Big-Tech’s Performance

Macro Headlines This Week: Tariff Escalation? Fed Divided; U.S. Markets Enter Structural Rotation

Tariff Escalation:

Early this week, Donald Trump announced new tariffs ranging from 25% to 40% on goods from countries including Japan, South Korea, Malaysia, and South Africa. The announcement on July 7 triggered immediate market panic. On July 9, Trump expanded the global trade war further by imposing a 50% tariff on Brazilian goods and planning a similar 50% tax on copper, set to take effect on August 1. While long-term impacts remain uncertain, copper prices surged in the short term, boosting related mining and metal stocks. Data suggests that uncertainty from this cross-border trade war is gradually seeping into corporate earnings and consumer costs.

Federal Reserve Division:

Minutes from the Fed’s June meeting showed most officials favored delaying rate cuts, with only two supporting action in July. Fed Governor Waller, considered a likely successor to Powell, argued that easing is justified as inflation cools and employment stabilizes, but others want more data before acting. Meanwhile, Trump kept pressuring Powell, saying current interest rates are 3 percentage points too high. With September rate cut odds still over 60%, this internal divide and murky economic signals mean the Fed is unlikely to act decisively in the short term. Markets now await upcoming inflation and labor data.

U.S. Equities Top Out, But Sector Rotation Emerges:

Midweek, all three major U.S. indices—S&P 500, Nasdaq, and Dow—reached new highs, with Nasdaq closing around 20,630 and S&P near 6,280 on July 10. Nasdaq led the gains thanks to a rebound in AI and tech stocks. Small caps, as reflected in the Russell 2000, also saw moderate gains, placing mid- and small-cap names among the week’s best performers. Airline stocks (e.g., Delta, United) surged on strong earnings guidance, while traditional consumer and energy sectors lagged. These moves highlight a distinct structural rotation within the market.

Big Tech Diverged Sharply This Week (as of July 10): $Apple(AAPL)$ -0.01%, $Microsoft(MSFT)$ +2.12%, $NVIDIA(NVDA)$ +4.36%, $Amazon.com(AMZN)$ +1.06%, $Alphabet(GOOG)$ -0.57%, $Meta Platforms, Inc.(META)$ +1.92%, $Tesla Motors(TSLA)$ -1.83%。

Big-Tech’s Key Strategy

Nvidia Crosses the $4 Trillion Milestone

Nvidia became the first company to surpass a $4 trillion market cap, making it one of the most resilient and crowded trades amid tariff-induced uncertainty. The "All in AI" thesis has turned Nvidia into the industry standard in accelerated computing. While there are concerns about peaking growth and the rise of custom accelerators, Nvidia holds multiple structural advantages that may support continued outperformance.

Upcoming Catalyst: Earnings

AI Monetization to Improve Visibility: Key uncertainty lies in how much incremental revenue AI brings, especially through enterprise cost-savings. Capital expenditures on AI infrastructure are expected to grow over the next 2–3 years, albeit at a slower pace. This trend could improve confidence in Nvidia’s FY2026 revenue, easing fears of a growth peak.

Diversified Customer Base to Reduce Concentration Risk: Previously, 65%-70% of data center revenue came from U.S. hyperscalers. With the rise of Gen-AI, the customer base now includes sovereign clients and emerging hyperscalers. We estimate sovereign AI contributed $12 billion (10% of DC revenue) in FY25 and will grow further in FY26. Enterprise adoption is also accelerating, helping to reduce geographic/geopolitical risks such as China export limits.

Blackwell Deployment On Track; Inventory Concerns Overblown: Despite market noise about delays, multiple field checks confirm Blackwell rollout is going smoothly. It already accounts for 70% of FY25 Q1 data center revenue. Transition from Hopper to Blackwell is mostly complete. Large clients are installing ~1,000 GB200 racks per week and scaling further in Q2, easing concerns over ODM inventory build-up.

