As the United States intervenes in the Israel-Iraq war, people are increasingly worried about whether the Strait of Hormuz, the "most important oil choke point in the world", will be closed.

Kusari, a member of the National Security Committee of the Iranian Parliament, recently said,Iran's parliament has concluded that the Strait of Hormuz should be closed, but the final decision lies with Iran's Supreme National Security Council.

The Strait of Hormuz is the strait connecting the Persian Gulf and the Indian Ocean, and it is also the only waterway entering the Persian Gulf. Its strategic position is self-evident. Crude oil from major oil-producing countries such as Saudi Arabia, Qatar, Kuwait and Iran needs to be transported to all parts of the world through the Strait of Hormuz, making it a key artery for the operation of the global economy.

Therefore, if oil tankers fail to pass through the Strait of Hormuz, even temporarily, it may lead to a surge in global energy prices, soaring transportation costs and serious supply delays. In addition to oil, the Strait of Hormuz is crucial to global container trade. Many container cargo flows in the Middle East also rely on the Strait of Hormuz.

Although Iran frequently threatens to "close the Strait of Hormuz", many experts believe that this is just a "false shot". Because Iran has repeatedly threatened to close the Strait of Hormuz over the years, butTaking history as a mirror, Iran ultimately chose less destructive measures.

Iranian Foreign Minister Araghzi also sidestepped the issue in his response on Sunday, saying only that "Iran has a variety of options".

However, hours before the attack, Mohsen Rezaei, a member of the decision-making committee of Iran's Supreme National Security Council, said on state television that Iran would take action to close the Strait of Hormuz if Trump went to war.

Analysis pointed out that,Indeed, closing the Strait of Hormuz would affect Iran's own oil sector and cut off a key source of revenue for the country.Iran itself uses the waterway for energy exports, totaling more than 1.3 million barrels per day through the Strait of Hormuz in 2023, according to CEIC data.

US Vice President Vance commented on this in an interview on Sunday, "That would be suicide. If they want to destroy their economy and cause chaos in the world, I think that's their decision. But why do they do this? I don't think it makes any sense."

U.S. Secretary of State rubio warned that Iran's closure of the Strait of Hormuz would be "another terrible mistake … We have reserved the option to deal with this problem."

For investors who want to short on rallies, you can consider using the bear market spread strategy to short crude oil.

Shorting Crude Oil with Bear Put Spread Strategy

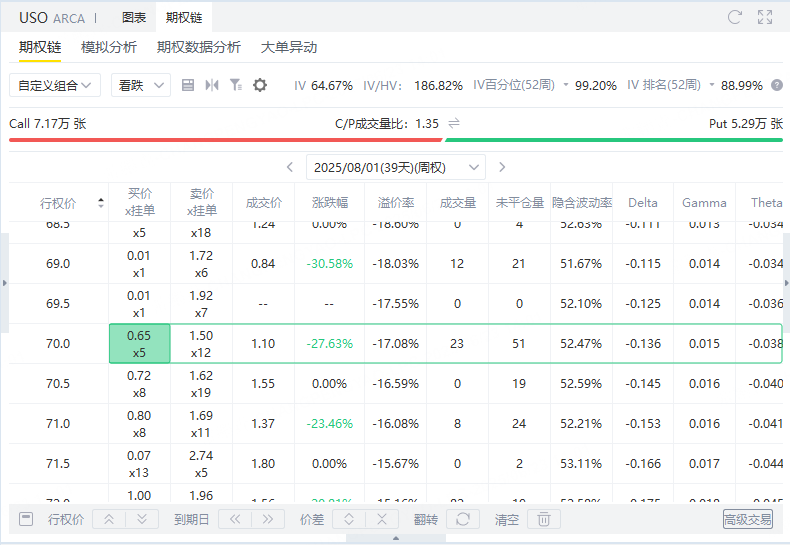

The current $United States Oil Fund LP(USO)$ price is $84.4, and we can get $110 by selling a put option with an expiration on August 1, 2025 and an exercise price of $70.

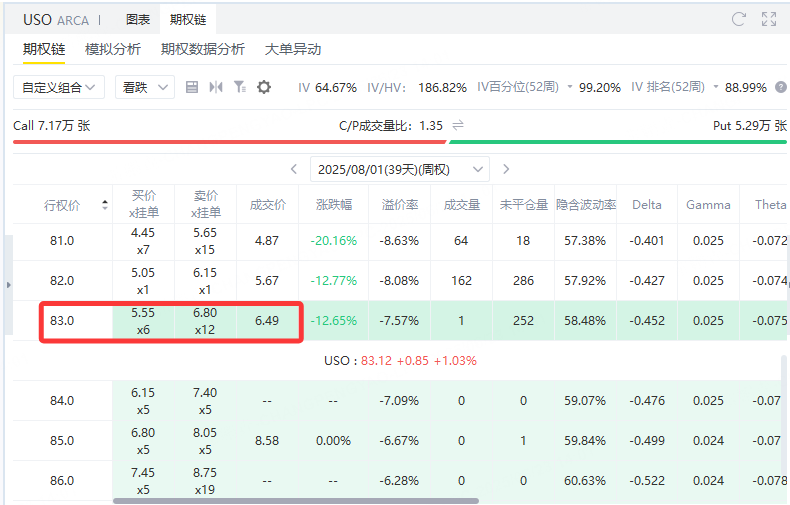

On the short side, we can buy a put option with a strike price of $83, which costs $649.

USO Bear Market Put Spread Strategy Profit and Loss Analysis (Bear Put Spread)

Underlying assets: USO (United States Crude Oil Fund)

Current price: $84.40

Strategy structure:

Buy 1 Put option (Put) with an exercise price of $83 expiring on August 1, 2025 and a cost of $649

Sell 1 Put option (Put) with an exercise price of $70 expiring on August 1, 2025 and get $110

Total net costs (expenses): 649-110 =$539

Maximum gains (USO falls to $70 or below): (83-70)×100-539 =$761

Maximum loss (USO above $83): Maximum loss is net expense, i.e.$539

Break-even point: 83-(539 ÷ 100)=$77.61

Analysis of pros and cons of bear market put spreads

This strategy operates on the premise of bearish USO. The Put option bought provides a downward return, and the low strike price Put sold is used to recover part of the cost. The strategy belongs to the structure of limited risk and limited income.

Advantages:

The maximum loss is fixed and the risk is clear

The maximum profit can reach $761, and the risk-benefit ratio is reasonable

Longer terms, allowing volatility to fulfill expectations

Disadvantages:

Relatively high costs and low break-even point ($77.61)

Possible loss if USO moves sideways or modest down

It takes a large decline to make a profit

Comments