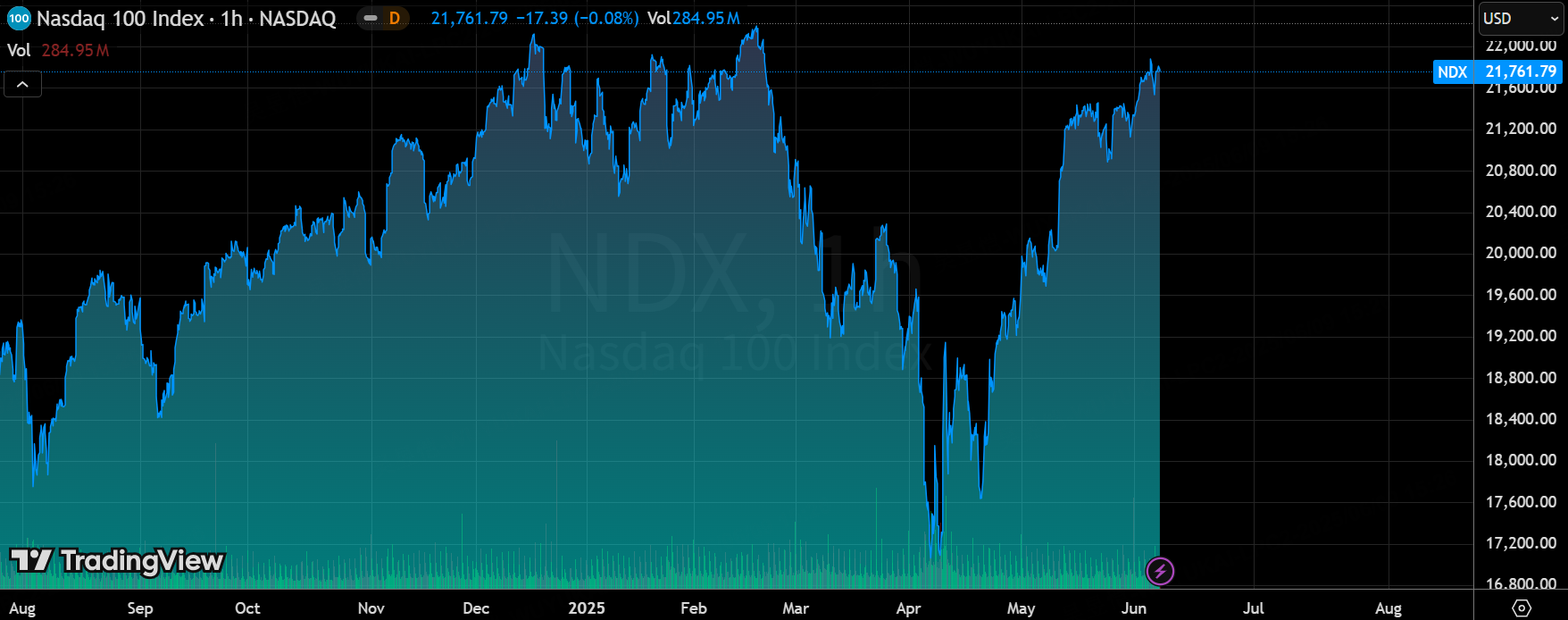

$NASDAQ 100(NDX)$ for two consecutive weeks rose more than 2%, rebounded about 30% from the previous lows, close to all-time highs, $Broadcom(AVGO)$ $Microsoft(MSFT)$ record highs, $Amazon.com(AMZN)$ $NVIDIA(NVDA)$ and so on from the highs of the difference of 5-10%; $Cboe Volatility Index(VIX)$ since mid-February to closed below 17 for the first time since mid-February, and TMT sector fundamentals improved (e.g., AI-driven $Credo Technology Group Holding Ltd(CRDO)$ Broadcom beat expectations, $MongoDB Inc.(MDB)$ $Guidewire(GWRE)$ reported strong earnings) but investors are skeptical of the H2 trend.But investors are skeptical about the second half of the year.

Market Performance and Sentiment

Indices rallied strongly:

The Nasdaq 100 is up more than 2% for the second week in a row, bouncing about 30% off its prior lows and approaching all-time highs (ATH).

Among the components, Broadcom (AVGO) and Microsoft (MSFT) hit all-time highs last week, while Amazon (AMZN), NVIDIA (NVDA), and $Meta Platforms, Inc.(META)$ are just 5-10% off their highs.

Volatility and Money Sentiment:

The VIX volatility index closed below 17 for the first time since mid-February 2025 as market fears cooled.

GS Private Bank data showed U.S. net leverage rose for the fourth consecutive week as investors adjusted their long exposure amid the rally.

