Key Takeaways

$Circle Internet Corp.(CRCL)$ will IPO on NYSE on June 4 at a valuation of approximately $6.9 to $8.1 billion

Initial IPO price of $31 per share, raising approximately $1.1 billion, exceeding the initial expected range ($24)

Investor interest in the stablecoin industry is strong, with Circle's USDC holding ~29% of the market share

Regulatory environment may be favorable for Circle, with potential stablecoin legislation (e.g., Genius Act) potentially enhancing its legitimacy

Valuation is slightly lower than previous private market valuations, but reflects market conditions and the complexity of the company's fundamentals

Overall Industry Overview

Stablecoins are divided into four main types with their own characteristics

Fiat currency collateralized type: anchored 1:1 with fiat currencies such as USD, EUR, etc., with low credit risk

Cryptocurrency collateralized: overcollateralized with cryptocurrencies such as ETH, with liquidation risk

Commodity collateralized: linked to gold, oil and other commodity prices, high volatility

Algorithmic stablecoin: relies on algorithms to regulate supply and demand, high risk and easy to de-anchor

Market Size and Growth Drivers

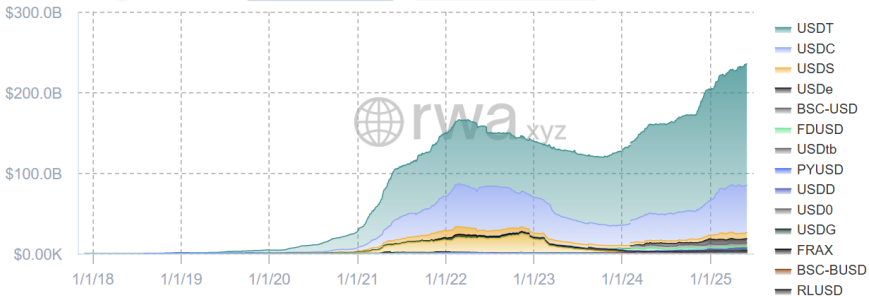

Global stablecoin market capitalization has reached $232 billion in 2025, a 45-fold increase from 2019

Growth Drivers:

Demand for value scales as crypto markets mature

Demand for "cash-on-chain" in the face of macroeconomic uncertainty

Clarifying regulatory framework (MiCA, GENIUS Act, etc.)

Competitive Landscape

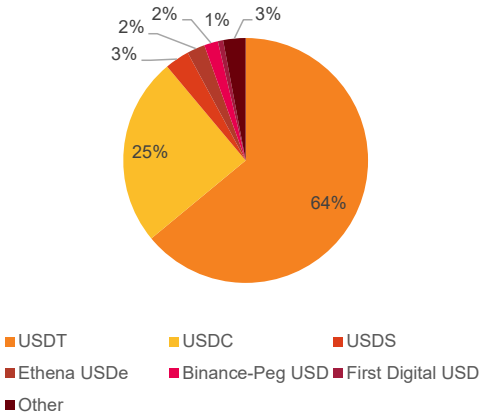

Highly concentrated: USDT (64%) and USDC (25%) together hold 89% market share

Traditional institutions in the game: PayPal (PYUSD), Fidelity, Robinhood, etc.

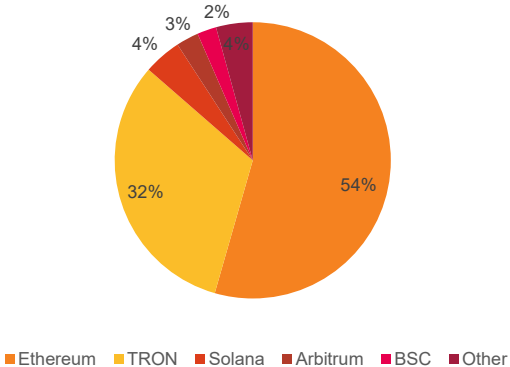

Public Chain Distribution: Ether accounts for 54% of liquidity and is the main place where USDC circulates (67%)

Circle Company Overview

Founded in 2013, Circle is dedicated to providing greater financial accessibility to people around the world.Its flagship product, USDC, is a stablecoin pegged to the U.S. dollar, providing the stability of traditional currencies while serving as an alternative to digital assets.USDC has been widely adopted across exchanges, wallets, and Decentralized Finance (DeFi) applications, solidifying Circle's leadership in the stablecoin market.

Leading global issuer of compliant stablecoins: USDC has over $43 billion in circulation and supports 19 public chains

All-in-one financial infrastructure: provides complete solutions for stablecoins, wallets, cross-chain protocols, etc.

