$Meta Platforms, Inc.(META)$ has recently announced a pivotal shift in its WhatsApp strategy by introducing advertising to the platform, marking a departure from its long-standing "no ads" policy.

This move aims to monetize WhatsApp’s massive user base of over 3 billion monthly active users, leveraging its Updates tab for ads, channel subscriptions, and promoted channels. This report analyzes Meta’s strategic pivot, recent financial performance, market expectations, and valuation implications, arguing that while the advertising initiative presents significant revenue potential, it must navigate user privacy concerns and market dynamics to ensure long-term success.

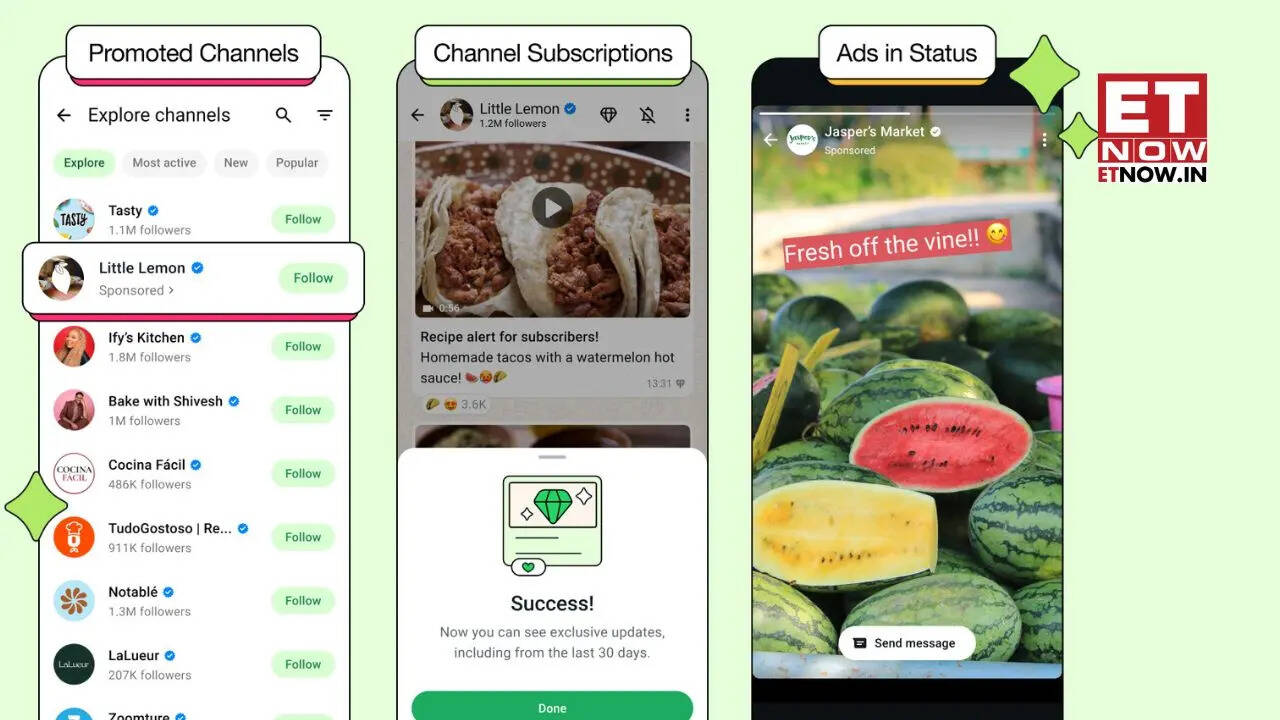

Strategic Shift: Advertising on WhatsApp

Meta’s decision to introduce ads on WhatsApp, announced in June 2025, targets the Updates tab, specifically the Status section, ensuring that personal chats remain ad-free and end-to-end encrypted. This strategy aligns with Meta’s broader goal of diversifying revenue streams beyond its core advertising platforms, Facebook and Instagram. Additional monetization efforts include channel subscriptions for exclusive content and promoted channels for businesses, alongside existing tools like the WhatsApp Business API and Click-to-WhatsApp ads, which already generate an estimated $10 billion annually.

