahead of expectations ($3.79 billion expected).

Revenue by business:

Hotel bookings: +23% yoy (1.4 pct ahead of expectations);

Ticketing: +8.4% yoy (in line with expectations);

Other revenues such as advertising: +33% yoy (high growth highlight).

Operating metrics:

Inbound bookings: +100% yoy; outbound air and wine bookings recovered to 120% of the same period in 2019;

Overseas-only bookings: +60% yoy (+70% last quarter).

Margin: 80.4% gross (81% expected), 29.2% operating margin (-2.4 pct yoy).

Key features:

Increased revenue but not profit: solid revenue growth, but profit growth (+7%) significantly lower than revenue growth (+16%) and margin contraction;

Weak domestic business: mid-single-digit decline in hotel unit price, airfare -10%~15% yoy, dragging down growth;

Marginal slowdown in overseas business: pure overseas booking growth declined from 70% to 60%, still strong but failed to accelerate further.

Share price volatility was limited after the earnings announcement, with the market having previously expected a fall in margins, falling into the category of neither surprise nor shock.Investor sentiment is neutral to cautious.

Investment Highlights

Revenue structure divergence, incremental overseas business, domestic demand under pressure

Overseas business: Trip.com (purely overseas) revenue share increased, but gross margins are even lower (dragging down overall margins).Inbound (+100% yoy) and outbound (recovered to 120% by 2019) remain growth engines, but growth is not accelerating again.

Domestic business:

Hotels: revenue +23% yoy driven by outbound and overseas, domestic growth rate only 10% - 15% (decline in unit price);

Airfare: price war led to a single-digit revenue growth rate (+8.4%), domestic and outbound airfares declined by 10% -15% yoy

Advertising business: +33% yoy, benefiting from travel community content operation, may become the second curve in the future.

Whether the overseas business can sustain high growth still depends on the overall demand this summer.Of course, inbound tourism brought by the visa-free policy may continue to be favorable, but the growth rate may slow down mildly from a high base.

Margin contraction: Structural and competitive pressures coexist

Gross margin decline (80.4% vs. 81% expected): mainly due to increasing share of low margin overseas business and domestic air ticket/hotel price war.

High expense growth: marketing expenses +30% yoy (16% revenue growth), but lower than expected (savings of $300m), better control of R&D/management expenses (+14.2%/+11.7% yoy).

Operating margin: 29.2% (-2.4 pct yoy), reflecting rising domestic customer acquisition costs and overseas expansion investment.

The company expects to continue to invest in overseas markets in 2025, short-term margins are under pressure, long-term look at Trip.com scale effect.

Next expense control focus:

Reasonably control marketing expenses, develop more precise marketing strategies and improve the return on marketing investment.

Enhance differentiated competition, dig deeper into our own features and advantages, and create differentiated products and services.

Engage in more in-depth cooperation negotiations with suppliers to secure more favorable purchase prices and terms of cooperation.

Performance Guidance and Valuation Contradiction

Short-term outlook: Domestic wine tourism boom is "stable to weak", need to rely on overseas business; profit growth may remain single-digit.

Valuation: Currently 20x PE to 2025 adjusted operating profit, higher than the average of Chinese internet companies (reflecting overseas growth premium).

Rising competition: competition from Meituan, Jitterbug, etc. on destination tickets made Ctrip's packaged tour product revenue performance weak and slipped again to 91% of revenue in the same period of FY19, and it should be ramped up to enhance the stickiness of the travel community content (guides, travelogues) to promote advertising realizations.

Risks: If Trump's tariff policy escalates, cross-border tours may be hit harder than domestic tours.

Key divergences:

Optimistic points: overseas business growth remains high in absolute terms (60%), advertising and content ecosystem potential underpriced;

Risk point: weak domestic consumption + overseas investment period, weak profit growth, 20x PE not cost-effective enough.

Comments