According to Bloomberg Intelligence forecasts, if $Xiaomi Corp.(XIACY)$ $XIAOMI-W(01810)$ 's electric vehicle (EV) business can reach break-even by the end of 2025, the likelihood of its credit ratings being upgraded to Baa1/BBB+ by Moody's and Fitch will significantly increase.

By bloomberg Analysts: Cecilia Chan, Steven Tseng

Read more>>

Cup and Handle Breakout in Xiaomi – What Traders Should Watch

Xiaomi's Meteoric Rise Post-SU7: Will YU7 Replicate the Surge?

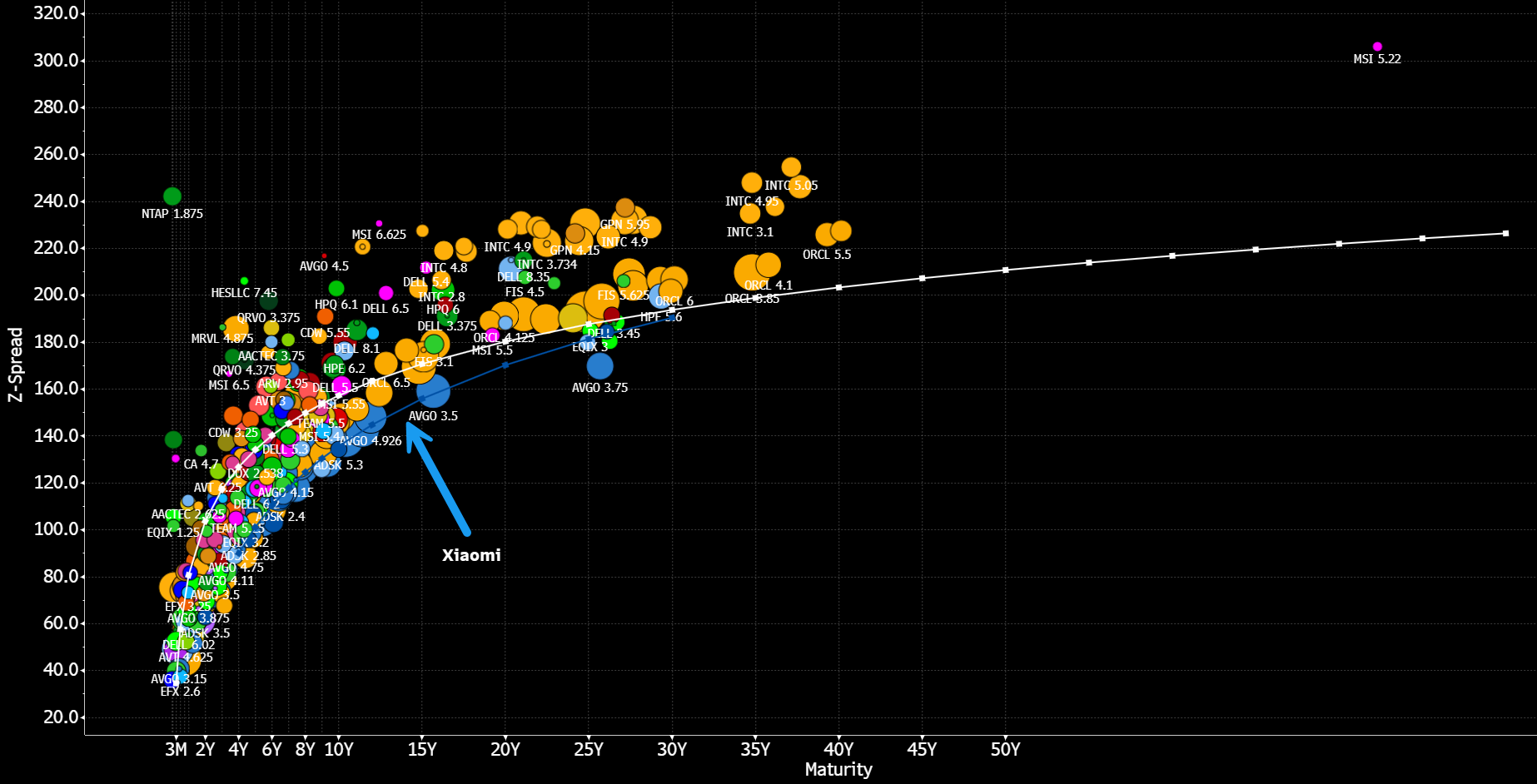

Among global BBB-rated technology companies, the trading spread on Xiaomi's dollar bonds is at the narrowest level, suggesting that the market may already have factored in this upside catalyst. With both rating agencies providing positive outlooks, the potential for a rating upgrade will depend on the launch of new models and the narrowing of losses in the EV business.

1. Xiaomi's EV Business Expected to Break Even by End of 2025

