$Snowflake(SNOW)$ Q1 2026 earnings demonstrated robust revenue growth (+26% YoY), an EPS beat ($0.24 vs. $0.21 est.), and strong customer expansion (606 high-value clients, RPO +34% YoY). The AI Data Cloud strategy, partnerships with NVIDIA and Anthropic, and operational efficiency gains underpin long-term growth. However, revenue growth deceleration, declining NRR, and high stock-based compensation remain points of caution.

Valuation Re-Rating Triggers:

Accelerated AI Revenue Contribution: Significant growth in AI-driven workloads (e.g., Cortex AI-powered queries and app development) could prompt a valuation re-rating.

Sustained NRR and RPO Growth: NRR recovering to higher levels (e.g., 130%) or continued RPO growth would bolster confidence in future revenue.

Profitability Improvements: Sustained increases in non-GAAP operating and free cash flow margins could mitigate loss concerns, supporting a valuation premium.

Market Expectation Boundaries: The current stock price ($183) suggests ~10.65% upside to the consensus target ($198.2). If AI revenue underperforms or macro pressures intensify, near-term downside risks could emerge.

Industry Dynamics: Snowflake’s AI Data Cloud leadership provides a first-mover advantage, but competition from Databricks in data lakes and AI warrants ongoing scrutiny.

Performance Overview and Market Reaction

1. Core Performance vs. Market Expectations

Revenue: Total revenue reached $1.042B, up 26% YoY, surpassing consensus estimates of $1.01B. Product revenue was $996.8M, up 26% YoY, aligning with prior guidance of $955M-$960M.

Earnings Per Share (EPS): Non-GAAP adjusted EPS was $0.24, up 50.3% YoY, beating consensus estimates of $0.21. GAAP EPS was -$1.29, reflecting ongoing operating losses.