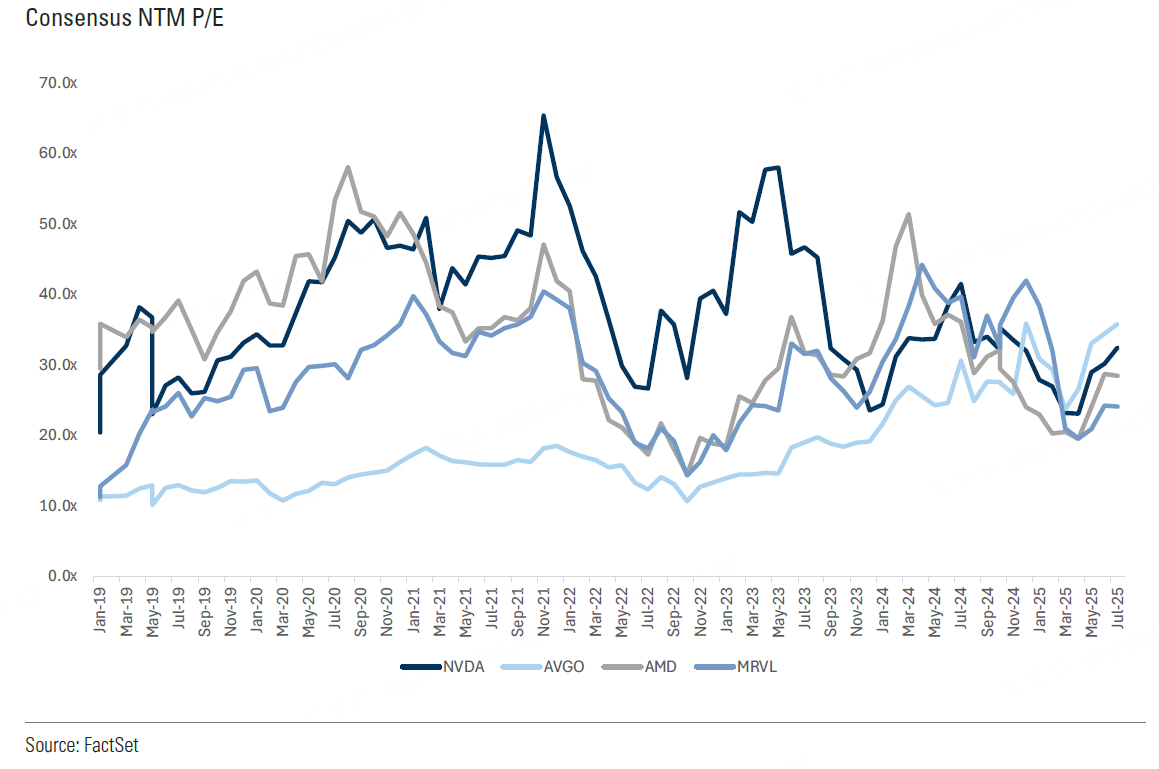

Valuation Support via Industry Leadership: Nvidia’s R&D budget dwarfs peers; its CUDA software ecosystem and model accuracy beat $Advanced Micro Devices(AMD)$ . Forward P/E is slightly behind $Broadcom(AVGO)$ , ahead of AMD/ $Marvell Technology(MRVL)$ , and still below its 5-year average.

Bonus Gossip: $Goldman Sachs(GS)$ ’ top Nvidia analyst, Toshiya Hari, recently left to join Nvidia’s IR team. A two-way bet of this kind is arguably the ultimate “Buy” rating. While analysts jumping to the corporate side is common, joining a chip giant like Nvidia is rare—especially given their need for deep industry knowledge.

Big Tech Options Strategy

MSFT Layoffs Draw Attention

Unlike Nvidia’s binary AI bet, Microsoft’s diversified portfolio offers downside protection—even if AI disappoints, the broader impact is manageable.

