Big-Tech’s Performance

Macro Headlines This Week:

“The Great and Beautiful” bill passes; conflicting employment data; U.S.-Vietnam tariff deal reached, but July 9 deadline looms?

The "Great and Beautiful" Bill, championed by Trump, passed the Senate in a 50-50 tie (with Vance casting the decisive vote). The House also approved it on July 3, and it's expected to be signed into law on July 4. While markets fear it may worsen the fiscal deficit, it could provide a short-term economic boost — potentially just the beginning. In response, Elon Musk once again lashed out, threatening to form a new political force to oppose it.

Employment Data Clash:

June ADP report showed a drop of 33,000 jobs (vs. forecast of +98,000), pushing the probability of a July rate cut to over 27%.

However, the next day, the NFP report showed an increase of 147,000 jobs (vs. forecast of 100,000), with unemployment falling to 4.1%, driving rate cut expectations sharply lower — to below 7%.

The discrepancy arises mainly from different methodologies: ADP uses payroll data from its clients (mostly SMEs), while NFP is a broader survey including temps, part-timers, and specific sectors. So, the true state of the labor market remains debatable. Fed Chair Powell had hinted at potential early cuts if the job market weakened, but after the NFP data, Atlanta Fed’s Bostic stated the labor market remains healthy, supporting a “wait-and-see” stance.

U.S.-Vietnam Trade Agreement:

Tariff rate set at 20% (with 40% for transshipped goods), higher than the UK’s 10%. Vietnam will also open its markets to U.S. products and buy $8B worth of Boeing aircraft.

Meanwhile, U.S.-Japan negotiations stall. Japan refuses to retain the 25% auto tariff, and the U.S. threatens to impose 30%-35% tariffs. Trump said letters would be sent to affected countries starting today, with final decisions on new tariffs by July 9. Another round of “TACO” coming?

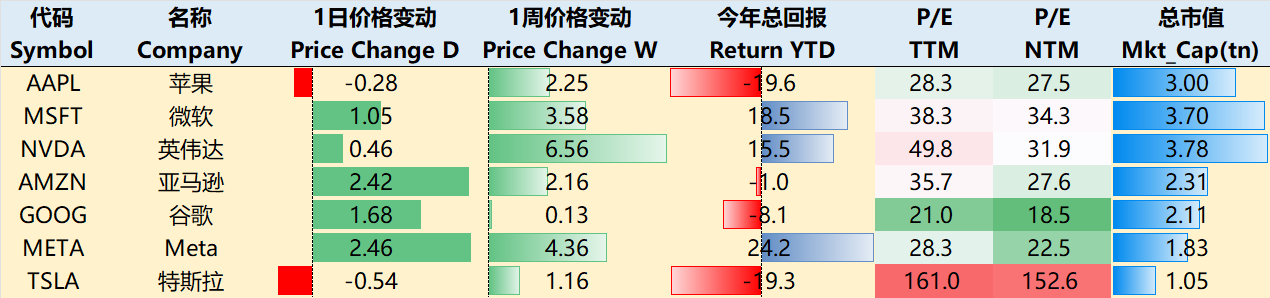

Big Tech Weekly Performance (through July 3 close): $Apple(AAPL)$ +6.24%, $Microsoft(MSFT)$ +0.28%, $NVIDIA(NVDA)$ +2.79%, $Amazon.com(AMZN)$ +2.90%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ +3.45%, $Meta Platforms, Inc.(META)$ -0.98%, $Tesla Motors(TSLA)$ -3.20%

Big-Tech’s Key Strategy

Apple’s Redemption Arc

Apple is simultaneously dealing with challenges across multiple fronts: hardware innovation (headsets/foldables), AI strategy (external partnerships), service diversification (cloud), and regulatory compliance (especially in the EU).

1. Apple vs. EU App Store Regulations: Strategic Concessions Under Pressure

Apple is in the final stages of negotiations with the EU over changes to App Store rules to avoid massive fines. The EU previously fined Apple €500M for violating the Digital Markets Act (DMA), demanding it open up to third-party payments and remove "anti-steering" clauses.

Apple’s potential concessions include:

Relaxing payment restrictions: Allowing developers to offer external payment options, reducing reliance on the 30% “Apple Tax.”

Adjusting core tech fees: Apple may revise its €0.50 per install charge for apps with over 1 million annual downloads to appease developer discontent.

If talks fail, Apple faces daily fines of 5% of global revenue (~$55M/day). This standoff reflects Apple’s struggle to balance ecosystem control with regulatory demands — and may reshape its service profit model in the long term.