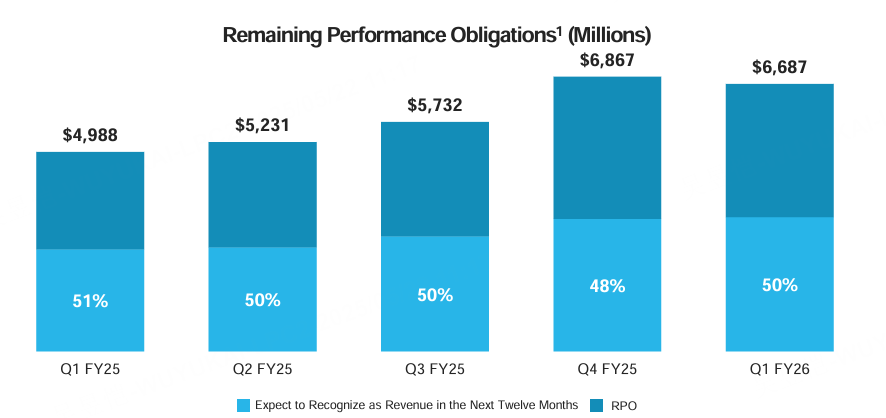

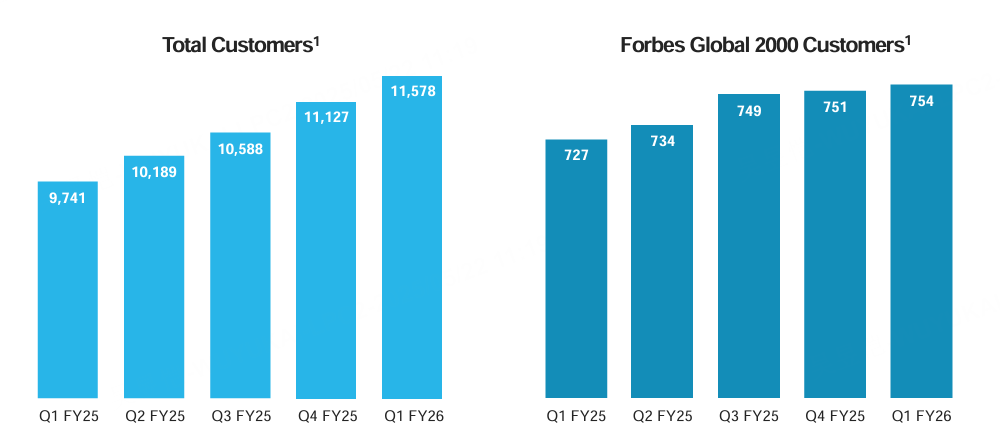

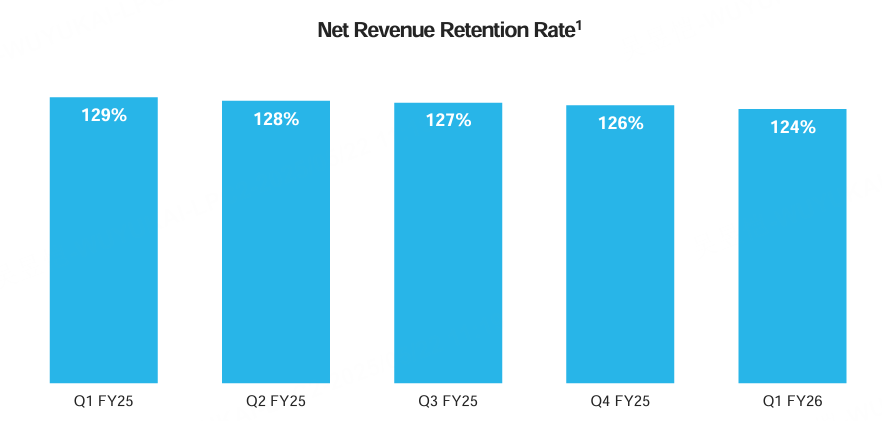

Key Operating Metrics: Net Revenue Retention (NRR) was 124%, down 2 percentage points YoY, indicating slightly softer customer expansion but still healthy. Customers with over $1M in annualized product revenue grew to 606, up 27% YoY. Remaining Performance Obligations (RPO) reached $6.7B, up 34% YoY, signaling strong future revenue potential.

Stock Performance and Investor Sentiment

Market Reaction: Post-earnings, Snowflake’s stock surged approximately 7.3% in after-hours trading, reflecting optimism around the beat on revenue and EPS, as well as an upwardly revised full-year guidance. The stock price stands at $183, with a market cap of ~$51.53B, up 16.2% YTD and 33.6% over the past month.

Snowflake’s stock underperformed over the past year but has rebounded 41.8% since November 2024, driven by improved revenue and profitability outlooks. The Q1 beat and raised guidance further bolstered investor confidence in the company’s AI-driven growth potential. However, its high valuation (forward P/S ratio significantly above industry median) and persistent GAAP losses may introduce volatility.

II. Investment Highlights (Core Analysis)

1. AI-Driven Growth and Product Innovation

Snowflake’s AI Data Cloud strategy remains a key highlight. Through a multi-year partnership with Anthropic and the acquisition of AI startup Datavolo, Snowflake has strengthened its platform’s AI application development capabilities, enabling customers to build and deploy AI solutions without data migration. Additionally, deepened collaborations with NVIDIA and AWS (e.g., integration of Snowflake Cortex AI with NVIDIA AI Enterprise) have enhanced AI performance and expanded industry-specific solutions in financial services, retail, and healthcare.

Logical Analysis: Rapid iteration of AI features (e.g., Cortex AI integration with OpenAI and Anthropic models) lowers technical barriers for customers, boosting platform stickiness. The growth to 606 high-value customers (>$1M annualized revenue, +27% YoY) and 745 Forbes Global 2000 clients (+4% YoY) underscores expanding enterprise adoption, driven by AI use cases.

Valuation Impact: While AI-related revenue is not yet fully reflected in current results, the 34% RPO growth signals strong future revenue certainty, potentially triggering valuation re-rating. The market assigns a premium to Snowflake’s AI data platform leadership, though risks remain if AI revenue materialization is delayed.

2. Steady Revenue Growth Amid Slowing Momentum

Despite 26% YoY revenue growth, the pace has decelerated from prior years (e.g., 85% in Q1 2023). This partly stems from large enterprise clients optimizing cloud spending, favoring prepaid credits over on-demand consumption, which could shrink future renewals. NRR declined from 126% last quarter to 124%, reflecting cautious spending by some customers amid macroeconomic pressures.

Logical Analysis: Snowflake’s consumption-based revenue model relies heavily on customer data workload growth. Macroeconomic uncertainties (e.g., high interest rates, geopolitical risks) may continue to impact budgets, but AI-driven workloads (e.g., natural language queries, ML training) are expected to offset this pressure over time.

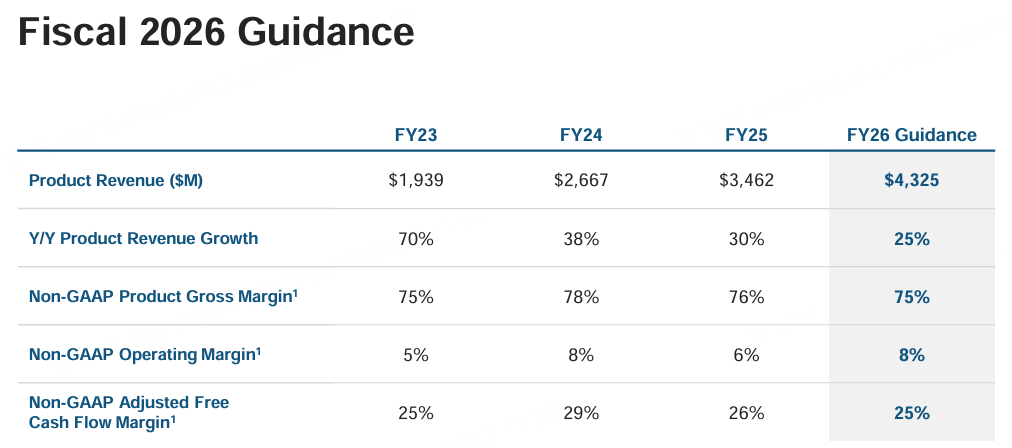

Valuation Impact: Revenue growth deceleration and high stock-based compensation (37% of revenue) may cap near-term valuation upside. However, the company’s raised FY26 product revenue guidance of $4.325B (up from $4.32B, +25% YoY) signals management’s confidence in sustained growth. If AI-driven consumption accelerates, concerns over slowing growth could diminish.

