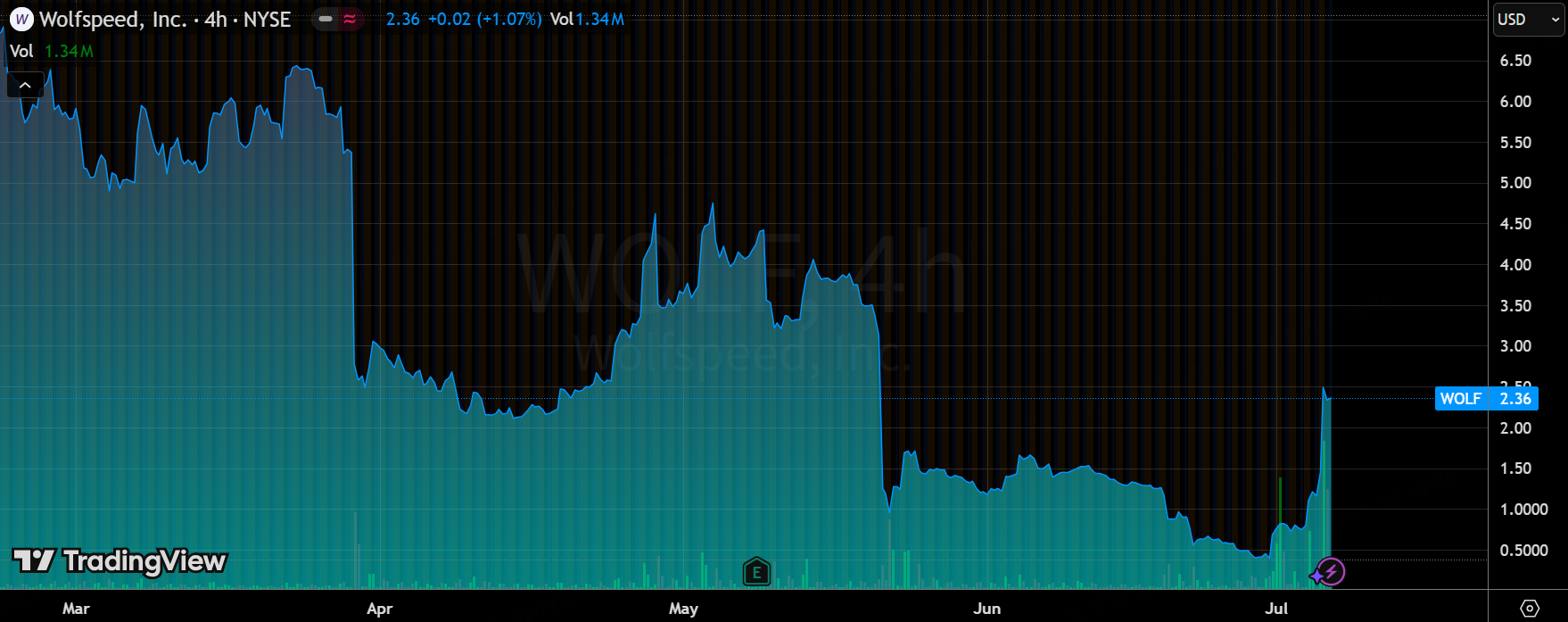

$Wolfspeed Inc.(WOLF)$ shares nearly doubled on Monday on good news from its bankruptcy reorganization, with the market expecting contact with bankruptcy status by Q3.Meanwhile, the company appointed Gregor van Issum, a former AMS-OSRAM AG and $NXP Semiconductors NV(NXPI)$ Semiconductors executive, as CFO, effective Sept. 1st.

I. Core elements of bankruptcy reorganization and market reaction

Debt Restructuring Plan

Wolfspeed filed for bankruptcy protection under Chapter 11 of the Bankruptcy Code on June 30, 2025, and plans to reduce its total debt by 70% (approximately $4.6 billion) through a Pre-packaged Bankruptcy, while obtaining $275 million in new financing.The reorganization will reduce annual cash interest expense by 60% and significantly improve cash flow.