2. AI Strategy Shift: Abandoning In-House LLM, Betting on External Partnerships

Apple’s in-house foundation model (Apple Foundation Models) is lagging behind competitors like Anthropic’s Claude and OpenAI’s GPT-4. Its original 2026 target for “LLM Siri” may be scrapped. The revised strategy includes:

Prioritizing partnerships: Apple is negotiating with Anthropic and OpenAI to customize models for its Private Cloud Compute infrastructure. Claude outperforms, but licensing costs are high; OpenAI is a fallback.

Dual-track approach: Lightweight models (e.g., email summarization) will remain in-house; complex tasks will run on third-party cloud models. However, due to server capacity constraints, APIs won’t yet be open to developers.

Internal unrest: Morale within the AI division is low, with key talent leaving (e.g., Tom Gunter), and the MLX open-source team near disbandment. Leadership is split: Siri head Mike Rockwell favors partnerships, while software chief Craig Federighi supports pragmatic in-house development.

Markets are optimistic about the shift (Apple shares +2%), but long-term dependence on external AI may weaken Apple’s privacy and ecosystem moat.

3. Headsets & Foldables: The Next Hardware Frontier

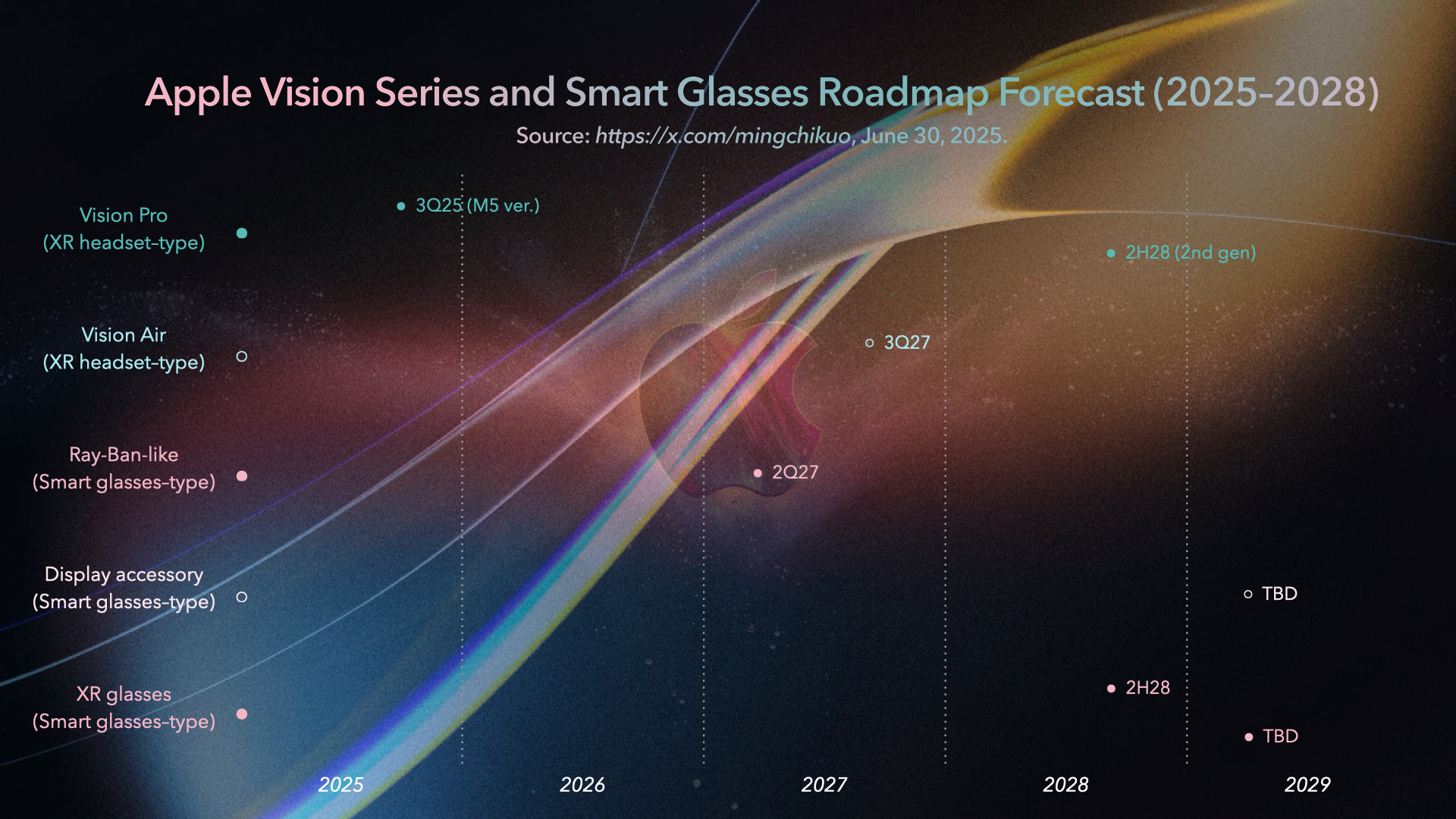

Apple views headsets as the “next-gen computing platform,” with seven products planned across two tracks: Vision and smart glasses.

