Big-Tech’s Performance

Weekly Macro Highlights: Escalation Between Iran and Israel, Powell vs. Trump War of Words, Stablecoin Turmoil

The escalation in the Middle East was one of the main drivers of market volatility this week. Israel’s strike on key Iranian facilities could lead to further increases in oil prices, fueling inflation expectations and exerting pressure on U.S. equities—particularly those in energy-sensitive sectors. While the upward trend in oil prices slightly eased this week, geopolitical uncertainty remains a key market risk for the foreseeable future.

On the other hand, despite solid economic data, the Fed unsurprisingly refrained from cutting interest rates and reiterated concerns over tariffs and their potential inflationary effects. Trump again lambasted Powell as “stupid,” while ballooning interest payments on U.S. Treasuries added to the pressure.

The AI supply chain (e.g., NVIDIA, AMD) and quantum computing attracted significant capital inflows. Meanwhile, stablecoin players like Circle and Coinbase surged sharply following the passage of the “GENIUS Act,” while traditional payment players such as Visa and Mastercard were dumped, leading to steep declines.

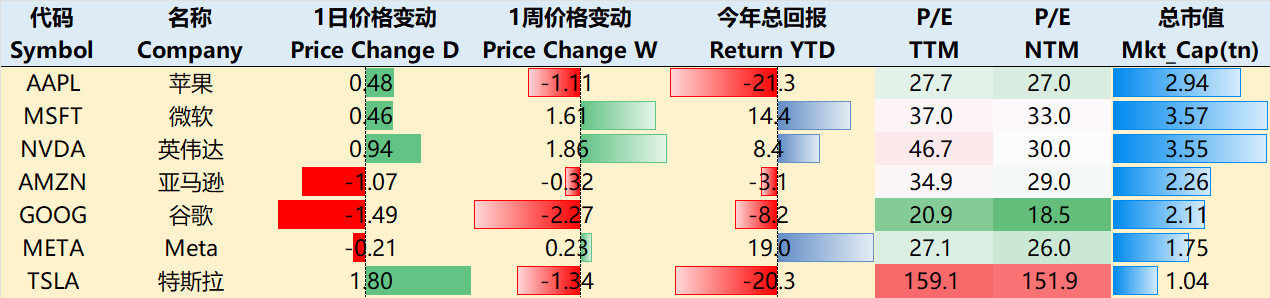

Aside from Apple, big tech stocks saw mixed performance this week. As of the June 18 close: $Apple(AAPL)$ -1.11%, $Microsoft(MSFT)$ +1.61%, $NVIDIA(NVDA)$ +1.86%, $Amazon.com(AMZN)$ -0.32%, $Alphabet(GOOG)$ -2.27%, $Meta Platforms, Inc.(META)$ +0.23%, $Tesla Motors(TSLA)$ -1.34%

Big-Tech’s Key Strategy

What Risks Are Lurking for Big Tech?

Microsoft (MSFT):

Microsoft’s relationship with OpenAI has sharply deteriorated, triggering shockwaves across the AI industry. OpenAI is reportedly considering an antitrust lawsuit against Microsoft. If pursued, this could fundamentally reshape the AI industry landscape. The two parties are engaged in high-stakes negotiations over a partnership worth tens of billions. OpenAI’s growing independence is increasingly evident—bypassing Microsoft to work directly on core U.S. Department of Defense projects, posing a serious threat to Microsoft's dominant position.

Key points of contention include:

OpenAI’s request to block Microsoft’s access in the Windsurf acquisition deal

A proposal to restructure the partnership, converting Microsoft’s profit-sharing into a 33% equity stake

Ambiguities in contract terms regarding AGI (Artificial General Intelligence) trigger clauses

While Microsoft is accelerating its diversified AI strategy and has hired DeepMind co-founder Mustafa Suleyman to mitigate risks, losing OpenAI’s support would pose a serious threat to its leadership, especially amid intensifying competition with Google and Amazon.

Apple (AAPL):

Apple is caught in a regulatory tug-of-war over its AI strategy in China. On one hand, large models like OpenAI’s may require regulatory approval in China—which is unlikely to be granted. On the other, Alibaba’s release of the Open3 model on Apple’s MLX framework has sparked concerns in Washington over international AI collaboration. Apple finds itself between two conflicting geopolitical forces, making execution extremely challenging.

Meta (META):

Meta’s aggressive metaverse gamble continues to raise market skepticism. The company plans to invest $14.3 billion in Reality Labs in 2025—a 15% increase year-over-year. While its AR glasses roadmap targets commercialization by 2026 and technical capabilities are solid, the commercial timeline remains highly uncertain. Shareholders are increasingly concerned about whether such long-term, large-scale investment is justified. Current user adoption is low, and the content ecosystem is underdeveloped—meaning returns may be a long way off.

