$Tesla Motors(TSLA)$ Robotaxi is officially on the road in Austin, and while the early feedback has been a bit more optimistic than the market predicted, and represents a disruptive innovation in the transportation industry, the road to commercialization is still uncertain.The main concerns are

1. actual FSD progress (moving away from hard indicators such as intervention mileage)

2. regulatory environment evolution (legislative developments in key markets)

3. Capital allocation strategy (balancing Robotaxi investment with traditional business needs)

Overall Industry Landscape

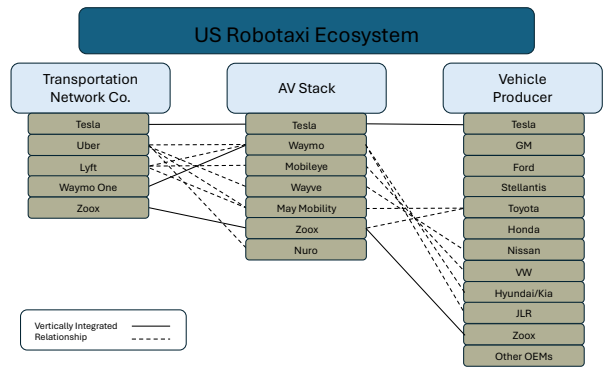

Currently, there are three main operating models in the Robotaxi sector:

Pure technology providers (e.g., $Alphabet(GOOG)$ 's Waymo): focusing on self-driving technology and relying on third-party vehicles and platforms

Full-stack solution providers (e.g., Zoox, $Intel(INTC)$ 's $Mobileye Global Inc.(MBLY)$ ): in-house development of technology, vehicles, and platforms

Tesla model: the only player targeting both consumer and enterprise markets

Tesla's differentiation is reflected in three areas:

Data Flywheel: collect real road data through one million consumer vehicles and continuously optimize the FSD system

Cost Advantage: Scale production reduces the cost of hardware, and it is expected that the cost of Robotaxi's specialized vehicles will be 30-40% lower than that of competitors.

Network effect: Individual vehicle owners can connect their vehicles to the Tesla network at any time, creating flexible supply capacity.

Commercialization path and key milestones

The development of Tesla Robotaxi is characterized by progressive commercialization, which can be divided into three phases:

1. Validation phase (2024-2026)

Small scale testing (Austin pilot only 10-20 vehicles)

Requires safety officer oversight, limited scope of operation (Geofencing)

Primary goal: validate technical reliability and build regulatory trust.

2. Expansion phase (2027-2030)

Fleet size expected to reach 18-25,000 vehicles

Gradual elimination of safety officers and expansion of operating areas

Unit economics begin to emerge (UBS forecasts EBIT margins of 25%)

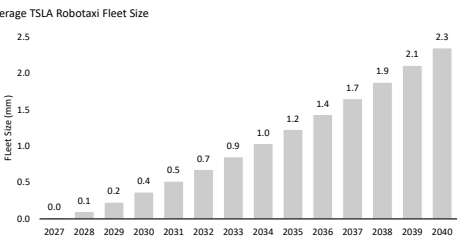

3. Maturity stage (2031-2040)

Formation of "Tesla-owned + user-contributed" hybrid fleet

Expected fleet size of 2.3 million vehicles

Diversified revenue mix (ridesharing fees, platform commissions, software subscriptions)

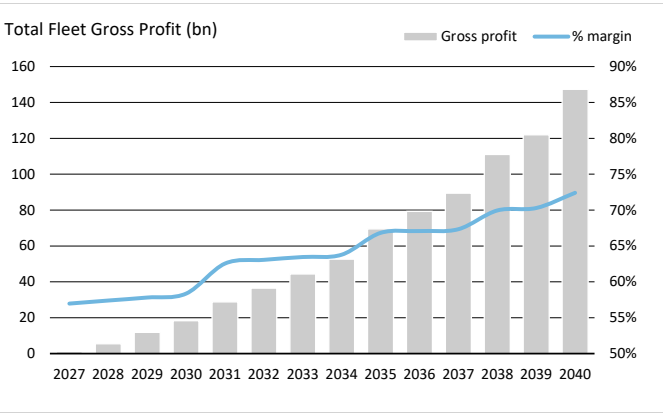

Financial modeling and value creation

The financial potential of the Robotaxi business is characterized by high growth and high margins:

Revenue drivers

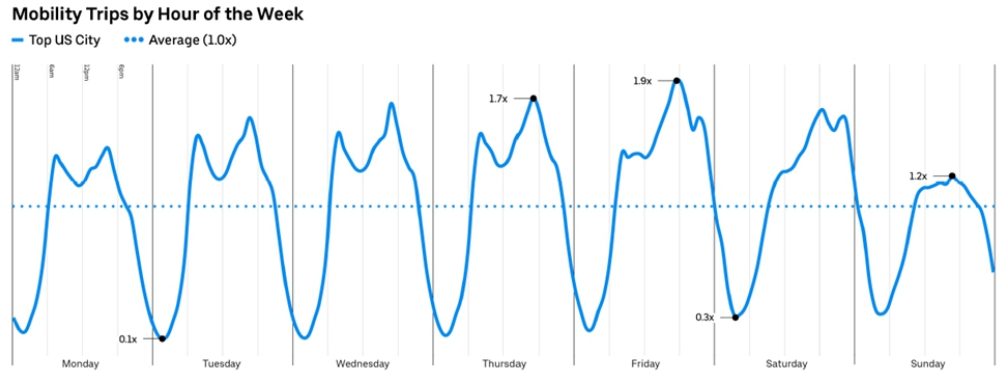

Utilization improvement: from 50% to 70% initially (UBS modeling shows peak utilization up to 60% in NYC market)

Pricing power: $3/mile initially, may drop to $2-2.5/mile in the long term due to competition

Fleet size: Goldman forecasts 1-10 million units, UBS more conservative (2.3 million)

Cost structure optimization:

Vehicle depreciation: 4 years/280,000 mile life cycle, 5% salvage value

Operating costs: insurance ($0.26/mile), charging ($0.10/mile) are the main variables

Scale effects: 200 miles per day per vehicle, ~$210,000 annual revenue (at 70% utilization)

Valuation divergence:

Goldman Sachs: using scenario analysis, value range of $2.50-$72.25 per share

UBS: more optimistic, valued at $350 billion (~$99/share)

Key difference: different assumptions on fleet size (UBS more conservative) and margins (UBS higher)

Core challenges and risk factors

Despite the promise, the Tesla Robotaxi strategy faces a trio of obstacles:

1. technical bottlenecks

Complex scenarios such as left turns still need to be optimized (Goldman report mentions navigation errors in Austin pilot)

Unproven ability to cope with extreme weather

Cybersecurity risks (increased attack surface as fleet size increases)

2. Regulatory barriers

Varying local permitting requirements (California requires specialized permits, new Texas regulations coming soon)

Lack of framework for determining liability for accidents

Data privacy compliance challenges (especially in the European and Chinese markets)

3. Economic viability

Poor initial unit economics (UBS model shows negative EBIT until 2027)

High capital intensity (vehicles + infrastructure investment)

Pressure on price differentials with traditional online rides and public transportation

Strategy takeaways

Based on our comprehensive analysis, we offer three key judgments on Tesla's Robotaxi strategy:

1. short-term caution, long-term optimism

Difficult to contribute material profits until 2026 (high costs in validation phase)

Likely to be a major profit engine after 2030 (UBS forecasts EBIT margin of 55% in 2040)

2. Share price already partially reflects expectations

Current valuation includes a ~$250-350B Robotaxi premium

Be wary of valuation pullback risk from technology delays or regulatory hurdles

3. Recommendations for differentiated strategies

Focus on the Sunbelt: prioritize rollout in climatically favorable areas to reduce technical complexity

Establishment of insurance subsidiaries: internalization of risk management and reduction of premium costs

Development of specialized vehicle models: optimization of cabin design and durability to improve unit economics

Comments