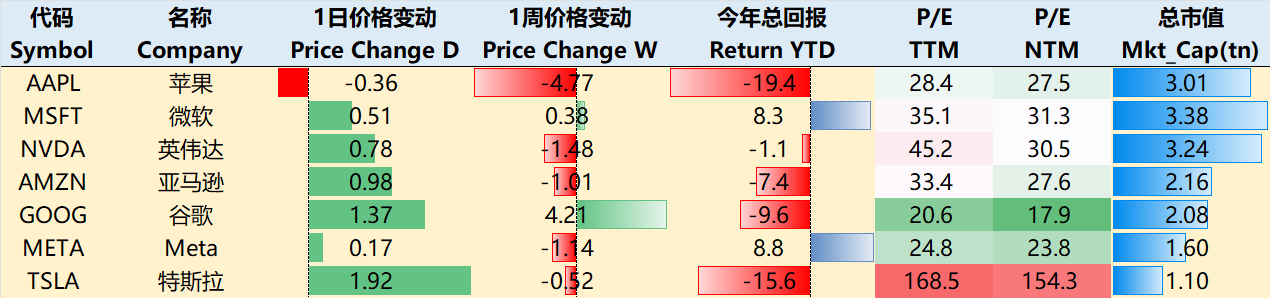

Big-Tech’s Performance

Weekly macro storyline: Triple Kill Across Equities, Bonds, and FX – Is Trump Quietly Backing Down?

The week began with a series of "black swans": Moody's downgraded the U.S. credit outlook, Japan's government bond auctions saw weak demand, and the U.S. 20-year Treasury auction was poorly received. These were all ripple effects stemming from tariff tensions and hit the market just as the global bond market faces synchronized pressures:

Persistent inflation (Japan’s core inflation has remained above the 2% target for two consecutive years),

Declining ALM investor demand (as rising interest rates dampen appetite for long-dated bonds),

Surging government financing needs (fiscal deficits and debt supply pressure).

Rising JGB yields may push U.S. Treasury curves steeper, which could negatively impact equity market liquidity. However, history tells us that liquidity crises often present attractive buying opportunities.

Central banks’ response? The ECB moved first – its minutes revealed that the April rate cut was effectively a pull-forward of the cut originally planned for June. The Fed, however, maintained its stance: “As long as tariffs exist, no rate cuts.” Governor Waller indicated the Fed expects to cut rates in H2 2025 as the impact of tariffs stabilizes. Unlike Japan, the Fed is not expected to directly participate in primary bond auctions.

Crypto markets remained active, with Bitcoin surging past $110,000, solidifying its dual role with gold as a “safe haven.” At the same time, speculative activity also surged—cutting-edge sectors like quantum computing have performed well year-to-date. However, retail companies have delivered gloomy earnings reports, with multiple guidance downgrades or withdrawals, signaling brewing risks in consumer demand.

Big Tech saw relatively moderate moves this week (through May 22 close): $Apple(AAPL)$ -4.77%, $Microsoft(MSFT)$ +0.38%, $NVIDIA(NVDA)$ -1.48%, $Amazon.com(AMZN)$ -1.01%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +4.21%, $Meta Platforms, Inc.(META)$ -1.13%, $Tesla Motors(TSLA)$ -0.52%。

Big-Tech’s Key Strategy

Is NVIDIA Planning a Subtle Surprise?

Jensen Huang is renowned for his precise insights into AI trends and visionary product positioning. Every major product launch from NVIDIA sets a new industry benchmark. At Computex 2025, Jensen’s keynote clarified NVIDIA’s strategic goal: accelerating generative AI through GPU-driven data center solutions. Three key developments were unveiled:

NVLink Fusion – This chip-level interconnect technology signals NVIDIA’s entry into the ASIC ecosystem, a domain Huang once dismissed. It enables clients to build semi-custom AI infrastructures, expanding collaboration with partners like $Astera Labs, Inc.(ALAB)$ and $Marvell Technology(MRVL)$ . This breaks the previous market assumption that “NVLink isn't applicable to ASIC,” similar to NVIDIA’s successful incursion into the Ethernet domain.

Isaac GROOT N1.5 – A foundational physical AI model for humanoid robots that can generate synthetic motion data on Blackwell systems. Jensen predicts physical AI will have its own "ChatGPT moment" and could become a new growth frontier.

