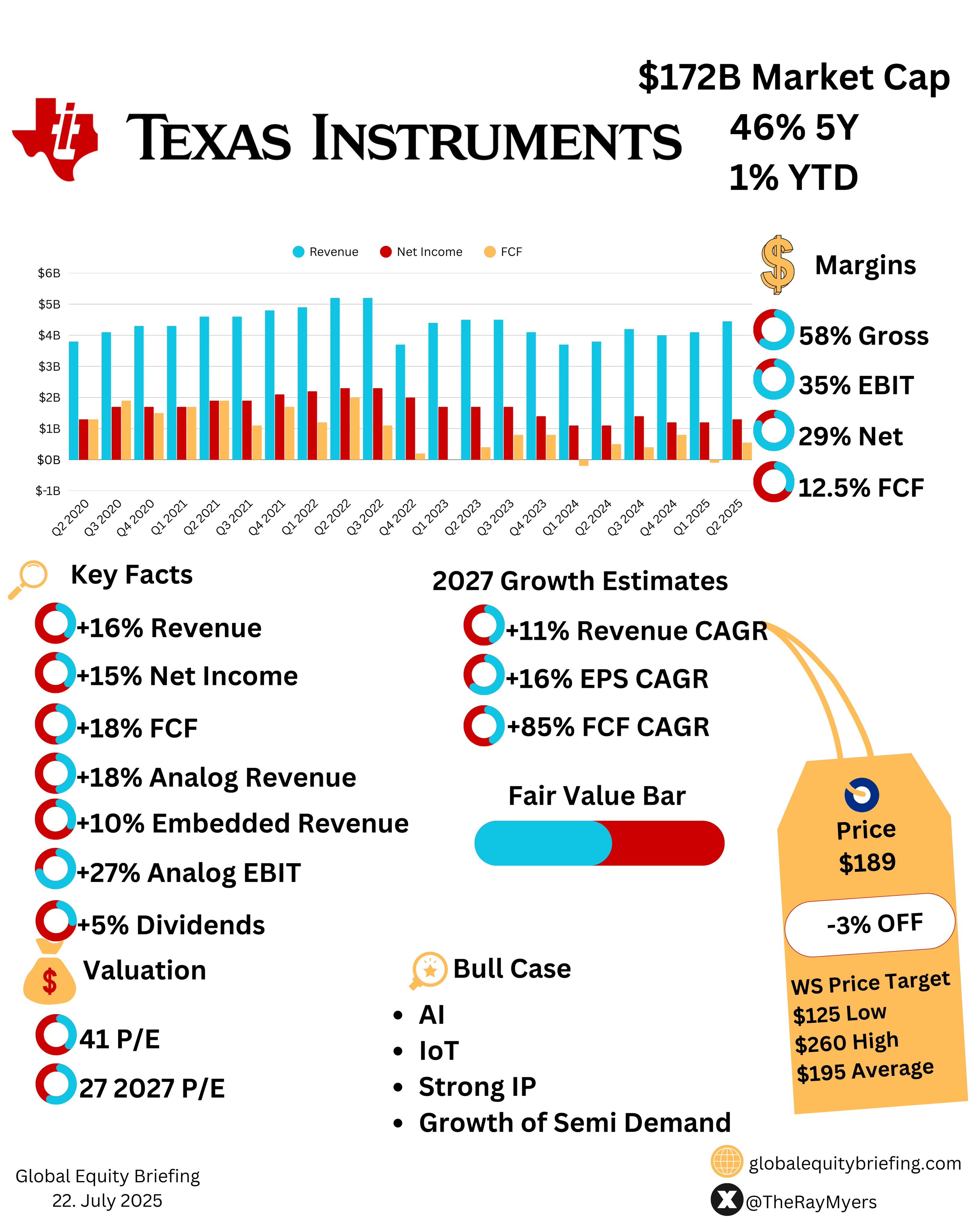

$Texas Instruments(TXN)$ announced Q2 earnings after the plunge, Q2 high growth is actually "tariffs to ripen", Q3 guidance exposure of endogenous demand weakness, valuation from the "recovery premium" to return to the "reality of pricingThe price of valuation has returned from "recovery premium" to "realistic pricing". The short-term focus is on whether industrial demand can offset the auto drag, while the long-term bet is on whether US manufacturing cost reductions can hedge against geopolitical risks.At this juncture, the market needs to digest the dual uncertainties of tariff policy and capital expenditure, and share price volatility will remain high.