Creditor support: Major creditors Apollo Global Management, Renesas Electronics and others have signed a Restructuring Support Agreement (RSA) agreeing to convert claims into equity in the new company, with existing shareholders potentially retaining up to 5% of the equity value.

Operational security: The company is committed to maintaining normal operations during the reorganization period to ensure that customer deliveries and employee compensation will not be affected.

Logic of the stock price surge

Short Squeeze (Short Squeeze): the stock price surged 170% in a single day after the bankruptcy news was announced, mainly due to the short ratio of nearly 50%.When positive reorganization triggered the closing of short positions, it was forced to buy back shares to push up the stock price.

Reversal of market expectations: significant debt reduction (from $6.5bn to $1.9bn) and enhanced liquidity ($1.3bn in cash reserves + new financing) led investors to revalue the company's long-term value.

Root causes of the financial crisis: expansion mistakes and external shocks

Aggressive Expansion and Low Capacity Utilization

Wolfspeed spent $5 billion to build the world's first 8-inch silicon carbide wafer fab (Mohawk Valley, New York), but the capacity utilization rate of 2024 is only 20%, far below the industry average, resulting in excessive fixed cost sharing.

During the same period, capital expenditures amounted to $2.1 billion, while revenue was only $807 million, costs out of control exacerbated losses.

Market Competition and Policy Risks

Rise of Chinese vendors: $Tianke Heda, Tianyue Advanced and other Chinese companies seize the market by virtue of their cost advantage (wafer cost is only 1/4 of Wolfspeed's), and their combined market share will reach 34.4% in 2024, squeezing Wolfspeed's share (from 62% to 33.7%).

Risk of subsidies falling through: the Trump administration is proposing to repeal the Chip Act, so that Wolfspeed may not be able to obtain the original $750 million in subsidies, leading to a break in the financial chain.

Changing Market Demand

Weakness of electric vehicle market: $Tesla Motors(TSLA)$ and other car companies delayed orders and reduced the amount of silicon carbide, resulting in Wolfspeed's revenue declining sequentially (2025 Q3 revenue down 14.9% year-on-year).

Third, the change of senior management and strategic adjustment

Mission of the new CFO and COO

Gregor van Issum (new CFO) is experienced in the semiconductor industry as a former ams-OSRAM and NXP executive, with a mission that includes optimizing the capital structure and boosting profitability [citation: user-supplied news].

David Emerson (new COO in May) is responsible for driving capacity consolidation and shutting down inefficient fabs (e.g., 150mm wafer fabs in North Carolina), targeting $200 million in annual cost savings.

Technology path realignment

Abandon 150mm device market and focus on 200mm (8-inch) high-end wafer production, focusing on high-priced markets such as AI data centers and energy storage.

Mohawk Valley factory has contributed to revenue growth (2025 Q3 revenue of $78 million, up 50% YoY), proving the potential of 8-inch technology.

IV. Industry Outlook and Post-Reorganization Challenges

Silicon carbide market long-term growth

Industry scale is expected to reach $7 billion in 2027 (CAGR 25%), electric vehicles, photovoltaic is still the core driver.

Wolfspeed's technological advantage remains: 200mm fully automated production line has scarcity, and may return to high-end market after reorganization.

Key challenges after reorganization

Capacity creep: need to rapidly ramp up Mohawk Valley plant utilization (targeting 60% by 2026) to turn cash flow positive.

Debt risk: Remaining debt of about $1.9 billion, may fall into crisis again if demand recovery is not as expected.

Dilution of shareholders' equity: the original shareholders' equity has shrunk significantly after creditors replaced 95% of the equity, and long-term confidence needs to be supported by performance.

Opportunities and risks on the road to rebirth

Short-term positive: Debt reduction and short position unwinding drive stock rebound, but be wary of volatility risks.

Long-term key: whether new management can achieve 2026 profitability targets through technology focus (200mm wafers) and cost control ($200 million annual savings).

Industry warning: Wolfspeed's case reveals the risk-balancing challenges of high-investment expansion in the semiconductor industry, especially in the context of volatile policy and demand.

Table: Wolfspeed's core terms of debt restructuring

Whether Wolfspeed can regain the market share eroded by Chinese manufacturers after the restructuring will be the ultimate test of its rebirth.

Comments