In the past few years, $Oracle(ORCL)$ in the eyes of most people is an "old-school factory": database license sales, rely on services to eat the old money, flat growth.But now access to AI, climbed into a large capital expenditure customers, the problem will come.

First the conclusion: OCI's second growth curve is promising

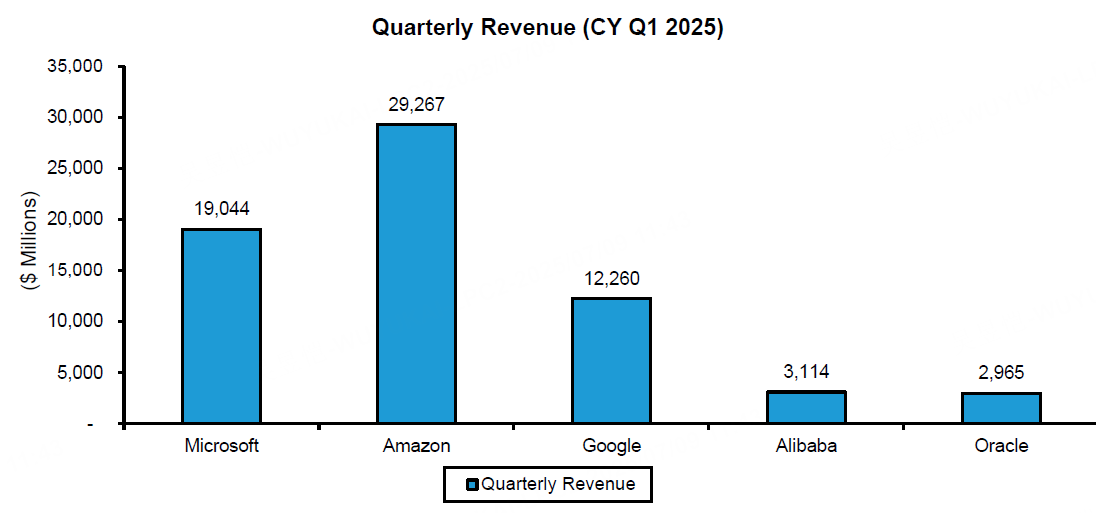

Over the past year, Oracle's Cloud business (primarily OCI, which is its cloud infrastructure) has become a real growth engine.According to estimates, FY25 (ending May 2025) OCI revenues reached $10.2 billion, up a full 50% year-over-year, and that growth rate was maintained for two years in a row.

And that number isn't even the whole family bucket - it only counts IaaS + PaaS (that's arithmetic + data platforms) and doesn't include the entire SaaS business.

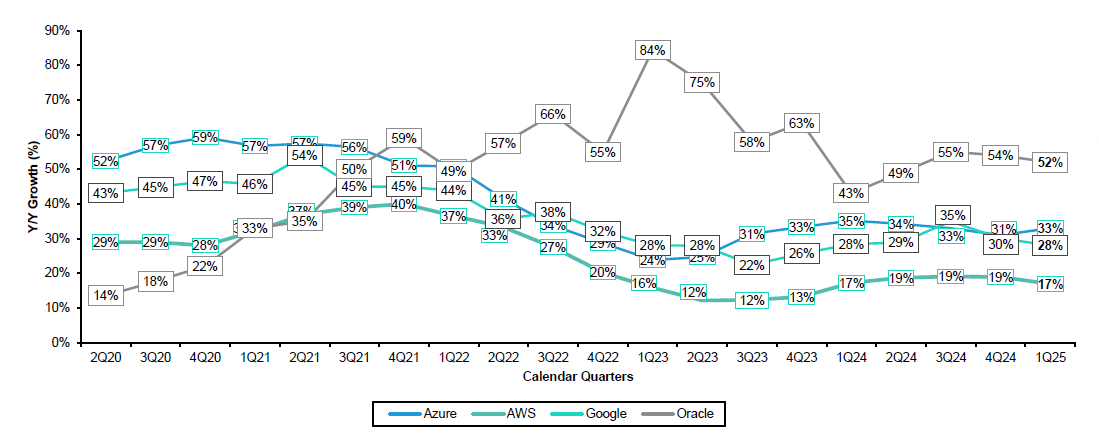

Comparison of peers: $Amazon.com(AMZN)$ AWS, $Microsoft(MSFT)$ Azure, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ GCP and other giants, the base has been very large, the annual growth rate has fallen to more than 20%, Oracle's current OCI, the growth rate is still more than 50%, and the momentum is still very strong; although the base is small, but is close to $Alibaba(BABA)$ Ali Could, and is expected to take "the world's fourth largest cloud ".Aliyun, and is expected to take the "world's fourth largest cloud vendor" position.

What exactly is OCI?Why is it growing so fast?

