$MongoDB Inc.(MDB)$ reported Q1 FY2026 (ending April 30, 2025) earnings on June 4 after-hours, a quarterly turnaround to a profit (the market expected a loss as well) Its strong performance may further consolidate its leading position in the cloud database market, and the advancement of its AI strategy may change the competitive landscape of the industry, attracting more enterprise-class customers.At the same time, increased competition with $Amazon.com(AMZN)$ AWS, $Alphabet(GOOGL)$ Google Cloud may also put pressure on the non-Atlas business, and we need to continue to monitor the long-term market share changes.

Performance and Market Feedback

Revenue: Revenue was $549 million, up 22% year-on-year, exceeding market expectations of $528 million, showing strong growth momentum.

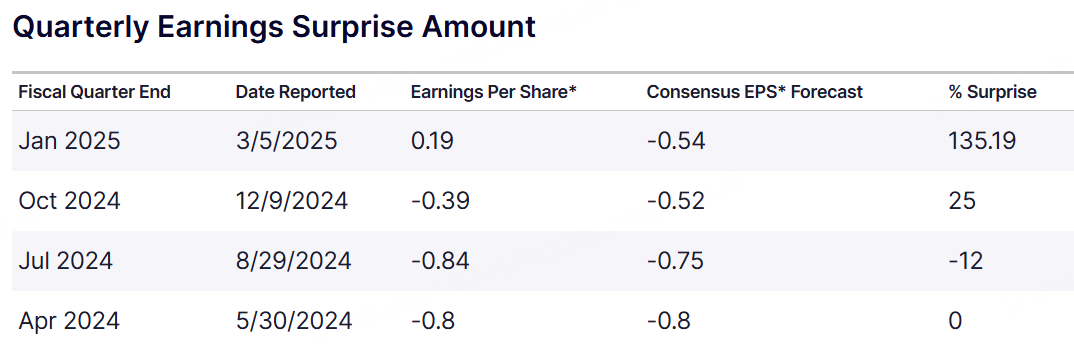

Profit: EPS came in at $1.00, far exceeding market expectations of $0.66, with a significant BEAT margin.

SHARE REACTION: Following the earnings release, shares rose 3.09% to $199.73 in after-hours trading, reflecting positive investor sentiment on the earnings beat.

Market feedback indicated that investors recognized MongoDB's continued expansion and improved profitability in the cloud database space, particularly the increase in Atlas revenue share to 72%, further solidifying its cloud growth logic.Previously, the market was concerned about the slowdown in non-Atlas revenue growth and competition with cloud giants (e.g., AWS, Google Cloud), while in this earnings report, Atlas is revenue is the highlight, indirectly reinforcing the market's confidence through the AI strategy and customer expansion plans, which may ease valuation pressure in the short term.

Key investment points

1. Revenue Growth Driver: Atlas Cloud Service Becomes Core Engine

MongoDB Q1 revenue was $549 million, up 22% year-over-year, with Atlas revenue up 26%, accounting for 72% of total revenue, indicating that cloud services have become a major growth driver.In contrast, non-Atlas revenue growth slowed down, which may be affected by the intensification of competition in the traditional database market. the high growth of Atlas reflects the strong demand for enterprise digital transformation and AI applications, and MongoDB's document model and scalability fit the needs of AI scenarios (e.g., data processing and real-time analytics), and it is expected that Atlas will continue to increase the proportion of its revenue in the future, which will support the valuation of the repricing.

2. Improved profitability and optimized operational efficiency

Non-GAAP operating profit was US$87 million, with an operating margin of 16%, a significant improvement over the same period last year.Gross margin declined slightly from 75% to 73.32%, but remained at an industry high, demonstrating good cost control.Free cash flow increased to $106 million from $61 million in the year-ago period, with cash reserves of $2.5 billion and increased financial robustness.This provides room for increased R&D investment (e.g., AI technology integration) and shareholder returns (e.g., $1 billion share repurchase program), potentially boosting market confidence in the company's long-term growth.

3. Customer Expansion and Market Penetration, Long-Term Growth Potential Emerges

Total number of customers increased to 57,100, a net increase of 2,600, indicating continued expansion of market penetration.In particular, growing demand for AI and cloud solutions from enterprise-level customers is driving new workloads to the cloud.Management mentioned that the migration of traditional databases to the cloud is accelerating, and MongoDB is expected to further capture market share.Combined with the upward revision of full-year revenue guidance to $2.25 billion-$2.29 billion, market expectations may be further revised upward, and the space for valuation repricing will open up.

4. Increase in guidance supports valuation, AI strategy becomes new highlights

The company raised its full-year operating margin guidance from 10% to 12%, demonstrating confidence in profitability.Q2 revenue guidance is $548m-$553m, slightly lower than Q1 but higher than market expectations, reflecting solid growth expectations.Management's positive tone, emphasizing AI applications (e.g., enhancing embedded modeling capabilities through the acquisition of Voyage AI) will be a catalyst for future growth, which may change the market's expectations of the company's technological barriers and competitive landscape, supporting the valuation premium.

5. Valuation repricing and changes in market expectations

Valuation repricing of MongoDB may be driven by the following factors:

1) Atlas revenue share increasing to 72%, reinforcing cloud services growth logic;

2) AI strategy (e.g. Voyage AI integration) opens up new growth space;

3) Improved cash flow and share buyback program to enhance shareholder return expectations;

4) Upward revision of full-year guidance supports valuation.

Slowdown in non-Atlas revenues and competitive pressures may limit upside, and the market needs to pay attention to the subsequent implementation of the expected change in boundaries.

Comments