Big-Tech’s Performance

Weekly Macro Highlights: The showdown between the bigwigs

With May’s CPI continuing to decline—core inflation easing even further—Trump launched a fierce attack on Powell at the White House this week, urging a rate cut and even specifying a "2 percentage point" reduction. Although his claim of saving $600 billion annually may not materialize, the reality is that with ballooning U.S. debt, government interest expenses are under significant pressure. On June 13, he went so far as to call Powell a “blockhead.” However, Powell remained committed to data-driven policy and resisting political interference, with no signs of easing tension. The market is closely watching the Fed's next moves.

In macro markets, U.S. long-term bond yields fell by 6–8bps as expectations of Fed rate cuts later this year (>50bps) strengthened, which supported a 23bps rise in tech stocks over the week. Meanwhile, the U.S. dollar weakened (USD -75bps to new lows, with the dollar index falling below 98), mainly due to potential tariff policies, widening fiscal deficits, and weaker economic growth and inflation data for May—all of which reduced demand for the dollar, benefiting future tech earnings but signaling softer demand for U.S. assets.

On June 13, Israel struck Iran's nuclear facilities and other targets, hitting key figures. Global financial markets experienced violent fluctuations. Oil prices surged 4%, while after several consecutive days of equity gains, stock markets began to pull back and the $Cboe Volatility Index(VIX)$ (fear index) surge again

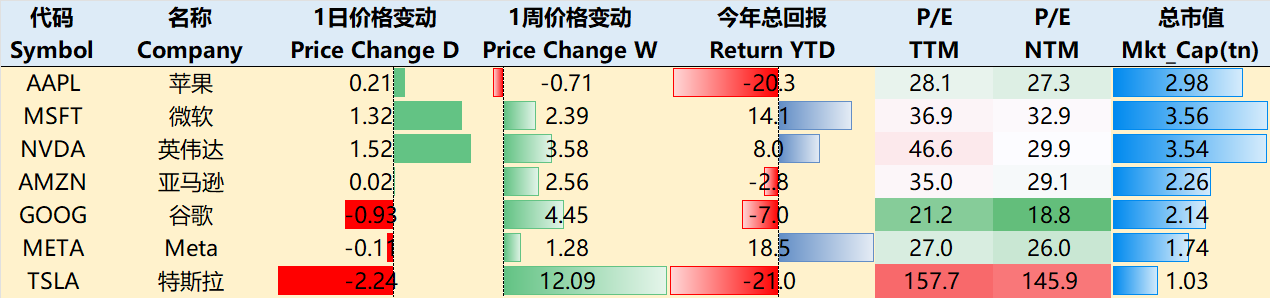

Aside from Apple, most Big Tech names posted gains this week. As of the June 12 close, one-week performance: $Apple(AAPL)$ -0.71%, $Microsoft(MSFT)$ +2.39%, $NVIDIA(NVDA)$ +3.58%, $Amazon.com(AMZN)$ +2.56%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +4.45%, $Meta Platforms, Inc.(META)$ +1.28%, $Tesla Motors(TSLA)$ +12.09%。

Big-Tech’s Key Strategy

Amazon Optimizing Cloud — Is an Inflection Point Ahead?

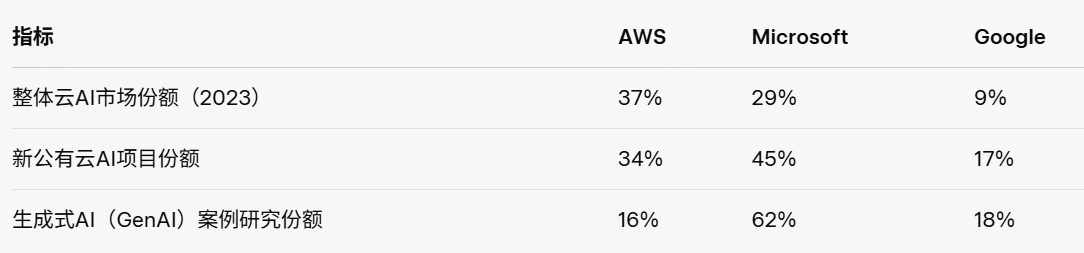

Recently, Microsoft shares have been hitting new highs (continuing an upward trend since Q1 earnings), largely driven by strong performance in AI and cloud computing. Outlook for Q2 remains highly optimistic, with Azure’s 21% YoY growth and deep collaboration with OpenAI seen as key drivers. Additionally, Copilot’s monetization progress (potentially millions of paid users), and Arista’s LPO technology boosting data center efficiency, have also been priced in by the market.

