Key Information

Industry Overview:

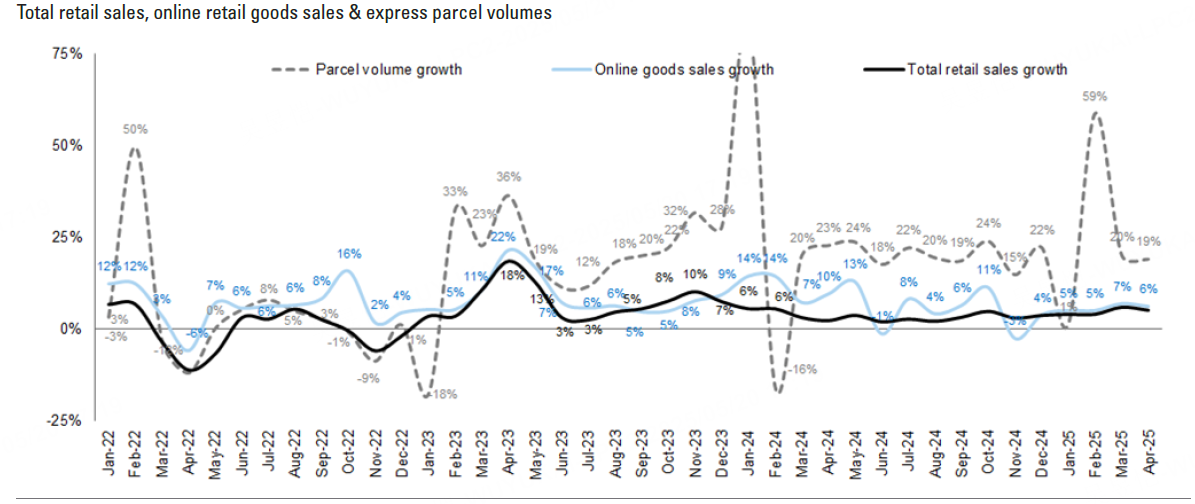

China's online retail merchandise sales (GMV) grew 6% YoY in April 2025, in line with the first quarter and significantly higher than the overall social retail growth rate (+5.1%).

The growth was mainly driven by a rebound in consumption of durable goods such as home appliances, telecommunication equipment and stationery, driven by the "trade-in" policy.

GMV growth is expected to be higher in May, benefiting from the early start of the 618 promotion period, but may fall back in June, and the whole year needs to be observed by combining May and June.

E-commerce platform performance:

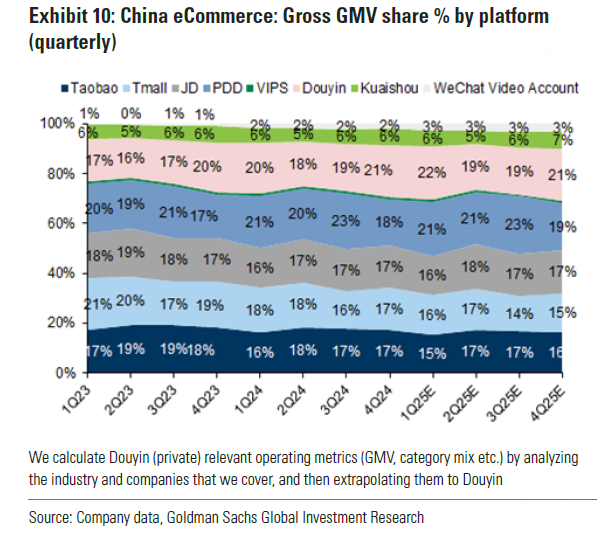

Alibaba: Core ad revenue CMR, Tmall gross profit beat expectations, AI-driven marketing tools boost penetration. $Alibaba(BABA)$ $BABA-W(09988)$

Jingdong: 1Q profit greatly exceeded expectations and raised full-year retail target.Kicks off food takeout offensive with nearly 20 million daily orders. $JD.com(JD)$ $JD-SW(09618)$

Pinduoduo: GMV growth estimates remain strong y/y (+15% marketing revenue/+34% commissions), but profit down 14% y/y. $PDD Holdings Inc(PDD)$

Platform dynamics highlights:

618 promotional changes: simpler discount structure (e.g. 15% direct reduction), collaborative promotion with content platforms such as Xiaohongshu, cooperation with the national "trade-in" subsidy, and advancement of the timeline by 7~17 days.

Temu resumed part of the "fully managed" direct mail mode in response to the US tariff adjustment, but the US market was affected by the policy and advertising cuts, and monthly activity dropped to 10%.

App Usage Trends:

All top 400 apps usage hours increased by 6% year-on-year.

E-commerce apps: Jingdong +56%, Pinduoduo +11%, Taobao -16%.

The game segment maintained +5% growth, with AIGC apps (e.g. "Doubao") becoming a highlight.

Tencent launched AI browser "Qbot", embedding AI search and college entrance exam assistant into QQ browser. $TENCENT(00700)$

Investment Views

1️⃣ Consumption rebound "moderates", policy pushers are the main, demand is not fully spontaneous release

Despite the 6% year-on-year growth in GMV, the actual consumer confidence has not yet been significantly restored, relying more on external forces such as "trade-in".In particular, auto sales growth dropped sharply to +0.7% from +5.5% in March, indicating that commodities are still cautious.

Opinion: is in the "structural warm" stage, rather than "full recovery".Concerned about the subsidy policy after the withdrawal of the real demand to undertake the force.

2️⃣ platform involution continues to deepen, jingdong change road overtaking show toughness

Jingdong food takeaway layout has become the biggest highlight, subsidies + supply chain advantage is obvious, the daily order is close to the United States group, is the future of the user traffic entrance important breakthrough.Pinduoduo although GMV is strong, but profit fluctuations show that "high-quality growth" has not been fully achieved.

Opinion: Jingdong has the clearest strategy and strongest execution among the three giants of e-commerce, and is gradually getting rid of the low-price label and turning into a composite scene platform.

3️⃣ Content ecology + transaction closed loop becomes a new paradigm for e-commerce growth

The linkage between Ali/Jingdong and Xiaohongshu marks a shift from "transaction-oriented content" to "content-feeding transaction".This strategy is borrowed from the Jieyin model, indicating that the graphic community is ushering in the realization of re-exploitation.

Opinion: The core competitiveness of future e-commerce is no longer price or logistics, but the integrated closed-loop capability of content-driven + scene guidance + accurate push.

4️⃣ AI is no longer just "storytelling", Tencent Qbot opens practical landing

AI applications have shifted from the early "spectator fever" to the "pragmatic testing period".Tencent Qbot try to solve the problem of education, investment and other scenes, AI in the browser, application search and other "native integration" is expected to become an efficiency tool, and gradually retrieve the user's time.

Opinion: The second half of the growth of domestic AI application will be the stage of "tools replacing manpower", rather than the shallow flow game of content entertainment.

Comments