Performance Overview and Market Feedback

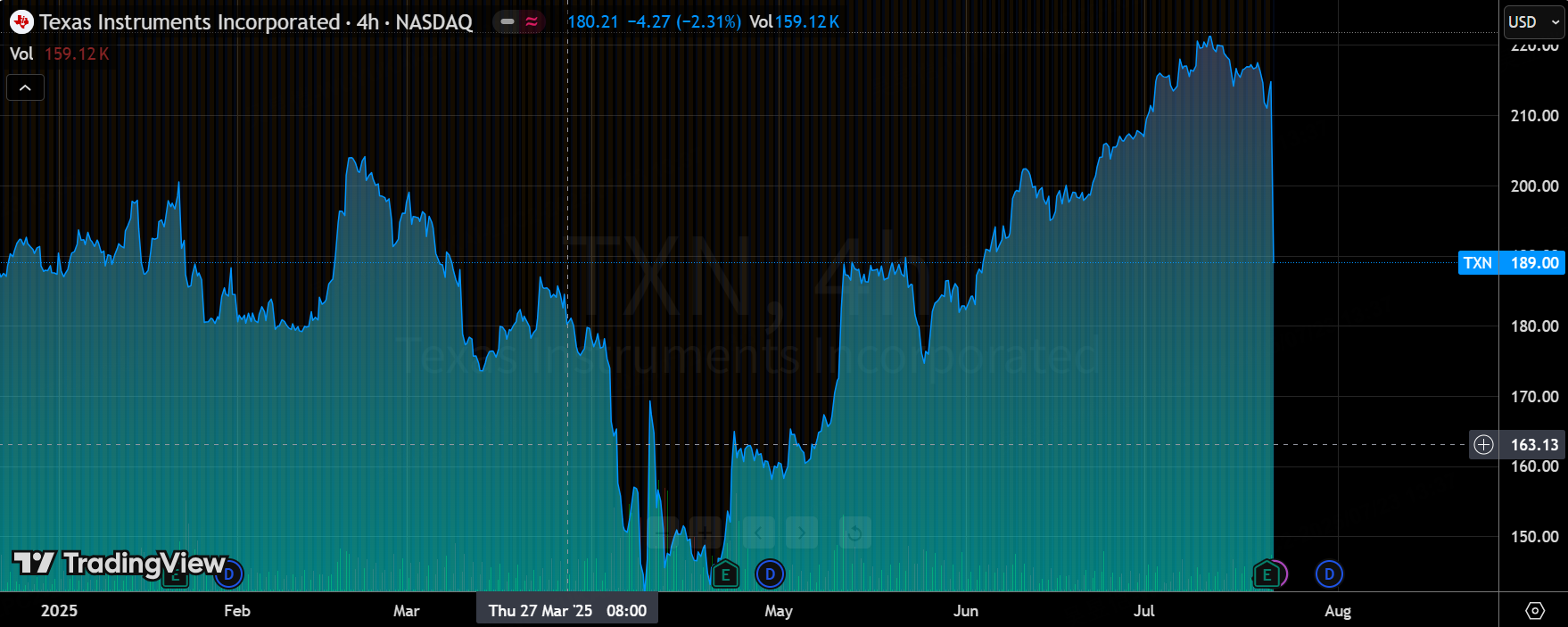

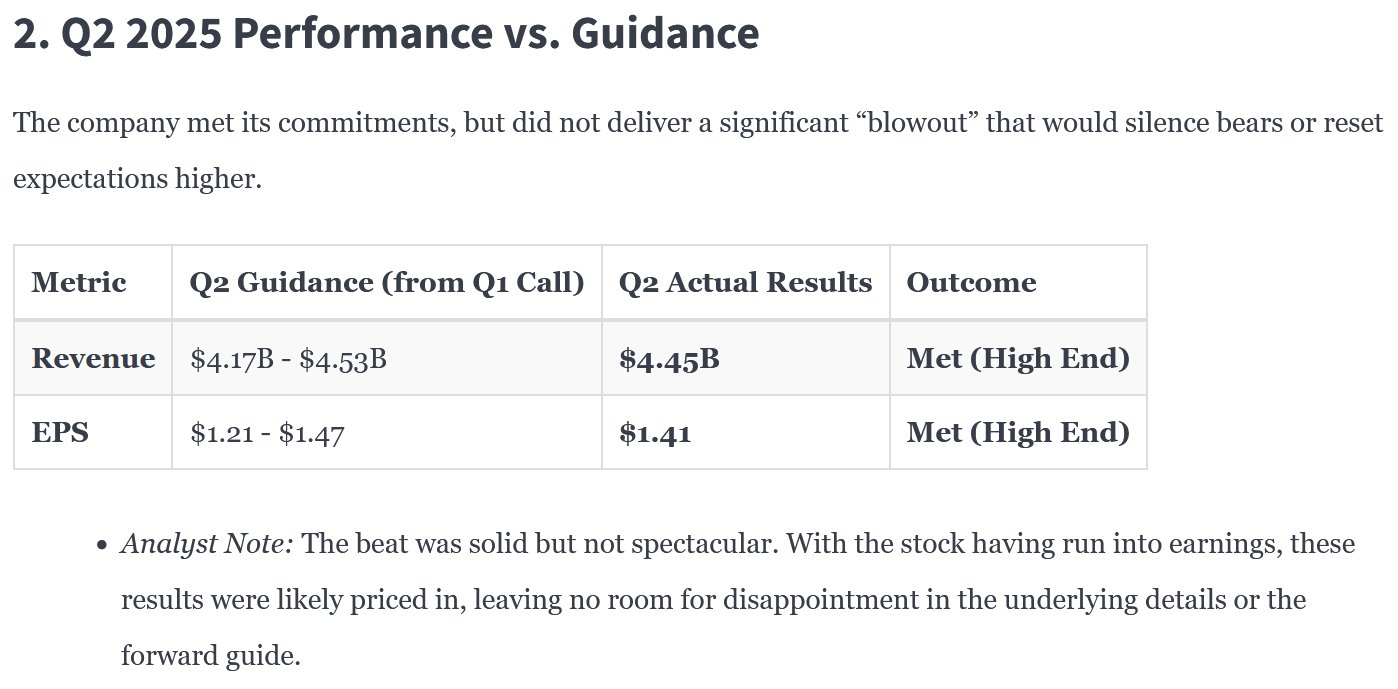

In terms of core metrics, revenue 4.45B, +16% YoY vs. 4.36B est.; EPS 1.41, +16% vs. 1.35 est.; operating profit 1.56B +25% vs. 1.47B est.

Tumbled 11.8% after hours, mainly due to weaker-than-expected median Q3 guidance (revenue 46.25B vs. 45.9B est.; EPS 1.48 vs. 1.50 est.), overlaid with a warning of stagnant gross margins.Dragging down the Philadelphia Semiconductor Index, NVIDIA, AMD and other chip stocks followed lower after hours.

Investment points

Tariffs distort demand, "false fire" overdraws growth, sustainability of the recovery in doubt

The truth of Q2 over-expectation is that tariff policy caused customers to stock up in advance (especially China revenue +32% yoy), which pushed up Q2 results but was unsustainable, and called this phenomenon "overheated".The core of weak Q3 guidance: order growth has fallen back to normal level, tariff uncertainty (e.g., rising costs of upstream materials) suppressed real demand.At the heart of the weakness in Q3 guidance: order growth has fallen back to normal levels and tariff uncertainty (e.g., higher upstream material costs, spending cuts by automakers) is depressing real demand.Market revises "tariffs boost demand" logic, pricing shifts from "cyclical recovery" to "demand overdraft", PE contraction reflects concerns about growth sustainability.

End-market divergence, automotive industry drags vs. industrial/telecom support

Automotive chips continue to weaken, revenue only mid-single digit growth (yoy), down sequentially, CEO said "recovery has not yet begun".Mainly due to high interest rates suppressing demand for electric vehicles, subsidy reductions, and excess inventory triple pressure.

Strong hedge between industrial and communication, industrial side grew nearly 20% yoy (driven by automation equipments), communication equipments grew more than 50% yoy (5G infrastructure demand); analog chip business (accounted for 77% of revenue) +18% yoy to $3.45B, becoming a core pillar.For TXN, diversified layout buffer automotive risk, but automotive accounted for about 20%, if long-term weakness will suppress the overall growth ceiling.

