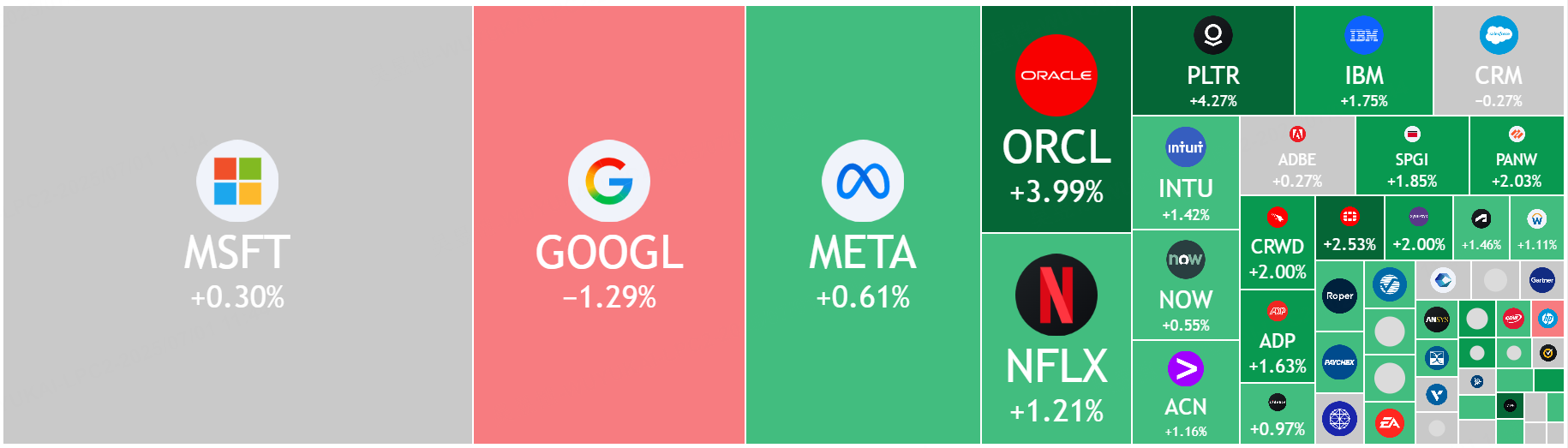

$Oracle(ORCL)$ led the tech sector higher on Monday, led by CEO Safra Catz, who hailed a "strong" start to fiscal 2026 and said in a filing with the SEC that "cloud database revenues continue to grow at more than 100%, with the signing of several large-scalecloud services agreements, one of which is expected to contribute more than $30 billion in annual revenue beginning in fiscal 2028."

Oracle's rise in the AI computing market

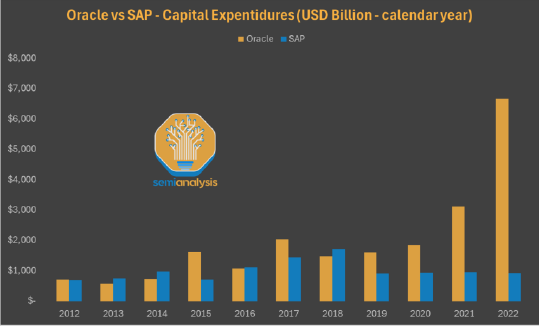

Oracle's cloud infrastructure (OCI) business has performed strongly in the AI computing market, far exceeding market expectations.Oracle was initially known for its enterprise software, particularly in the relational database and enterprise resource planning (ERP) software space, second only to Germany's SAP.

As cloud computing accelerated in the early 2010s, Oracle made a major transition to cloud database and ERP services, launching its OCI Gen2 cloud service in 2016, marking a shift from infrastructure to support its own software to a full-fledged cloud service aimed at competing with AWS, Azure, and GCP.

Strategic Data Centers and Partnerships

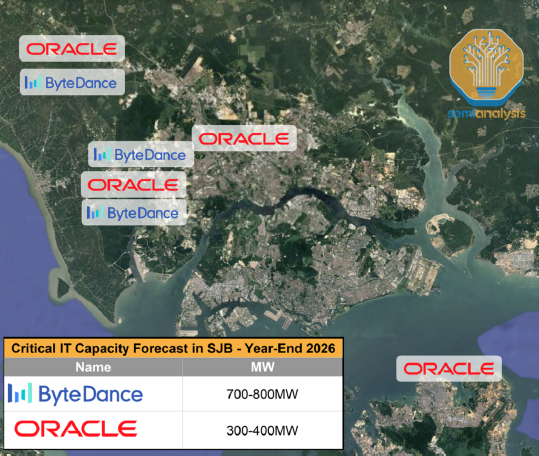

Oracle's success is due to its unique data center strategy, which combines traditional U.S. hyperscale cloud providers, AI-native "Neocloud," and a partnership approach with Chinese data center developers.Gigawatt-scale data center in Abilene, Texas, as part of OpenAI's Training Center and Stargate Joint Venture.

