$Adobe(ADBE)$ Strong performance in revenue, profitability and AI innovation in the second quarter of fiscal 2025.Solid growth in the Digital Media and Digital Experience segments, combined with rapid advancement of the AI strategy, provide a clear growth path for the company going forward.

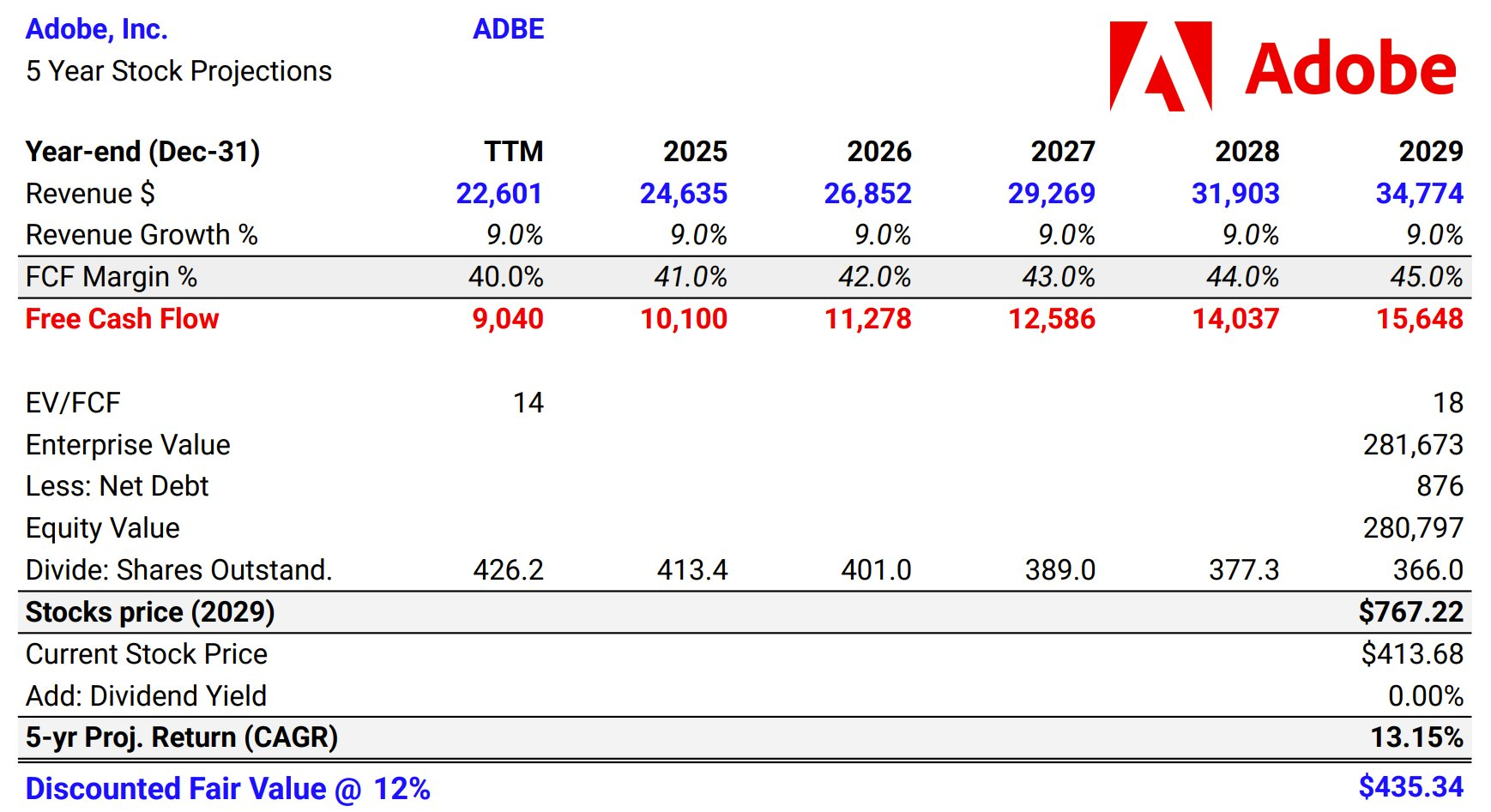

Despite the small after-hours drop in share price, Adobe's long-term investment value remains solid, especially driven by the combination of AI and subscription model.

