$Lululemon Athletica(LULU)$ Q1 2025 earnings report shows potential for international-driven growth, but weakness in the U.S. market and lower full-year guidance could trigger a valuation repricing.International expansion strategy is paying off, with improved gross margins supporting profitability, but need to be wary of the valuation impact of increased competition and macroeconomic uncertainty in the US market.

Performance and Market Feedback

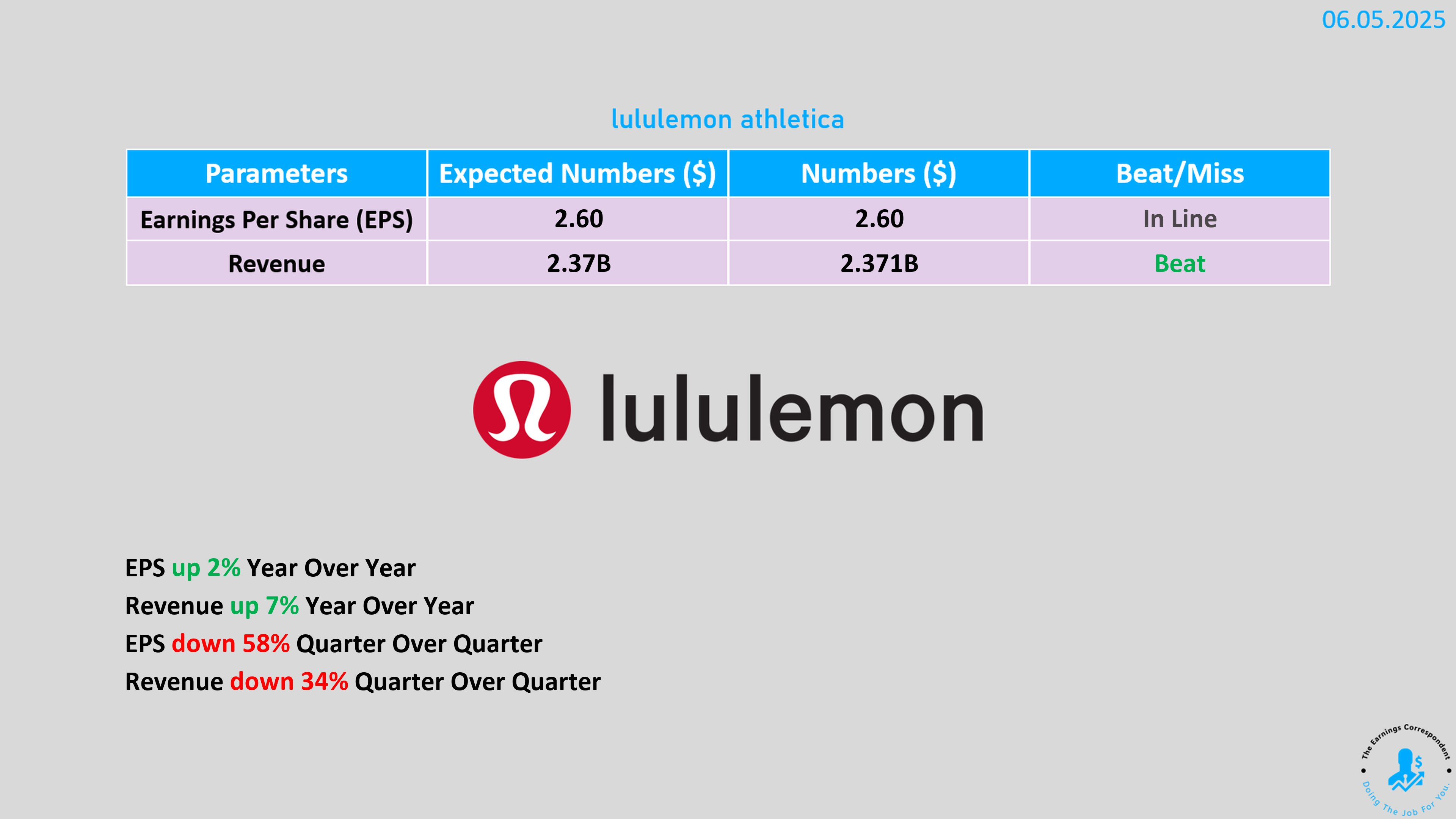

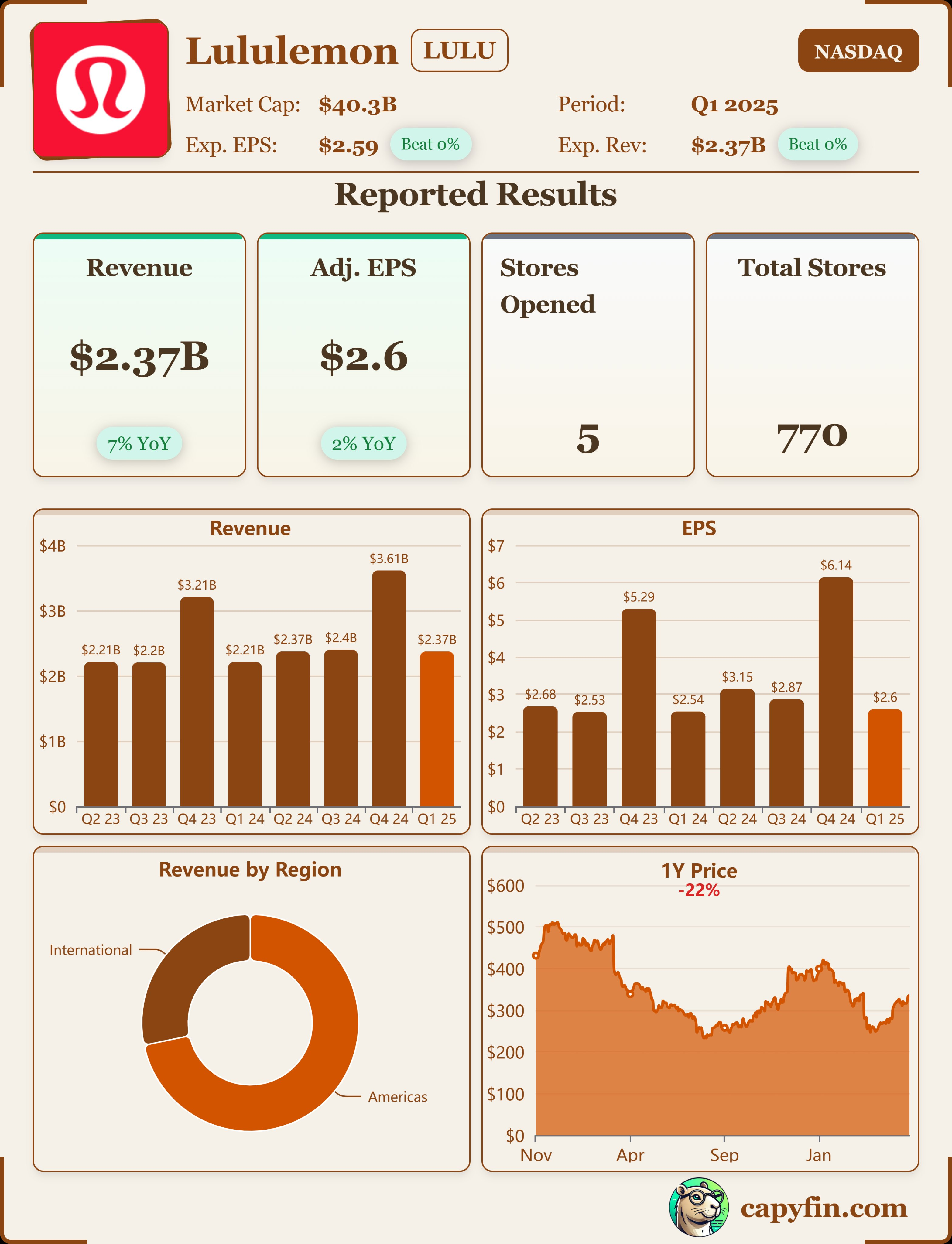

Lululemon Q1 2025 revenues came in at $2.37 billion, up +7% YoY, slightly ahead of the market estimate of $2.36 billion, indicating that the company's strong performance in international markets offset weakness in the U.S. EPS of $2.60 was in line with the estimate and up +2% from $2.54 a year ago, with profitability remaining solid.

Gross margin was 58.3%, higher than the expected 57.7%, reflecting the effectiveness of cost control and pricing strategy.Regional performance was clearly differentiated, with same-store sales in the U.S. declining by 1% to 2%, and same-store sales in international markets growing by 7% to 19%, especially in China, which guided for 25-30% growth, showing that the globalization strategy is beginning to bear fruit.

Investment Highlights

International market becomes growth engine, valuation support may be differentiated

Same-store sales in international markets grew 7% to 19%. Same-store sales in international markets grew 7% to 19%, with a particularly strong performance in China (guiding for 25-30% growth), demonstrating the effectiveness of the globalization strategy.In contrast, same-store sales in the U.S. declined 1% to 2%, driven by economic uncertainty and a slowdown in consumer spending, consistent with management's previous references to economic uncertainty and a slowdown in consumer spending.The strong performance in international markets is supportive of valuations, but weakness in the U.S. market could lead to a downward revision of market expectations, especially as the macroeconomic environment continues to be under pressure.