Microsoft is the “service provider” in the AI ecosystem, embedding AI into existing product lines (Azure, Office) to create value. Success hinges on whether users are willing to pay a premium for AI-enhanced services. This approach is more complex than Nvidia’s.

However, valuation and growth challenges remain:

Its market cap is near $4 trillion, but trades at a 20+ year-high expected P/E ratio—setting a high bar for performance.

AI only accounts for 4% of total revenue ($11.5B), growing fast but still a small piece.

Key risks:

Uncertainty in the OpenAI partnership could limit tech access

Struggles with in-house AI chips increase reliance on Nvidia

Efficiency issues: revenue per employee trails peers

Ongoing layoffs (targeting another 9,000) highlight transformation stress

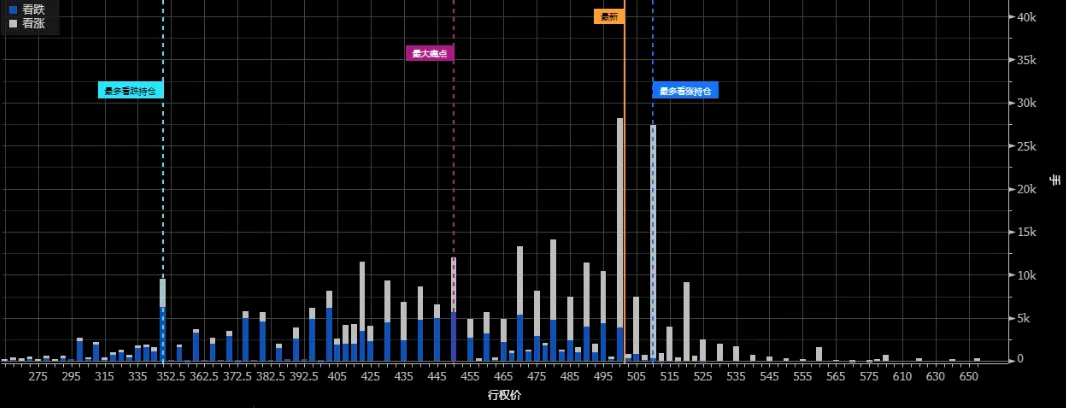

In options markets, despite recent highs, MSFT still shows strong call buying interest even after a pullback. Open interest data shows confidence in the stock pushing up to $510 in the coming weeks.

