Big-Tech’s Performance

Macro Highlights This Week: Disappointing ADP; A Springtime for Crypto? “Trump vs. Musk” Escalates

This week’s ADP data showed employment growth slowing to a two-year low, indicating a second consecutive month of cooling labor demand. This has raised concerns about economic momentum and could influence monetary policy. While a cooler labor market might pressure the Fed toward rate cuts, steady wage growth and tariffs may limit the room for such adjustments. Attention should also be paid to the discrepancies between ADP data and BLS non-farm payrolls, as well as the potential impact of subsequent revisions.

$Circle Internet Corp.(CRCL)$ successfully debuted on the U.S. stock market as the "first stablecoin stock." Its IPO price rose from the initial $24 to $31, and the stock soared 122% on its first day, reaching an intraday high of $103. This milestone signals that stablecoins have gained mainstream financial recognition. The IPO has boosted confidence in the crypto sector, accelerated integration between crypto and traditional finance, and may encourage other compliant stablecoin issuers to pursue listings.

Elon Musk, dissatisfied with the GOP's passage of the so-called “big beautiful bill,” lashed out on social media. The dispute escalated quickly, with Musk launching a poll to test the idea of starting his own political faction. What began as a policy debate turned into personal attacks within hours, sparking market concerns over Tesla’s stock. Musk had previously criticized Trump’s fiscal and trade policies and announced a shift in focus back to business rather than politics. While Trump tried to downplay the conflict, he did not directly address Musk’s demands, suggesting reconciliation is unlikely in the short term.

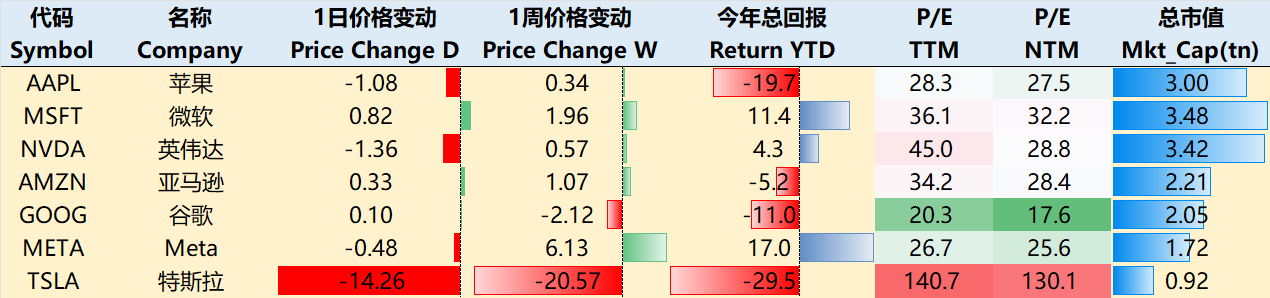

Big Tech mostly rose this week—except Tesla. As of June 5 close: $Apple(AAPL)$ +0.34%, $Microsoft(MSFT)$ +1.96%, $NVIDIA(NVDA)$ +0.57%, $Amazon.com(AMZN)$ +1.07%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -2.12%, $Meta Platforms, Inc.(META)$ +6.13%, $Tesla Motors(TSLA)$ -20.57%。

Big-Tech’s Key Strategy

Tesla's Challenges and Potential Supports

A core issue facing Tesla is that its valuation has become decoupled from fundamentals. Part of this is a bet on Elon Musk's personal behavior, while another part is based on “imagination” about future businesses (such as autonomous driving), which sustains its premium valuation.

In June 2025, political divergence and personal animosity led to a "rupture" between Musk and Trump, triggered by Musk’s criticism of Trump’s tax bill—calling it “disgusting” and “absurd.” Trump, in response, threatened to terminate federal contracts and subsidies for Tesla and SpaceX, causing Tesla’s stock to plummet 14% in a single day—the largest one-day drop in its history.

This incident triggered a triple revaluation:

Policy Risk: Uncertainty around government support.

Brand Risk: Political controversy potentially affecting consumer preferences.

Governance Risk: A lack of checks and balances on leadership behavior (Tesla’s board took no action, leaving shareholders unprotected).

Despite the fundamental deterioration, the 14% single-day drop likely includes irrational components, such as algorithmic trading effects, short-selling pressure, and media amplification. Historically, such sharp declines from unexpected events are often followed by technical rebounds.

xAI Launches $300M Funding Round

xAI’s core products include the Grok chatbot and the Colossus supercomputing cluster. In March 2025, xAI acquired X (formerly Twitter), with a valuation structure of $80B for xAI and $33B for X, bringing the group’s total valuation to $113B.

By the end of 2024, xAI had completed a $5B private funding round at a $45B valuation. Following the current round, the valuation has surged to $113B—a 151% increase in just 18 months—reflecting the intense AI sector heat and synergies within the Musk ecosystem.

A “Defense” Angle for Tesla?