This shift reverses WhatsApp’s founding ethos, as co-founders Jan Koum and Brian Acton had historically opposed advertising due to privacy concerns. The move follows years of deliberation, with earlier plans shelved in 2020 due to potential user backlash. Meta’s cautious approach—limiting ads to the Updates tab and emphasizing privacy—aims to balance monetization with user trust. However, posts on X suggest skepticism, with concerns that ads could alienate users who value WhatsApp’s privacy-focused identity.

Recent Financial Performance

Meta’s Q1 2025 earnings report underscores its robust financial health, providing a foundation for its WhatsApp monetization strategy. The company reported revenue of $42.3 billion, surpassing Wall Street’s $41.3 billion estimate, with advertising revenue reaching $41.39 billion, a 16.2% year-over-year increase. Earnings per share were $6.43, exceeding expectations of $5.25. The Family of Apps (FoA) segment, including WhatsApp, drove a 48% year-over-year increase in non-advertising revenue, primarily from WhatsApp’s business messaging services.

WhatsApp’s contribution to Meta’s revenue remains modest, estimated at $1.3 billion in 2024, less than 1% of Meta’s total revenue. However, its business messaging platform, with 200 million monthly active users, has shown steady growth, from $443 million in 2018 to $1.279 billion in 2023. The introduction of ads is projected to significantly boost this figure, with Evercore ISI analysts estimating WhatsApp’s advertising revenue could reach $10 billion annually by 2028.

Meta’s Q2 2025 revenue guidance of $42.5 billion to $45.5 billion reflects confidence despite tariff-related concerns affecting Asia-Pacific ad spending. The company’s capital expenditures for 2025, raised to $64 billion–$72 billion, signal heavy investments in AI and infrastructure to support advertising and messaging innovations.

Market Expectations and Sentiment

Market reactions to Meta’s WhatsApp advertising strategy have been largely positive, with shares rising over 2.5% to above $700 following the announcement. Analysts, including those at Oppenheimer, have raised price targets (to $775 from $665), citing an improving ad market outlook and WhatsApp’s untapped potential. The platform’s 1.5 billion daily users on the Updates tab offer a massive advertising audience, comparable to Meta’s core platforms.

However, challenges loom. Tariff uncertainties and reduced ad spending from Asia-based e-commerce exporters, such as Temu, pose risks. Additionally, regulatory pressures in Europe, where Meta faces a Digital Markets Act ruling, could impact 16% of its 2024 ad revenue. Posts on X highlight user concerns about privacy, with some viewing ads as a “double-edged sword” that could erode WhatsApp’s appeal.

Valuation Analysis

Meta’s stock has shown resilience, gaining over 25% in the past 12 months despite a 7% year-to-date decline in 2025. A discounted cash flow valuation suggests Meta is undervalued, with WhatsApp’s monetization potential and AI-driven ad improvements not fully priced in. The company’s price-to-earnings (P/E) ratio, while not explicitly stated in recent data, aligns with its historical range of 20–30, reflecting strong investor confidence in its growth trajectory.

WhatsApp’s advertising initiative could significantly enhance Meta’s valuation. If it achieves the projected $10 billion in ad revenue by 2028, it could contribute 5–7% of Meta’s total revenue, assuming current growth trends. Combined with AI-driven ad targeting and cross-platform synergies, Meta’s forward P/E could compress further, making it an attractive investment. However, risks such as user backlash and regulatory hurdles could temper this upside.

Conclusion and Outlook

Meta’s introduction of advertising on WhatsApp is a bold yet calculated move to unlock the platform’s revenue potential. The strategy leverages WhatsApp’s vast user base and integrates with Meta’s AI and business messaging capabilities, positioning it as a key growth driver. Financially, Meta remains robust, with strong Q1 2025 performance and optimistic guidance. Market sentiment is positive, but privacy concerns and external economic pressures warrant caution.

To succeed, Meta must maintain WhatsApp’s core appeal—privacy and simplicity—while scaling its advertising and business services. The projected $10 billion in ad revenue by 2028 underscores WhatsApp’s potential to reshape Meta’s revenue mix. Investors should monitor user retention and regulatory developments, as these will determine the strategy’s long-term viability. Meta’s stock remains a compelling buy for those bullish on its ability to balance innovation with user trust.

Comments