$MEITUAN-W(03690)$ 25Q1 results showed strong growth and profitability, with core local commerce and membership programs as key drivers.Competitive pressures have not yet significantly impacted financial performance as Q1 did not start the takeout war, with overseas expansion and AI investments providing potential for long-term growth.More important though is the guidance from the earnings call.To summarize the market concerns:

The impact of Q1 competition is not yet significant, and the reduction of subsidies eases the pressure on profits;

However, Q2 takeaway competition intensifies, operating profit growth will decline significantly, and it is impossible to predict how long irrational competition will last

Keeta's initial success responds to internationalization expectations, and the initial cost of overseas expansion is high.

Market had already raised revenue and earnings estimates for 2025, but unexpected competition concerns limit valuation upside

Performance and Market Feedback

Meituan's first quarter 2025 (1Q25) performance was solid, with core financial metrics exceeding market expectations, reflecting the company's improved competitiveness and operational efficiency in the local services market.Below is a comparison of key figures:

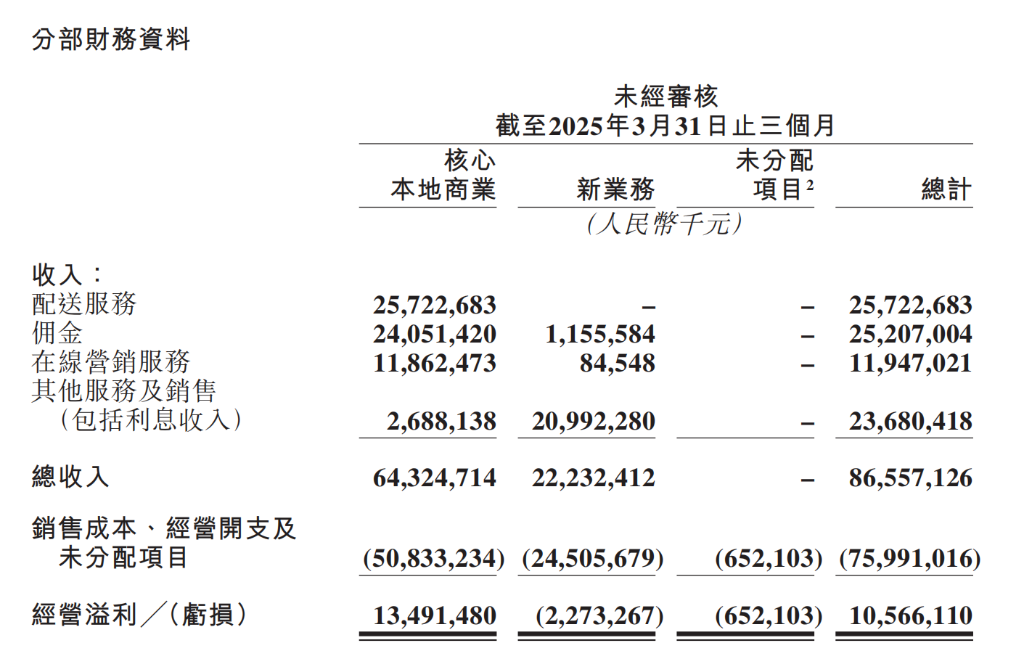

Revenue: 86.6B, +18.1% YoY (1Q24: 73.3B), beating expectations by 1.2B (85.4B expected).Core local commerce: 64.3B, +17.8% YoY, with delivery transaction volume growth and subsidy optimization as key drivers.Distribution revenue of core local commercial segment contributed ~0.6B over-expected revenue due to subsidy reduction.New Business: 22.2B, +19.2% YoY with strong performance in retail and overseas business.

Gross margin was stable overall as core local commercial gross margin improved due to distribution cost optimization.

Marketing expense ratio decreased to 18.0%, while R&D expense ratio rose to 6.7%, reflecting increased investment in technology.

Operating profit: 10.6B, exceeding expectations by 2.0B, of which 1.0B came from non-operating investment income and actual operations exceeded expectations by 1.0B.

Net cash flow from operating activities 10.1B, cash and equivalents 115B, short-term investments 65.4B, strong liquidity.

Investment Highlights

Core local commercial segment driving growth

Core local commercial revenue of $64.3B (+17.8% YoY) accounted for 74% of total revenue.Growth in instant delivery transaction volume and reduction in delivery fee subsidy (~0.6B over-expected revenue) were the key drivers.Membership program nationwide rollout boosted transaction frequency and user stickiness, while commission and online marketing revenue grew due to increase in active merchants.The solid performance of this segment provided a stable cash flow base for Meituan.

