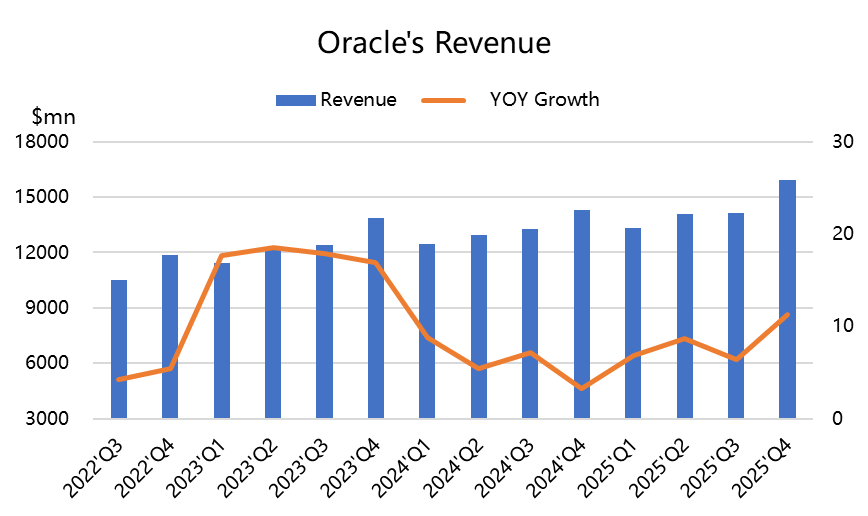

$Oracle(ORCL)$ announced its fiscal 2025 fourth quarter (ending May) results after the bell on June 11, a report card that was both explosive and controversial, with revenue up 11% year-over-year and adjusted EPS of $1.70, both of which exceeded expectations.

But what attracted the most attention was not the current results, but management's aggressive guidance for cloud infrastructure (OCI) revenue growth of more than 70% in fiscal year 2026, a figure that far exceeds the current year-on-year growth rate of 52%, which directly drove the stock price to surge 8% at one point after the bell

Results and Market Feedback

Revenue exceeds expectations, up 11% year-over-year

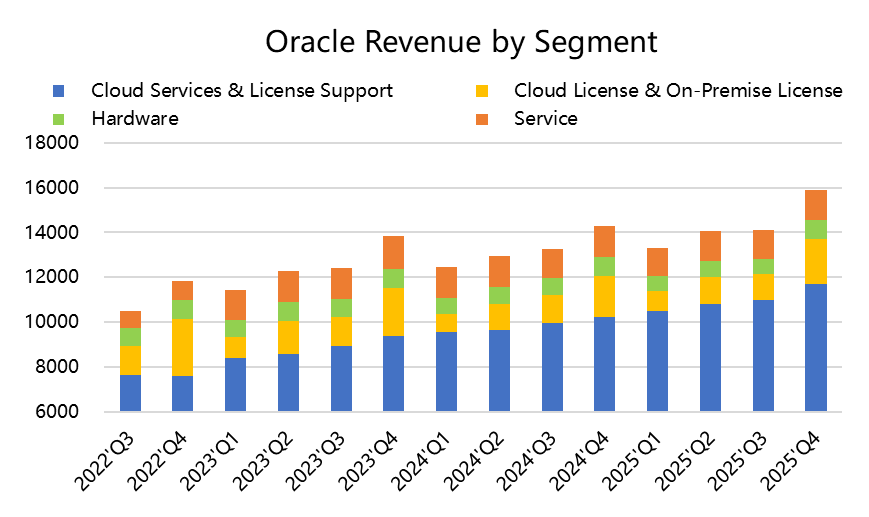

Oracle's total revenue for the fourth quarter of fiscal year 2025 (ended May 31, 2025) was $15.9 billion, up 11% year-over-year, beating market expectations of $15.8 billion.Cloud revenue (IaaS + SaaS) reached $6.7 billion, up 27% year-over-year, and accounted for 42% of total revenue, demonstrating the successful execution of the company's cloud transformation strategy.

Non-GAAP Earnings Per Share Exceeded Expectations

Non-GAAP earnings per share were $1.70, up 4% year-over-year, beating market expectations of $1.64 and a 3.7% surprise.Adjusted net income increased to $4.88 billion from $4.61 billion a year ago, reflecting the company's continued optimization of cost controls and operational efficiencies.

Strong Cloud Infrastructure Performance

Cloud Infrastructure (IaaS) revenues grew 52% to $3.0 billion, with OCI (Oracle Cloud Infrastructure) consumer revenues up 62%, driven by explosive growth in AI demand.Software-as-a-Service (SaaS) revenue grew 11% to $3.7 billion, with Strategic Back Office SaaS (annualized) revenue up 20% to $9.3 billion.

