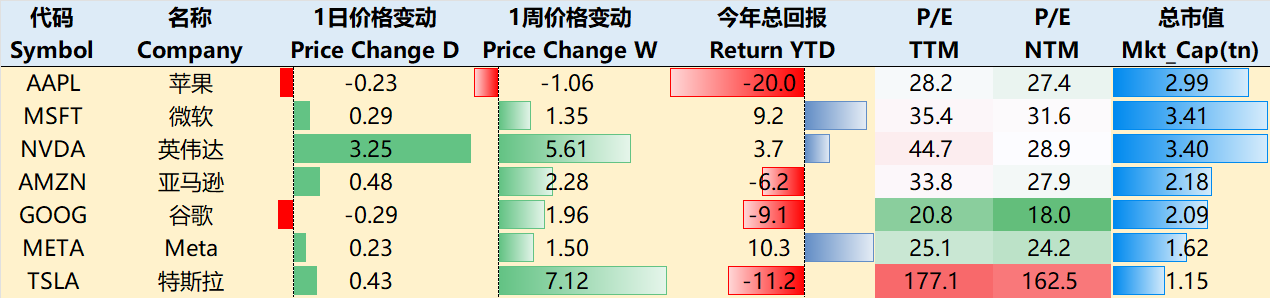

Big-Tech’s Performance

This Week’s Macro Theme: A Sudden Appeal—Trump and the Courts in a Tug-of-War?

The market rebounded so quickly due to the emergence of the "TACO" (Trump Always Chicken Out) narrative.

On May 29, the U.S. Court of International Trade ruled that some of Trump’s tariffs and fentanyl sanctions exceeded the authority granted by the International Emergency Economic Powers Act (IEEPA) and ordered an immediate halt, briefly sparking market optimism (the index surged). However, Trump’s team swiftly appealed, and on May 30, the appeals court issued a "stay" order, temporarily reinstating the tariffs. The core dispute revolves around IEEPA’s applicability—the court argued that trade deficits don’t constitute a "national emergency," while Trump’s side claimed national security concerns. Even if Trump ultimately loses, he could still invoke alternative tools like Sections 122, 301, or 232 of the Trade Act to maintain the tariff framework, limiting the policy’s real-world impact. While market sentiment fluctuated, the long-term outlook hinges on the Trump administration’s policy adjustments (e.g., shifting to "more legal" provisions). This episode highlights the legal flexibility of U.S. trade policy, where judicial intervention struggles to meaningfully alter the hardline stance on China. Next, watch for developments in the appeals court by June 9 and potential Supreme Court maneuvering.

Big Tech Mostly Rises, Except Apple Hit by Tariff Woes

As of May 29’s close, over the past week: $Apple(AAPL)$ -1.06%, $Microsoft(MSFT)$ +1.35%, $NVIDIA(NVDA)$ +5.61%, $Amazon.com(AMZN)$ +2.28%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +1.96%, $Meta Platforms, Inc.(META)$ +1.50%, $Tesla Motors(TSLA)$ +7.12%。

