Intel's stock price has risen recently after many days of addiction, with its stock price rising 7.8% to $22.08. With the double blessing of coaching change and cost streamlining, Intel is expected to usher in new opportunities.

Lip-Bu Tan is in charge this year$Intel (INTC) $(INTC) Shuai Yin, whose resume of successfully reversing the company's decline during his tenure as CEO of Cadence Design Systems (CDNS) from 2009 to 2021 has attracted much attention.

In the field of AI, Chen Liwu, with the support of the new chief technology and AI officer Sachin Katti, has launched a hardware and software plan optimized for AI. In the long run, as technology giants such as Alphabet (GOOG) and Amazon (AMZN) seek reliable foundry partners, Intel's existing layout in quantum computing-such as the 12-qubit "Tunnel Falls" chip-may gain development opportunities.

Intel will also benefit from the current trend of semiconductor localization driven by the U.S. government. In addition, Goldman Sachs (GS) predicts that the humanoid robot market will reach US $38 billion by 2035. If Intel's processors and RealSense depth cameras can become the standard "brains" of the new generation of robot systems, it may open up additional room for growth.

Go Long Intel with Put Options

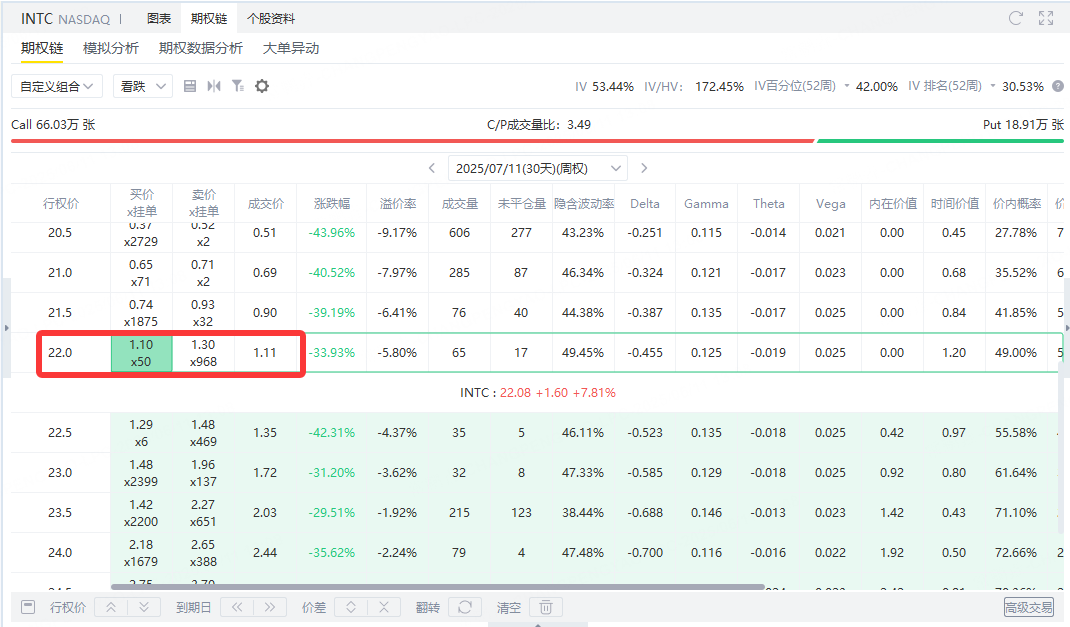

The current Intel price is $22.08, and we can sell itExpires July 11, 2025, exercise price 22, premium $111Put Option to go long Intel.

This strategy not only makes profit when Intel rises, but even if Intel goes sideways or slightly down, it can still rely on premium to earn earnings.

Maximum benefit:If the Intel stock price is higher than or equal to $22 at expiration, the option will not be exercised and you retain your entire premium. The maximum gain is $111.

Maximum loss:If the Intel stock price drops to $0, you need to buy 100 shares at $22, with a total cost of $2,200. Subtracting the premium received of $111, the maximum loss was $2,089.

Break-even point:The breakeven point is $20.89 (i.e. the exercise price of $22 minus $1.11 per premium). As long as the Intel stock price is above $20.89 at expiration, you are in net profit.

Advantages:

The limited gain ($111) is locked in at the outset;

Higher winning rate, as long as the stock price does not fall sharply, you can make a profit;

If you want to buy Intel stock in the first place, this way can reduce the buying cost.

Risk warning:

Profit and loss are asymmetric, the maximum income is limited, but the potential loss is large;

Requires a margin account to support selling naked Put;

Closing positions before expiration or rolling operations can be considered to dynamically manage risk.

Comments