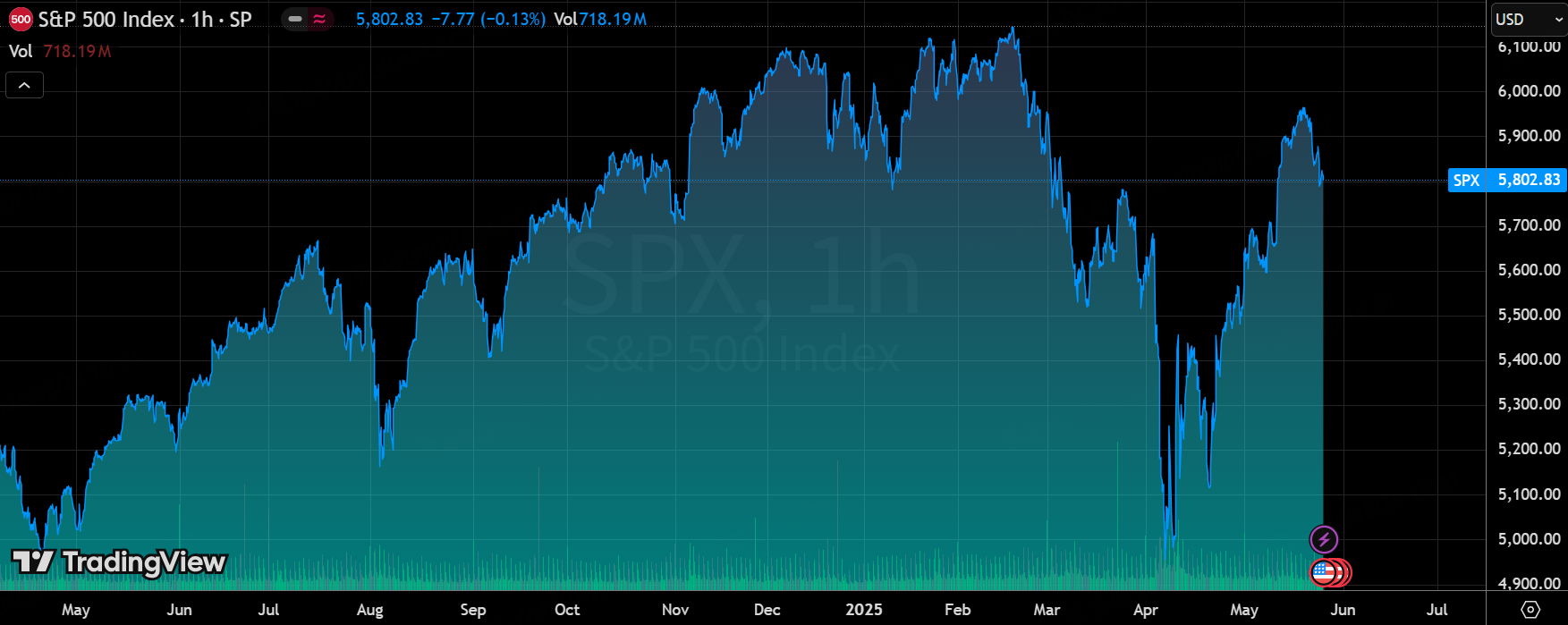

There was a significant pullback in the $S&P 500(.SPX)$ last week, with the bond market a key contributing factor.Long-term bond supply issues (U.S.-Japan auction chaos), deficit pressures from the U.S. budget proposal (locking in a $2 trillion deficit over the next several years), and intensifying pressures on the back end of the global interest rate curve, as well as debt sustainability concerns and tariff uncertainty (the "zero Sharpe ratio guessing game"), combined to lead to a highly volatile trading environment.

Equity markets, on the other hand, have been heavily influenced by slowing demand strength (although companies are still buying), cooling risk appetite, and technicals suggesting a weakening of near-term demand trends.

Key insights and outlook

Risk-Reward and Incremental Favor: Underlying risk-reward is unattractive and the market needs incremental favor such as a trade deal, core U.S. data or NVIDIA earnings to break out of the current range.In the absence of upside, the S&P may remain shaky.

Market resilience and strategy: market resilience exceeded expectations (analogous to the 1990s), equities have support but need to focus on "interstices" (interstices), i.e., structural opportunities when the market is not unilateral up.

Asset Discussion

U.S. Treasury Market $iShares 20+ Year Treasury Bond ETF(TLT)$

Lack of support for long-term bonds (policy uncertainty, rising term premium, de-dollarization, dovish Fed Chair expectations, etc.), yield curve expected to continue to steepen (driven by economic data on the front end and pricing pressures on the back end).The likelihood of a significant rise in 30-year Treasury yields over the next few years is low (non-core scenario).