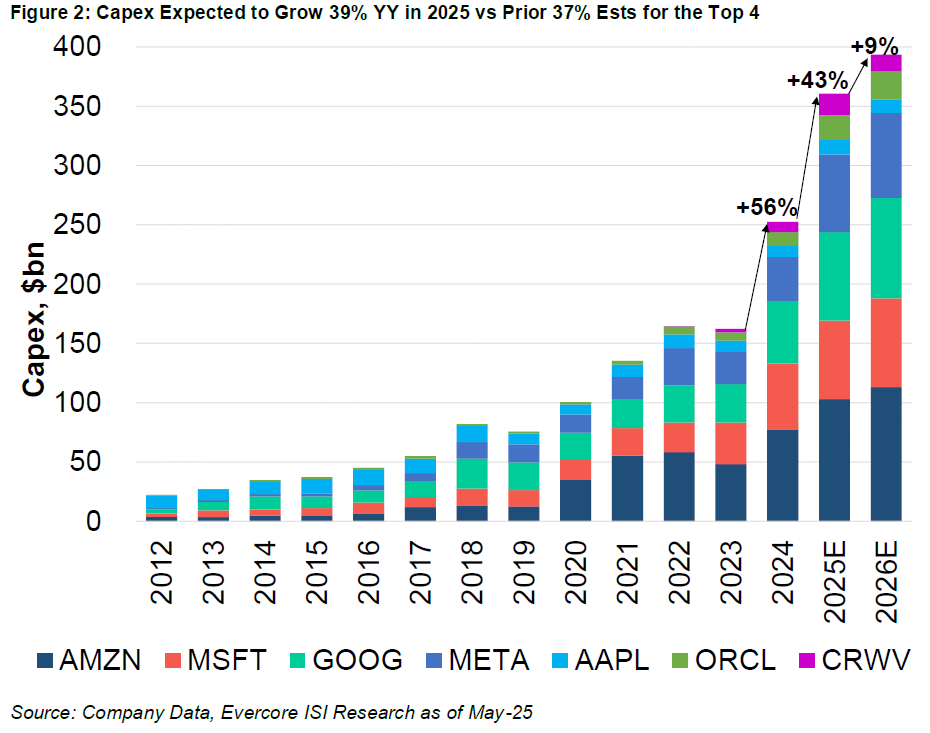

Big-Tech’s Key Strategy

Nvidia Charges Ahead, While Its Peers Fade?

After Nvidia’s earnings report, its stock surged to new highs, proving that even under high expectations, its performance still shines.

Total revenue: 44.06B(+1243.3B, driven by strong gaming segment growth (+48% QoQ).

Data Center revenue: $39.1B (+10% QoQ), largely in line, with 70% of compute revenue from Blackwell architecture products. Networking revenue jumped 64% QoQ.

Non-GAAP gross margin: 61% (71.3% excluding China’s H20 chip-related costs), below the expected 71%.

GAAP EPS: 0.81,missingthe0.93 estimate. Adjusted EPS (excluding H20 costs and tax impacts): $0.96.

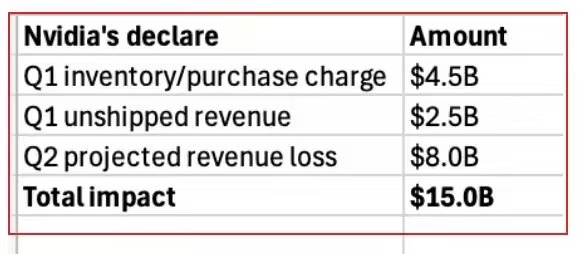

China Impact

The H20 chip export ban led to a 2.5BQ1revenueloss(actualH20revenue:4.6B). Q2 could see an additional $8B loss due to further restrictions.

Mitigation: Nvidia is offsetting China’s decline via four growth drivers—inference models, AI factories, AI diffusion, and enterprise agents—while highlighting sovereign AI projects (e.g., Saudi Arabia, UAE). Still, short-term pressure remains.

Risks: If China tightens policies further, Nvidia’s Asia-Pacific system sales (e.g., GB200) and supply chain could suffer.

Marvell’s Lackluster Performance

Last week, we noted that Nvidia’s ASIC ecosystem opening could benefit smaller players like Marvell. However, Marvell’s Q1 F26 results and guidance showed tepid growth.

Revenue met expectations, supported by data center and telecom infrastructure recovery.

AI-related revenue (custom ASICs, optical chips) grew notably, partly due to Amazon’s Trainium 2 ramp-up.

China contributes ~40% of revenue but faces Sino-U.S. friction risks.

Adjusted gross margin: 59.2% (-0.3% QoQ), in line. Q2 revenue guidance: $2B (+5% QoQ), also meeting expectations.

Takeaway: Marvell’s AI growth is steady but unexciting, with no near-term ASIC catalyst.

Salesforce’s Macro Caution

Despite strong AI product momentum, Salesforce faces:

Macro headwinds (public sector, manufacturing, and European demand uncertainty).

