Big-Tech’s Performance

Week Macro Highlights: Diverging Markets Amid Peace; Is the Fed Splitting Too?

The Israel-Iran conflict appears to have reached a temporary conclusion this week. Although the U.S. launched strikes on three Iranian nuclear facilities, escalating tensions, a ceasefire was soon reached between Israel and Iran, easing market concerns. U.S. equities showed divergence: while the Nasdaq 100, driven by tech stocks, hit new highs, the Dow Jones, with its traditional energy sector heavyweights, remained below its peak.

Fed Chair Jerome Powell is facing off directly with Trump. Regardless of Trump's accusations that he's acting “too late,” Powell remained unmoved on rate cuts. In his congressional testimony this week, he emphasized a reluctance to “take the blame” and expressed concerns about tariffs. Meanwhile, dovish comments from two other Fed officials (hinting at a July rate cut) lifted market sentiment, leading to a rally in sectors like banking. Trump is reportedly considering an early announcement to replace Powell and is pushing for tax legislation to be finalized before July 4.

The stablecoin frenzy cooled somewhat this week, but market emotions don’t appear to have fully released.

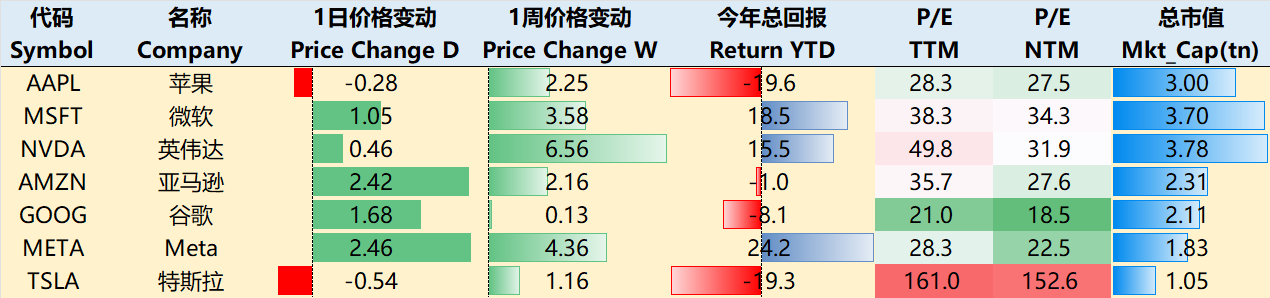

Among mega-cap tech names, most rose this week except Apple. As of the June 26 close, one-week performance: $Apple(AAPL)$ +2.25%, $Microsoft(MSFT)$ +3.58%, $NVIDIA(NVDA)$ +6.56%, $Amazon.com(AMZN)$ +2.16%, $Alphabet(GOOG)$ $Alphabet(GOOG)$ +0.13%, $Meta Platforms, Inc.(META)$ +4.36%, $Tesla Motors(TSLA)$ +1.16%.

Big-Tech’s Key Strategy

NVIDIA: From $3 Trillion to $6 Trillion?

The semiconductor industry, much like the broader market, has gone through wild swings in just four months — from “demand doubts” (a 30% pullback after DeepSeek’s debut) to a 40% rally on surging demand. As the industry bellwether, NVIDIA broke out to new highs after a month of consolidation, catalyzed by its shareholder meeting.

Key bullish factors include:

Clarity in Tech Roadmap: NVIDIA commits to releasing one AI chip per year (post-Blackwell will be Vera Rubin), and has signed sovereign AI agreements with nations like Saudi Arabia and the UAE.

Jensen’s Highlight on Robotics: CEO Jensen Huang emphasized robotics as the next mega-opportunity after AI, aiming to cover autonomous vehicles, humanoid robots, and smart factories.

Supply Chain & Partner Support: This week, memory chip supplier Micron reported record quarterly revenue and gave strong AI demand guidance.

