May 27, the main packaging printing and cross-border e-commerce business of the A-share company $JIHONG CO(02603)$ listed in Hong Kong, the first day soared more than 50%, and become the first Hong Kong listing that is included in the Hong Kong Stock Connect A + H companies.Of course, it has some other logos on it, such as: the first A+H in Xiamen, the first cross-border e-commerce A+H, the first A+H company in the packaging industry, and the smallest A+H company with the smallest market capitalization (previously, the threshold of the A+H was about 7.3 billion Hong Kong dollars) $Xiamen Jihong Co.,Ltd.(002803)$

At the current stage can enter the Hong Kong Stock Connect, is a lot of small and medium-capitalization companies dream of the goal.

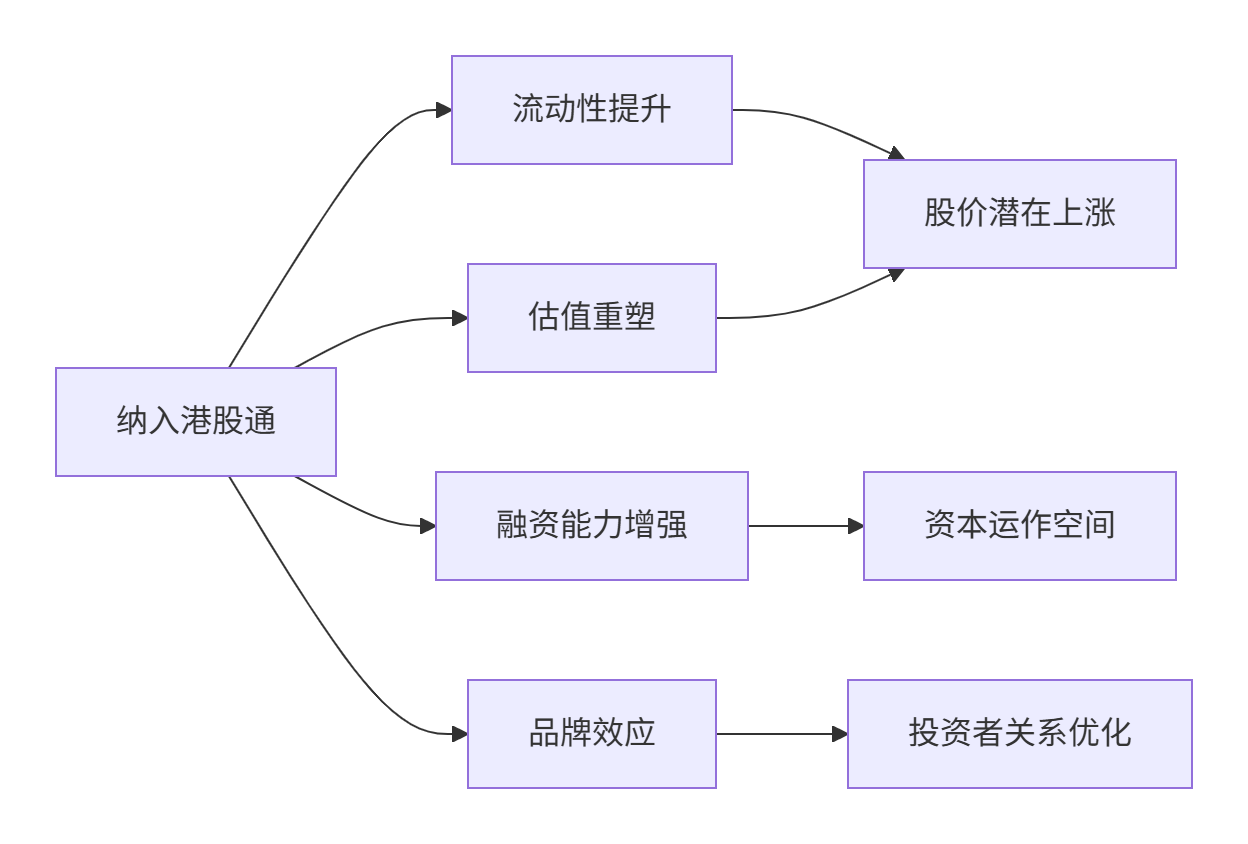

On the one hand, it is because the net inflow of southbound funds so far this year has exceeded that of the past, and access to the Hong Kong Stock Connect can often bring in a very large amount of incremental funds;

On the other hand, the pricing of the two places is slightly different, there is often a discount premium, and the Hong Kong Stock Connect stocks to a certain extent, the trading volume is more active.