AI investment’s short-term margin drag.

Integration risks from the Informatica acquisition and competitive threats (Zoho CRM, Dynamics 365, Monday.com).

Big Tech Options Strategy

This Week’s Focus: Trump vs. Courts—Is Apple’s Fate at Stake?

In the Trump-court showdown, Apple may be the most vulnerable.

If tariffs resume/remain: iPhones, Macs assembled in China could face 10% tariffs, adding billions in annual costs. While Apple has shifted some production to India/Vietnam, core capacity still relies on China.

If tariffs lift: Short-term supply chain relief, but long-term uncertainty lingers (Trump could use other legal tools).

Market reaction: May 29’s ruling briefly lifted Apple (+1.5%), but the May 30 stay order revived uncertainty. Apple’s countermeasures (lobbying, price hikes, supply chain diversification) may not fully offset decoupling risks.

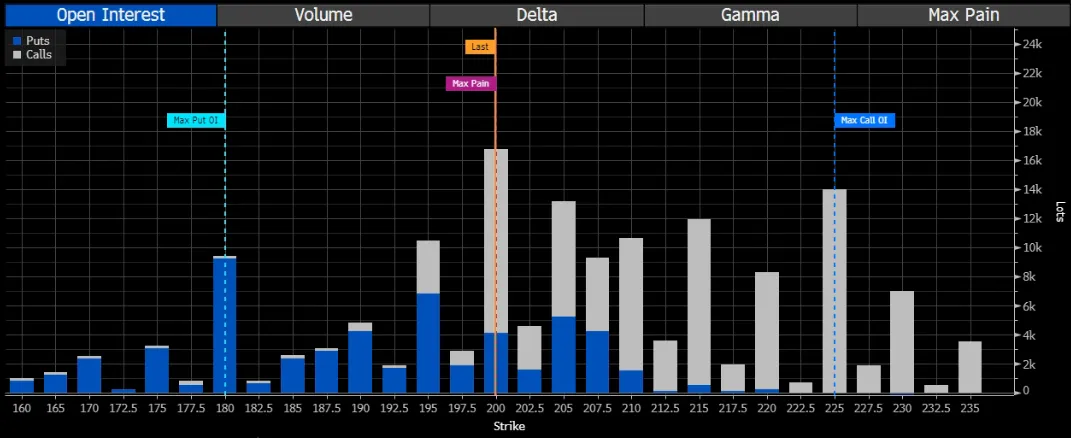

Options Activity

May 30 expiry saw muted trading (no major PUT/CALL pressure).

June 6 expiry reflects expected volatility, with max pain at PUT 180andCALL225, signaling tariff uncertainty.

