618 Shopping Festival Performance Summary

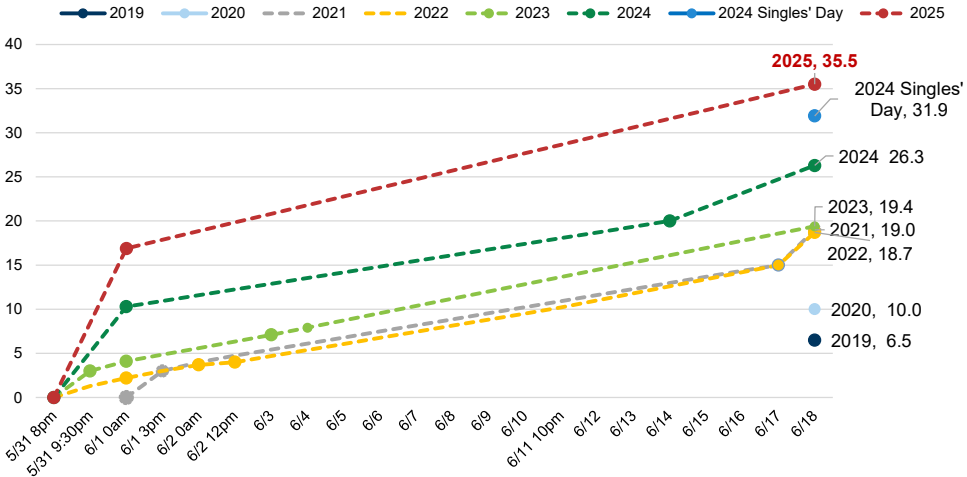

GMV reached RMB 35.5 billion during the 618 Shopping Festival, up 35% year-over-year and 11% higher than Double 11 2024

This performance was in line with expectations and equaled 71% of GSe's forecasted 2Q25 China smartphone and AIoT revenue

Historical comparison: 69% of 618 in 2024, 59% of 618 in 2023, 66% of Double 11 in 2024

Smartphone performance:

Ranked #1 in sales and GMV among domestic brands on the Jingdong platform

4 of the top 10 best-selling models (Redmi K80, Redmi Turbo 4 Pro, Redmi 14C and Redmi Note 14 Pro)

Strong performance in the ultra-high-end market ($6,000+), with the Xiaomi Mi 15 Ultra in the top 10

Discount levels remained the same as last year, with an average discount of about 19% (excluding state subsidies), and up to 33% after subsidies are taken into account

AIoT product performance:

Significant sales growth in smart appliances: air conditioners (+52% YoY), refrigerators (+62% YoY), washing machines (+63% YoY)

Sales of TVs and monitors grew by 24% and 90% respectively

150% growth in kitchen stove sales

Improvement in service capability: 20% increase in peak day installations and 27% increase in consumers enjoying installation services

Market Competition Analysis

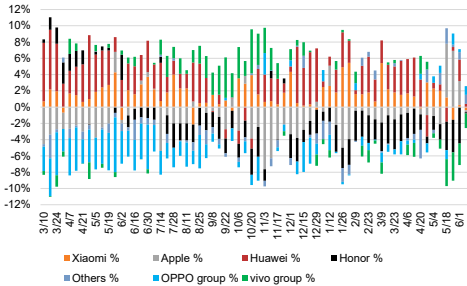

Market share change:

Xiaomi expanded its market share in China for three consecutive weeks (the weeks of May 18, May 25 and June 1) for the first time in a year

Apple expands market share with an additional 100 yuan (5%) discount

Price range performance:

Xiaomi accounted for 15 of the 70 best-selling models in the seven price ranges of 0.5-1k, 1-1.5k, 1.5-2k, 2-3k, 3-4k, 4-6k and 6k+

Future product plans

Upcoming product releases:

Cars: YU7 series (focusing on the first 30 minutes to 24 hours of orders)

Smartphones: Xiaomi Mi Mix Flip 2 and Redmi K80 Ultra

Portable AIoT:

Xiaomi Pad 7S Pro (powered by XRING O1 SoC, targeting iPad Air)

Redmi K Pad (powered by MediaTek Dimensity 9400+ SoC, targeting iPad mini)

Mi Band 10, Mi Watch S4, Mi OpenWear Stereo Pro

Possible release of Xiaomi's first AI glasses (expected to trigger a series of product launches from the tech giant in 2H25)

Home appliances:

Mijia AC Pro Healthy Wind

Vacuum Cleaner M40 S

Floor Cleaner 4 Max

Hair Dryer Pro

AI Glasses Market

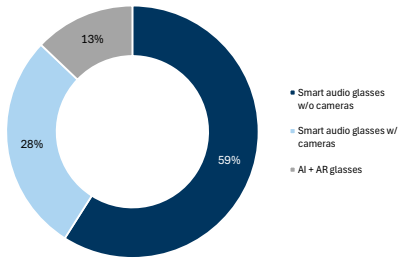

China Smart Glasses Market to Grow 116% to 494k Units by 2025, Smart Audio Glasses to Grow 197%

IDC forecasts China smart glasses shipments to reach 2.9 million units in 2025, including 2.16 million units of smart audio glasses

Price distribution: about 60% of online sales in January-February were camera-less glasses

Retail price distribution: mainly in the range of $1,000-1,500

Valuation

Current share price: HK$53.80

2025E Revenue Forecast: 478.66 billion yuan (+30.8% YoY)

2025E EBITDA forecast: 52.56 billion yuan (+70.5% YoY)

With a forecast P/E ratio for the next 12 months (Forward PE) of 31.4x

Comments