RTX PRO 6000 Blackwell Server – Tailored for enterprise AI workloads like multimodal inference and scientific computing, aimed at replacing the $1 trillion CPU server market, this strengthens NVIDIA’s dominance in AI infrastructure.

This open strategy combines technical integration (e.g., NVLink + ASIC) with expansion into emerging markets (e.g., physical AI), thereby increasing NVIDIA’s Total Addressable Market (TAM), filling white spaces, expanding ecosystem control, and reinforcing its leadership in traditional AI infra like data centers.

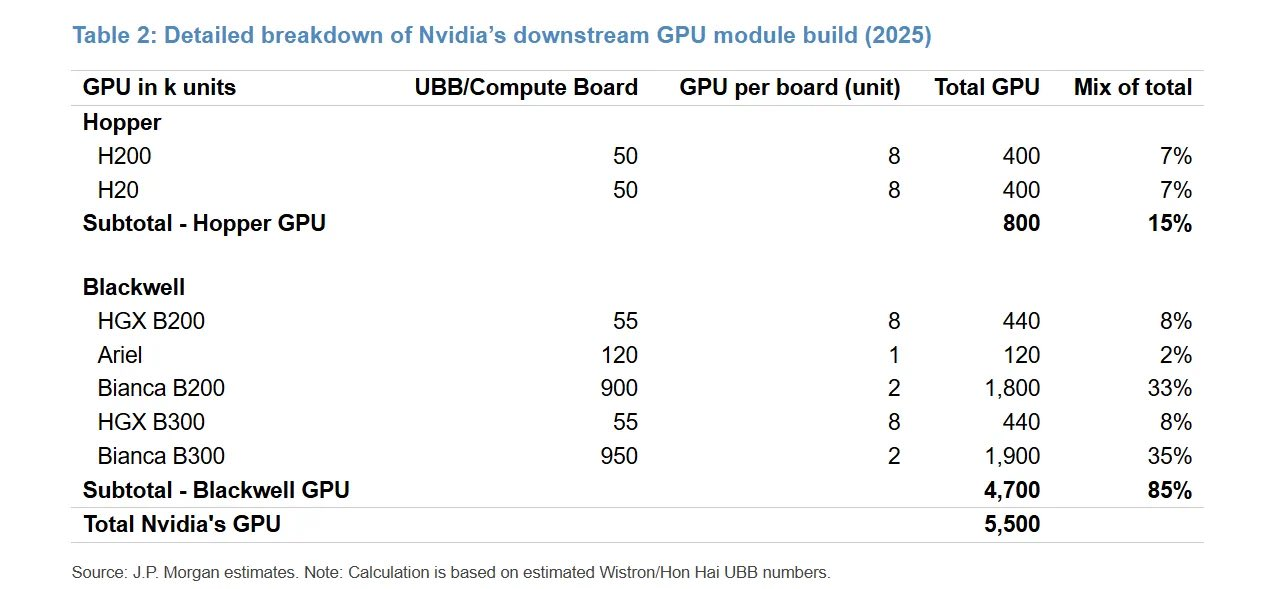

ASIC market note: In 2025, AI ASIC chip shipments are expected to grow ~40% YoY to ~4 million units. Given macro headwinds, U.S. CSPs may adopt a more conservative CapEx stance in 2026, leading them to prioritize NVIDIA GPU servers over continued ASIC development under tighter budgets.

Q1 Earnings Preview

NVIDIA had previously announced it would record $5.5B in charges in F1Q26 due to the China H20 ban.

H20 was a significant revenue contributor in FY26 – with Wells Fargo estimating a $12.5B hit, far exceeding NVIDIA’s initial disclosure that China accounts for only 10–15% of its data center revenue.

This implies that the impact goes beyond just H20 chips, possibly including L20 and L2. The Street has underestimated the true financial fallout.

The company has responded through inventory write-downs and loss recognition on procurement commitments.

Cloud CapEx in Q1 (Meta, Google, AWS, Azure) totaled $70.5B, +67% YoY – confirming ongoing AI infra investment.

Q1 revenue is expected to slightly exceed $43B.

Q2 revenue should be flat or slightly higher, with consensus at ~$44.6B.

Q3 could re-accelerate on the back of GB300 shipments and potential rollout of modified Blackwell chips in China.