Tesla (TSLA):

Confidence in Tesla’s autonomous driving ambitions has been shaken. The NHTSA has reopened a probe into the safety of the FSD system, posing a significant threat to its Robotaxi roadmap. Although Tesla’s FSD Beta has made progress—building a 5-million vehicle fleet for closed-loop data—its performance in complex urban environments still struggles with edge cases. Core concerns center on whether Tesla is overly optimistic in evaluating its AV technology readiness. The company also faces fierce competition from traditional taxi firms, ride-hailing platforms, and other AV developers like Waymo and Cruise, which have also made substantial progress.

NVIDIA (NVDA):

NVIDIA is under pressure as the AI chip landscape is being restructured. Cloud giants such as Amazon, Google, and Microsoft are actively developing in-house AI chips and large-scale custom ASICs, signaling their intention to reduce dependence on NVIDIA’s hardware stack.

Big Tech Options Strategy

Focus of the Week: Marvell Raises Guidance

$Marvell Technology(MRVL)$ provided new updates at its latest investor event, focusing on its custom AI chip strategy. The company now targets a 20% market share and raised its FY29 revenue outlook above consensus estimates. It has secured new clients and design wins in Custom XPU and XPU attach, and revised its AI-related TAM for 2028 from $75B to $94B. Custom compute TAM now stands at $55B (CAGR of 47%), and XPU attach TAM at $15B.

Assuming a 20% market share, Marvell could achieve:

$19B in data center revenue (vs. consensus $11B)

$11B in custom compute revenue (vs. consensus $4.7B)

The company’s client base has expanded to 10+ customers with 50+ active project pipelines, mitigating customer concentration risk and improving platform resilience. Increased attach ratio enhances gross margins and strengthens the company’s economic moat.

The XPU attach ecosystem, including HBM, packaging, IP, and interconnect, significantly boosts customer stickiness and delivers an end-to-end AI compute solution.

With data center TAM expanding to $94B and Marvell ranking second globally in interconnect and packaging, its strong integration capabilities are well positioned to benefit from the growing AI ASIC trend.

Although skepticism remains regarding the commercialization path of custom ASICs, these updates provide long-term revenue visibility and may lead to upward revisions in expectations.

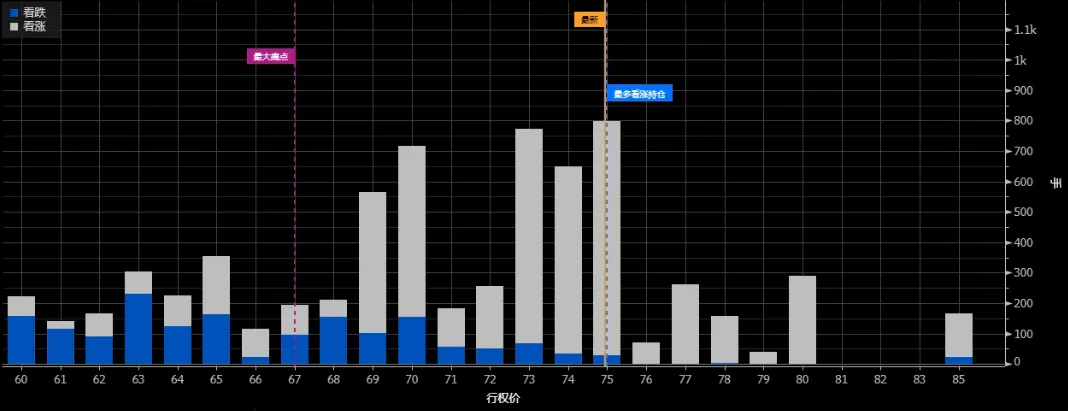

Options Market Sentiment: Call options expiring before mid-July are mostly concentrated around the $75 strike, with maximum pain slightly below that level. For July 18 expirations, the highest open interest call options are at $80. This indicates a rising options price center and reflects the market’s increasingly bullish sentiment toward semiconductor stocks.