Xiaomi's strong supply chain management capabilities and the high similarity between its vehicle models could mean that the EV business reaches break-even faster than other EV startups. The supply chain for Xiaomi's high-cost-performance smartphones is quite complex, and the company's experience in managing it could make it more adept at managing the EV supply chain. Focusing on a limited number of models and the high similarity between the SU7 and YU7 are expected to accelerate production ramp-up and bring cost synergies.

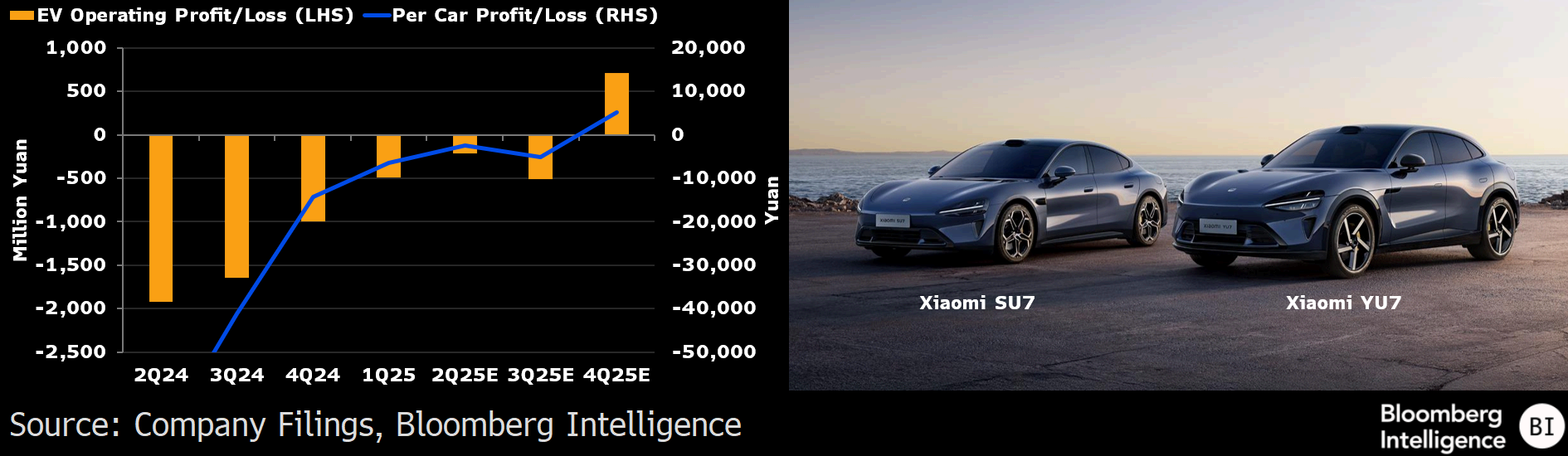

Xiaomi EV Business Operating Profit Forecast

We expect that due to the upfront expenditure for the second phase of the factory and the shift to new models, Xiaomi's EV business will still not be profitable in the second and third quarters. However, with the ramp-up of the new factory's production capacity, the EV business is expected to turn profitable in the fourth quarter. According to our calculations, the operating profit per vehicle is approximately 5,000 yuan.