Big-tech Portfolio

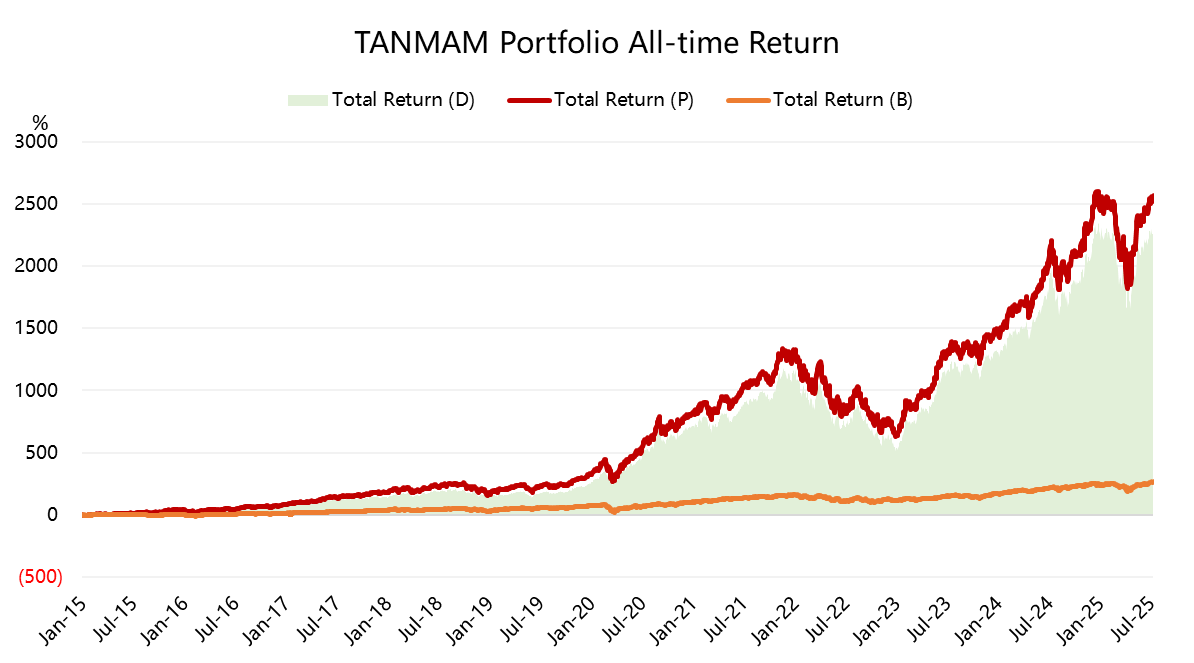

The Magnificent Seven, when held in an equal-weighted portfolio (TANMAMG) with quarterly rebalancing, has massively outperformed the $S&P 500(.SPX)$ since 2015.

TANMAMG total return: +2565.62%

SPY total return: +264.90%

Excess return: +2300.72%

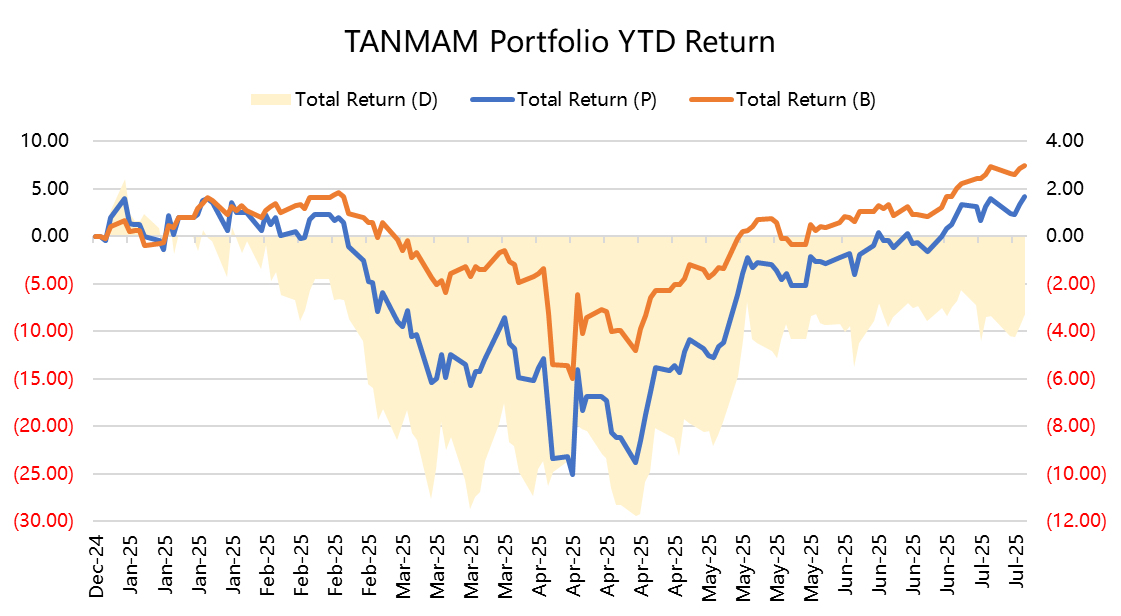

So far this year, Big Tech stocks are up +4.14%, trailing $SPDR S&P 500 ETF Trust(SPY)$ +7.42%.

Over the past year, the TANMAMG portfolio’s Sharpe ratio has declined to 0.52 (SPY = 0.52), with an Information ratio of 0.34.

Still, the structural advantage of these firms—market leadership, profit margins, and innovation—continues to make them the cornerstone of modern equity portfolios.

Comments