If GB300 shipments hit target in Q3 and NVIDIA adds ASIC partners like $Broadcom(AVGO)$ this could add $2–3B in incremental revenue.

Every “Jensen launch effect” not only shakes the industry but also boosts investor confidence. NVIDIA’s high valuation reflects the market’s strong conviction in its future growth and industry dominance.

As long as the AI wave rolls on, NVIDIA’s growth story isn’t ending.

Big Tech Options Strategy

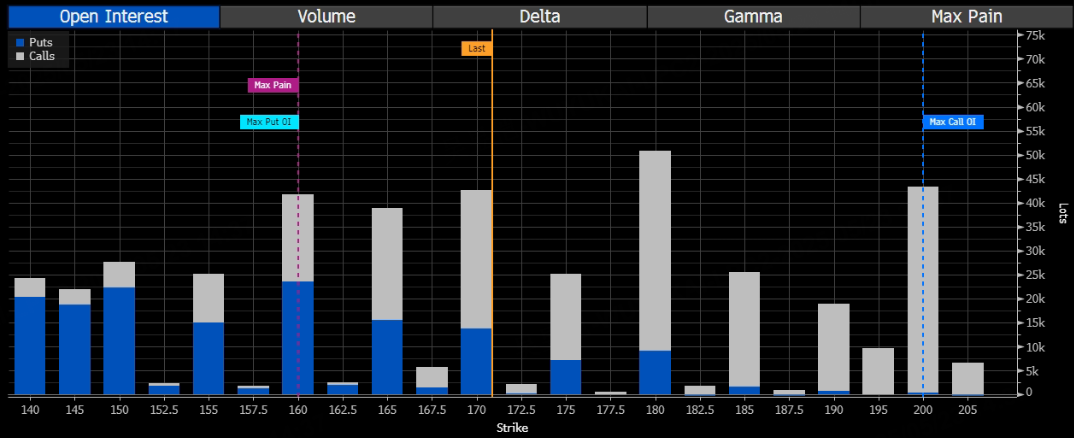

Google Makes a Comeback?

Long plagued by antitrust litigation and concerns of being “displaced by AI,” Google finally saw significant institutional option inflows this week.

The Google I/O 2025 event refocused attention on AI. Major updates to Gemini 2.5, including:

Performance gains in the Pro version and efficiency in the Flash version.

Launch of Gemini Pro & Ultra subscription plans.

Imagen 4 improves image generation speed and detail.

Veo 3 enables video generation with audio.

Android XR platform and AI-powered search and shopping enhancements aim to build a smarter, personalized experience.

Google’s AI strategy is clear: ecosystem integration + gradual monetization.

Short-term: free AI search (AI Mode) to expand user base, enhancing ad monetization (e-commerce, local services).

Long-term: subscriptions (Gemini Ultra) and enterprise services (Vertex AI) for high-margin revenue streams.

On the options front, we saw net inflows this week, with notable 185 call positions, and large buys at the 180 and 200 strikes for June expiry.