Oracle's Cloud Infra is actually more than just a "cloud server", its combination of punches include:

Oracle Cloud@Customer: Oracle's cloud equipment to the customer's local, government and enterprise customers to engage in "sovereign cloud";

OCI Gen2 public cloud: like AWS kind of data center, hosting AI training, big model, database and other workloads;

Autonomous Database: autonomous database service, Oracle's strength, database with AI O&M;

Alloy Plan: similar to White Label Cloud, licensing Oracle's technology to local operators, rapid expansion in overseas markets;

AI training: the FY25 piece brought in $1.5~2.2 billion in revenue, mainly by the GPU training business.

Oracle is now engaged in AI training, and even signed OpenAI super large orders, rumors may be billions of dollars level of GPU orders.At the same time there are rumors of a recent (Asian) order, the customer wants the company's "full capacity, wherever it is, either in Europe or in Asia", the market forecast may be bytes?

How fast is OCI growing?

Oracle + AI is not just talk.

AI cloud was previously considered Microsoft/AWS territory, but Oracle is also cutting the cake.First of all, in cooperation with Microsoft, launched the "Oracle Database@Azure" service, Azure users can directly access Oracle's database, Oracle is still charging money; and then Oracle directly put their own Gen2 cloud racks into the Azure data center, eliminating latency problems, the service experience is not inferior to native Azure; in addition, Google, Amazon is also in the AI cloud.Eliminate the latency problem, the service experience does not lose native Azure; In addition, Google, Amazon is also "learning" Azure, began to support the Oracle database cloud deployment.Multi-cloud deployment + database binding = growth + lock-in customers, a multi-two punch.

This batch of AI data centers that Oracle is getting (like Abilene's training center, Malaysia's 6.5B project, and Abu Dhabi's Stargate project) are all GW level in size, solid heavy asset investments.

The market is a bit of an afterthought?

Because OCI's growth rate is a bit "quiet and fierce", Oracle's financial results are not disclosed in detail, many people are concerned about the AI hype, stock valuation is not high, but ignored the most solid part of the growth.

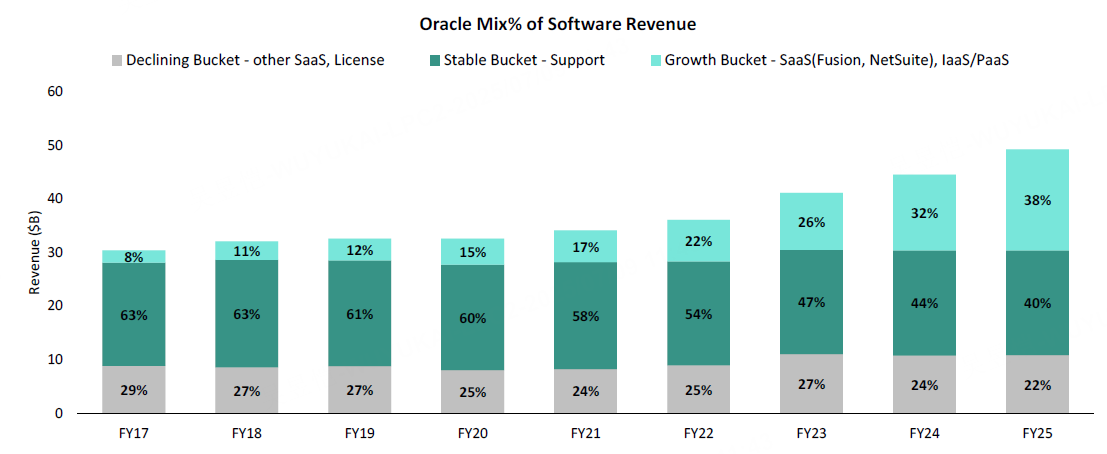

SaaS part is also growing steadily, especially ERP/HCM back-end products (Fusion + NetSuite); OCI has become the fastest-growing segment in the revenue structure; Oracle's overall gross margins fell slightly (because of low gross margins in the AI training segment), but operating profits are still high; support revenue remains stable because customers still use the old License in the cloud, and still pay maintenance fees.The support revenue remains stable because customers still use the old License on the cloud, and still pay the maintenance fee, this set of "double revenue model" is still effective.

"Oracle is probably one of the most undervalued Cloud+AI composite stories in the US stock market right now.

It's not as sexy as NVIDIA or as big as MSFT, but it is:

Continued high growth rates in cloud revenue (OCI);

Underlying database dominance;

Working with MSFT/Google/AWS rather than against them;

AI training infrastructure in hand;

Solid financials and reasonable valuation (FY26 expected PE 33x);

Oracle has gone from a 'slow-growth, old-school database company' to a cloud vendor feeding off AI data centers."If you believe that AI training + sovereign cloud + multi-cloud architectures will be increasingly important in the future - then Oracle is getting ahead of the curve and is already cashing in.

Comments