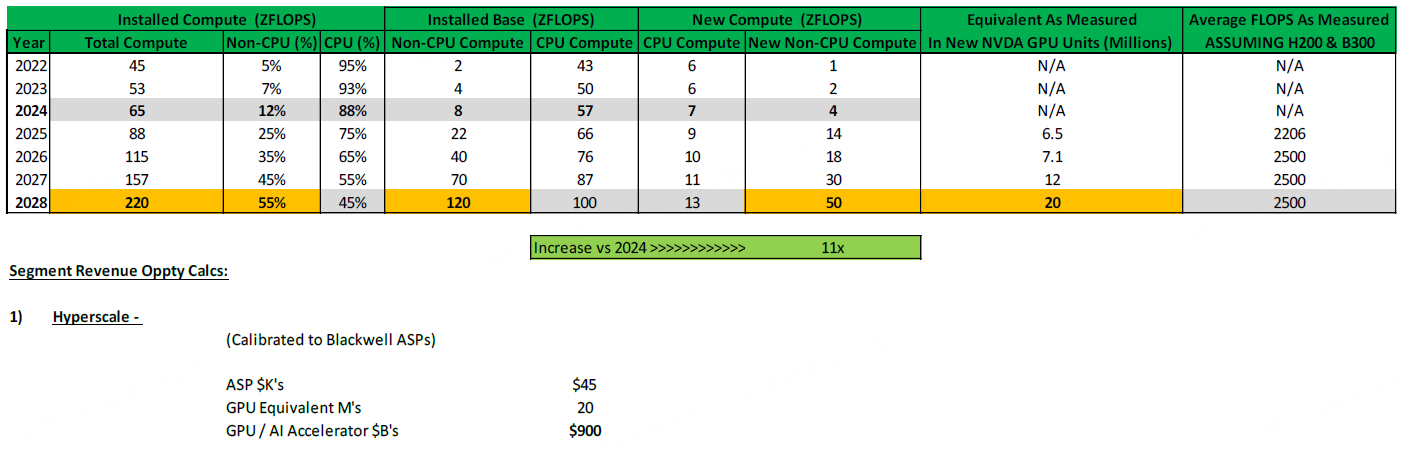

Consequently, several investment banks jumped on the bandwagon with “FOMO” upgrades. For instance, Loop Capital projected NVIDIA’s market cap could hit $6 trillion by 2028 (price target $250), citing expectations for $2 trillion in AI computing spend.

The main thesis revolves around hyperscalers shifting non-CPU compute (e.g., GPU, custom silicon, AI accelerators) from the current 12–15% share to 50–60% by 2028, resulting in ~$900 billion in annual spend.

This projection is based on NVIDIA’s own estimate: each 1 GW of compute power brings in $40–50 billion in revenue. By 2028, with a projected ~20 GW deployed, revenue could hit $900 billion.

Similarly, UBS also raised its NVDA price target, essentially arguing that GenAI demand remains underappreciated. More such bullish reports are likely to follow.

Overall, NVIDIA’s forward PE valuation has never been overly expensive. The target price hikes are mainly due to upward earnings revisions — some based on 2026 projections, others stretching to 2028 or beyond. Traditionally seen as a cyclical industry, semiconductors are now being re-rated in the AI era. Against this backdrop, the FOMO sentiment across the sector becomes much easier to understand. $GraniteShares 2x Long NVDA Daily ETF(NVDL)$

Big Tech Options Strategy

Focus of the Week: Robotaxi Expectations Diverge

TSLA experienced a dramatic rollercoaster this week, driven by market sentiment swings around its Robotaxi pilot. Shares surged 8.23% on Monday, only to drop 2.35% and 3.79% on Tuesday and Wednesday, as valuation concerns resurfaced. Lingering worries also include:

Q2 delivery warning: may fall 21% YoY

Texas factory shutdown: maintenance pause from June 30 to July 4

Declining market share in China: Jan sales -11% YoY vs. BYD +45%

Robotaxi could fundamentally reshape Tesla’s valuation logic. A successful Robotaxi business would pivot Tesla from an EV manufacturer to an AI-driven mobility platform, with revenue shifting from one-off vehicle sales to recurring mobility services and high-margin software subscriptions — a key to its second growth curve. Tesla’s unique camera-only approach (no LiDAR) reflects technical confidence but also introduces potential risks.