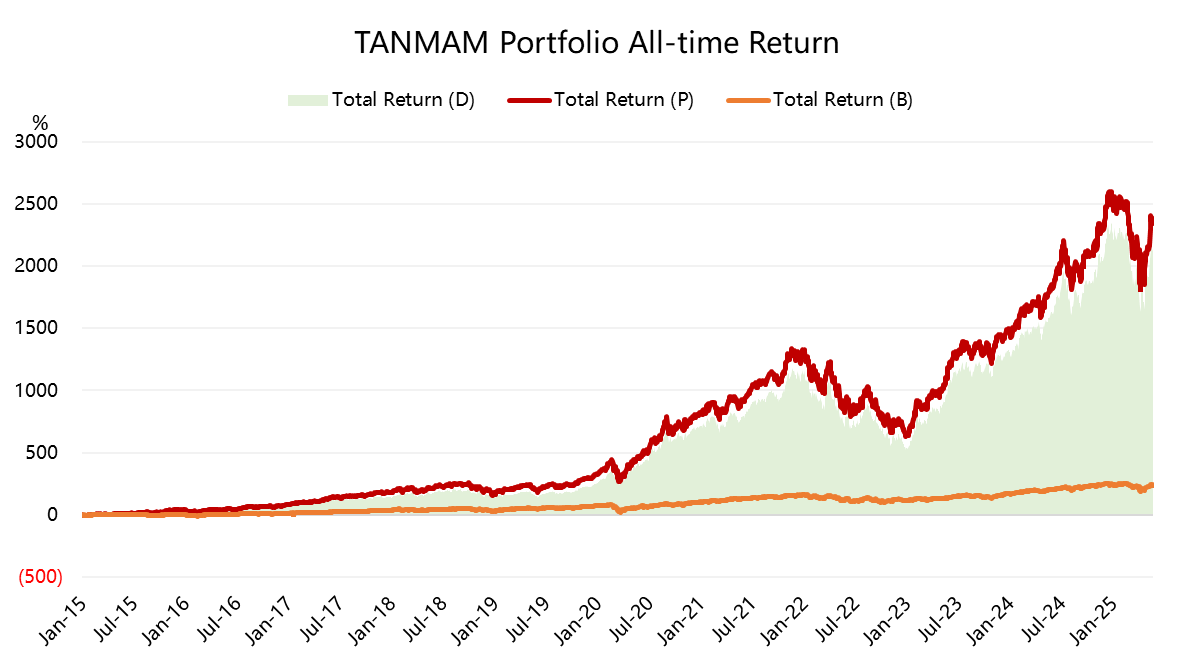

Big-tech Portfolio

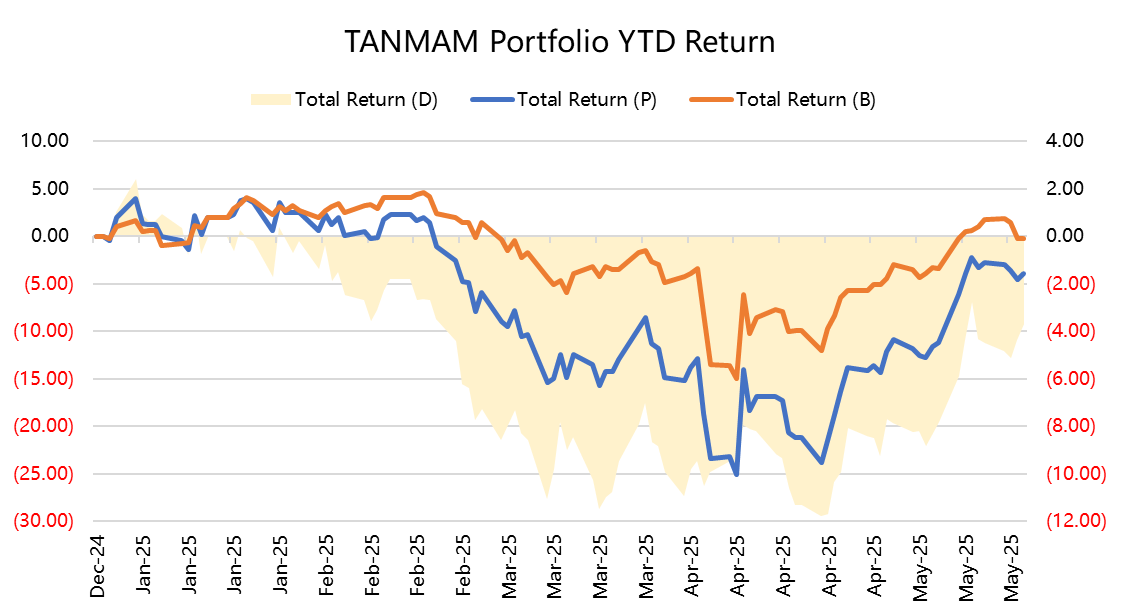

The “Magnificent Seven” or “TANMAMG” portfolio is an equal-weighted strategy, rebalanced quarterly. Since 2015, it has massively outperformed the $S&P 500(.SPX)$ :

Total return: 2,359.21%, vs. 238.98% for $SPDR S&P 500 ETF Trust(SPY)$

Excess return: 2,120.23%

YTD 2025, Big Tech has seen some pullback:

TANMAMG return: -3.93% vs. SPY’s -0.21%

However, over the past year:

Sharpe ratio of TANMAMG: 1.01 vs. SPY’s 0.52

Information ratio: 1.16

$NASDAQ(.IXIC)$ $Invesco QQQ(QQQ)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$

Comments