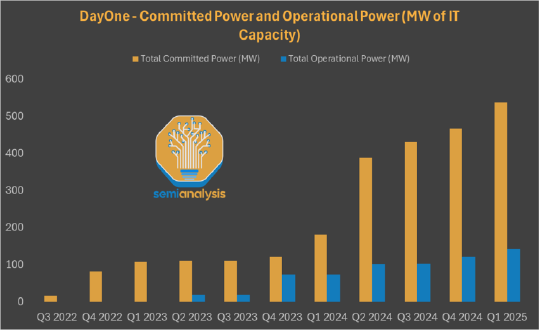

Despite Crusoe's lack of experience with large-scale projects, Oracle's bold move enables it to meet the computing needs of AI giants such as OpenAI and ByteDance.Additionally, Oracle's partnership with GDS International (now DayOne) in the Asia-Pacific region, specifically the AI center in Johor, Malaysia, is expected to deliver more than 1GW of committed power within a year.

Competitive Advantage and Technical Expertise

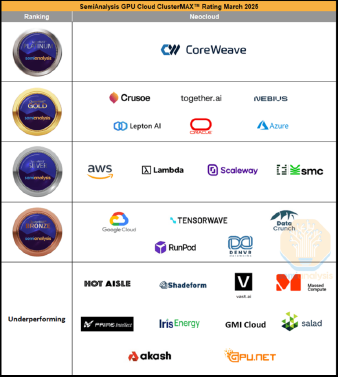

Oracle's competitive advantages in the AI computing market include significant cost savings, particularly in networking.Its adoption of the AI network model and Arista's 512T Tomahawk 5 high-base switch reduced network costs by 34.4 percent.In addition, Oracle's independently tested Gold ClusterMAX rating for its technical capabilities in software, networking, security and storage has attracted a broad customer base ranging from large enterprises to small companies.

Oracle also leveraged its relationships with existing customers by partnering with ByteDance in the Asia Pacific region to offer GPU capacity upsells through GDS International.This relationship-driven strategy strengthens its market position and enables it to expand from traditional cloud services to AI infrastructure.

Challenges and Risks

Despite significant progress, Oracle faces multiple challenges. sustainability of the GPU business is uncertain due to competition from hyperscale cloud providers and new entrants.

Uncertainty about financial returns, the ability to effectively upsell high-margin services, and the risk that prices could collapse at the end of a contract are major issues.Entering into long-term contracts with unproven developers such as Crusoe poses credit and term risk, especially given that OpenAI is on the hook for up to $10 billion in annualized fees in mid-2024 despite achieving only $2 billion in annualized revenues.

Additionally, grid stability issues in gigawatt-scale data centers can lead to outage risk, requiring reliance on innovative solutions such as Tesla Megapacks and gigawatt-scale batteries.

Key Developments and Financial Outlook

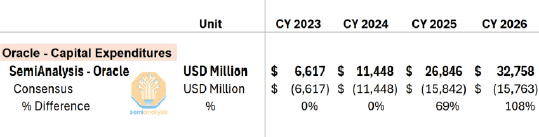

As of early 2025, Oracle will have secured $150 billion in contracts over the next 12 months, driven by strong demand for GB200/300 rack orders and shipments.

The Stargate project, which, despite vague public information, primarily involves an 80MW OpenAI deal in Abilene, has been credited to Oracle's financial statements in late 2024 and early 2025.

Expansion in Asia Pacific, particularly with ByteDance and DayOne, is expected to deliver rapid growth, with power commitments exceeding 1GW within a year.

The GPU contract is expected to deliver EBIT margins in excess of 40%, and assuming steady growth in the non-cloud business, a 9% CAGR in the SaaS business, and 25% growth in non-GPU IaaS, the company's overall EBIT is expected to grow at a CAGR of more than 20%, with significant revenue growth from 2025-2027.However, prices may decline at the end of the contract and long-term sustainability needs to be carefully assessed.

Comments