$Alphabet(GOOG)$ Q2 confirmed AI's full empowerment of its core business, with overall results exceeding expectations, driven by double-digit growth in search ads, YouTube and cloud business.

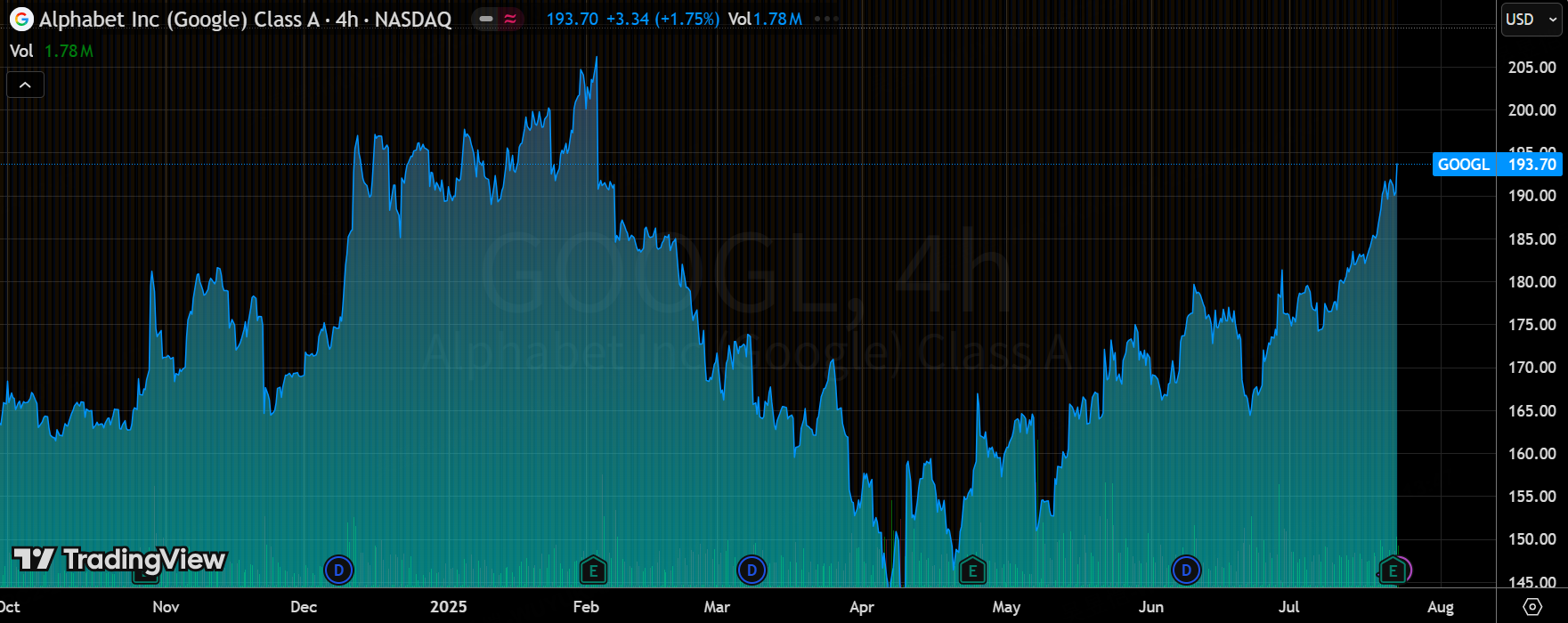

In addition, the $85 billion capital expenditure was another surprise to the market, regaining confidence in AI incremental, but with the policy risks constitute a "dual-track narrative".The current share price corresponds to the 2026 PE of 17.6 times (5-year low), if the cloud business growth rate is maintained, it is expected to be revalued, but we need to be vigilant about the GPU supply bottleneck (lasting until the end of 2025) and regulatory black swans. $Alphabet(GOOGL)$