Tariff policy

US reaches agreement only with UK, most countries wait and see.Markets are confusing "delay" with "agreement", and the baseline scenario for tariff policy is no significant change after the end of the "90-day pause" (Trump may apply pressure through the "tariff rate")."Tariff rate" pressure, but historical performance on June 1 deadline for EU 50% tariffs, etc. suggests market has priced in risk).The risk of a preliminary injunction from the Court of International Trade (blocking the "Liberation Day" tariffs) is an upside risk that is of less concern at this time.

Over the weekend, Trump issued a statement that he is easing relations with the EU, pushing back the tariff date to July 9 while negotiations continue.Risk assets are currently on the upside.

US Dollar Trend $Invesco DB US Dollar Index Bullish Fund(UUP)$

The U.S. dollar still has room to fall.Shifts in investor allocations to unhedged foreign assets (e.g., reducing holdings of U.S. assets or increasing hedges) will affect exchange rates.Despite the bumpy adjustment process, the dollar's positive correlation with U.S. equities has strengthened and safe-haven assets such as Europe and JPY/CHF have become more attractive, with the dollar expected to weaken over the long term.

Oil and the Economy $United States Oil Fund LP(USO)$

The net impact of lower oil prices on the U.S. economy is limited (consumer income roughly offset by energy capex).The recent decline in oil prices (year-to-date TWI down 23%) has boosted consumers (GDP contribution of ~0.1ppt), but the direct impact of tariffs on inflation (rather than financial market offsets) is more pronounced, with tariffs expected to be a drag on GDP growth of ~1.4ppt in the next four quarters.

Inflation outlook $iShares TIPS Bond ETF(TIP)$

Without tariffs, inflation may continue to rise, but tariffs (especially the direct impact of a non-recovery of the dollar and a non-sharp decline in the stock market) will depress inflation.Core PCE is expected to come in at 3.6% (full year), with 1.1ppt of downward pressure coming mainly from tariffs, and wage growth (currently about 3% below) is a key watch for sticky inflation.

Fed Policy.

Markets are pricing in multiple rate cuts this year and next (currently pricing in 50bp/50bp), but actual policy path may be more conservative (front-end rates are still attractive, Fed views current rates as mildly restrictive, high threshold for rate hikes).Front-end rates are reasonably priced and if risk is repriced, going long front-end rates is preferable.

US Consumer $Consumer Discretionary Select Sector SPDR Fund(XLY)$

Consumer spending did not slow as expected (credit card data, Amazon, etc. were strong), and while some areas (corporate/government leveraged travel, inbound travel) slowed moderately, home improvement, discounters, etc. picked up in late April/early May, and consumers "spent while they were worried", which was better than expected overall.

Small Cap (Russell 2000) $ProShares Short Russell2000(RWM)$

Down 8% year-to-date (S&P 500 down 1%), under triple pressure from growth fears, rising interest rates and tariffs.Small caps remain under pressure as the economy is below trend and U.S. bond yields hold steady through the end of the year.However, there are individual stock opportunities within the index (e.g., 5% of small caps beating the benchmark).

US tech stocks $NASDAQ 100(NDX)$

Nasdaq 100 breaks above 200-day SMA as institutions re-engage in large-cap tech stocks (improving macro sentiment, earnings beat (7 non-Nvidia companies beat EPS estimates by 22%), AI-related growth (Azure/GCP, compute hardware)).P/E returning to 5-year average, need to rely on revenue/subscription growth (not valuation expansion) in H2, risk is trading higher but guidance unchanged.

NVIDIA (NVDA). $NVIDIA(NVDA)$

Nearly 12-month range-bound (volatile, up 50% since April 7 low, technically overbought), focusing on margins this quarter, longer-term on 2026 earnings trajectory and trade/geopolitical dynamics.Institutional position gauge rating 7.5 (bullish setup).

Remaining categories

High Yield Bonds: About half of U.S. high yield bond option adjusted spreads (OAS) are below 200 bps (rare). $AB HIGH YIELD ETF(HYFI)$

Thematic trading: basket trading and thematic monitoring tools (e.g., Positioning Monitor) enhance strategy efficiency.

Short Squeeze: S&P 500 median stock rolled short to highs since 2021 (above long term average).

AI Arithmetic: NVIDIA H100 Arithmetic Market Share May Reach 50% (Growth by 2040)

Comments