Individual stock performance and investor focus

Leaders and laggards diverged:

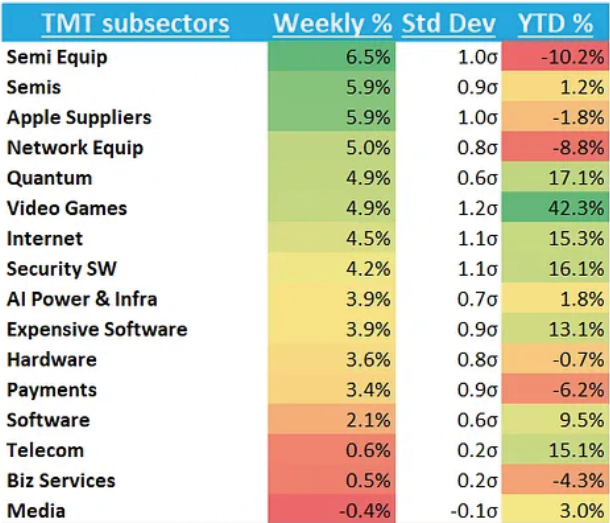

Last week's best performers were shorting basket targets and 12-month laggards in the TMT sector (up 7% weekly) as investors sought opportunities to cover.

June leaders included $ON Semiconductor(ON)$ $Micron Technology(MU)$ $CoStar(CSGP)$ , and $Airbnb, Inc.(ABNB)$ while early year leaders $MercadoLibre(MELI)$ , $Palantir Technologies Inc.(PLTR)$ , and others were down for the month.

High-frequency advisory targets:

MDB shares rallied after earnings (highs back over $15) with significant long/short divergence:

Long side: conservative 2H guidance may present an opportunity to outperform, high potential for AI transformation, plans to buy back mid-to-high single-digit % of market cap.

Short side: revenue guidance flat YoY, AI scale-up takes until 2026, competitive pressure.

Amazon (AMZN) is seen as a potential catalyst in the second half of the year, with the market focusing on the potential for its cloud services (AWS) capacity to come online.

Fundamentals and Future Outlook

Fundamental Improvement

TMT sector data turned positive, e.g. CRDO/AVGO beat earnings due to AI-driven earnings, MDB and GWRE reported bright earnings, and non-farm payrolls data were solid.

Investors are optimistic about improved Q2 results, but remain skeptical about H2 growth.

AI Adoption and Industry Dynamics

U.S. enterprise AI adoption rate increased to 9.2% from 7.4% in Q4 2024, with education, information, and finance sectors increasing by more than 3 percentage points.

In the Asian supply chain, Wistron's May revenue increased 56% YoY (benefiting from AI server demand), and Inventec declined 1% YoY (impacted by slowing demand for PC and cabinet-class AI servers).

Next week's key events

June 9-13: Apple WWDC, NVIDIA GTC Paris, $Datadog(DDOG)$ user conference, $Adobe(ADBE)$ earnings, etc.

June 11: U.S. CPI data (expected 2.9% core y/y)

June 12: US PPI data and 30-year Treasury auction

Market Sentiment and Seasonality

Excluding Apple (-19%) and $Tesla Motors(TSLA)$ (-26%) drag, NDX may be up over 6% for the year, reflecting market optimism (or even fervor).

Historical data shows that NDX is strong in July (up 16 of 17) and investors may be ahead of the seasonal curve.

Key Question.

What is the current rally and market sentiment for the Nasdaq 100?

The Nasdaq 100 has rallied about 30% from its prior lows, just one step away from its all-time highs, and has gained more than 2% for two consecutive weeks. the VIX volatility index has closed below 17 for the first time since mid-February, and market fears have cooled.If we exclude the drag from Apple and Tesla, the index may be up more than 6% for the year, reflecting optimism and even fervor in the market.

What are the main points of divergence between long and short MDB (MongoDB)?

Long view: conservative H2 revenue guidance sets the stage for an outperformance, high potential for AI transformation (GenAI), planned buyback of ~mid-to-high single-digit percentage of market cap ($1bn in licenses), re-acceleration of the Atlas business, and the largest QoQ customer net new additions in 6 years.

Short-side view: F2Q revenue guidance flat YoY (midpoint up only 50 bps) despite 3 more business days, AI scale remains a "story to be told" (management says more after 2026), operating margin guidance down YoY, competition and AI architecture controversy continues.

What are the current trends and industry distribution of US enterprise AI adoption rates?

The U.S. enterprise AI adoption rate increased to 9.2% in Q2 2025, a significant increase from 7.4% in Q4 2024.By industry, education, information, finance, and professional services firms saw the largest increase in adoption rates, up more than 3 percentage points from the previous quarter, indicating that these industries are more aggressive in getting AI technology off the ground.

Comments