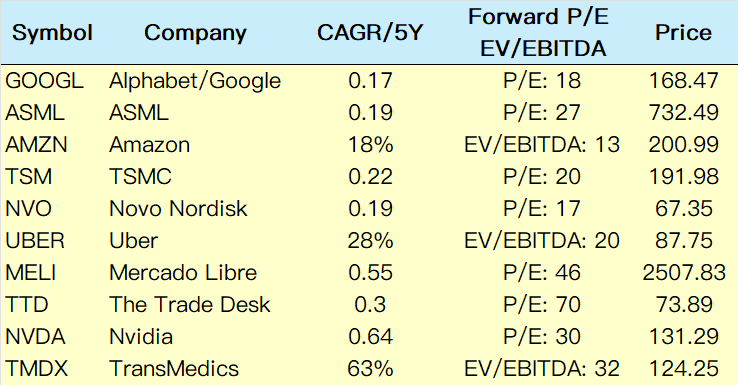

1. Alphabet $Alphabet(GOOG)$ $Alphabet(GOOGL)$

Business Overview: Alphabet is a leading global technology giant with businesses covering search, advertising, cloud computing and artificial intelligence.Its core product, the Google search engine, dominates the global market, the Google Cloud Platform (GCP) is growing rapidly in cloud computing, and YouTube is the world's largest video platform.In addition, Alphabet's forward-thinking approach to self-driving cabs (via Waymo) and quantum computing offers plenty of scope for future growth.

Recent concerns about its search business being eroded by AI and the market over-booking factors, however, in terms of actual revenue and user hours, are inconclusive for the time being.The market has reacted too pessimistically, so there is room for a rebound as well

Reason to invest:

World's largest search engine with solid market share.

GCP is growing rapidly and becoming a key player in the cloud computing market.

Leadership in self-driving cabs.

Potential for disruptive growth in quantum computing.

YouTube's advertising and subscription revenues continue to grow.

Revenue has grown at a compound annual growth rate (CAGR) of 17% over the past five years.

Forward-looking price-to-earnings (PE) ratio of just 18, a reasonable valuation.

Current Share Price: $168.47 (as of May 26, 2025)

ANALYSIS: Alphabet's diversified businesses and ability to innovate put it at the center of the tech industry.Despite regulatory pressures, its strong cash flow and market position make it a solid investment choice. growth in YouTube and GCP provide additional revenue streams, while the long-term potential of autonomous driving and quantum computing further enhance its attractiveness.

2. ASML $ASML Holding NV(ASML)$

Business Overview: ASML is the world's leading supplier of lithography equipment, and its products are the core equipment for semiconductor manufacturing.With the rapid development of AI, 5G and IoT, the global demand for chips continues to grow, and ASML's market position is irreplaceable.

Investment Rationale:

Core supplier in the semiconductor industry with extremely high technical barriers.

Growing demand for artificial intelligence driving demand for chip manufacturing equipment.

Has significant competitive barriers (moats).

Revenue CAGR of 19% over the last five years.

Attractive valuation with a forward P/E of 27.

Current share price: $732.49 (as of May 26, 2025)

ANALYSIS: ASML's monopoly in the semiconductor equipment market makes it a direct beneficiary of artificial intelligence and technological advances.Despite its high share price, its technological superiority and continued growth in market demand support its long-term investment value.Investors need to pay attention to the cyclical fluctuations in the global semiconductor industry.

3. Amazon $Amazon.com(AMZN)$

BUSINESS OVERVIEW: Amazon is a global leader in e-commerce and cloud computing, with a dominant market position in its AWS cloud service and a fast-growing advertising business.Amazon has reshaped the retail and technology industries through its logistics network and digital services.

Investment Rationale:

Monopoly position in e-commerce.

AWS cloud service continues to grow rapidly.

The advertising business has become a new growth engine.

Revenue CAGR of 18% over the past five years.

Forward-looking EV/EBITDA of just 13, an attractive valuation.

Current share price: $200.99 (as of May 26, 2025)

ANALYSIS: Amazon's diversified revenue streams and strong market position make it a cornerstone of tech investing.AWS's high margins and rapid growth in its advertising business provide stable cash flow.Despite competitive and regulatory challenges, its low valuation and high growth potential make it a quality investment choice.

4. Taiwan Semiconductor $Taiwan Semiconductor Manufacturing(TSM)$

Business Overview: Taiwan Semiconductor (TSMC) is the world's largest chip foundry, providing chip manufacturing services to top technology companies such as Apple and Nvidia.Its advanced process technology is a leader in the industry.

Investment Rationale:

Has broad competitive barriers and technology leadership.

Demand from Artificial Intelligence and Technology sectors driving chip manufacturing growth.

Revenue CAGR of 22% over the past five years.

Forward-looking P/E of 20, a reasonable valuation.