Core performance and market feedback

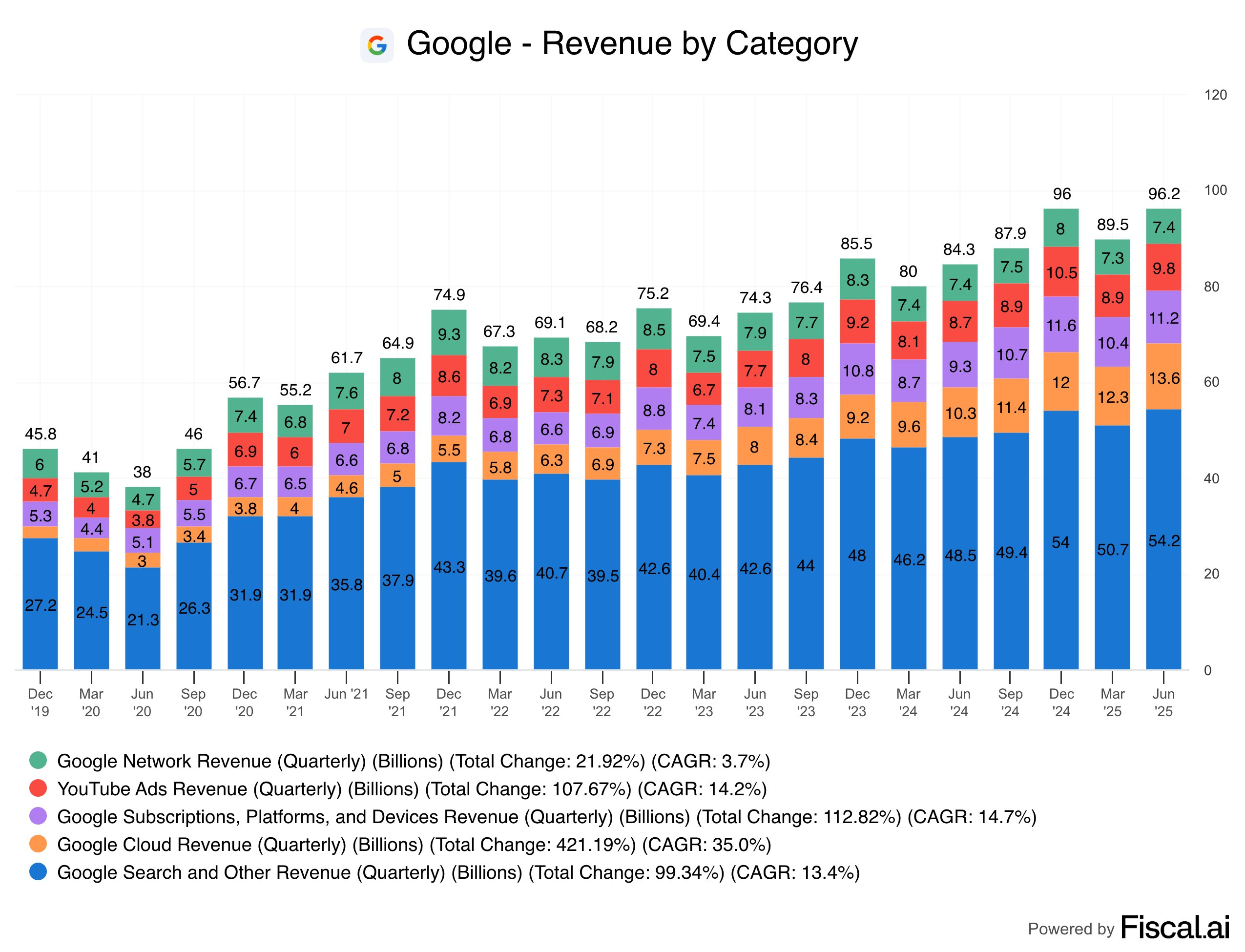

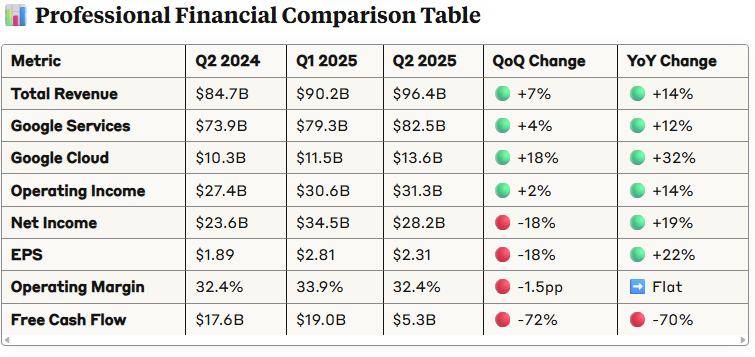

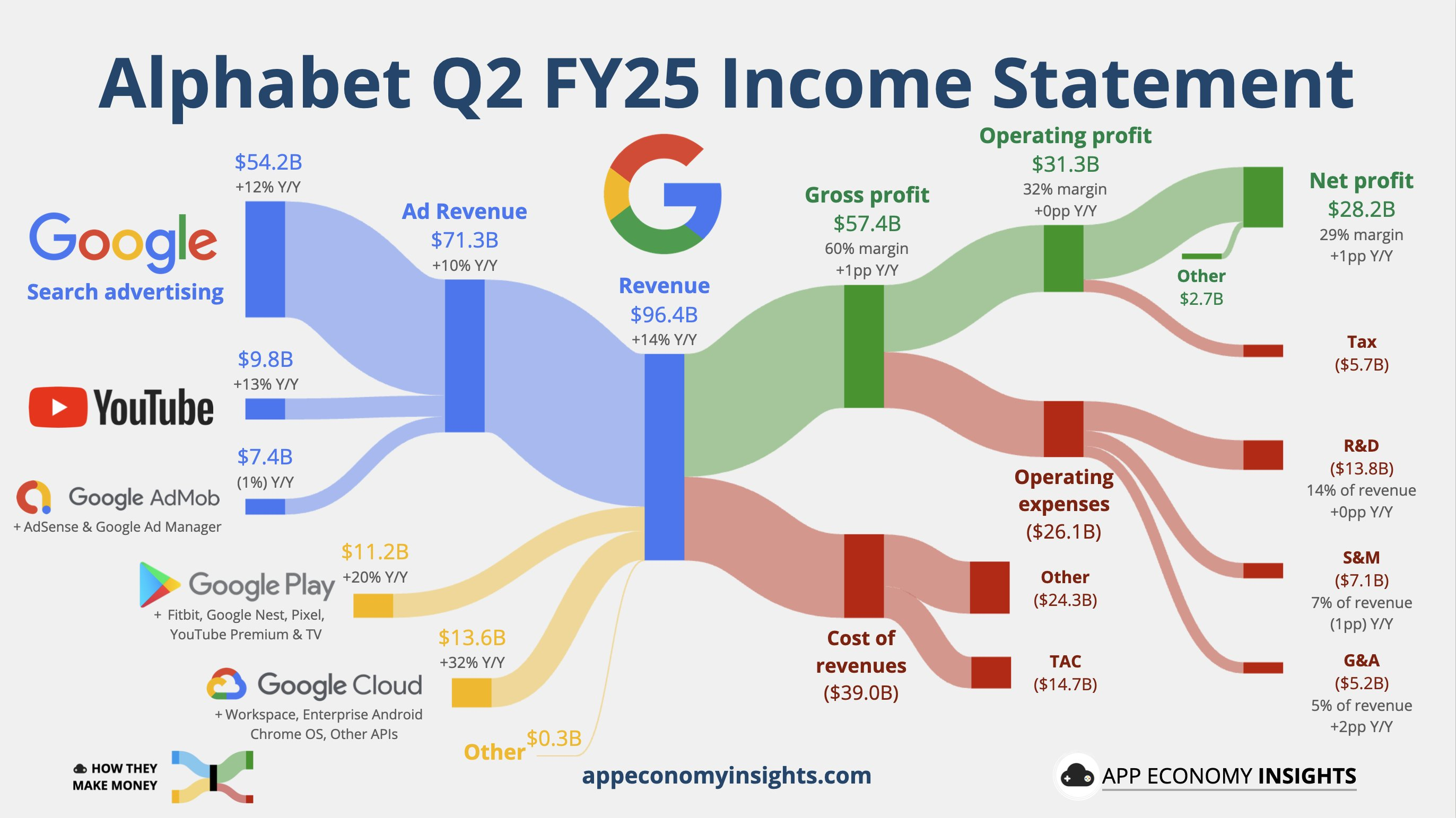

Total revenue reached $96.428 billion, up 14% year-on-year (13% at constant exchange rates), beating market expectations of $94 billion (buyer expectations were likely to be above $95 billion), with unexpectedly strong performances in the advertising and cloud businesses.

Business segmentation, Google Services revenue of $82.543 billion, an increase of 12% year-on-year, of which YouTube advertising revenue of $9.796 billion, an increase of 13% year-on-year, exceeding expectations of $9.56 billion; Google Cloud revenue of $13.624 billion, an increase of 32% year-on-year, a record high; Other BetsRevenue of $373 million, essentially flat year-on-year, but losses widened.

On the profit side, operating profit of $31,271 million was up 14% year-on-year, with an operating margin of 32.4%, essentially unchanged from a year ago.Net profit of $28.196 billion, up 19% year-on-year, down slightly from Q1 2025, but excluding non-cash gains in Q1, Q2 performance was solid.EPS of $2.31, up 22% year-on-year, higher than the market's expectations of $2.18, reflecting continued improvement in profitability.

Google shares rose as much as 3% in after-hours trading after the earnings announcement, reflecting positive investor sentiment on the results, with market readings focusing on the growth potential of the AI and cloud businesses.