Big-tech Portfolio

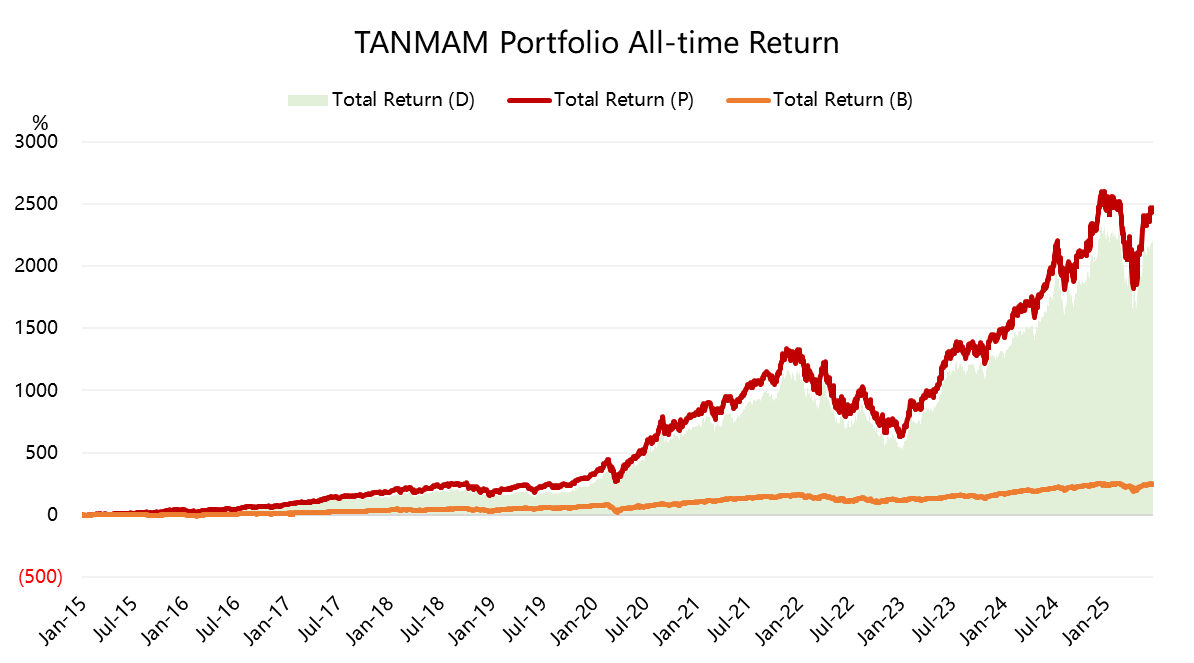

The Magnificent Seven stocks form the “TANMAMG” portfolio—equally weighted and rebalanced quarterly. Backtests since 2015 show the portfolio has massively outperformed the $S&P 500(.SPX)$ , with a total return of 2,441.80%, compared to $SPDR S&P 500 ETF Trust(SPY)$ ’s 247.32%, generating an excess return of 2,194.48%.

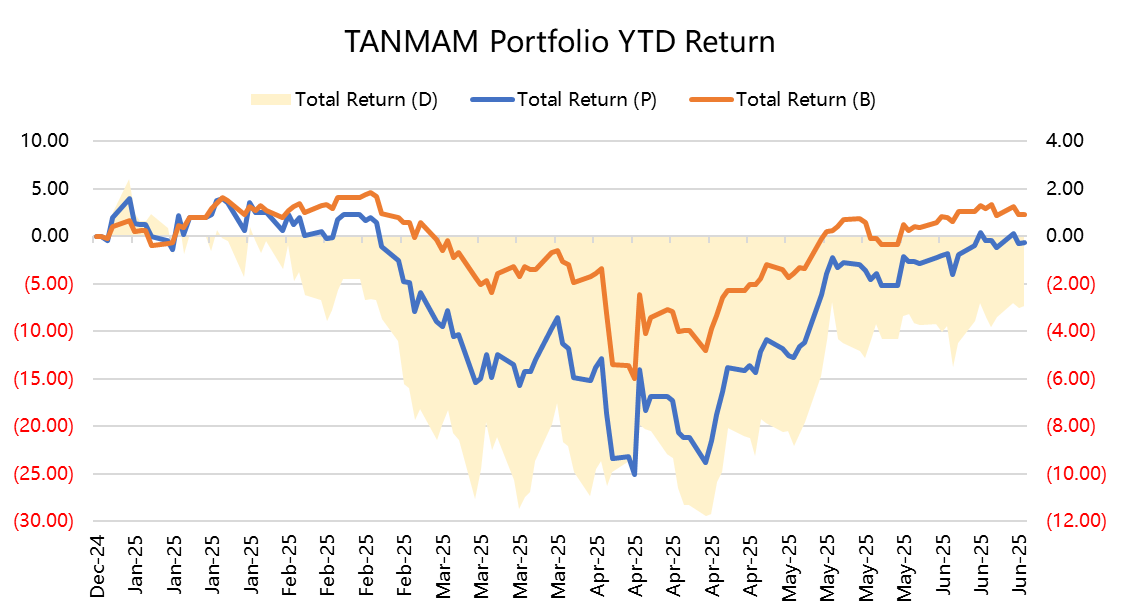

This year, big tech stocks have pulled back, with the TANMAMG portfolio returning -0.70% vs. SPY’s 2.24%.

Over the past year, the portfolio’s Sharpe ratio dropped to 0.74 (vs. SPY’s 0.39), with an information ratio of 0.85—still reflecting strong risk-adjusted returns.

Comments

If President Trump really wants to strengthen Dollar, from a global investor lens, re-appointing Mr. Powell would probably go a long way to doing this. At least this FED Chair can be relyed upon not to do anything impulsively or in a hurry.