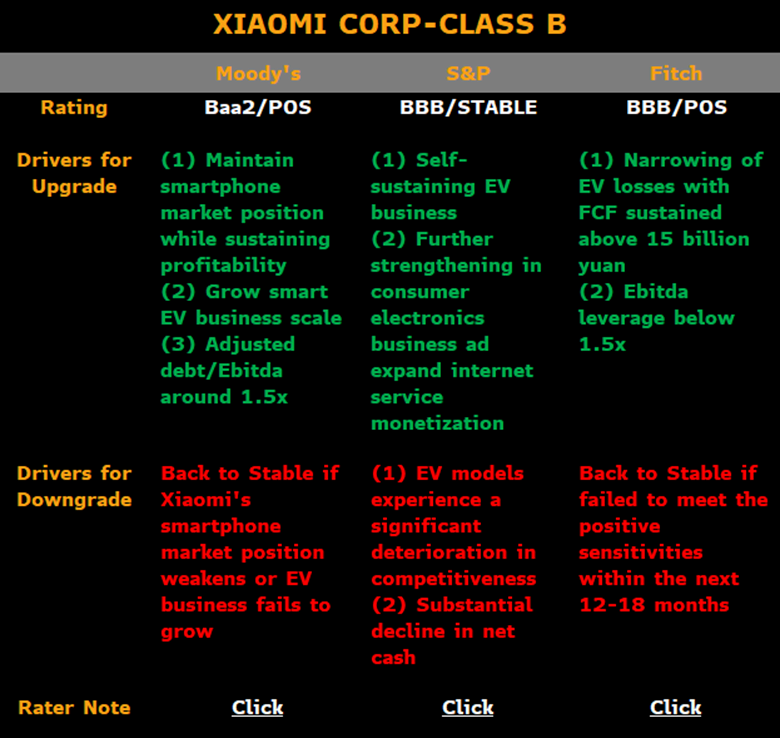

2. Key to Xiaomi's Rating Upgrade Lies in EV Business

The positive rating outlooks from Fitch and Moody's are mainly based on the strong cash flow generation capability of Xiaomi's Internet of Things (IoT) business, as well as the effective control of initial losses while gaining market share in the EV business. Additionally, Xiaomi's low exposure to tariff policy risks makes it a relative "safe haven" among Asian technology companies. Xiaomi's ample net cash position and continuously strengthening cash flow will strongly support its ongoing investments in the EV and artificial intelligence fields. According to market consensus expectations, by 2025, its adjusted leverage ratio is expected to drop to 0.7 times, which meets the condition to trigger a positive rating outlook. Whether Fitch and Moody's can upgrade Xiaomi's rating to BBB+/Baa1 within the next 12-18 months will depend on whether the EV business can significantly improve profitability while scaling up. For S&P to upgrade its rating to BBB+, in addition to requirements for the scale and profitability of the EV business, it also pays extra attention to the diversity of the product line. Given that Xiaomi currently has only one model, it will take time to establish a product matrix.

3. Lower Tariff Risk Exposure

Xiaomi's Bond Spread Outperforms $Lenovo Group Ltd.(LNVGF)$ $Lenovo Group Ltd.(LNVGY)$

Among global BBB-rated technology peers, the trading spread on Xiaomi's dollar bonds has narrowed to the narrowest level. This indicates that the market may have already factored in the expectation of its enhanced credit fundamentals, including the steady market share gains in smartphone and large appliance businesses, accelerated growth in EBITDA, and rapid deleveraging process. A lower proportion of U.S. business allows Xiaomi to better withstand the impact of U.S. tariffs. Although the EV business will initially consume a lot of cash, the company's strong credit metrics—expected leverage ratio to drop below 1 times by the end of 2025 and a net cash reserve of up to 5.5 billion U.S. dollars—provide a solid cushion for its current rating. Any substantial rating upgrade in the future will ultimately depend on the scale, product matrix, and profitability of the EV business. In the long run, with improving profit margins, expanding business scale, and deepening global network layout, Xiaomi's credit status is expected to continue to improve.

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

Comments