Investment highlights

AI-driven business growth becomes the core highlight, further pushing up valuation repricing

Google's Q2 results show that the all-round penetration of AI into the business has significantly boosted its performance.Google Services revenue of $82.543 billion, up 12% year-on-year, of which the search business benefited from the AI Overviews and AI Mode features, driving double-digit growth; YouTube advertising revenue of $9.796 billion, up 13% year-on-year, exceeding expectations of $9.56 billion.Google Cloud revenue of $13.624 billion, up 32%, showing the effect of AI-optimized ad placement.The expected $9.56 billion, showing the effect of AI-optimized advertising; Google Cloud revenue of $13.624 billion, up 32% year-on-year, a record high, reflecting strong demand for AI infrastructure and generative AI solutions.Google's AI strategy is shifting from R&D investment to commercialization, which may trigger the market's expectation of valuation re-pricing, especially in the context of intensifying AI competition, Google's "full-stack AI" advantage may further consolidate its industry leadership.

Google Cloud's 32% YoY growth to $13.624 billion was the brightest metric of the quarter, with growth leading the industry (AWS +23%) and operating margin jumping to 20.7% (11.3% YoY), validating the scale effect inflection point.Behind this is strong demand for core cloud products, AI infrastructure and generative AI solutions.Management upgraded 2025 capex to $85 billion (up $10 billion from prior), primarily for cloud business expansion, demonstrating confidence in future growth.

Growth momentum came from three sources

Order Reserve Surge: Backlog reached 106B (+182.5B YoY), the volume of large orders doubled YoY, and OpenAI's adoption of Google Cloud Services further strengthened its technology endorsement;

Expansion of AI development ecosystem: Gemini model attracted over 1 million developers, and Vertex AI platform doubled the volume of Token processing to 980 trillion per month;

Industry solutions deepening: financial and healthcare customers adopt customized AI tools (e.g., federated learning risk control models), driving up enterprise subscription stickiness.

Supply chain bottlenecks constrain short-term delivery: GPU shortage persists until the end of 2025, forcing Google to invest 66% of its capex in AI servers (including its own TPUs as well as $NVIDIA(NVDA)$ Blackwell chips), but lagging production capacity may lead to fluctuations in the growth rate of cloud business.High-growth narrative may face challenges if order delivery rates fall short of expectations.

Advertising business is solid, but macro risks still need to be vigilant

Search business revenue reached B54.2B (+1252.8B in the quarter, with the core driver coming from the large-scale penetration of AI functionality. AI Overviews monthly active users exceeded 2 billion (up 33% QoQ), covering more than 200 countries, and drove a 10% growth in search query volume.Especially in the medical, financial and retail verticals, AI Overviews improved user decision-making efficiency by integrating authoritative information (e.g. WebMD disease cards, Ping An insurance comparison engine), with the trigger rate of medical and health queries reaching 63%.However, structural risks loom:

One, AI summarization led to publisher traffic diversion and affiliate ad revenue declined 1.2%;

Second, only 83% of users aged 14-24 viewed Google as a core search tool (vs. 88% of users aged 41-55), intensifying pressure on TikTok and AI agency platforms to divert traffic.

Despite the innovation of advertising tools (e.g. Smart Bidding bidding strategy) to improve the conversion rate of 19%, but the generational migration of young users and antitrust rulings (the results of the Chrome spinoff will be announced in August) are still potential factors to suppress the valuation repair.

85 billion capital expenditure bet on AI infrastructure, market carnival under the expectation of ROI

Alphabet raised its 2025 capex guidance to $85bn (+13%) from $75bn, and for the first time specified "further increases" in 2026, a record high.So instead, $Broadcom(AVGO)$ is up 2.8% after hours.Use of funds is highly focused on server procurement (66%) to alleviate GPU shortage and support cloud business arithmetic demand; colleague data center expansion (34%): accelerate global AI infrastructure layout.Short-term free cash flow plummeted 61% to $5.3B (Q2), depreciation expense +35% y/y, depressing 2026 margins; if cloud business $106B orders are converted as expected, AI investment can support 30%+ long term growth rate, forward valuation may be benchmarked to $Amazon.com(AMZN)$ AWS premium

Changing Market Expectations and Competitive Landscape Impact

The earnings report responded to the market's previous concerns about the growth potential of AI and cloud business, with a positive tone from management emphasizing the positive impact of AI.Compared to Q1, Q2 earnings guidance did not specify future quarters, but the upward revision of capital expenditures may hint at management's confidence in growth in the second half of the year.The market may reassess Google's competitive advantage in AI and cloud, especially against Microsoft and Amazon, and Google's valuation may move further upward due to accelerated AI commercialization.

Market gaming focus on GOOGL:

August antitrust ruling: valuation squeeze lifted if Chrome spinoff avoided;

Q3 cloud order delivery rate: $106B backlog conversion efficiency;

Agent-based AI landing in 2026: Gemini app with 450M monthly activity (daily requests + 50% QoQ) may open up $30B+ incremental market if agent-based workflow commercialization is successful

Comments

With that, Google should be traded at 300...