One of the strongest performing defense stocks so far this year $Philip Morris(PM)$ in the tobacco sector announced Q2 earnings, an unexpected plunge of 8.4%, of which revenue fell slightly short of expectations, but also because of the slowdown in combustible tobacco shipments, gradually mentioned by smokeless products.

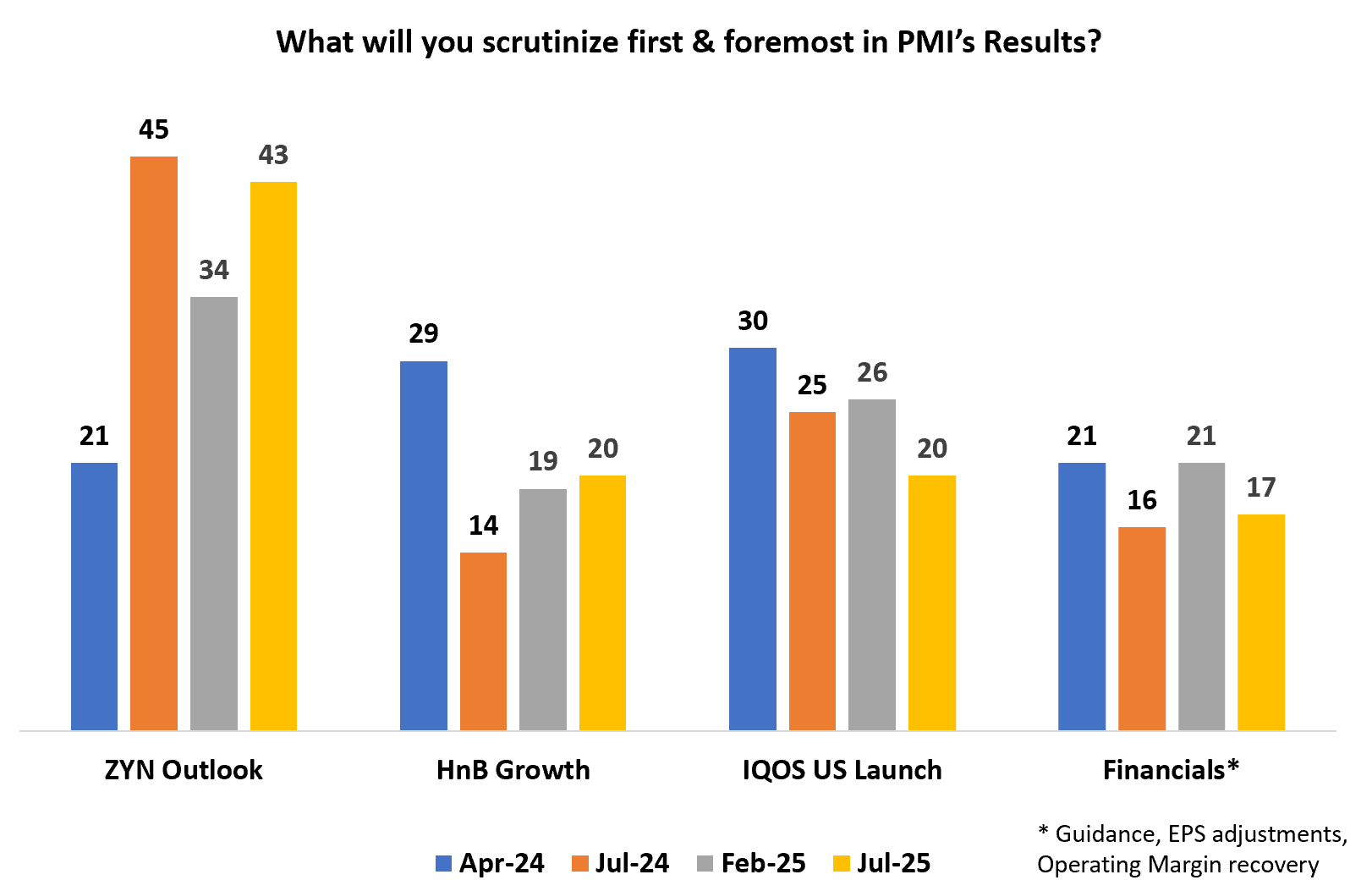

The company has entered the "smokeless-led" strategy to realize the period, short-term reliance on EPS upgrades + rate cut expectations (Fed rate cut probability of 78% in September) to support the defensive premium, but need to be vigilant about the H2 combustible tobacco weakness and approval delays.Long-term to look at smokeless products 2030 target share of >50% of the path is clear, ZYN U.S. share, IQOS emerging market penetration and VEEV earnings improvement are the three main points of observation.

In terms of valuation, although the valuation level is now higher than the historical average, it is still suitable for long-term holders. If ZYN shipments are lower than 800M cans for two consecutive quarters or IQOS approval is delayed until 2026, we need to be vigilant about the risk of valuation pullback.