In terms of segmentation, the e-commerce channel and new international store openings contributed to revenue growth, but the weakness in the US market could be related to increased competition in the industry (e.g. Nike, Adidas).Inventory levels have not seen clear data, but combined with improved gross margins, it is speculated that the company's inventory turnover efficiency may have improved.

Gross margin exceeded expectations, cost control ability is already strong

Gross margin of 58.3% was higher than expected 57.7%, reflecting success in supply chain optimization and pricing strategy.Combined with the scale effect in international markets, the gross margin improvement may provide a cushion for future profitability, but attention needs to be paid to the impact of raw material cost fluctuations and promotional efforts on margins.

Full-year guidance lowered, market sentiment under pressure

The company lowered its FY25 EPS guidance to $14.58-$14.78, down from $14.77-$15.00 previously, and the market reacted negatively, with the stock down ~10% after hours.Management's tone shows cautious optimism for a recovery in the U.S. market, with growth in international markets seen as a key variable, but guidance deviation from market expectations could weigh on short-term valuations.

Competitive landscape may be impacted by weakness in the U.S. market

U.S. same-store sales declined 1% to 2%, consistent with management's previous reference to economic uncertainty and slowing consumer spending.Combined with increased competition in the industry (e.g., Nike, Adidas), Lululemon will need to consolidate its market share through product innovation and marketing investments or it may face valuation repricing risks.

New Information on Industry Impact, Accelerated International Expansion and Increased Competition

Strong growth in international markets suggests Lululemon still has plenty of room in the global market, but could also attract more competitors to enter, especially in China.Earnings data show the company is capturing market share through new store openings and e-commerce channel expansion, but it needs to be wary of the impact of localized competition and rising operating costs on margins

Comments