Compliance Advantage: Holds the largest number of compliance licenses and is regularly audited by the Big 4

Business Model

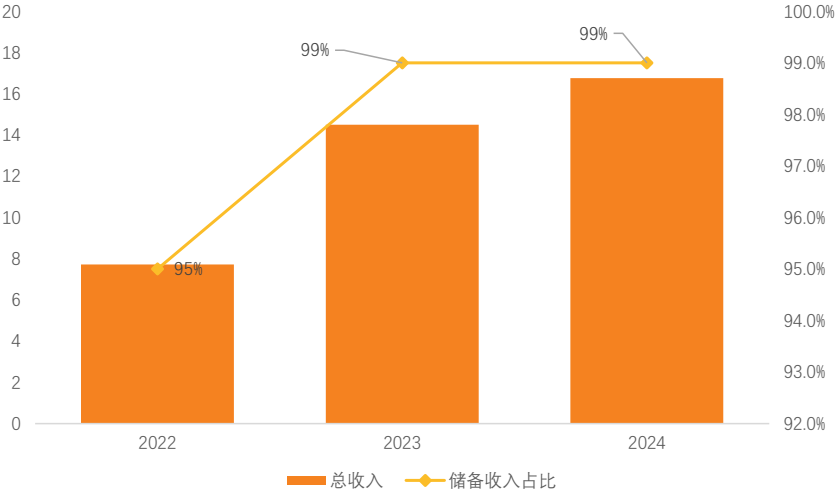

Revenue structure: highly dependent on reserve interest income (99%), totaling $1.676 billion in 2024

Cost structure: distribution costs account for 61% of reserve revenue as a result of the split agreement with Coinbase

Earnings performance: $156 million net profit in 2024, the first two consecutive years of profitability

Financial Performance

Circle's revenue will grow at a compound annual growth rate (CAGR) of approximately 55% from 2022 to 2024.Integration services revenue reached $3,617 million in 2024, primarily from services to implement stablecoin solutions on the public blockchain; transactional services revenue was $1,517 million, down from $1,986 million in 2023, with declines attributable to the company'sphasing out certain services (e.g., Web3 ether processing) and changes in Circle Yield.

Circle realized significant profit growth in 2023-2024, achieving two consecutive years of profitability for the first time, with an operating margin of approximately 10% ($1.67 billion/$16.611 billion) and a net profit margin of approximately 9.4% ($1.56 billion/$16.611 billion).These margins are quite healthy in the cryptocurrency and fintech industry.

Product Matrix

Core Products: USDC/EURC Stablecoins

Extended Services:

Circle Wallets (10 million deployed)

CCTP Cross-Chain Protocol ($24.7 billion in cumulative transfers)

Circle Mint Institutional Services (1819 accounts)

IPO and Valuation Analysis

Circle's IPO process has undergone several adjustments to accommodate market conditions and investor interest.The IPO application was initially filed in May 2025 with plans to offer 24 million shares at a price range of $24-$26 per share, targeting to raise up to $624 million.

Due to strong investor demand, the offering size was increased to 32 million shares on June 2, with an adjusted price range of $27-$28 per share and a target fundraising of $896 million.

Ultimately, it was priced on June 4 at 34 million shares at $31 per share, raising approximately $1.1 billion.

Date: June 4, 2025

Exchange: NYSE

Shares sold: 34 million (14.8 million by Circle, 19.2 million by selling shareholder spin-off)

Price per share: $31

Amount raised: $1.1 billion

Valuation: $6.9 billion based on outstanding shares; $8.1 billion fully diluted

Because the company's business model is highly dependent on USDC reserve interest income (99% of total revenue of $1.676 billion in 2024 comes from reserve earnings), its valuation is unusually sensitive to two key variables:

Size of interest-earning assets: USDC liquidity is expected to reach $569.2 billion and $853.8 billion in 2025-2026.Growth assumptions are based on 1) overall stablecoin market expansion, 2) USDC share remains around 26%, and 3) Fed interest rates remain above 4%.If either of these assumptions does not hold, it will have a direct impact on revenue expectations.

Profit Distribution Mechanism: Under the agreement with Coinbase, Circle is required to distribute 50% of its remaining profit after operating costs to Coinbase. distribution costs amounted to 61% of reserve revenue in 2024.This rigid expense significantly compresses margins.However, as it scales up, operational leverage begins to emerge and net profit margins are expected to improve to 17.6%-19.7% in 2025-2026.

If we take the net profit of $294 million in 2025, based on the total equity after the IPO, the Forward PE in 2025 would be around 24 times at an IPO price of 31, which is higher than that of traditional digital financial companies $Block, Inc.(XYZ)$ and $PayPal(PYPL)$, which is around 15 times.

However, considering its faster growth rate, if its net profit can reach $550 million in 2026, its IPO price is almost flat if its IPO price corresponds to a 26-year Forward PE of only 14 times.

Considering that the market's valuation for high-growth companies is more lenient and can reach 30x or more, there is still good upside after its IPO, given the good market sentiment.

Comments