$Palo Alto Networks(PANW)$ delivered a "healthy but not spectacular" earnings report, with revenue and EPS beat but slowing billings, continued long-term structural optimization, and a lack of clear short-term catalysts.Investors need to look beyond quarterly volatility to ARR platformization trends and AI commercialization prospects.

In the coming quarters, the company will need to further quantify the impact of AI in its earnings reports and increase the conversion rate of its platform customers in order to support the current valuation to enter a new cycle of upward revisions.

Performance and Market Feedback

Revenue: $2.29B (+15% YoY), slightly ahead of expectations (consensus $2.27B)

EPS (Non-GAAP): $1.32, beating estimates ($1.25 est.)

Billings (Billings): $2.33B (+3% YoY), below expectations ($2.41B)

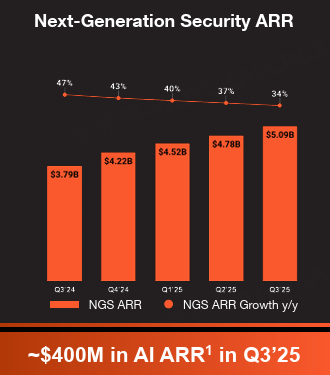

NGS ARR: $5.1B (+34% YoY), platform transformation continues to accelerate

While revenue and EPS exceeded expectations, a significant slowdown in billings growth became the focus of market attention.

Overall, market sentiment is cautious and valuation flexibility is limited.

Investment highlights

Platform transformation enters a period of realization: ARR drive outperforms billing cadence

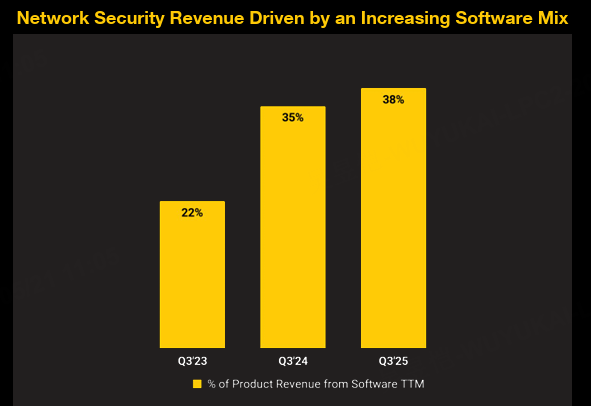

Palo Alto Networks is undergoing a deep transformation from a "single-point security tool provider" to a "unified security platform provider", the core manifestation of which is a significant increase in the proportion of Next-Gen Security (NGS) business.NGS ARR reached $5.1B in Q3, accounting for nearly half of the overall ARR, with an annual growth rate of 34%.This structural improvement not only reflects the effective implementation of the company's platformization strategy, but also implies a steady increase in future revenue visibility and earnings quality.

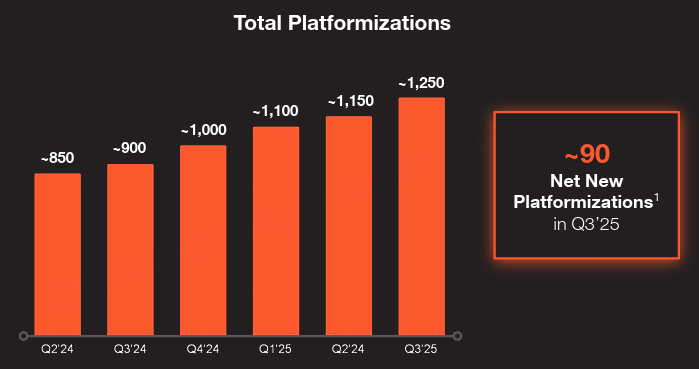

Management pointed out that the number of platform-based transaction customers has reached 1,100 (+70 QoQ), indicating that large enterprise customers are shifting from "decentralized procurement" to "centralized platform binding".This is synergistic with the company's investment in AI, SASE, XSIAM and other core modules over the years, in particular, AI-driven security incident response efficiency and automation level has gradually become a core consideration in enterprise procurement.

In short, ARR has become a valuation anchor rather than a quarterly bill, which is typical of the early days of platform-based enterprises and a repeat of the path of growth-oriented SaaS companies such as Cloudflare and Datadog.