Current share price: $191.98 (as of May 26, 2025)

ANALYSIS: TSMC is a pillar of the semiconductor industry, benefiting from the global wave of technological advances.While geopolitical risks may weigh on it, its technological edge and market position make it an ideal choice for long-term investment.

5. Novo Nordisk $Novo-Nordisk A/S(NVO)$

Business Overview:Novo Nordisk is a leading global pharmaceutical company focused on diabetes and obesity treatments.Its obesity treatment drugs are significantly competitive in the market and the obesity market is expected to grow significantly by 2030.

Investment Rationale:

Obesity market projected to grow from 650 million adults to over 1 billion by 2030.

Has strong competitive barriers with only Eli Lilly (LLY) as a major competitor.

Revenue CAGR of 19% over the past five years.

Forward-looking P/E of 17, an attractive valuation.

Current share price: $67.35 (as of May 26, 2025)

ANALYSIS: Novo Nordisk's focus on the healthcare sector makes it a quality choice for long-term investment.The rapid growth of the obesity market offers significant room for growth, and its low valuation further enhances its attractiveness.Investors need to keep an eye on competitor developments.

6. Uber $Uber(UBER)$

Business Overview: Uber is the world's leading mobile mobility platform, offering cab, delivery and freight services.Its app is widely used worldwide and has a strong brand presence.

Reason to invest:

Leadership in self-driving cars.

Strong brand and extensive moat.

Revenue CAGR of 28% over the past five years.

Forward-looking EV/EBITDA of 20 and reasonable valuation.

Current share price: $87.75 (as of May 26, 2025)

ANALYSIS: Uber's leadership in shared mobility and autonomous driving makes it a central player in the future mobility market.Its high growth rate and brand strength support its investment value, but attention needs to be paid to the regulatory and implementation progress of self-driving technology.

7. Mercado Libre $MercadoLibre(MELI)$

Business Overview: Mercado Libre is the leading e-commerce and fintech platform in Latin America and is known as the "Amazon of Latin America".Its business covers online retail, payments and logistics services.

Reason to invest:

Diversified business portfolio covering e-commerce and fintech.

Low e-commerce market penetration in Latin America with huge growth potential.

Rapidly increasing margins.

Revenue CAGR of 55% over the past five years.

Forward-looking P/E of 46, reflecting high growth expectations.

Current share price: $2507.83 (as of May 26, 2025)

ANALYSIS: Mercado Libre's first-mover advantage and rapid growth in Latin American markets make it an ideal choice for a high-growth investment.Despite its high valuation, its market potential and margin improvement support its long-term value.

8. The Trade Desk $Trade Desk Inc.(TTD)$

Business Overview:The Trade Desk is the world's leading programmatic advertising technology company that helps companies run data-driven digital marketing campaigns.Its platform is known for high customer retention rates.

Investment Rationale:

Growth in digital ad spending driving demand for programmatic advertising.

Best-in-class ad tech platform with high customer retention.

Revenue CAGR of 30% over the past five years.

Forward-looking P/E of 70, reflecting high growth expectations.

Current share price: $73.89 (as of May 26, 2025)

ANALYSIS: The Trade Desk's technological prowess in digital advertising makes it a core player in a high-growth industry.Despite its high valuation, its stable customer base and market trends support its investment value.

9. Nvidia $NVIDIA(NVDA)$

Business Overview: Nvidia is the world's largest supplier of GPUs for a wide range of applications in artificial intelligence, machine learning, gaming, and data centers.The company's leadership in AI hardware is unrivaled.

Reasons to invest:

The world's largest GPU supplier with leading technology.

Rapid growth in artificial intelligence, machine learning and data center demand.

Revenue CAGR of 64% over the past five years.

Forward-looking P/E of 30, a reasonable valuation.

Current share price: $131.29 (as of May 26, 2025)

ANALYSIS: Nvidia is a central beneficiary of the AI boom, with its high growth rate and market position making it a top pick for tech investments.Its technological edge and diversified application scenarios support its long-term growth despite increased competition in the market.

10. TransMedics $TransMedics Group, Inc.(TMDX)$

Business Overview:TransMedics is a medical technology company specializing in organ transplant preservation systems designed to improve transplant success rates.The growing global demand for organ transplants provides a broad market.

Investment Rationale:

Global demand for organ transplants continues to grow.

Potential to expand into markets outside the US.

High margin improvement margins.

Led by founders with a strong capacity for innovation.

Revenue CAGR of 63% over the past five years.

Forward-looking EV/EBITDA of 32, reflecting high growth expectations.

Current share price: $124.25 (as of May 26, 2025)

ANALYSIS: TransMedics' innovation in medical technology makes it a potential high-growth investment.Its founder leadership and market expansion potential enhance its attractiveness, but regulatory risks in the healthcare sector need to be kept in mind.

Comments

Great article, would you like to share it?