$700 major shareholder, South African newspaper group $ Naspers (Tencent South Africa's major shareholder) (NPSNY) $, in its just released annual report, showed that it intends to reduce its holdings of $ $ 4 billion (71 billion South African rand) worth of $ Meituan-W (03690) $, which were distributed out by Tencent in the form of a "special dividend" that year . These shares were distributed by Tencent in the form of a "special dividend" that year.

Core Events

Meituan has entered Brazil, where it plans to launch its overseas takeaway service brand "Keeta" and invest $1 billion (R17.78 billion) over the next five years to build and expand its business in the country.This comes on the heels of a formal entry into the Saudi Arabian market, which has seen above-industry average growth.

Reasons for stake reduction

Dual status of shareholder and direct competitor. Naspers owns about 4% of Meituan, and Meituan's entry into Brazil will be in direct competition with iFood, Naspers' takeout platform that is already dominant in the region

Strategic challenge.The direct competition between Meituan and iFood in the Brazilian market has left Naspers with the dilemma of playing left and right hand against each other.

The company's international expansion prospects are bearish. Bloisi believes that Meituan has a "low probability of winning" in international markets such as Brazil, where it faces "fierce competition" and an "increased risk of failure".

Why is Naspers so interested in the takeout business?

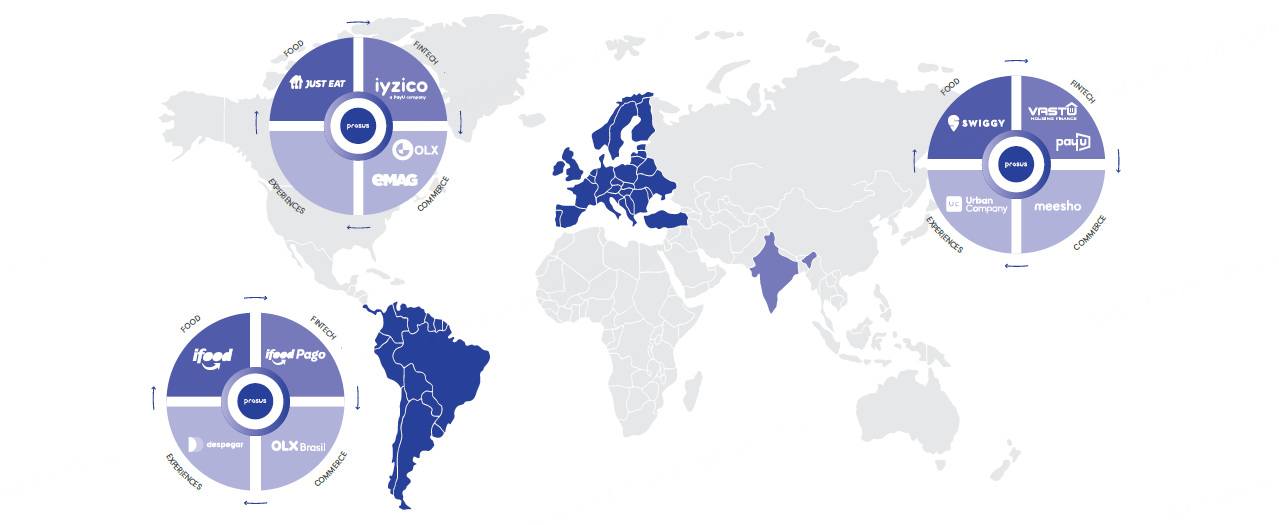

Looking at the composition of Naspers' assets, more than 90% of its net asset value comes from Tencent's shares.As a result, it has been trying to unlock the value of businesses "outside of Tencent" by investing in other businesses.