Performance and market feedback

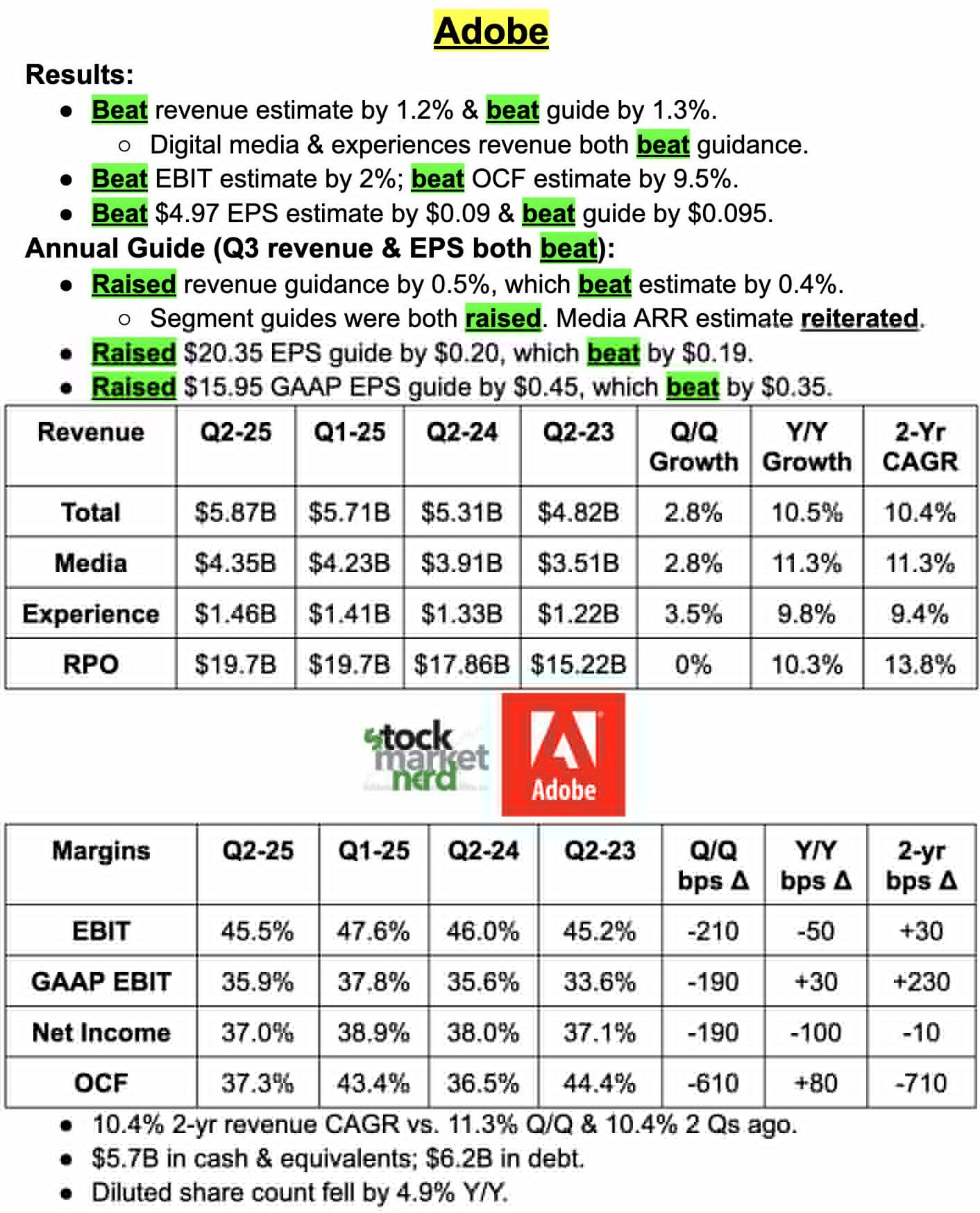

On the revenue front, revenue of US$5.87 billion ($5.87B) grew 11% year-on-year, exceeding market expectations of US$5.8 billion, driven by the two core business segments of Digital Media and Digital Experience.