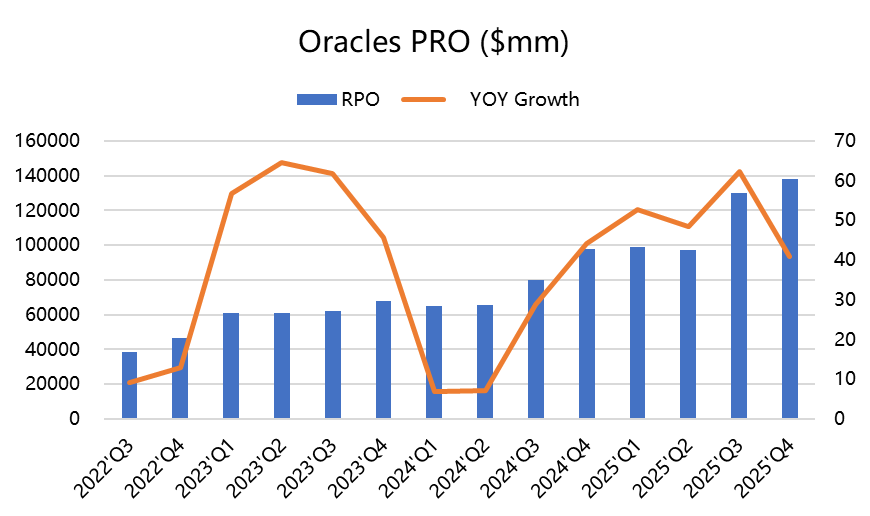

Remaining Performance Obligations (RPO) grew significantly

RPO reached $138 billion, up 41 percent year-over-year, demonstrating strong visibility into future revenue.This metric reflects customers' long-term commitment to Oracle's cloud services, particularly in the areas of enterprise applications and AI infrastructure.

Market reaction slightly cautious

Despite the earnings beat, Oracle shares fell 0.55% to $177.39 in after-hours trading, giving it a market capitalization of about $495.4 billion.Market concerns over high capex ($9.1 billion) and negative free cash flow (-$2.9 billion) may have contributed to the short-term volatility in the stock.

Investment Highlights

Cloud Business Becomes Core Growth Engine

Oracle's cloud business was a standout performer in the fourth quarter, with total cloud revenues growing 27 percent to $6.7 billion, with IaaS revenues up 52 percent to $3 billion and SaaS revenues up 11 percent to $3.7 billion.The rapid growth in cloud infrastructure was driven by demand for AI, with Oracle deploying the world's largest AI supercomputer, scaled to 65,000 NVIDIA H200 GPUs (Investing.com).CEO Safra Catz said cloud infrastructure revenue growth is expected to exceed 70% in fiscal 2026, well ahead of 50% in fiscal 2025 and market expectations of 62%.This forward guidance indicates Oracle's competitive advantage in the AI infrastructure market and could drive valuation repricing.

High capex supports long-term growth

High capital expenditures of $9.1 billion in the fourth quarter resulted in negative free cash flow of $2.9 billion.This high level of investment was primarily used to expand OCI capacity to meet the rapidly growing demand for AI and cloud services.Despite the short-term pressure on cash flow, these investments set the stage for Oracle to capture market share in high-growth markets such as AI and cloud infrastructure.The potential for return on these investments is further validated by RPO growth of 41% to $138 billion, demonstrating the long-term customer demand for Oracle's cloud services.

SaaS business solid but slower growth rate

SaaS revenue grew 11% to $3.7 billion, below the 52% growth rate for IaaS, but strategic back-office SaaS (annualized) revenue grew 20% to $9.3 billion, demonstrating the continued attractiveness of enterprise-class applications such as Fusion Cloud ERP and NetSuite.Cloud database services (annualized) revenues grew 31% to $2.6 billion, demonstrating Oracle's core competency in databases. the relatively slow growth rate of SaaS may reflect increased competition in the market or a customer tilt toward IaaS, and will need to be monitored on an ongoing basis to see how it performs in the enterprise applications market.

Profitability and Operating Efficiency

Non-GAAP earnings per share were $1.70, up 4% year-over-year, with adjusted net income growing to $4.88 billion and gross margin at 71.12%.Operating income grew 7% year-over-year, showing that the company has maintained a balance between cost containment and revenue growth.However, negative free cash flow due to high capital expenditures could raise investor concerns about short-term profitability.In the coming quarters, Oracle will need to demonstrate that its investments translate into higher revenue growth and positive cash flow.

Market expectations and valuation repricing potential

Oracle's outperforming revenue and EPS performance and guidance for cloud infrastructure growth of over 70% in FY2026 exceeded market expectations (62%).This will further push up its value, triggering a valuation repricing.Strong RPO growth further strengthens the market's confidence in the company's future revenues.

Market Focus Tracker

AI-driven cloud infrastructure growth: analysts previously focused on Oracle's competitiveness in the AI infrastructure market.OCI consumer revenue growth of 62% in the quarter and the deployment of the world's largest AI supercomputer responded to the market's expectations for Oracle's AI strategy.

CAPEX & CASH FLOW: The market is concerned about the sustainability of high capital expenditures.Negative free cash flow in the quarter may have exacerbated this concern, but management emphasized that these investments will drive future growth.

SaaS Competitive Pressure: SaaS revenue is growing at a slower rate than IaaS, likely reflecting intense competition with rivals such as Salesforce.Oracle needs to further consolidate its market position through product innovation and integration.

Comments