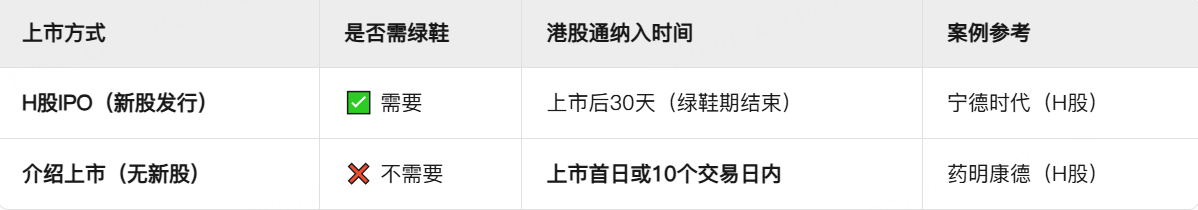

The reason why Gihon shares can enter the Hong Kong Stock Connect on the first day of listing is related to the fact that it does not have a green shoe mechanism.

In the new, the market is speculating, obviously is a A-share liquidity is also more common company, why not "green shoes"?It is likely to be related to its desire to enter the Hong Kong Stock Connect as early as possible.

Why are companies without the Green Shoe Mechanism likely to be admitted to the HK Stock Connect more quickly?

The Nature of the Green Shoe Mechanism and the HK Stock Connect Review

Role of the Green Shoe Mechanism: The Green Shoe Mechanism (Over-allotment Option) is a tool used by underwriters to stabilize the share price during the 30-day period after listing, which involves the issuance of up to an additional 15% of shares.During this period, the company is required to maintain price stability, and the share price and trading volume may be artificially interfered with (e.g. underwriters protecting the market).

Audit logic of HK Stock Connect: HK Stock Connect requires the underlying stock to have the authenticity of market-based trading.If there is a green shoe mechanism, the Exchange may consider that the trading data (e.g. liquidity, volatility) cannot reflect the real market behavior in the short term, and need to wait for the end of the green shoe period (usually 30 days) before assessing.

Therefore, for companies without a green shoe mechanism, their share price and trading volume are spontaneous market behavior from the first day of listing, and the data meets the review requirements earlier.

Impact of Listing Type

In addition to the scenario of no green shoe, which is not set up by the company, there are also companies using introductory listing (e.g. secondary listing, spin-off listing) that usually do not issue new shares to raise funds and therefore do not need the green shoe mechanism.

These companies have lower financial and compliance risks due to their existing history of public trading (e.g. in A-shares or overseas markets) and are more quickly reviewed by HKEx.

Are there any exceptions?

Yes, the fast-track mechanism.HKEx provides exemptions for some high quality companies (e.g. large tech stocks, A+H shares), allowing them to skip the green shoe period and directly enter the HK Stock Connect, in order to enhance the attractiveness of the market.

Special treatment for AH shares: A+H share companies may be included in the H-share segment immediately after 10 trading days of A-share listing without waiting for the green shoe period due to regulatory synergies between the two places.

Core criteria for inclusion in HK Stock Connect

Regular Inclusion Criteria

Market Capitalization Requirement: Hang Seng Composite Index constituents are required to meet the average daily market capitalization of ≥HK$5,000 million for the last 12 months (small cap stocks are additionally required to meet the month-end market capitalization of ≥HK$7,359 million). 2025 market capitalization threshold for Main Board companies has been raised to HK$7,457 million after the latest adjustment.

Liquidity requirements: average daily turnover rate ≥ 0.05% for the past 12 months (or met the threshold for the last 6 months).

Compliance Requirements: A-share not under risk warning (e.g. ST, *ST), no major violation records.

Additional Requirements for Special Types of Companies

Same-share different rights (Class W) companies (e.g. Horizon Robotics-W): listed for 6 months + 20 trading days; average daily market capitalization ≥ HK$20 billion and total turnover ≥ HK$6 billion in the 183 days prior to the inspection date.

A+H-share company: A-share listing for 10 trading days and the end of H-share price stabilization period.

Secondary listed companies: market capitalization ≥ HK$40 billion (or HK$10 billion + annual revenue ≥ HK$1 billion).

Fast Track Inclusion Mechanism

Large IPO: Market capitalization up to top 10% of Hang Seng Composite Index on the first day of listing, to be included after 10 trading days.

Medium-sized IPOs: new listings in the current quarter with average daily market capitalization ≥HK$16 billion (exempted from liquidity requirement).

Periodic Adjustment

Reviewed semi-annually (June, December), with the results taking effect on the second Monday of March/September of the following year.After the Exchange publishes the list, the underlying opens for trading on the effective date.

Some of the underlying (e.g. Bruco, Honeysuckle Group) are included through quarterly review with effective date on the first Monday of June/December

Temporary Adjustments: Quick Tune-outs include: Immediate Tune-outs when market capitalization (<HK$4bn), liquidity (suspension of trading for more than 3 months) or compliance is not met.Special dates are also available, e.g. Horizon Robotics-W effective May 26, 2025 when conditions are met.

Comments