Big-tech Portfolio

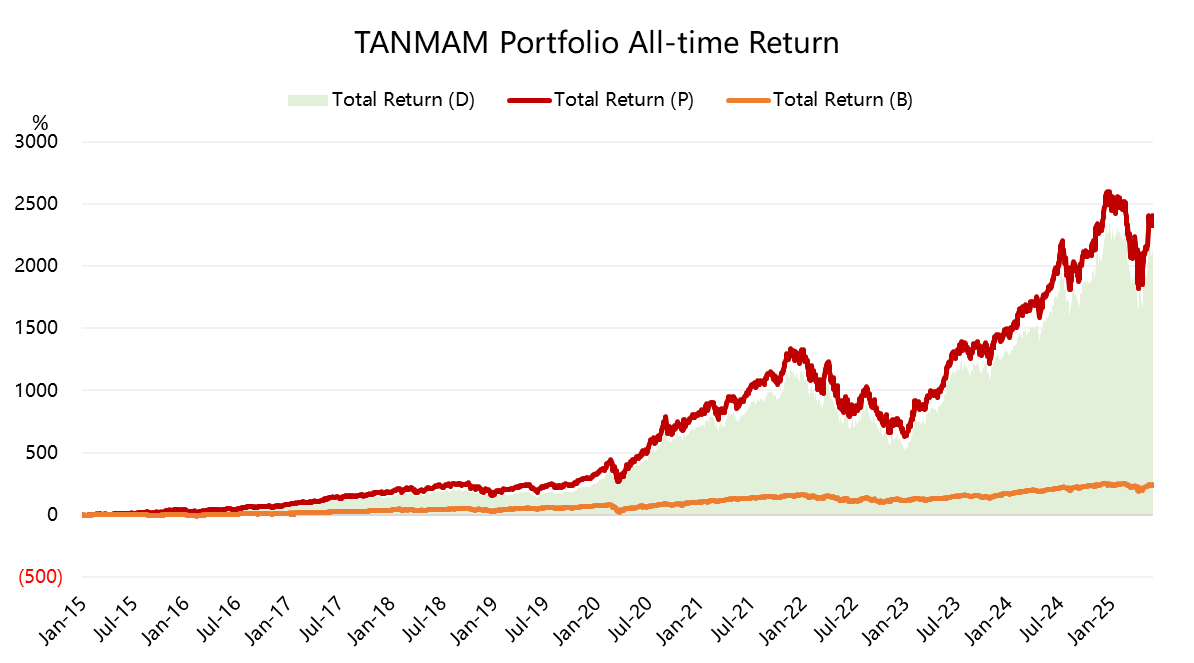

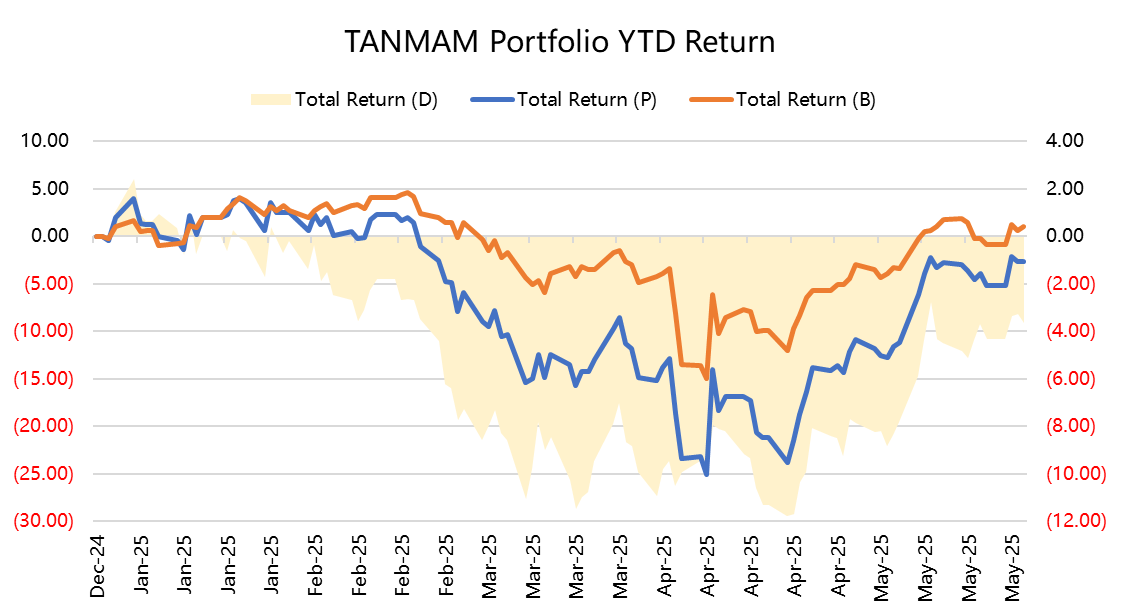

The "Magnificent Seven" (TANMAMG: Tesla, Apple, Nvidia, Meta, Amazon, Microsoft, Google) in an equal-weight, quarterly-rebalanced portfolio have crushed the S&P 500 since 2015: $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$

Total return: 2,390.72% vs. SPY’s 243.02% (2,147.69% alpha).

YTD: -2.69% vs. SPY’s +0.98%.

Risk-adjusted metrics: Sharpe ratio 0.91 (SPY: 0.55), info ratio 0.97.

Comments