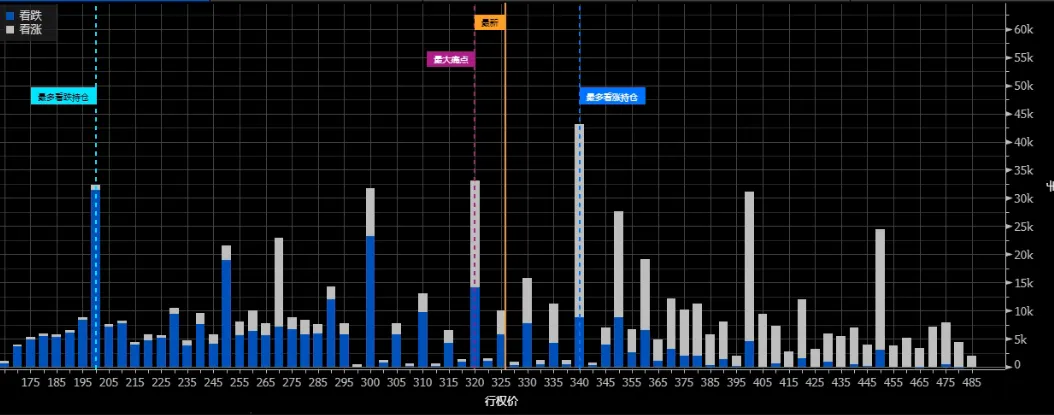

On the options front, recent price gains driven by Robotaxi optimism led to some profit-taking. Reviewing July’s option chain, both open interest on Calls and Puts have shifted downward. The “max pain” point (where most options expire worthless) is also trending lower, indicating heightened speculative activity ahead for July. $Direxion Daily TSLA Bull 2X Shares(TSLL)$ $GraniteShares 1.25X Long TSLA Daily ETF(TSL)$ $Tradr 2X Short TSLA Daily ETF(TSLQ)$

