Design software company $Figma(FIG)$ , which is expected to go public on the Nasdaq this Wednesday, July 30, is using an auction-like IPO pricing mechanism to get more accurate stock valuation information.

Read more>>Figma’s IPO: What to Expect as It Hits the Market from @Invesight_Capital

What is an Auction IPO, a revolutionary break from traditional pricing?

An auction IPO (also known as a Dutch auction IPO) is an IPO pricing method in which the offering price is determined through public bidding by investors.Unlike traditional IPOs where the investment banker takes the lead in pricing, auction IPOs require investors to take the initiative to submit a limit order (specifying the price and quantity), and the system sorts all the bids in descending order, and takes the lowest winning bid that sells out all the shares as the final offering price, and all winning bidders are sold at this uniform price.

The core advantage is its fairness and pricing accuracy, with retail investors and institutions bidding on the same stage, weakening the privileges of investment banks in placing.Reflecting real demand, it reduces the "first day surge" common to traditional IPOs (e.g., Circle's 500% surge after listing).

Of course, this also needs to be done when investors understand the bidding rules and there is sufficient demand, otherwise the offering may fail or be underpriced.

Historical cases

Auction-style IPOs are more likely to succeed during market frenzies, but tend to run cold in bear markets.

$Alphabet(GOOG)$ 's (2004) pioneering attempt at an auction-style offering.

First auction IPO of a tech giant: priced at $85 using a Dutch auction offering, but the final offering price was below the expected range (originally planned at $108-$135) due to a cold market.

Only up 18% on first day of IPO (traditional IPOs average ~50% first day gain), but outperforms over the long term - attracting long-term holders by excluding speculative money.

$Airbnb, Inc.(ABNB)$ and $DoorDash, Inc.(DASH)$ Bucking the Epidemic

In 2020, Airbnb had a successful precision pricing, setting an offering price of $68 via an auction-based IPO, but still surged 112% on its first day due to the particular circumstances at the time, while DoorDash's offering price of $102 was up 85% on its first day.

The key factor here was the surge in demand for tech stocks during the epidemic, and the auction mechanism captured hidden investment enthusiasm to avoid underpricing.

While $Circle Internet Corp.(CRCL)$ which went public in June this year at a traditional IPO offering price of $31, soared 168% on its first day and the current share price is up over 500% from the offering price, suggesting that the pricing is severely underestimating market expectations.

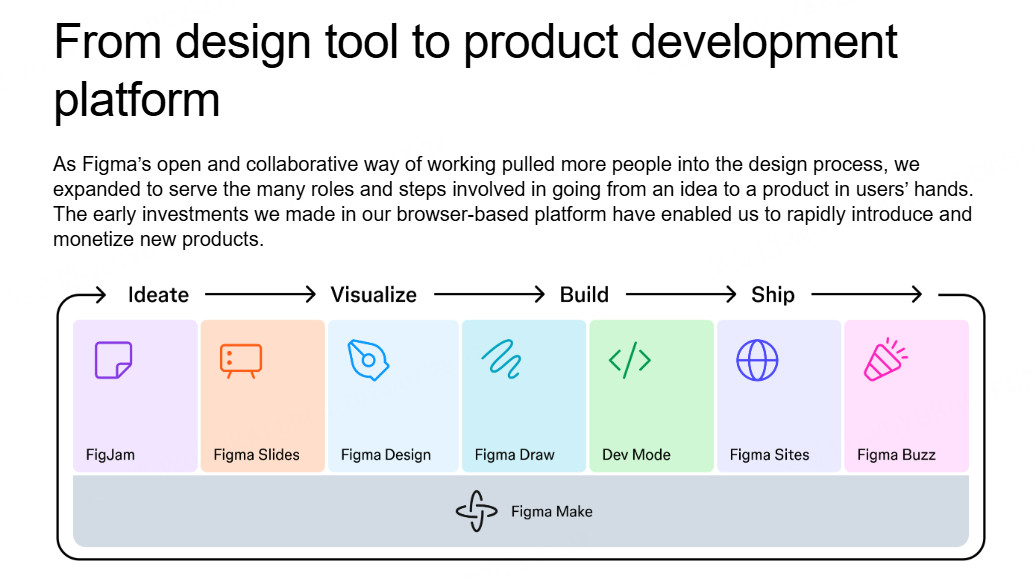

Current IPO market tech strength and Figma's ambitions

In the current market environment, the strong recovery of technology IPOs, Figma restarted the auction mechanism (previously used by DoorDash, Airbnb), reflecting the rebound in investor demand for high-quality technology stocks. 2025 first half of the U.S. IPO fundraising increased by 40% year-on-year, and the technology sector accounted for more than 60% of the total.At the same time, the head of the industry such as Figma also has a scarcity premium, Figma is currently "the only choice in the market", investors are also willing to pay a premium for the scarcity of the subject.

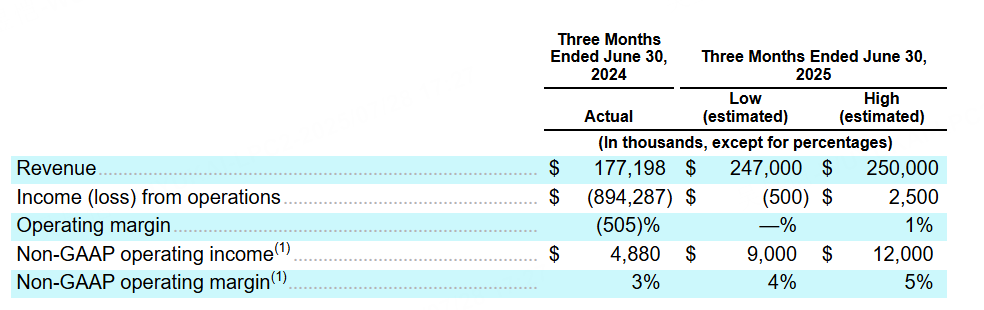

Figma against 20 billion valuation

Offering details pricing range of $25-28, raising $1.03 billion, valuation of $16.4 billion (close to 82% of Adobe's 2022 acquisition offer).

Using the auction mechanism to screen "high bidders" and create an image of a "hot deal"; at the same time, the top-tier underwriters (Morgan Stanley/Goldman Sachs) endorsed the offering to strengthen market confidence.

The new trend in tech IPOs is both efficiency and risk.Traditional IPOs have an average first-day price depression of about 20% (i.e., they "give away" to the secondary market), and auction-based IPOs can reduce this loss.

Figma's attempt also represents two innovations, including the tokenization of equity: its prospectus reserves the right to issue "blockchain common stock", which may enhance liquidity through the fragmentation of equity on the chain in the future.Accelerated disintermediation: small and medium-sized tech companies can use the auction mechanism to reduce the cost of going public (underwriting fees down to 3-5%, compared to 7% for traditional IPOs).

Capital markets are always looking for a balance between efficiency and fairness. figma's auction-style IPO is both a footnote to the rebound in demand for tech stocks and a prelude to an iteration of Wall Street's power structure.

🏦 Open a CBA today and enjoy privileges of up to SGD 20,000 in trading limit with 0 commission. Trade SG, HK, US stocks as well as ETFs unlimitedly!

Find out more here:

Trade on a Cash Boost Account and enjoy up to 6 months of Commission-Free trading.

💰Join the TB Contra Telegram Group to Get $10 Trading Vouchers Now🎉

Comments