Performance and market feedback

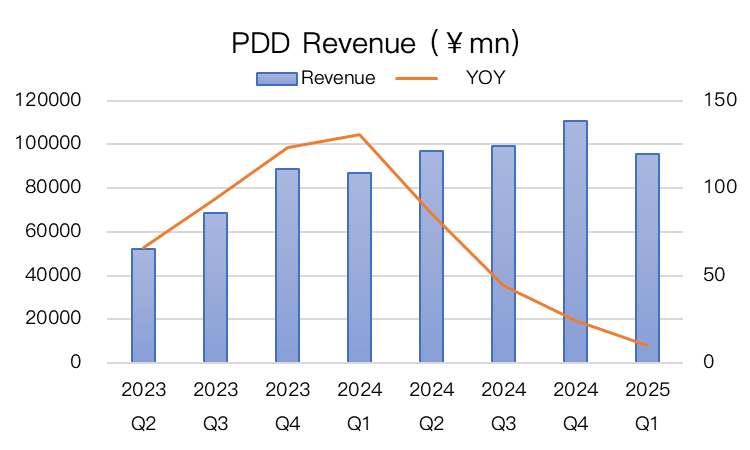

Q1 total revenue of 95,672.2 million yuan, up only 10% year-on-year, below market expectations of 103,368 million yuan, of which online marketing services +15% and transaction services +6%.

Gross margin was about 57.2%, much lower than last year's 62.3% and below the market's expectation of 58.2%, with rising cost pressure.What's more, operating expense ratio accelerated, marketing expenses as a percentage of revenue rose from 27% to 34.9%, and high intensity investment in a competitive environment was unavoidable and exceeded the market's highest expectations, thus also leading to an operating profit of NT$16,085.6 million, a year-on-year decline of 38%, and a non-GAAP operating profit of NT$18,259.7 million, a year-on-year decline of 36%.Diluted profit per ADS was 9.94 yuan (about $1.37), below the market's expectation of $2.62, down 47.6% year-on-year.

Market Feedback

The stock took a nosedive after the release of the earnings report, falling more than 20% at one point. Previous quarters, despite also being in the midst of a competitive cycle and corresponding macro cycle, had not been ridiculously bad, and the market was expecting between $20-25 billion, but this time it fell right back to the $16 billion level, which was far less than expected.

The decline in margins may be related to marketing expenses, but the revenue side of the equation was also less than expected, raising investor concerns about the sustainability of growth.

Combined with previous management indifference to shareholder returns, it is thought that investors may not be too interested.

Investment highlights

Slower revenue growth is indeed an ecological change, but is the problem reversible?

Overall, merchant-side-dominated online marketing services revenue of +15% outperformed transaction services revenue of +6%.The faster growth in online marketing services indicates the company's increased reliance on advertising revenues, which may be related to merchants investing more in marketing on their platforms in response to competition.However, the low rate of growth in transaction services revenues may reflect a slowdown in transaction volumes or commission rates, and attention will need to be paid to whether pressure persists in subsequent quarters as a result of increased competition or weaker spending.

One factor not accounted for by the market - spillover effects from the takeaway wars.

Competition between $Beijingdong Group-SW (09618)$, $Meituan-W (03690)$, and Taobao in the takeaway business has significantly boosted the DAU and length of stay of their respective apps, indirectly contributing to the growth of their e-commerce businesses and potentially diverting users and orders away from Pinduoduo.At the same time, the impact of instant retail is large, the instant retail (fast delivery) business of Meituan and other platforms is growing rapidly, and some of the categories of Pinduoduo overlap (such as daily necessities, fresh food), and may directly compete for market share.

Even Q1 Pinduoduo revenue less than expected has been affected by this, the market may not be fully priced.

Costs and expenses surged, the first victim of state subsidies?

Q1 costs were +25% y/y, far outpacing revenue growth, probably related to higher logistics costs or payment processing fees.

But more importantly, operating expenses rose 37% year-on-year, with sales and marketing expenses surging 43%, far exceeding market expectations and hitting the top end of big bank estimates.This high-intensity investment reflects JD.com's strategic focus on user acquisition, brand promotion and merchant support, and while its peers are enjoying "state subsidies", it is using the real money it earns to win back users.As a result, operating margins fell to 16.8 percent from 29.9 percent last year.

Meanwhile, executives on the call said that with the expansion of the business scale and the emergence of challenges, the growth rate is slowing down is an inevitable trend.And changes in the external environment in the first quarter further accelerated this process.It also looks like they've been seeing this trend for a long time and have been decisive in getting money out to subsidize it.

This Q1 press release is almost identical to the wording of Q2 '24 when it plunged over 30%.

Overseas market risks cannot be ignored

The international trade environment is also changing, the small parcel duty-free policy was officially canceled on May 2, which had a significant impact on Temu's sales, but even if the tariff is now reduced to 54%, it does not materially affect buyers will be affected.

The key is this policy, which the EU is also considering.

The only advantage now is strong cash reserves

Cash equivalents and short-term investments of $364.5 billion are also the strongest backing to support long-term strategy.Originally this money was going to be more to support its internationalization strategy (e.g. Temu platform expansion) and ecosystem building in the domestic market.However, operating cash flow was down 26.3% year-on-year, indicating cash flow pressure from high spending in the near term.

If earnings really do take a big step backwards from 2025, then 2024 was probably right not to have a buyback.

In terms of valuation, the downside is still there if profits slide more than just a little.

Slower growth and declining margins could trigger a market reassessment of valuation.

On an annualized basis of first-quarter non-GAAP diluted EPS of $11.41 (down 40% for the year), the $95 pre-market price corresponds to a P/E ratio of 15x, which is above the valuation levels of Alibaba (12x) and Jingdong (8x).To align Alibaba's 12x would be down to 76, and for its Jingdong's 8x would be around 50.

Comments