New Business Diversification Begins to Pay Off

Revenue from new business segments (retail, overseas, etc.) of $22.2B (+19.2% YoY) shows progress in diversification strategy.Retail business benefited from consumer demand for cost-effective products, and overseas business (e.g. Saudi Keeta platform) was initially successful.Profitability needs to be improved despite narrowing losses.Overseas expansion offers potential for long-term growth, but initial investment may put pressure on margins.

Q1 profitability improvement reflects growth

Operating margin rose to 12.2% from 7.6% in 1Q24 and cost-to-income ratio declined to 62.6% (1Q24: 64.9%).Marketing expense ratio decreased from 19.0% to 18.0% with significant distribution cost optimization.R&D expense ratio rose to 6.7% (5.8B), focusing on AI technology and showing long-term growth commitment.Earnings beat expectations mainly driven by revenue growth, complemented by cost structure optimization.

It should be noted that fair value changes due to investment income, as well as other gains, exceeded expectations by a relatively large amount (approximately $1 billion) during the period, and thus contributed significantly to the overall improvement in operating margins, but this profit did not result in cash flow.

Membership program to cope with competitive pressure

Increased competition in the takeaway market (Shake Shack, Hungry House, etc.), but limited financial impact in the quarter.Membership program increased user stickiness through discounts and tiered offers, and transaction frequency increased significantly.This strategy is effective in alleviating competitive pressure, and the long-term effect needs to be observed in terms of changes in user acquisition costs.

Overseas and AI investments offer potential for valuation repricing

Initial success of Keeta platform in Saudi Arabia demonstrates product and technology strengths, but financial contribution is yet to be verified AI investment (R&D expenses + YoY) to optimize user experience and operational efficiency could be a trigger for valuation repricing.Market is concerned about how Meituan will balance resource allocation between domestic competition and overseas expansion.

Conference call guidance and management's tone

The company delivered a clear strategic signal in the earnings call that, in the face of short-term competition from new players such as Jingdong, which is hitting the takeaway market with "tens of billions of dollars of subsidies", Meituan will defend its market share at all costs, but emphasize more on winning the long-term victory through supply-side innovations, improvement of user experience, and health of the ecosystem.

Short-term fear of subsidy war, but refused to "irrational competition"."Winning the competition at all costs" and hinted that Meituan has sufficient funds (180.4 billion yuan in cash and equivalents) to deal with the subsidy war. $JD.com(JD)$ $JD-SW(09618)$ entry is seen as a validation of the industry's potential, but Meituan believes low-quality, low-price subsidies are unsustainable.

Differentiation advantage: Meituan emphasizes its complex service capabilities (e.g., 30-minute delivery network, high order fulfillment rate) and merchant ecosystem (480 branded satellite stores, small- and medium-sized merchant support programs) accumulated over 11 years, highlighting its operational barriers compared to the system failures and high refund rates that newer players may face.

In the long run, supply-side innovation and industry healthization are the core barriers.

In-depth empowerment on the merchant side helps merchants reduce costs and increase efficiency through innovative modes such as "branded satellite stores" and "cloud kitchens" (the income of satellite stores can be several times that of ordinary restaurants), and provides small and medium-sized merchants with traffic flow, digitalization tools, and a food safety program called "bright kitchen", which consolidates the fundamentals of the supply side.For small and medium-sized merchants, we provide traffic, digital tools and the "bright kitchen" food safety program to consolidate the fundamentals of the supply side.

The user side pays more attention to the experience, Meituan flash sale (instant retail) has integrated 300 million users' needs, covering all categories of 24-hour delivery; the membership system strengthens the viscosity, and in the future, it will launch the priority delivery of takeaways and other privileges, so as to improve the retention rate of high-frequency users.In addition, the ecological construction of riders is in progress, with welfare inputs such as occupational injury insurance, pension pilots, and educational support to protect capacity stability and social identity.

The company guided that Q2 core local business revenue growth will slow down (core local life revenue growth in the second quarter will decline compared to the first quarter) operating profit fell significantly year-on-year, mainly due to increased subsidy investment.Funds will be prioritized for merchant support (such as the 100 billion yuan industry growth plan), technology iteration and membership system, rather than pure price war.Meituan believes that after the industry returns to rationality, the scale effect will drive GTV margins steadily up.

Comments