3. Operational Efficiency and Cost Control

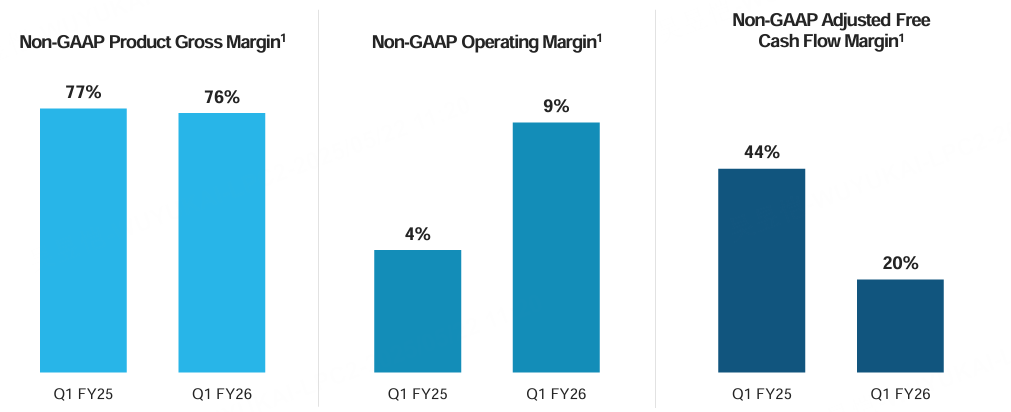

Non-GAAP operating margin was 5%, in line with guidance, but GAAP operating loss was $447.3M, reflecting high R&D and sales investments. The company projects stock-based compensation to decline from 41% to 37% of revenue, indicating efforts to balance AI integration with efficiency. Non-GAAP gross margin is expected at 75%, reflecting optimized cloud infrastructure costs.

Logical Analysis: Snowflake is leveraging automation and AI to reduce operating costs while expanding partnerships with AWS and Microsoft Azure to enhance cloud efficiency. This cost discipline supports price competitiveness in the crowded cloud data market and bolsters long-term profitability.

Valuation Impact: Improved operational efficiency and stable gross margins support the profitability outlook, potentially alleviating concerns over persistent losses. Non-GAAP free cash flow margin is projected at 25% for FY26, highlighting robust cash generation and reinforcing long-term investment value.

4. Guidance and Management Tone

Q2 Guidance: Snowflake projects Q2 2026 product revenue of $1.01B-$1.015B, implying 22%-23% YoY growth. Non-GAAP operating margin is expected at 6%, reflecting optimism in growth and efficiency.

Full-Year Guidance: The company raised FY26 product revenue guidance to $4.325B (+25% YoY), exceeding consensus estimates of $4.18B, driven by confidence in AI-driven demand. Non-GAAP operating margin is forecasted at 8%, with free cash flow margin at 25%.

Management Tone: Management emphasized the differentiated value of the AI Data Cloud and its expanding cross-industry applications while acknowledging potential near-term volatility from macroeconomic factors and customer optimization. CEO Sridhar Ramaswamy highlighted AI and data-sharing as key long-term growth drivers during the earnings call.

Valuation Impact: The upwardly revised guidance, exceeding market expectations, strengthens confidence in Snowflake’s AI and cloud data leadership. However, management’s mention of a “leap year effect” may temper YoY growth comparisons, warranting close monitoring of execution.

5. Market Focus and Competitive Landscape

Market Risks and Highlights:

Highlights: Analysts previously focused on Snowflake’s AI strategy and customer growth. The earnings report addressed these through AI advancements (e.g., Cortex AI) and high-value customer expansion, reinforcing market optimism. JMP Securities reiterated an “Outperform” rating with a $201 target, with consensus at $203.36, reflecting confidence in AI potential.

Risks: Some analysts (e.g., Seeking Alpha) flagged revenue growth deceleration, declining NRR, and high stock-based compensation as valuation concerns. Competitive pressure from Databricks, particularly in AI and data lakes, remains a risk.

Earnings Response: Snowflake addressed growth concerns with raised guidance and AI innovation but didn’t fully dispel worries about customer optimization and competition.

Market Expectation Shift: Post-earnings, the market is more optimistic about Snowflake’s AI-driven growth and long-term profitability, but high P/S multiples and macro uncertainties may pressure near-term valuation.

Industry Impact: Snowflake’s AI Data Cloud positioning secures a unique role in the cloud data and AI market, with $Amazon.com(AMZN)$ AWS and $Microsoft(MSFT)$ Azure partnerships strengthening its ecosystem. However, Databricks’ rapid growth in data lakes and AI could challenge market share, necessitating focus on AI use case execution.

Comments