Big-tech Portfolio

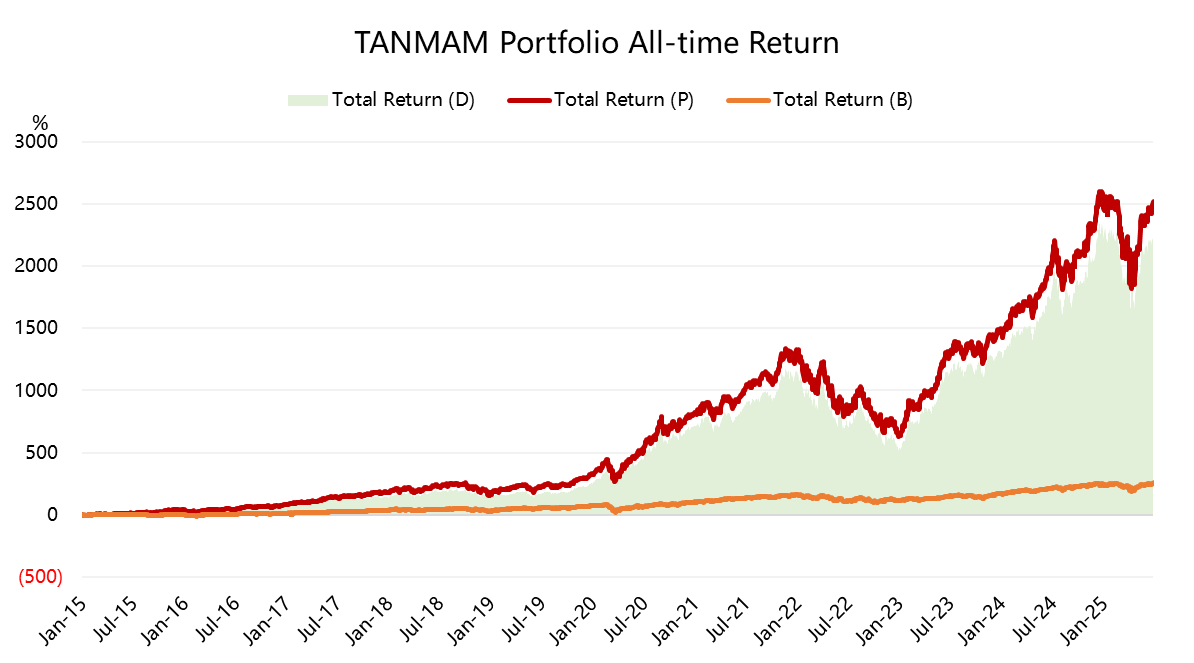

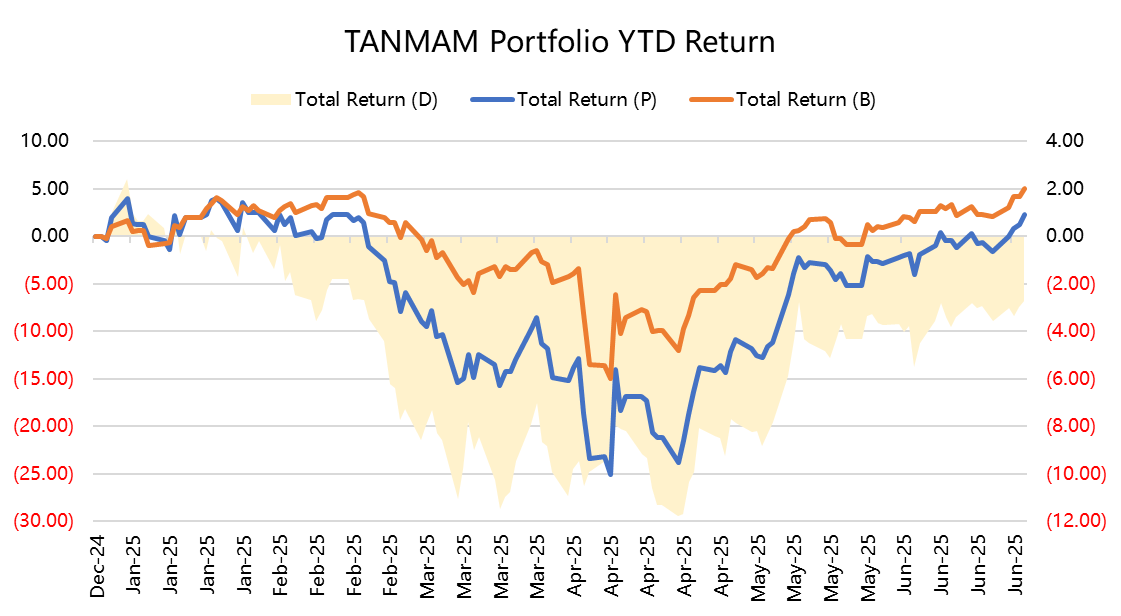

The “Magnificent Seven” tech giants can be structured into an equal-weight portfolio (“TANMAMG”), rebalanced quarterly. Backtesting from 2015 shows it vastly outperformed the $S&P 500(.SPX)$ with a total return of +2,517.77%, versus $SPDR S&P 500 ETF Trust(SPY)$ ’s +256.76%, yielding +2,261.01% in excess return.

In 2024 YTD, Big Tech has pulled back, with this portfolio returning +2.27%, lagging SPY’s +5.02%.

Over the past year, the portfolio’s Sharpe ratio fell to 0.84, versus SPY’s 0.57, with an information ratio of 0.36.

Comments

I love your section on " $NVIDIA Corp(NVDA)$ from 3 trillion to 6 trillion" [Cool]

Do you think it can go beyond, like to 12 trillion?