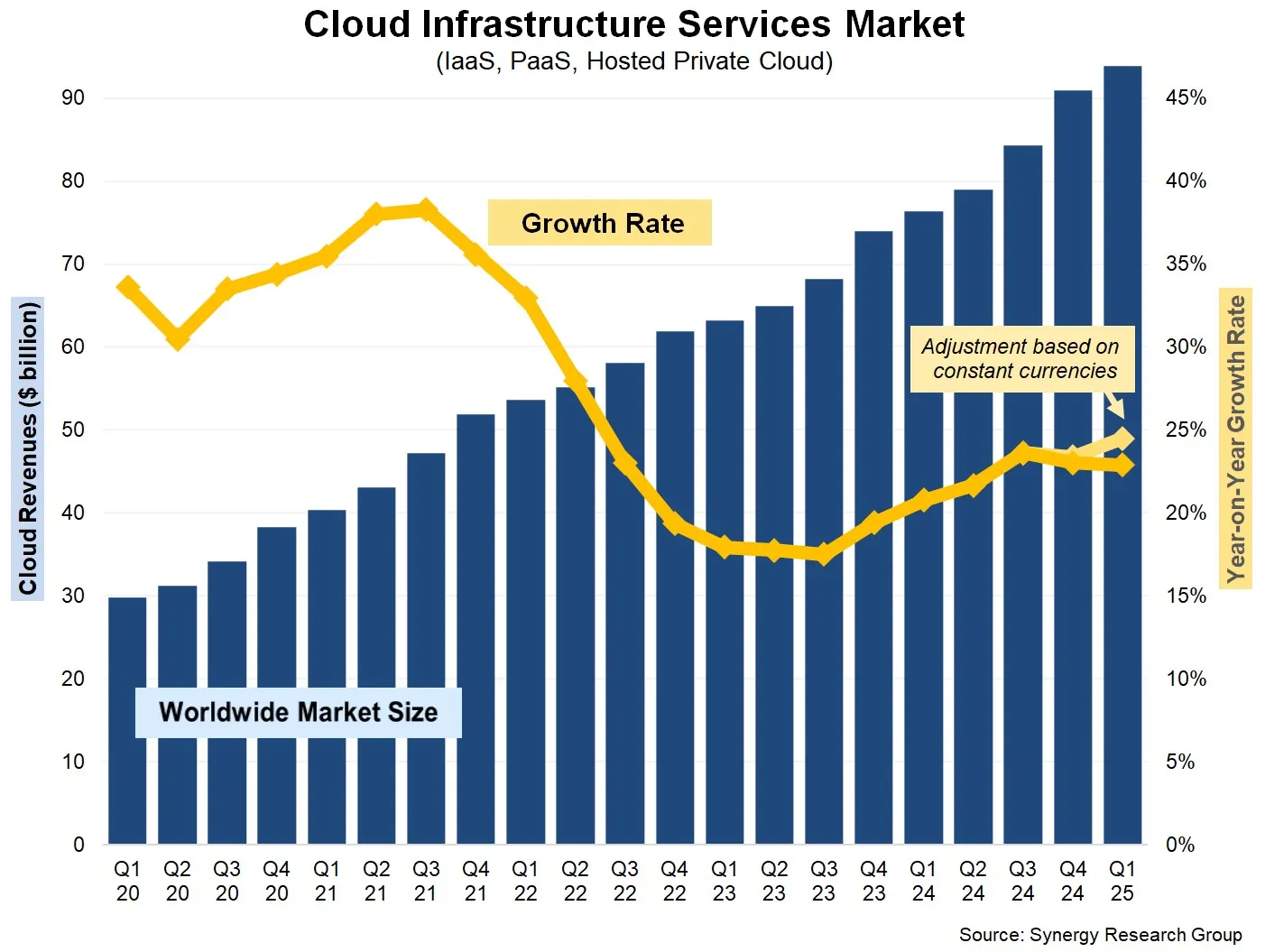

As the leader in cloud services, Amazon is beginning to feel the pressure. AWS is planning a major overhaul of its core AI cloud platform Bedrock to stay competitive — including supporting multi-cloud models and optimizing AI agent development. Previously, AWS faced stiff competition from Google and Microsoft in the AI agent development space (their revenue growth outpacing AWS by 10-15%).

Some AWS customers report that rival platforms offer better convenience and compatibility for AI application development. For example, Google Cloud’s Vertex allows customers to manage AI models across cloud providers (including those hosted on Microsoft or AWS), while AWS currently supports only a limited range of tools and models.

Key Changes Include:

Enhanced Runtime Environment:

Expand Bedrock’s toolchain to support more open-source frameworks (e.g., CrewAI, Hugging Face agent builders), allowing customers to run models hosted on other clouds (Microsoft, Google).Cross-Cloud Compatibility:

May allow Bedrock to manage non-AWS-hosted models, though it's uncertain if OpenAI models (currently hosted on Microsoft cloud) will be included.

Addressing Customer Pain Points:

Today, customers must manage different clouds via multiple control planes, leading to fragmented experiences. The upgrade could enable unified management.

Relaxed Agent Development Restrictions:

Currently limited to AWS’s own tools and few models; future updates may open more open-source options.

Strategic Significance:

AWS cloud computing remains Amazon’s core profit engine; Bedrock upgrades are key to preventing market share loss.

Maintaining market share by attracting enterprise clients that require multi-cloud AI models and agent development.

Big Tech Options Strategy

This Week’s Focus: NVDA’s new estimates?

Post-Nvidia (NVDA) earnings, shares appear stable, but NVDA underperformed the $Philadelphia Semiconductor Index(SOX)$ on 5 out of the past 6 trading days, suggesting that recent semiconductor rallies are more driven by "cyclical recovery + optimism over U.S.-China negotiations" rather than stock-specific alpha.

Key Takeaways from GTC Paris Conference:

European sovereign AI demand (projected $1.5 trillion investment in the future).

Blackwell chip production ramp expected in Q3.

Europe GPU deployment projected to grow 10x by 2026, with GB200 system annual shipments reaching 50,000 units.

In options trading, volume for June monthly options expiring on next Wednesday's triple witching (June 20) is rising. The $150 strike has become key resistance, with speculative trading increasing as investors hedge for small-probability surprise events.

Big-tech Portfolio

The Magnificent Seven form a portfolio ("TANMAMG") that is equally weighted and rebalanced quarterly. Backtesting shows that since 2015, this portfolio has far outperformed the $S&P 500(.SPX)$ , delivering a total return of 2446%, compared to 250.99% for $SPDR S&P 500 ETF Trust(SPY)$ , an excess return of 2195.35%.

This year, Big Tech saw some pullback, returning -0.52% YTD, versus SPY’s +3.32%.

Over the past year, the portfolio’s Sharpe ratio rose to 0.79 (SPY: 0.52), with an information ratio of 0.80.

Comments