EPS performance was strong, with non-GAAP earnings per share (EPS) of $5.06, exceeding market expectations of $4.97, with efficient cost management and stability of the subscription model.

In the business segments, Digital Media revenue of $4.35 billion ($4.35B) increased 12% year-over-year, driven by strong demand for Creative Cloud and Document Cloud, and rapid growth in AI-powered products such as Firefly.Digital Experience revenue of $1.46 billion ($146B) increased 10% year-over-year, reflecting continued demand from organizations in the areas of customer experience management and data analytics.

In terms of cash flow, operating cash flow reached $2.19 billion ( $219B ), a record high for the second quarter.

Market sentiment stabilized, although it briefly moved up 6% after earnings came out.But then followed the broader market slide and traded down 0.% after hours.On the one hand, changes in macro markets have shifted risk appetite, and on the other hand, the market's previous optimistic expectations have Price-in quite a few moves.And Adobe's P/E ratio has been high for a long time, which needs to be reassessed through a reassessment of growth expectations.

Investment highlights

AI Strategy Becomes New Growth Engine

Adobe's investment in AI is paying off significantly.During Q2, the company launched several AI-powered products.Subscriptions to Firefly apps grew 30% year-over-year, driving AI Direct Annual Subscription Revenue (AI Direct ARR) projected to be more than $250M ($250M), which not only enhances product functionality, but also provides Adobe with a differentiator in the highly competitiveCreative Software Market

Firefly subscriber growth of 30% and AI Direct ARR expectation beat are a direct response to the market's expectations for the AI strategy.

The rapid growth of the AI product could be a key variable in valuation repricing, but of course it is also important to continue to watch for competition from Sora and Midjourney, as well as free/low-cost alternatives such as Canva and the competitive threat of $Microsoft(MSFT)$ $Alphabet(GOOG)$ , as the company strengthens its position in the market with product innovations and ecosystem extensions such as the partner programThe subscription model has supported steady growth.

Subscription Model Supports Stable Growth

Adobe's subscription model (Creative Cloud, Document Cloud, Experience Cloud) continues to provide predictable revenue streams and strong cash flow.Q2 revenue growth of 11% year-over-year demonstrates the resilience and customer stickiness of the subscription model.

The stability of the subscription model provides Adobe with a cushion against macroeconomic volatility while supporting its continued investment in innovation.

Digital Media and Digital Experience Synergy

Digital Media revenue grew 12% ($4.35B) and Digital Experience revenue grew 10% ($1.46B), demonstrating Adobe's two-wheel-drive strategy in personal creativity and enterprise digital.The strong performance of Digital Media was driven by the widespread adoption of professional creative tools, while the growth of Digital Experience reflected corporate demand in the areas of marketing automation and data analytics.The synergies between the two business segments strengthened Adobe's market moat.However, the Digital Experience segment grew slightly less than Digital Media and also faced competitive pressure in certain market segments, such as small and medium-sized businesses.

Upgraded Guidance Reflects Management Confidence

Adobe raised its fiscal 2025 revenue guidance to $23.5B-$23.6B ($23.5B-$23.6B) and non-GAAP EPS guidance to $20.5-$20.7 ($20.5-$20.7).This upbeat guidance exceeds market expectations and demonstrates management's confidence in AI-driven growth and global market demand.

Valuation repricing triggers: rapid AI Direct ARR growth, upward guidance, and stable subscription revenues could drive the market to reassess Adobe's valuation.However, investors need to be mindful of increased competition, regulatory risks, and volatility risks associated with high valuations.

Comments