Performance Overview and Market Feedback

In terms of core financial metrics

Revenue of 10.14B (+6.8% organic growth, vs. 10.32B expected), mainly due to slower growth in combustible tobacco shipments (+1.2%) and exchange rate volatility in emerging markets.Adjusted EPS: 1.91 (+200.02), ahead of expectations ($1.86 est.), reflecting cost optimization and higher share of high margin smokeless products.Operating margin: 41.9% (+3.3 pct y/y), a record, management attributed to "multi-category synergies" and 500M cost savings in H1 (target 2B in 2024-2026).

Shares were shaken after the report, as the market was briefly concerned about revenue miss, but management raised full-year EPS guidance to +13%-15% (from +12%-14%) and ZYN shipment target (800-840 million cans) to offset the pessimism.

Investment Highlights

Accelerated multi-category strategy for smokeless products, commercialization capability validation

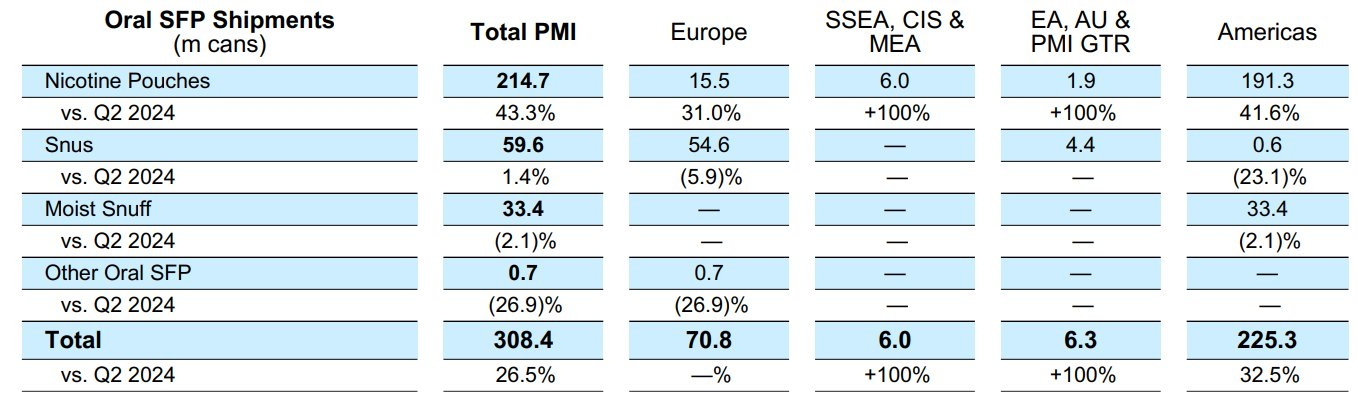

Revenue structure change: H1 smokeless products revenue $8.1B (+17.3% organic growth), accounting for 42% of revenue, gross profit accounted for 44% (gross margin of more than 70%), the management emphasized IQOS (IMS growth +11.4%), ZYN (U.S. shipments +26% in Q2, accelerated to +36% in June) and VEEV (e-cigarettes doubled the growth) of the "triple-engine drive".

Regional differentiation: IQOS European market recovery (taste ban impact weakened), Japan's share of 32.2% record high, emerging markets (such as Indonesia +47.4%) to fill the gap. ZYN: U.S. production capacity restored share of 66%, the management of the Q4 shipments are expected to increase year-on-year, the target of 80-84 million cans in 2025 (corresponding to an annualized growth rate of +35%-42%).

The company pointed out that "multi-category momentum beyond expectations", three category synergies to reduce the risk of a single policy, VEEV rapid profitability (Bernstein's response to questions) to verify the ability of the platform.

Sustainability of margin expansion

Mainly cost optimization and pricing power, driven by

Product premiumization: significant premiums for IQOS ILUMA i-series (touch screen technology) and combustible tobacco pricing +3.8%.

Supply chain restructuring: 500M cost savings in H1 (full year target of 1.6B capex), offsetting CHF exchange rate pressure.

Risk note: CFO admits H2 combustible tobacco trend may be weaker than Q2 and uncertainty over EU tobacco tax reform (TPD proposal) may depress 2026 margins.

Implied signals of guidance upgrades: growth quality and valuation anchors

EPS upward revision: full year median EPS guidance of 7.50 (originally 7.43), implied:

Smokeless product growth rate upwardly revised: capacity release of ZYN (Q4 production increase planned) and IQOS Europe recovery.

Tax rate optimization: effective tax rate is expected to be reduced by 50-100bps (CFO revealed).

Of course, current market expectations are poor: current PE 18x reflects high growth expectations and needs to be tracked:

ZYN US share: if it reaches 70% or triggers valuation upgrade ($200+ target price).

IQOS ILUMA US approval: if H2 approved (50% probability), will open up $10B incremental market.

Supply Chain & Regulatory Developments

Supply chain: ZYN restocking impact was lower than expected (only 10-20M tank shortfall in Q2), but CFO highlighted "restart of commercialization activities".

On the regulatory front, the US IQOS ILUMA PMTA may be delayed until 2026 (originally expected H2 2025).The EU regional TPD proposal does not explicitly heat tobacco tax rates, but the impact of flavor bans in member states has diminished marginally.

Comments