Vision Series:

Vision Pro M5 (2025 Q3): Upgraded M5 chip; niche product with 150K–200K units expected.

Vision Air (2027 Q3): 40% lighter, plastic/magnesium build, lower price point to target mass market.

Vision Pro 2 (2028): Redesigned, Mac-level processor, further price cuts.

Smart Glasses:

Ray-Ban-style glasses (2027 Q2): No screen; voice/gesture control, photo capture, AI context awareness. 3–5M units expected, partial AirPods/phone replacement.

XR Glasses (2028): Color AR via LCoS + waveguide display tech.

Foldable iPhone:

First model expected in 2026; ultra-premium positioning ($2,000–$2,500), multimodal AI support. Inward folding, 7.8" display, side fingerprint ID, titanium hinge to reduce crease visibility.

4. Cloud Services Strategy: Apple’s Chips vs. AWS & Microsoft

Apple is exploring cloud services based on its own chips (project code: "ACDC"), planning to lease servers to developers — a direct challenge to AWS, Azure, and Google Cloud. Key drivers:

Tech validation: Private Cloud Compute already powers Apple Wallet and Vision Pro processing. Tests show 30% lower costs vs. traditional servers in AI inference tasks.

Business motives:

Reduce reliance on third-party clouds (current spend ~$7B/year).

Grow services revenue (already 26% in 2024), offset App Store regulatory risks.

Attract developers: MLX open-source framework optimized for Apple chips, currently limited to on-device models; cloud capabilities still under construction.

Biggest hurdle: lack of enterprise services experience and fierce competition from Google Cloud (2024 revenue: $43.2B).

Big Tech Options Strategy

Focus of the Week: META’s Poaching Spree

META is in advanced talks to acquire PlayAI, a voice AI startup specializing in converting human commands into machine-executable code. Their tech outperforms Google Assistant and Siri in handling complex instructions — ideal for boosting Messenger interactions and Oculus VR experiences. Deal not yet finalized.

Meanwhile, META has reportedly poached top talent from OpenAI and DeepMind, especially in multimodal and AGI areas. Notable hires include:

Lucas Beyer

Alexander Kolesnikov

Xiaohua Zhai

Shengjia Zhao

Jiahui Yu

Shuchao Bi

Hongyu Ren

Trapit Bansal

These researchers have strong track records in reasoning systems, large language models, and multimodal AI.

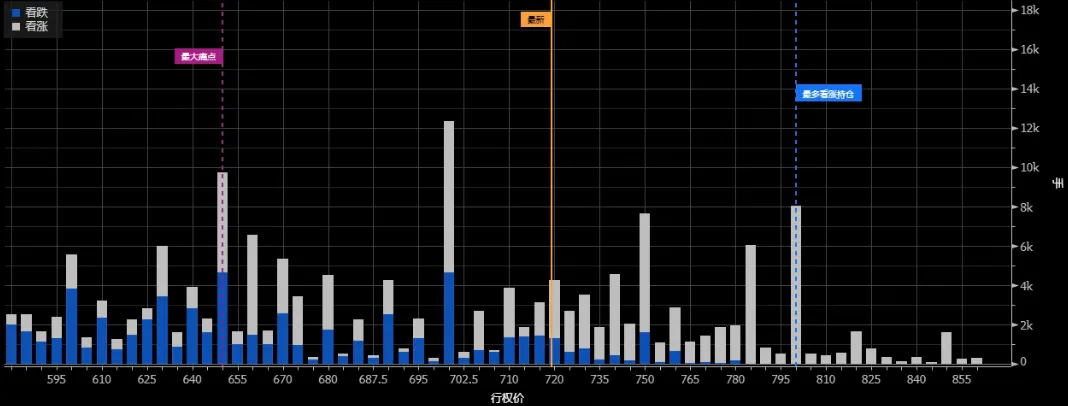

Options Data: META’s price dipped after record highs, but buying interest remains strong. Open interest shows confidence in META moving towards the $750–$800 range. Previously, heavy PUT positions in the $500–$600 range created pain points to the left of current prices — but now, new positions have shifted upward, suggesting bullish sentiment persists.

Big-tech Portfolio

The “TANMAMG” portfolio (equal-weighted “Magnificent Seven”) is rebalanced quarterly. Since 2015, it has vastly outperformed the S&P 500:

TANMAMG total return: +2561.36%

SPY return: +264.62%

Excess return: +2296.74%

2024 YTD Performance:Big Tech up 3.97%, lagging behind SPY’s 7.34%. Sharpe Ratio (past year): TANMAMG = 0.66 vs. SPY = 0.62 Information Ratio: TANMAMG = 0.46

Comments