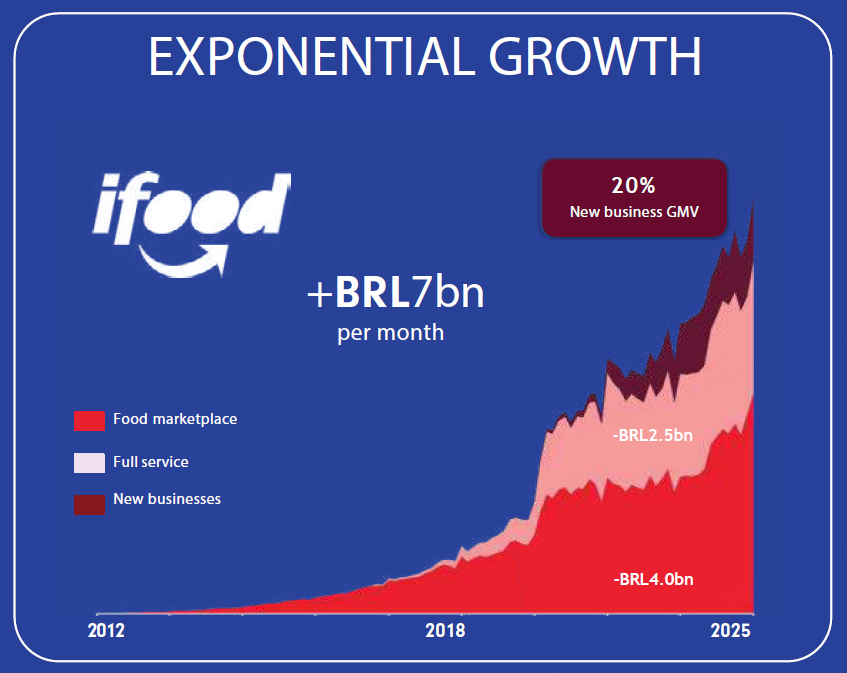

Fully acquired iFood for €1.5 billion in 2022

Acquired Just Eat Takeaway.com for $4.6 billion in February 2025

Acquired Despegar, Latin America's leading online travel agency, for $4.6 billion in February 2025

Its strategy centers on building a high-quality ecosystem of complementary businesses across food delivery, classifieds, payments and fintech, retail e-commerce (eMAG) and education technology (Edtech).According to its disclosure, iFood dominates the Brazilian food delivery market, with a market share of more than 80%, surpassing competitor PedidosYa, a subsidiary of Delivery Hero.

Therefore, the high-profile announcement of Meituan's entry into the Brazilian market is tantamount to disrupting its plans, and it's no wonder that its CEO was very direct in stating:

Meituan has a "low probability of winning" in international markets such as Brazil;

It will face "intense competition" and "increased risk of failure";

As a shareholder, Naspers is "disappointed" with the move.

The proceeds from the sale of Naspers' stake in Meituan will be used to invest in businesses that strengthen Naspers' own ecosystem, i.e., enhancing competitiveness in iFood and synergies across multiple sectors

Impact on Meituan

Meituan's entry into the Brazilian market must have been a well-considered decision, and its successful expansion into the Saudi Arabian market has given the company some confidence;

Meituan may not be able to sustain a "takeaway war" in both domestic and overseas markets.The company didn't expect Jingdong to launch a "play hard to get" takeaway war, causing Meituan to enter the subsidy war again in the domestic market; and if Prosus sells Meituan's shares, it will have a billion-dollar level of funds to support its Brazilian competition, which is a back-breaking situation for Meituan;

From the shareholders' point of view, Meituan may give up or delay its entry into the Brazilian market, with current quick assets of about 200 billion yuan and current liabilities of 100 billion yuan; and considering that Jingdong has said it will invest more than 10 billion yuan in one year, and Meituan has said it will invest 100 billion yuan in merchant subsidies in three years, as well as expenditures on AI, it is too tired to cope with the competition in the overseas market at the same time;

Tencent once also experienced a reduction in the holdings of major shareholders, all of which brought considerable pressure on the share price.If it is a block trade, the impact of the discount will also have a corresponding impact on the secondary market share price on the same day/next day, even in a bull market cycle will take about 3 months to recover slowly, bear market cycle is far less than the broader market; if it is a direct reduction in the secondary market, Tencent is also through a corresponding amount of repurchases to support its secondary market share price.Meituan's cash flow may not be able to support the same amount of additional buybacks.

The short-term impact on Meituan's share price is negative, but the takeout war is unsustainable in the long run.

Comments