Cost and capital expenditure, short-term pain suppressed margins, long-term competitiveness game

Gross margin stagnation warning, the company expects Q3 gross margin flat (58% in Q2), mainly due to capacity utilization did not improve, the plant load is flat, fixed cost dilution is hindered.In addition, the tax and investment squeeze also caused a certain impact, the new tax law pushed up the effective tax rate to 12% -13% (Q1 7.6%), overlaid on the 60B fab investment in the short term erosion of cash flow (FCF over the past 12 months only 1.8B).

Long-term strategy bets on 300mm wafer transformation: expanding 7 fabs in Texas/Utah, targeting 30% unit cost reduction, countering the rise of China's local chipmakers (China accounts for 20% of revenue, competition intensifying.) Gross margins declined from 68.8% to 56.8% in 2023 after a price war, with recent price hikes on some products to hold margins.

Earnings guidance and market expectation revision

Management's tone shifted to cautious: Compared to Q1's optimism that "recovery is on the way", Q2 emphasized "flexibility to cope with uncertainties", with median implied YoY growth rate of guidance reduced to 4% (compared to 9% in Q2).Not including the impact of the new tax bill, implying the risk of a potential downward revision of net profit.

Sell-side concerns migrate.Prior focus: bottoming out of inventory cycle, sustainability of industrial recovery.Post-earnings focus: ① Is the tariff-induced order front end? ② When will automotive demand bottom out? ③ $60B capex payback cycle (300mm wafer cost reduction takes 2-3 years).

Valuation

If Q3 industrial/communication demand resilience is verified and 300mm plant progress exceeds expectations, valuation is expected to be repaired; if automotive continues to weaken or tariff shock expands, PE may further compress to cycle bottom (current forward-looking PE 20x vs. 5-year average 23x).

Comments