Musk argues that countries unable to produce their own drones will become vassals of those that can—a concern fueled by the fact that China produces more drones daily than the U.S. does annually. Drones could become Tesla’s next major opportunity.

Morgan Stanley believes the low-altitude economy has trillion-dollar potential—reaching $1T by 2040 and possibly $9T by 2050. From a monetization standpoint, one eVTOL (electric vertical takeoff and landing aircraft) could generate as much revenue as 15 shared vehicles. Tesla has strong transferable technologies in this field: manufacturing, materials science, autonomous driving, battery tech, robotics—and can leverage Starlink’s communication capabilities.

If the U.S. government accelerates drone localization policies, Tesla’s tech could be extended to defense applications (e.g., Optimus robots, Dojo supercomputers).

Big Tech Options Strategy

Focus of the Week: AVGO Earnings – Strong, But Not Without Flaws

$Broadcom(AVGO)$reported earnings after the bell on June 5. Results exceeded expectations, driven primarily by AI-related segments. However, due to already lofty market expectations, the stock did not see the usual post-beat surge.

Key positives:

AI accelerators and networking segments provide dual growth engines.

In-house XPU products are already serving three hyperscalers (Google, Meta, ByteDance); four more are in deep customization stages, showing growing client diversity.

Strong free cash flow, stable gross margins, and high-quality earnings.

VMware adds steady recurring revenue support.

Enormous ASIC total addressable market (TAM), with AVGO positioned to lead long-term.

However, some concerns persist:

FY25 EPS guidance slightly missed consensus (Q3 EPS of $1.65 vs. $1.66 expected).

Valuation remains high, putting pressure on sentiment—especially when compared with higher-growth peers like NVDA and AMD.

AI revenue is still mainly driven by networking; XPU/ASIC contributions are lagging (only 10–15% growth).

Export restrictions pose lingering uncertainty.

On the options front, June 20 monthly options show limited depth, and the stock price is currently above both the largest PUT and CALL open interest levels, suggesting some near-term pullback pressure. Given the post-earnings retracement, the next 1–2 months may face resistance on the upside.

Big-tech Portfolio

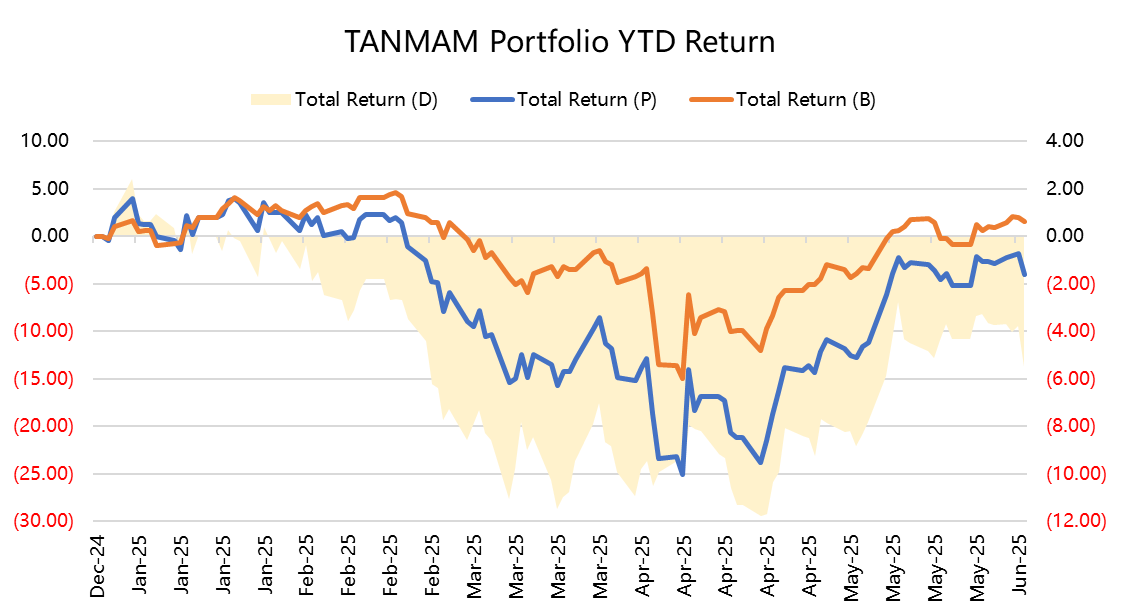

The "Magnificent Seven" form an equal-weight portfolio called "TANMAMG," rebalanced quarterly. Backtests since 2015 show it has dramatically outperformed the $S&P 500(.SPX)$ with total returns of 2,390.72%, compared to 243.02% for $SPDR S&P 500 ETF Trust(SPY)$ —an excess return of 2,147.69%.

So far in 2025, Big Tech has corrected, returning -2.69%, underperforming SPY’s 0.98%.

However, over the past year:

Sharpe ratio for the TANMAMG portfolio rose to 0.79 (SPY: 0.82).

Information ratio reached 0.97.

Comments