Slowing billings growth: not slowing results, but confirming the pace of change

Billings for the quarter were only +3% YoY, much lower than double-digit growth in previous quarters, raising short-term concerns among some investors.However, management made it clear in Call that more and more customers are adopting the "short-term contract + installment settlement" approach to cope with macro uncertainties:

More and more customers are favoring "short-term contracts + installment billing" to cope with macro uncertainty;

The total contract value (TCV) is not declining, but rather the billing confirmation method is more conservative.

This is in fact the "new confirmation cadence" phenomenon of the middle office in the cloud security industry.The same is true for peers like $ServiceNow(NOW)$ and $CrowdStrike Holdings, Inc.(CRWD)$

Investors should note that this is not weak demand, but rather a "mismatch between purchasing decisions and financial recognition," while ARR and subscription renewal rates, which are the true determinants of long-term value, continue to grow at a healthy rate.Valuation revaluation may fluctuate in the short term due to market misinterpretation, but long-term investors should focus on the increased anti-cyclicality brought by the change in ARR/NGS structure.

Profit margin better than expected: platform scale effect started to release

Non-GAAP operating margin reached 28.8%, a significant improvement over the same period last year (+150bps YoY), exceeding market expectations.This was mainly due to two aspects:

The higher proportion of high-margin NGS business helped push up the overall gross margin;

Management's investment in R&D has remained stable while avoiding over-inflated S&M from aggressive expansion.

Platform companies tend to have a high S&M ratio in the early customer acquisition stage, while PANW has entered the initial operational leverage release stage.If the subsequent platform customer conversion rate continues to improve, the profit margin improvement space still exists, is an important variable to support the high valuation.

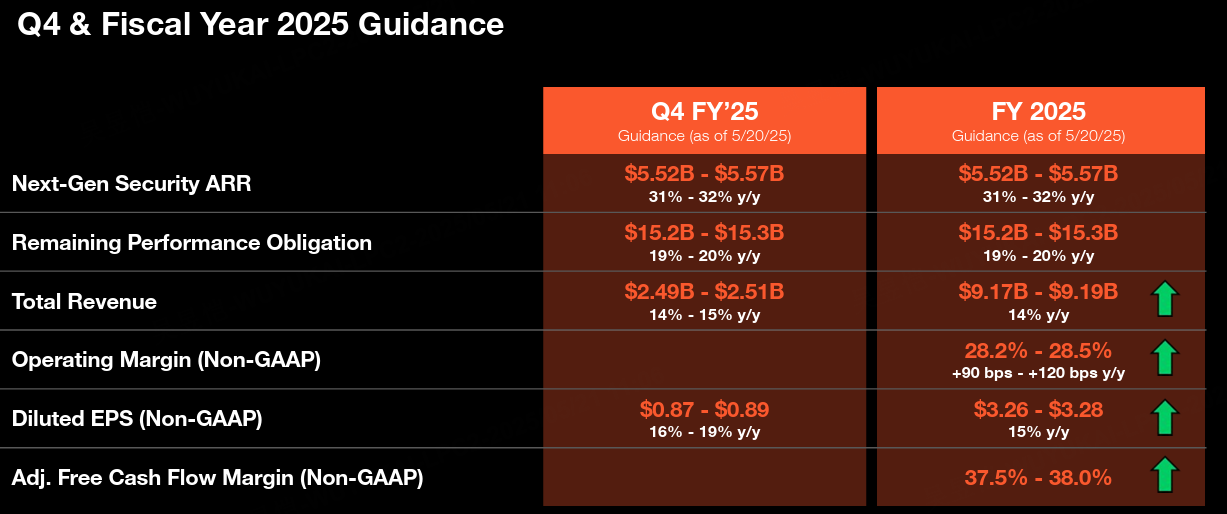

Q4 outlook is solid but neutral, the market is waiting for more "AI realization path".

The company guided Q4 revenue at $2.15B-$2.17B (+10-11% YoY) and EPS at $1.40-$1.42, which are both slightly higher than market expectations (revenue consensus $2.14B, EPS consensus $1.38).While positive on the surface, this "solid but not spectacular" guidance is not enough to trigger a valuation revision for PANW, which is already in high valuation territory.

In particular, the potential for AI-driven growth (e.g. GenAI-assisted detection, automated response, threat prediction) was mentioned several times in the Call, but the company has yet to provide a clear path to realization or pricing mechanism.The market is clearly waiting for more quantitative guidance on "AI-contributed ARR".

In other words, the story of PANW has shifted from "whether to grow" to "how to grow + AI realization path", and future catalysts need to be centered on AI ROI, rather than relying on traditional financial indicators beat to drive the stock price upward.

Comments